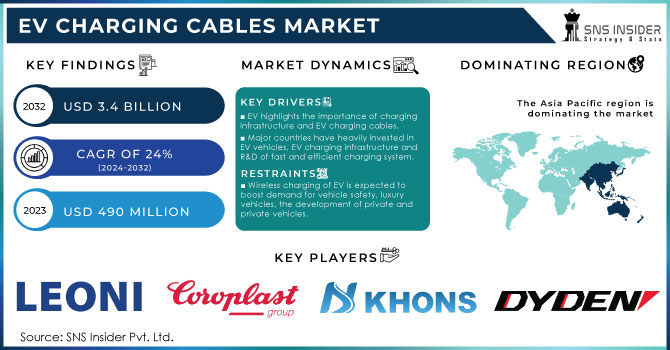

EV Charging Cables Market Report Scope & Overview:

The EV Charging Cables Market Size was valued at USD 1.25 Billion in 2023 and is expected to reach USD 5.95 Billion by 2032 and grow at a CAGR of 19.0% over the forecast period 2024-2032.

Get more information on EV Charging Cables Market - Request Sample Report

The EV Charging Cables market is growing at a rapid pace due to the growing adoption of electric vehicles worldwide and their increasing deployment of charging infrastructure around the world. There is a growing demand for green transportation, such as electric vehicles as governments introduce stricter emission standards and consumers seek out more eco-friendly vehicles. This increased demand for electric vehicles directly impacts the need for next-generation and reliable charging services like high-performance charging cables.

For example, On February 27, 2024, the United States had more than 61,000 publicly accessible EV charging stations with Level 2 or DC Fast chargers installed, which is more than double from around 29,000. This development is also enhanced by federal plans, such as the USD 7.5 billion that the 2021 Bipartisan Infrastructure Law set aside for building a national network of EV chargers to eventually reach 500,000 by 2030. Charging infrastructure growth has a direct link to the growing demand for advanced and reliable EV charging cables because efficient charging solutions are necessary for supporting the number of EVs on the roads.

Additionally, In the Alternative Fuels Data Center of the U.S. Department of Energy, there was a 6.3% rise in the number of EV charging ports in the second quarter of 2024, while public ports saw a 6.5% rise, and private ports 4.4%. Such an increase in charging stations and ports is of great importance and indicates the importance of high-quality charging cables in providing smooth and efficient charging for EV users.

Market Dynamics

Key Drivers:

-

Rising Adoption of Electric Vehicles Drives the Need for Advanced Charging Infrastructure and EV Charging Cables

The EV Charging Cables Market is the increased adoption of electric vehicles (EVs). As governments and private organizations urge people toward a greener future, there has been an evident shift from using internal combustion engine (ICE) vehicles to using electric vehicles. Recent reports indicate that the global EV market is expected to hit over 145 million vehicles by 2030. With an increasing number of consumers adopting EVs, the demand for charging infrastructure, including EV charging cables, is on the rise to ensure that these vehicles can be charged efficiently and conveniently. The demand for high-performance cables, including fast-charging options, is rising to accommodate the growing EV fleet.

Additionally, initiatives like the USD 7.5 billion investment of the U.S. government in enlarging EV charging networks through the Bipartisan Infrastructure Law support this growth. The increasing numbers of EV usage along with further demand for readily available and trustworthy charging solutions straightaway impacts the growth of the EV Charging Cables Market as a prime contributor to the broader electric mobility ecosystem. Due to this, sophisticated charging cables to support faster charge speeds and improved infrastructure are bound to be integral to meeting increasing demands.

-

Government Initiatives and Policies Promote Expansion of EV Charging Networks and Boost Market Growth for Charging Cables

Government support and policies are the most important factors driving the growth of EV charging infrastructure and, in turn, the EV Charging Cables Market. Governments around the world are providing incentives, grants, and subsidies to promote the use of electric vehicles, which indirectly creates a need for more charging stations and, consequently, more EV charging cables. For example, the US government's USD 5 billion investment to install 500,000 EV chargers by 2030 has influenced the growth of the market greatly. Such programs also alleviate many concerns of the consumer by providing accessible and ubiquitous charging stations.

Other countries also support this cause; especially, China, Germany, and the U.K. are implementing similar policies to increase their EV infrastructure. These government-driven policies focus on providing charging solutions in public spaces, commercial establishments, and residential areas, thereby increasing demand for a variety of charging cables. As electric mobility continues to pick up momentum, there is an increased need for durable, high-quality, and fast-charging cables to support the networks. With continued government support and investment in infrastructure, the EV Charging Cables Market is going to experience sustainable growth over the coming years.

Restrain:

-

High Installation Costs and Infrastructure Challenges Pose Obstacles to Widespread EV Charging Cable Adoption

Despite favourable growth factors, high installation costs and infrastructural challenges have always been significant challenges to the widespread acceptance of EV charging cables. Installation of extensive fast-charging networks requires large investments. In such cases, a large sum has to be paid for establishing power grids, setting up charging stations, and making them capable of sustaining the power loads of several charging cables simultaneously; this becomes challenging in rural or less-developed areas.

Additionally, the upgrading of the existing electrical grids to keep up with the spurt increase in electric vehicle demand is expensive. Both business entities and consumers looking to set up charging stations at home or public places may be discouraged from investing and subsequently adopting due to these high upfront costs. In addition, it provides more fuel to the fire in markets where adoption is slow because there are insufficient government incentives and subsidies. This further impacts the growth of both the charging infrastructure and the market size of EV Charging Cables.

Segments Analysis

By Type

The AC charging segment holds the largest share of revenue in the EV Charging Cables Market, accounting for 63.00% in 2023. The majority contribution to this segment is because AC charging solutions for home and public charging stations where the speed of charging is less important compared to DC fast charging. In Level 1 and Level 2 charging, the preferred type is an AC charger, thus often used for residential applications or locations where lengthy charging time is tolerable.

The DC charging segment is experiencing the largest CAGR of 19.95% within the forecasted period 2024-2032, driven by the growing need for faster charging solutions. The DC fast charger charges much quicker than the AC charger, meaning that it's suitable for large commercial charging stations and highway rest stops where ease and speed come first. Its growth is strongly influenced by such technological advancements in high-power charging, including the development of ultra-fast charging cables and improved power electronics.

By Application

The private charging segment dominated the EV Charging Cables Market with the largest share of revenue, accounting for 68.00% in 2023. This dominance is due to the widespread use of electric vehicles for personal mobility and the consumer's increased preference towards charging solutions based at home. Private charging enables an owner to conveniently charge his/her electric vehicle overnight without dependency on public infrastructure. The rise in electric vehicle owners around the world creates demand for dependable and efficient home charging solutions.

The public charging segment is witnessing the highest CAGR of 20.92% within the forecasted period, this demand in public spaces for accessible and reliable charging solutions has driven it. The surging demand for electric vehicles is increasing the need for a comprehensive public charging infrastructure. It is especially desired in urban cities and high-volume highway rest stops and commercial zones.

For example, Tesla has expanded its Supercharger network, offering fast charging capabilities that significantly reduce waiting times.

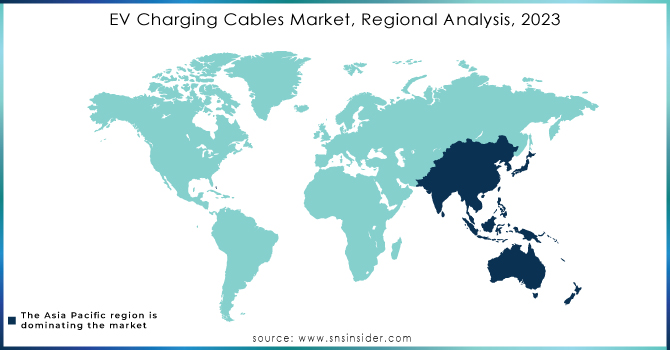

Regional Analysis

In 2023, the Asia Pacific region dominated the EV Charging Cables Market, accounting for an estimated market share of around 46%. This is mainly because of the high rate of adoption of electric vehicles (EVs) and massive investments in EV charging infrastructure across countries like China, Japan, and South Korea.

China, Being the world's largest EV market, China is at the forefront of this growth. The Chinese government has put in place many policies to support the EV industry, such as subsidies for electric vehicle purchases and investments in EV charging infrastructure.

For instance, China has over 2.5 million EV charging stations, making it one of the largest networks in the world. Similarly, Japan and South Korea are going all out, with key corporations such as Nissan, Toyota, and Hyundai not only building but also in heavy investment in these vehicles and their accompanying charging technology.

In 2023, North America emerged as the fastest-growing region in the EV Charging Cables Market, with an estimated CAGR of approximately 20.86%. This rapid growth is largely driven by the increasing adoption of electric vehicles (EVs), supported by favorable government policies, technological advancements, and a significant focus on building EV charging infrastructure.

The U.S. and Canada are at the lead of this growth, with the U.S. government allocating substantial funds to expand the country’s EV charging network. For instance, the Biden administration’s $7.5 billion investment through the Bipartisan Infrastructure Law aims to build 500,000 EV chargers across the country by 2030, contributing to the increased demand for EV charging cables. Additionally, the rise in EV sales, with automakers like Tesla, General Motors, and Ford ramping up their electric vehicle offerings, is fueling the demand for efficient and high-quality charging infrastructure.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the EV Charging Cables Market are:

-

Leoni AG (EV Charging Cables for High-Power Charging, Flexible Charging Cables for Residential Applications)

-

Coroplast (Charging Cables for Electric Vehicles, High-Voltage Cables for EV Charging Stations)

-

Chengdu Khons Technology Co., Ltd. (EV Charging Cables with Type 2 Connectors, Fast Charging Cables for Electric Vehicles)

-

Phoenix Contact (EV Charging Cables for Public Charging Stations, Wallbox Charging Cables for Home Use)

-

Aptiv (High-Speed EV Charging Cables, SAE J1772 Charging Cables for Electric Vehicles)

-

BESEN-Group (EV Charging Cables with Type 1 Connectors, DC Fast Charging Cables)

-

Dyden Corporation (Level 2 EV Charging Cables, Type 2 EV Charging Cables)

-

ABB (AC Charging Cables for Electric Vehicles, Fast DC Charging Cables)

-

Tesla (Tesla Charging Cables for Home Charging, Supercharger EV Charging Cables)

-

Besen International Group (EV Charging Cables with Type 2 Connectors, Portable EV Charging Cables)

-

EV Charging Cables (Type 2 EV Charging Cables, Flexible Charging Cables for Home Use)

-

EV Teison (Level 1 EV Charging Cables, Heavy-Duty Charging Cables for Commercial Use)

-

General Cable Technologies Corporation (High-Voltage EV Charging Cables, Industrial EV Charging Cables)

-

Phoenix Contact (Electric Vehicle Charging Cables with Integrated Communication, High-Power DC Charging Cables)

-

Sinbon Electronics (Smart EV Charging Cables, Type 2 Charging Cables for Electric Vehicles)

-

Systems Wire and Cable (EV Charging Cables for Residential Applications, Flexible High-Performance Charging Cables)

-

TE Connectivity (Electric Vehicle Charging Cables with Type 2 Connectors, Heavy-Duty Charging Cables for Commercial EVs)

-

BESEN International Group Co., Ltd. (Fast Charging Cables for EVs, Type 1 and Type 2 Charging Cables)

Recent Trends

-

In July 2024, Phoenix Contact installed a solar-powered EV charging station at its Pennsylvania campus to further its sustainability goals. The unit features four charging points and two fast-charging stations, powered by a 112.5-kW solar carport. This aligns with the company's pledge to carbon neutrality by 2030 and gives employees an environmentally friendly option to charge their electric vehicles without burdening the electric grid.

-

In November 2024, Tesla unveiled an EV adapter that would let its vehicles access charging stations built by other electric car networks, the Supercharger ones, for instance. This added a new wave of compatibility and ease for EV users to keep using their cars anywhere in town.

-

In April 2023, Leoni AG reported that it had renamed its Business Group AM the Automotive Cable Solutions (ACS) Division. ACS is underlined as an element of crucial significance for the automotive cable business of the cable segment. Ten locations in seven countries and some 3,300 employees make ACS today a significant provider of standard automotive cables, special cables, and charging cables.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.25 Billion |

| Market Size by 2032 | US$ 5.95 Billion |

| CAGR | CAGR of 19.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Charging Type (AC Charging, DC Charging) • By Application Type (Private Charging, Public Charging) • By Charging Level (Level 1, Level 2, Level 3) • By Cable Length (2-5 meters, 6-10 meters, >10 meters) • By Cable Shape (Straight, Coiled) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Leoni AG, Coroplast, Chengdu Khons Technology Co., Ltd., Phoenix Contact, Aptiv, BESEN-Group, Dyden Corporation, ABB, Tesla, Besen International Group, EV Charging Cables, EV Teison, General Cable Technologies Corporation, Phoenix Contact E-Mobility, Sinbon Electronics, Systems Wire and Cable, TE Connectivity, BESEN International Group Co., Ltd. |

| Key Drivers | • Rising Adoption of Electric Vehicles Drives the Need for Advanced Charging Infrastructure and EV Charging Cables • Government Initiatives and Policies Promote Expansion of EV Charging Networks and Boost Market Growth for Charging Cables |

| Restraints | • High Installation Costs and Infrastructure Challenges Pose Obstacles to Widespread EV Charging Cable Adoption |