Ethylene Glycol Market Report Scope & Overview:

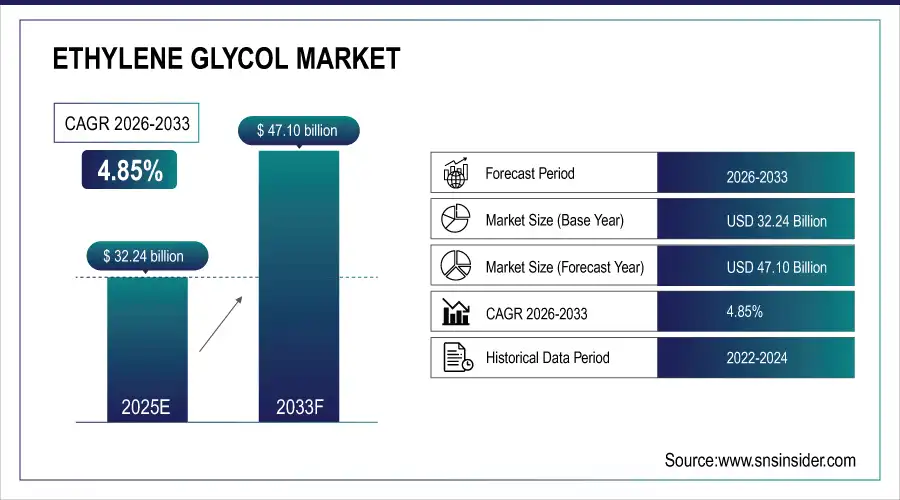

The Ethylene Glycol Market size was valued at USD 32.24 Billion in 2025E and is projected to reach USD 47.10Billion by 2033, growing at a CAGR of 4.85% during 2026–2033.

The ethylene glycol (EG) market is witnessing steady growth, driven by strong demand across polyester fibers, PET bottles and packaging, automotive antifreeze and coolants, and construction materials. Increasing industrialization, expanding textile and packaging sectors, and rising demand for sustainable materials are fueling market expansion. North America and Asia remain key regions, with strategic partnerships and production expansions enhancing supply reliability. Technological advancements in manufacturing processes, including Ethylene Oxide and Biological Routes, are supporting efficiency and sustainability. Overall, the market is poised for significant growth as EG continues to play a critical role in diverse industrial and consumer applications worldwide.

In October 2025 – Dow and MEGlobal have expanded their strategic ethylene supply agreement, adding 100 KTA from Dow’s Gulf Coast operations to support MEGlobal’s EG production at Oyster Creek, enhancing feedstock reliability, cost efficiency, and market supply across the U.S. and Asia.

Ethylene Glycol Market Size and Forecast:

-

Market Size in 2025: USD 32.24 Billion

-

Market Size by 2033: USD 47.10 Billion

-

CAGR: 4.85% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Ethylene Glycol Market - Request Free Sample Report

Ethylene Glycol Market Highlights:

-

Strong market growth drivers from increasing demand across polymers, antifreeze, and industrial solvents are encouraging manufacturers to enhance production efficiency, adopt alternative feedstocks, and implement advanced technologies

-

Supply-side constraints in key regions are prompting process optimization and technological upgrades to ensure consistent output and cost-effectiveness

-

Emphasis on energy-efficient and eco-friendly production methods supports wider adoption and aligns with global sustainability initiatives

-

Stringent regulations, high production costs, and environmental concerns may slow adoption and increase operational expenses

-

Growing automotive, textile, and packaging sectors drive EG consumption for PET resins, polyester fibers, and antifreeze production

-

Policy decisions ensuring stable raw material availability support market stability and reliable supply

Ethylene Glycol Market Drivers:

-

Ethylene Glycol Market Growth Fueled by Demand and Production Innovation

The ethylene glycol market is being driven by increasing demand across industries such as polymers, antifreeze, and industrial solvents, encouraging manufacturers to enhance production efficiency and explore alternative feedstock options. Supply-side limitations in key regions are prompting investments in technological upgrades and process optimization to ensure consistent output and cost-effectiveness. Additionally, the emphasis on sustainability and energy-efficient production methods is motivating players to adopt advanced production techniques. Growing industrialization, expanding end-use applications, and the need for reliable and diversified sourcing further support market growth. These factors collectively create a robust environment for the global ethylene glycol industry to expand steadily.

June 25, 2025: SABIC permanently closed its 865,000-ton ethylene plant in Wilton, UK, amid Europe’s petrochemical cutbacks, reducing regional capacity by 4.3 million tons and highlighting weak demand and high costs.

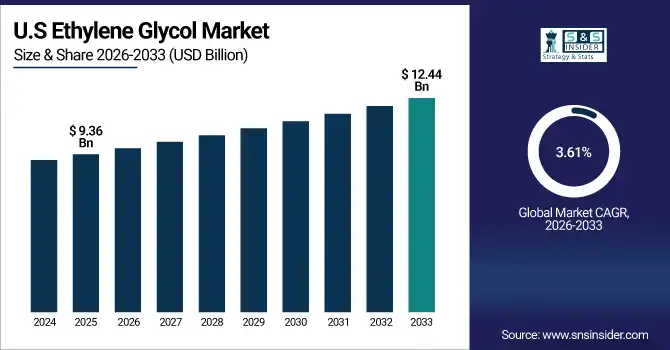

The U.S. Ethylene Glycol Market size was valued at USD 9.36 Billion in 2025E and is projected to reach USD 12.44 Billion by 2033, growing at a CAGR of 3.61% during 2026–2033, driven by rising demand in polyester fibers, PET packaging, and automotive applications. Growth is further supported by increasing industrialization, expanding construction activities, technological advancements in manufacturing, and the rising preference for sustainable and high-performance materials across various end-use industries.

Ethylene Glycol Market Restraints:

-

Ethylene Glycol Market Faces Regulatory, Environmental, and Production Challenges

The ethylene glycol market faces restraints due to stringent regulatory requirements, high production costs, and environmental concerns related to chemical manufacturing. Market growth can also be impacted by fluctuations in raw material availability, energy-intensive production processes, and increasing pressure to adopt sustainable and eco-friendly alternatives. These factors may lead to higher operational costs, supply chain challenges, and slower adoption in certain regions, limiting overall market expansion despite growing demand across industrial and consumer applications.

October 2025 – The WHO has sought clarification after multiple child deaths in India linked to Coldrif cough syrup containing toxic diethylene glycol, highlighting serious regulatory gaps in screening locally sold medicines.

Ethylene Glycol Market Opportunities:

-

Rising Industrial Demand and Sustainability Initiatives Driving Ethylene Glycol Market Growth

Rising industrialization and expanding automotive and textile sectors are driving increased demand for Ethylene Glycol (EG), as it is essential for polyester fibers, PET resins, and antifreeze production. The growing need for lightweight, durable, and recyclable packaging fuels PET-related EG consumption. Advances in bio-based and energy-efficient production methods reduce costs and environmental impact, encouraging wider adoption. Increasing focus on sustainability and eco-friendly materials creates additional market opportunities. Consequently, manufacturers investing in innovative technologies, efficient supply chains, and strategic collaborations can capture emerging demand, strengthen market presence, and respond to global consumption trends effectively.

In Dec 2024 – DGTR terminates anti-dumping probe on MEG imports from Kuwait, Saudi Arabia, and the U.S., citing outdated data, ensuring stable supply for PET-based pharmaceutical packaging.

Ethylene Glycol Market Segment Highlights:

-

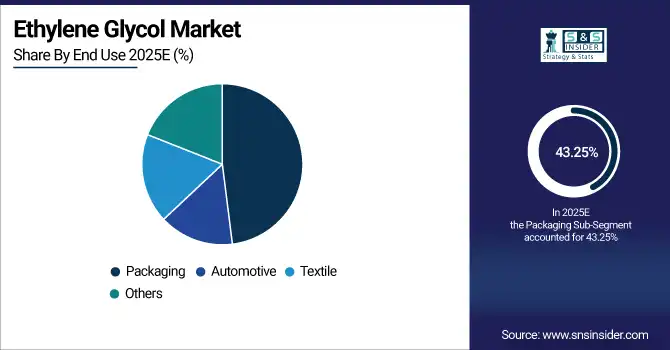

By Type: Dominant – Triethylene Glycol (TEG) (53.19% in 2025 → 42.31% in 2033); Fastest-Growing – Monoethylene Glycol (MEG) (CAGR 8.28%)

-

By Application: Dominant – PET (39.00% in 2025 → 33.00% in 2033); Fastest-Growing – Polyester Fibers (CAGR 7.04%)

-

By End Use: Dominant – Packaging (43.25% in 2025 → 38.75% in 2033); Fastest-Growing – Automotive (CAGR 9.81%)

-

By Manufacturing Process: Dominant – Ethylene Oxide (69.25% in 2025 → 64.75% in 2033); Fastest-Growing – Biological Route (CAGR 15.04%)

Ethylene Glycol Market Segment Analysis:

By Type Triethylene Glycol dominating and Monoethylene Glycol Fastest Growing

Triethylene Glycol leads the market with the largest share, reflecting its established applications and widespread usage. Meanwhile, Monoethylene Glycol is the fastest-growing segment, experiencing strong demand growth across various industries due to its versatility and expanding applications, signaling a significant shift in market dynamics over the coming years.

PET Leads the Market, Polyester Fibers Drive Rapid Growth in Applications

PET dominates the market by application, reflecting its widespread use and established demand, while Polyester Fibers are the fastest-growing segment, driven by rising industrial and textile applications and increasing adoption across diverse sectors.

Packaging Leads, Automotive Accelerates: Key Trends in End-Use Market Dynamics

Packaging dominates the market in terms of end use, reflecting its widespread adoption across industries, while Automotive is the fastest-growing segment, driven by increasing demand and expanding applications in vehicle manufacturing and related sectors.

Ethylene Oxide Dominates; Biological Route Emerges: Transforming Manufacturing Processes in the Ethylene Glycol Market

Ethylene Oxide dominates the manufacturing process segment, reflecting its established role and extensive industrial adoption. In contrast, the Biological Route is the fastest-growing process, driven by increasing demand for sustainable and eco-friendly production methods, technological advancements, and rising awareness of environmentally conscious practices, signaling a significant shift in industry manufacturing trends.

Ethylene Glycol Market Regional Highlights:

-

Dominating Region: North America (43.82% in 2025E → 42.76% in 2033, CAGR 4.53%)

-

Fastest-Growing Region: Asia-Pacific (8.64 → 13.36 in 2025E–2033, CAGR 5.60%)

-

Europe: 6.23 → 9.26 (CAGR 5.08%)

-

South America: 1.84 → 2.43 (CAGR 3.51%, moderate growth)

-

Middle East & Africa: 1.39 → 1.91 (CAGR 3.99%)

Ethylene Glycol Market Regional Analysis:

North America Ethylene Glycol Market Insights:

North America leads the Ethylene Glycol market, due to its well-established chemical industry, strong demand from automotive and packaging sectors, and advanced manufacturing infrastructure. Continuous investments in production capacity, coupled with technological innovations and supportive regulatory frameworks, further strengthen the region’s leadership position, driving consistent market growth and high regional share.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Ethylene Glycol Market Insights:

The United States leads the Ethylene Glycol market, driven by robust automotive and packaging demand, advanced chemical manufacturing, technological innovations, and supportive regulations, maintaining its dominant position globally.

Asia-Pacific Ethylene Glycol Market Insights:

Asia-Pacific is the fastest-growing region in the Ethylene Glycol market, fuelled by rapid industrialization, expanding automotive and packaging sectors, rising urbanization, and increasing investments in chemical manufacturing. Strong demand from China and India, coupled with supportive government policies, drives significant market growth and positions the region as a key growth hub.

China Ethylene Glycol Market Insights:

China leads the Asia-Pacific Ethylene Glycol market, China leads the Asia-Pacific Ethylene Glycol market due to its massive industrial base, high demand from automotive and packaging sectors, expanding chemical production capacity, and supportive government policies.

Europe Ethylene Glycol Market Insights:

The Europe Ethylene Glycol market is witnessing emerging trends driven by sustainability initiatives, increased use of bio-based glycol, advancements in production technologies, and growing demand from automotive and packaging industries. Regulatory support, innovation in recycling processes, and focus on eco-friendly solutions are shaping market dynamics and growth opportunities across the region.

Germany Ethylene Glycol Market Insights:

Germany is dominating the Europe Ethylene Glycol market due to its strong chemical industry, high automotive production, advanced manufacturing capabilities, and adoption of innovative and sustainable production technologies.

Latin America Ethylene Glycol Market Insights:

The Latin America Ethylene Glycol market is steadily expanding, driven by increasing demand in automotive, packaging, and construction sectors. Rising industrial activities, urbanization, and expanding manufacturing facilities are fueling market adoption. Investments in infrastructure and chemical production, coupled with technological advancements, are further strengthening regional production capabilities and market penetration.

Brazil Ethylene Glycol Market Insights:

Brazil is dominating the Latin America Ethylene Glycol market, driven by strong automotive, construction, and packaging demand, expanding chemical manufacturing, and strategic investments enhancing regional production and market presence.

Middle East & Africa Ethylene Glycol Market Insights:

The Middle East and Africa Ethylene Glycol market is witnessing moderate growth, supported by increasing industrialization, rising demand from automotive and construction sectors, and ongoing investments in chemical manufacturing. Expanding infrastructure projects and technological advancements are gradually enhancing production capabilities and strengthening the region’s overall market presence.

Saudi Arabia Ethylene Glycol Market Insights:

Saudi Arabia is dominating the Middle East and Africa Ethylene Glycol market, driven by its extensive chemical manufacturing infrastructure, strong industrial demand, and strategic investments in production and export capabilities.

Ethylene Glycol Market Competitive Landscape:

Indorama Ventures, established in 1994, is a global chemical company specializing in polyester, ethylene oxide, and derivatives. Headquartered in Thailand, the company operates manufacturing plants worldwide and provides sustainable solutions for textiles, packaging, and chemicals. It recently closed its Botany Bay, Australia, plants due to feedstock supply challenges.

-

June 13, 2024 – Indorama Ventures will shut its Botany Bay ethylene oxide and derivatives plants in Australia due to Qenos Olefins ceasing ethylene production, reducing its Australian presence to an office and technical center.

LG Chem, established in 1947, is South Korea’s leading petrochemical company, producing ethylene, propylene, and other key feedstocks for industries such as automotive, construction, and plastics. Headquartered in Yeosu, LG Chem focuses on innovation, sustainability, and global expansion while navigating challenges in the international petrochemical market.

-

August 20, 2025 – South Korea plans restructuring for 10 major petrochemical companies, including significant cuts to naphtha-cracking capacity, as top producers like LG Chem, Lotte Chemical, and Yeochun NCC face losses from oversupply and weak demand.

Ethylene Glycol Market Key Players:

-

BASF

-

China Petrochemical Corporation

-

EQUATE Petrochemical

-

Indorama Ventures

-

INEOS

-

LG Chem

-

Mitsubishi Chemical Corporation

-

Reliance Industries Limited

-

SABIC

-

Shell Chemicals

-

LOTTE Chemical Corporation

-

Kuwait Petroleum Corporation

-

Akzo Nobel N.V.

-

Clariant International Ltd

-

Formosa Plastics Corporation

-

Exxon Mobil Corporation

-

Huntsman International LLC

-

Dow Inc.

-

LyondellBasell Industries Holdings B.V.

-

SABIC Innovative Plastics

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 32.24 Billion |

| Market Size by 2033 | USD 47.10 Billion |

| CAGR | CAGR of 4.85% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Monoethylene Glycol (MEG), Diethylene Glycol (DEG) and Triethylene Glycol (TEG)) • By Application (Polyester Fibers, PET, Antifreeze and Coolants, Films and Others) • By End Use (Textile, Automotive, Packaging and Others) • By Manufacturing Process (Ethylene Oxide, Coal, Biological Route and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Key players in the ethylene glycol market include BASF, China Petrochemical Corporation, EQUATE Petrochemical, Indorama Ventures, INEOS, LG Chem, Mitsubishi Chemical Corporation, Reliance Industries Limited, SABIC, Shell Chemicals, LOTTE Chemical Corporation, Kuwait Petroleum Corporation, Akzo Nobel N.V., Clariant International Ltd, Formosa Plastics Corporation, Exxon Mobil Corporation, Huntsman International LLC, Dow Inc., LyondellBasell Industries Holdings B.V., and SABIC Innovative Plastics. |