Unsaturated Polyester Resins Market Report Scope & Overview:

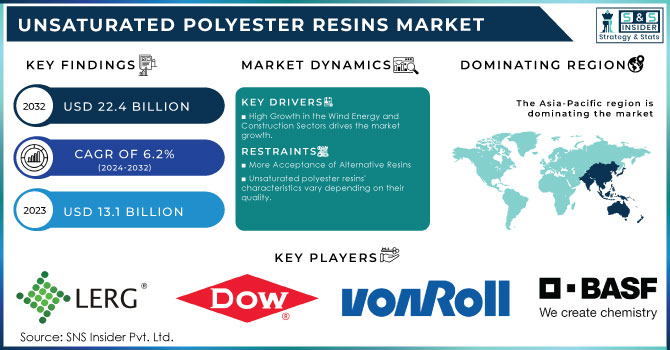

The Unsaturated Polyester Resins Market size was valued at USD 13.1 Billion in 2023. It is expected to grow to USD 22.4 Billion by 2032 and grow at a CAGR of 6.2% over the forecast period of 2024-2032.

Get More Information on Unsaturated Polyester Resins Market - Request Sample Report

The growth of the unsaturated polyester resins (UPR) market in the marine industry is significantly driven by their application in boat manufacturing, primarily due to their excellent corrosion resistance and mechanical strength. The National Marine Manufacturers Association (NMMA) reported that the U.S. recreational boating industry alone generated more than USD 50 billion for the economy. Furthermore, commercial shipping is booming with the International Maritime Organization (IMO) stating that around 90% of world trade is carried out by the global shipping industry. The growing need for effective and long-lasting marine crafts further propelled the use of UPRs in the fabrication of lightweight yet strong boats & ships.

The rising adoption of unsaturated polyester resins (UPRs) in construction applications is one of the key factors boosting market growth as these materials improve properties for buildings. UPRs are known for their high strength and toughness, ideal for numerous applications such as roofs, floors, and insulations. UPR provides waterproofing and UV properties in roofing which are important for protection against the elements When used for flooring, their mechanical strength provides a durable surface able to cope with heavy foot traffic and wear. Durability.

The U.S. Infrastructure Investment and Jobs Act, passed in 2021, allocated USD 1.2 trillion to upgrade roads, bridges, public transit, water systems, and energy grids over the next decade. This significant investment is expected to boost the demand for durable materials like UPR, particularly for electrical components, piping, and roofing systems used in new construction and renovation projects.

Increasing composite applications are likely to drive unsaturated polyester resins (UPR) demand, especially in fiberglass-reinforced plastics (FRP). These reinforced composites with high strength-to-weight ratio, corrosion resistance, and durability are preferred in industrial applications like marine, wind energy, aerospace, etc. FRP is utilized in the marine sector for boat hulls, decks, and other structural components because it performs better against water and chemical exposure compared with traditional materials.

According to the Global Wind Energy Council (GWEC), global wind power capacity grew by 93 GW in 2021, bringing the total installed capacity to over 837 GW. Governments worldwide are pushing for increased renewable energy capacity, with countries like the United States aiming for 30 GW of offshore wind energy by 2030 under the Biden administration.

Unsaturated Polyester Resins Market Dynamics

Drivers

-

High Growth in the Wind Energy and Construction Sectors drives the market growth.

The unsaturated polyester resins (UPR) market is largely driven by high growth in the wind energy and construction sectors. With the world seeking to find solutions via renewable energy, wind farms have been booming recently both onshore and offshore in the wind energy sector. To meet climate targets and cut carbon emissions, the United States, China, and many European countries are pouring huge investments into wind energy. UPR is commonly used in fabricating fiberglass-reinforced plastics (FRP), one of the essential components for the production of wind turbine blades, characterized by its lightweight, excellent strength, and resistance to environmental stress. With more and more wind power projects coming online globally, the need for UPR in this space is growing as well.

Moreover, the growth of the construction sector worldwide, particularly in urbanization developing regions is positively impacting demand for UPR. UPR is widely applied in building components including but not limited to roofing, pipes, and panels that need durability, chemical resistance, and thermal stability. Increasing infrastructure investments along with demand for cost-effective, efficient building materials is expected to enhance UPR consumption. The rapid growth of the wind energy and construction market has been driving strong growth in the UPR market too, both industries have started using advanced materials to achieve performance sustainability goals together.

The International Energy Agency (IEA) reports that global wind energy capacity grew by 17% in 2022, reaching a total of over 830 GW installed capacity. Governments are prioritizing wind energy in their renewable energy goals, with the U.S. aiming for 30 GW of offshore wind capacity by 2030 under the Biden administration. In Europe, the European Union’s 2030 Renewable Energy Targets plan to boost offshore wind capacity to 60 GW by 2030 and 300 GW by 2050.

Restraint

-

More Acceptance of Alternative Resins

-

Unsaturated polyester resins' characteristics vary depending on their quality.

The main restraint in the global unsaturated polyester resins (UPR) market is the variation in the quality of unsaturated polyester resins (UPR); which in turn hampers its performance characteristics. The nature of raw materials & processes leads to the preparation of UPR formulations with markedly different properties including mechanical strength, chemical resistance, thermal stability, and durability. In more critical end-uses, such as often the case in a harsh environment or in highly demanding industries like aerospace and wind energy where reliability and long-term durability are essential coveted qualifications, lower-quality resins may not deliver the performance that is needed.

UPRs that are not produced to stringent standards might show signs of premature cracking or discoloration, and also lower moisture & chemical resistance limiting their application in certain aggressive end-user markets (marine/building).

Unsaturated Polyester Resins Market Segmentation

By Type

Orthophthalic resin held the largest market share around 39% in 2023. This is due to low manufacturing costs along with its various significant mechanical, thermal, and electrical properties. Such resin has been used in automotive components, marine parts, pipes, and building materials. Orthophthalic resins have good mechanical strength, and chemical resistance and are easy to process making is suitable for the production of fiberglass-reinforced plastics (FRP) and other composites. Their lower cost, compared to other UPR types like isophthalic and dicyclopentadiene (DCPD) resins, makes them the choice for many applications where price sensitivity is an important consideration.

By End-Use Industry

Building & Construction held the largest market share around 31% in 2023. This is due to the significant consumption of UPR-based materials in several applications related to construction. UPR is widely used in construction for its excellent durability, corrosion-resistant properties, and cost efficiency making it an ideal choice for roofing systems, pipes, wall panels, and electrical enclosures. Rapid growth in construction and infrastructure development occurring around the world, particularly in developing nations, has led to a greater need for lightweight, strong, and resilient materials such as UPR. Besides mechanical properties, the cross-linking nature of UPR makes it possible to get composites embodied with other materials such as glass fibers into which plastic matrices are poured together, essential in contemporary construction projects needing more energy-efficient and lighter but relatively in-trade-expanding structures.

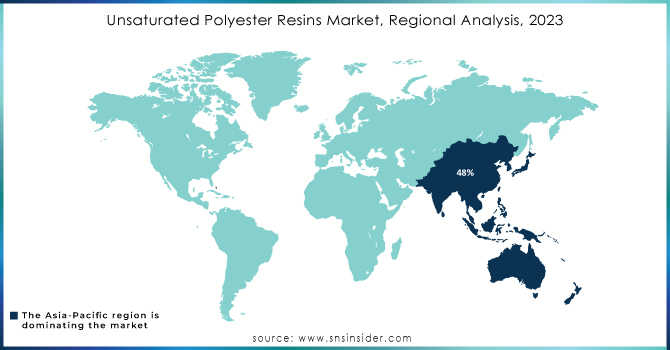

Unsaturated Polyester Resins Market Regional Analysis

Asia-Pacific region held the largest market share around 48% in 2023. It is driven by rapid industrialization, urbanization, and large infrastructure growth in China, India, and Japan. In response, these booming economies will increase their demand for construction materials, automotive parts, and consumer goods, which all involve UPR usage for attributes such as durability, lightweight nature, and chemical resistance. The booming construction industry in the region driven largely by government spending towards infrastructure projects is significant especially since UPR is utilized for applications such as roofing, piping, and high-performance composites used within automotive and marine end-use industries.

In addition, a huge manufacturing base and low-cost UPR in the Asia-Pacific region also make it suitable for use by various industries. The rising utilization of advanced materials in construction and other applications is coherent with the sustainability aspirations in the area, thus inducing UPR demand. The expansion of the renewable energy sector, especially wind energy, since UPR is used in turbine blades further increases the global market growth significantly. In summary, these comprehensive factors associated with industrial development and infrastructural investment along with a fast favorable changeover towards the usage of advanced composite materials have made Asia-Pacific a dominant region in the UPR market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Key Manufacturers

-

LERG SA (Polyester Resin)

-

DOW Inc. (DOW Styrofoam)

-

Von Roll (VONROLL UPR)

-

BASF SE (BASF Unsaturated Polyester Resins)

-

AOC (AOC UPR)

-

Ineos Group (Ineos Styrolution UPR)

-

DSM (DSM UPR)

-

TIANHE RESIN CO., LTD. (Tianhe Polyester Resin)

-

Scott Bader Company Ltd. (Crystic Resin)

-

UPC GROUP (UPC UPR)

-

Ashland Global Holdings Inc. (Aropol)

-

Hexion Inc. (Hexion UPR)

-

Polynt S.p.A. (Polynt UPR)

-

SABIC (SABIC UPR)

-

Renegade Materials Corporation (Renegade UPR)

-

Reichhold LLC (Reichhold UPR)

-

EPOXY Technology, Inc. (EPOXY UPR)

-

Wacker Chemie AG (Wacker UPR)

-

Kraton Corporation (Kraton UPR)

-

Ferro Corporation (Ferro UPR)

Recent Development:

-

In 2023, Dow announced the expansion of its production capacity for UPR at its facilities in the U.S., aimed at meeting the growing demand from the construction and automotive sectors.

-

In 2023, Reichhold introduced a new line of high-performance UPRs that provide enhanced UV resistance and durability for outdoor applications, particularly in the marine industry.

-

In 2023, Polynt announced the acquisition of a production facility in Europe to increase its UPR output and better serve the growing demand in the construction and marine sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.1 Billion |

| Market Size by 2032 | US$ 22.4 Billion |

| CAGR | CAGR of 6.2% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Orthophthalic resin, Isophthalic resin, Dicyclopentadiene (DCPD), Others (Gelcoat resin, Terephthalic resin, & Chlorendic resin)) • By End-use Industry (Building & Construction, Marine, Transportation, Pipes & Tanks, Electrical & Electronics, Wind Energy, Artificial Stones, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | LERG SA, DOW Inc., Von Roll, BASF SE, AOC, Ineos Group, DSM, TIANHE RESIN CO., LTD., Scott Bader Company Ltd., UPC GROUP, and other players. |

| DRIVERS | • High Growth in the Wind Energy and Construction Sectors • Industry expansion in the FRP, automotive, and composite manufacturing sectors • Economic Benefits Compared to Other Resins |

| Restraints | • More Acceptance of Alternative Resins • Unsaturated polyester resins' characteristics vary depending on their quality. |