AI Server DrMos Power Chip Market Size Analysis:

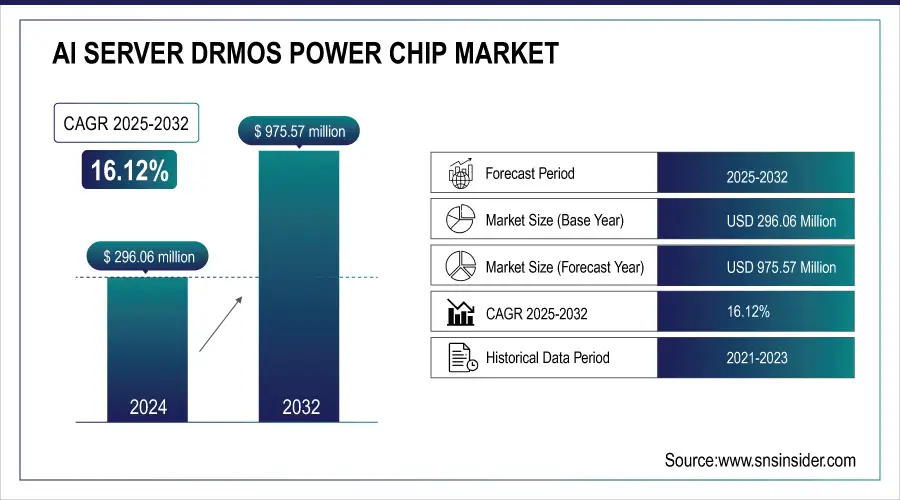

The AI Server DrMos Power Chip Market size was valued at USD 296.06 million in 2024 and is expected to reach USD 975.57 million by 2032, growing at a CAGR of 16.12% over the forecast period of 2025-2032. Factors, such as increasing adoption of AI servers, higher demand for high-efficiency power management, growing data center deployments, and greater technology development in GPU/accelerator architectures are driving DrMOS power chip market growth.

Growth of AI and machine learning workloads, coupled with the need for high-performance servers with effective power delivery solutions, drives the AI Server DrMOS Power Chip Market trends. Data centers need higher-density power management to scale up to drive new applications, such as generative AI, edge, and autonomous systems. Reserved for the AI workloads, DrMOS chips will continue to be an engine for cooling performance, higher power density, and lower heat at higher energy efficiency than conventional ISL chips and FETs, and they are best suited for the AI server architecture that integrates GPUs, FPGAs, and other maximum acceleration accelerators.

-

Data centers consumed approximately 460 terawatt-hours (TWh) globally in 2023 (IEA), and this is expected to nearly double by 2026, largely due to AI workloads.

-

Power density requirements in AI racks have exceeded 50 kW/rack in many hyperscale facilities.

To Get more information on AI Server DrMos Power Chip Market - Request Free Sample Report

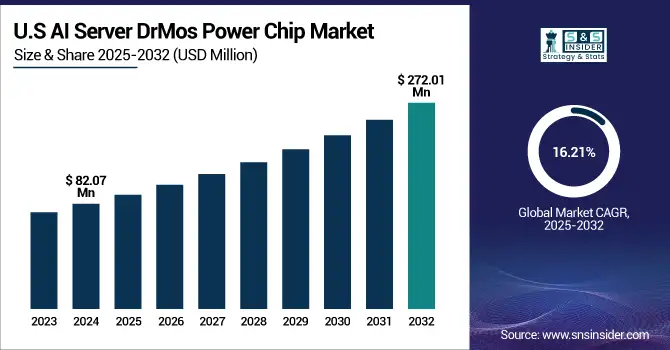

The U.S. AI Server DrMos Power Chip market size is estimated to be valued at USD 82.07 million in 2024 and is projected to grow at a CAGR of 16.21%, reaching USD 272.01 million by 2032. The U.S. AI Server DrMOS Power Chip Market growth is driven by increasing investment in AI, expansion of hyper-scale data centers, energy-efficient power delivery demand, and integration of High-End GPUs and Accelerators.

AI Server DrMos Power Chip Market Dynamics:

Key Drivers:

-

Rising Demand for Compact Thermally Optimized DrMOS Power Chips Fuels AI Server DrMos Power Chip Market Growth

Demand for highly efficient and high-density power delivery solutions for localized applications for AI and machine learning workloads is driving the AI Server DrMOS Power Chip market. To meet the growing demand for small-sized and thermally optimized DrMOS chips due to the rapid growth of hyperscale data centers and the integration of advanced GPUs, FPGAs, and AI accelerators in server architectures. In addition, DrMOS plays a significant role in AI infrastructure as the demand for server power density continues to rise due to increased utilization of generative AI, edge computing, and autonomous technologies.

For instance, DrMOS (Driver-MOSFET modules) integrate high-side/low-side FETs and drivers into a single chip, reducing power losses by 15%–20% and saving up to 30% PCB space compared to discrete solutions.

Restraints:

-

AI Server DrMOS Power Chip Faces Thermal Challenges Compatibility Issues and Global Supply Chain Constraints

The AI Server DrMOS Power Chip market faces technical challenges such as thermal management complexities. As AI servers require more current and power density, thermal management can be a fine line between component performance degradation and reliability. Moreover, the fast pace of innovation in AI hardware leads to compatibility issues, making DrMOS solutions have to evolve day by day to support various architectures using GPUs, FPGAs, and ASICs. Meanwhile, global supply chain constraints, from a scarcity of specialized semiconductor materials to personal components, continue to make it difficult for chips to be made and scale quickly.

Opportunities:

-

Emerging Markets Drive Growth for Miniaturized High Efficiency DrMOS Power Solutions in AI Servers

There is massive untapped potential in emerging economies, particularly in the Asia-Pacific and Latin America, strewn with increasing digitalization and investments in artificial intelligence infrastructure. Finally, the trend toward edge AI and on-device computing will open new markets for miniaturized and high-efficiency power solutions, such as DrMOS. Novel chip packaging, higher currents, and thermal management developments also widen opportunities for capability in advanced applications for next-generation AI server architecture.

Governments in India and Southeast Asia are investing heavily in AI. For example, India’s National AI Strategy aims to boost AI adoption across sectors with a USD 1.3 billion funding commitment

Asia-Pacific accounts for over 60% of global internet users as of 2024, driving digital transformation and AI adoption

Challenges:

-

Challenges in Miniaturized DrMOS Designs Include Cooling Power Delivery and Regional AI Infrastructure Gaps

The big challenge is using DrMOS in smaller and smaller server designs that offer less room to implement adequate cooling and power delivery solutions. In addition, ensuring adequate performance while maintaining low power consumption require design sophistication and testing to prevent failures in critical AI workloads. One possible reason is that the multi-phase power delivery systems required for heterogenous AI accelerators are more complicated to design and validate, which in turn, prolongs their development cycles. At last, due to the increasing growth of AI, regional inequalities exist in technological infrastructure, particularly in emerging markets, which serve as adoption hurdles.

AI Server DrMos Power Chip Market Segmentation Analysis:

By Type

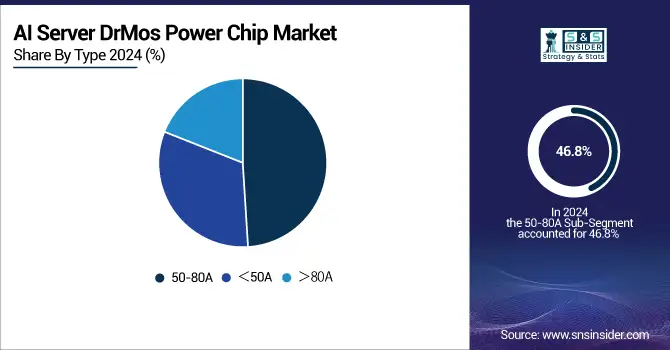

The AI Server DrMOS Power Chip market share was mainly occupied by the 50-80A DrMOS power chip segment, which contributed around 46.8% to the overall market in 2024. The reason for this dominance stems from the need for well-balanced power delivery solutions that provide an optimal combination of efficiency and current capacity needed for mainstream AI server configurations quite common nowadays.

The >80A DrMOS chip segment is expected to register the highest growth during 2025-2032. The growth is driven by the high-powered AI servers needing multiple GPUs and other accelerated workloads requiring higher current levels. With semiconductor technology and thermal solutions evolving to achieve higher power density and better energy efficiency, these chips are becoming critical components of next-generation AI infrastructure.

By Application

The CPU+GPU server segment accounted for the largest share of 51.4% in the AI Server DrMOS Power Chip market across the globe in 2024. The reason for this dominance is that AI utilizes GPUs for most of its use cases as they are designed for parallel processing required for training and inference tasks in Machine learning. CPU+GPU servers are still the backbone of most AI data centers due to their maturity in technology and ecosystem, and good performance in varied AI scenarios.

During 2025-2032, the fastest-growing segment of the market is likely to be the CPU+Multiple Accelerator Card Servers. With the complexity of AI workloads growing and their need for heterogeneous computing architecture, using GPUs, FPGAs, ASICs, and other accelerators, this growth is not only a storm in a teacup but creating massive ripples in the industry. Multi-accelerator servers require sophisticated power management solutions, such as DrMOS chips that deliver high current and efficient, stable power delivery to a variety of components.

AI Server DrMos Power Chip Market Regional Overview:

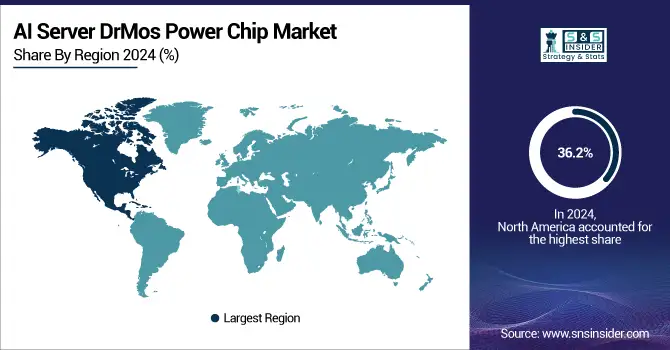

The North America AI Server DrMOS Power Chip market held the largest share at 36.2% in 2024 due to its technological advancement and interactive adoption in AI technologies. Home to many hyperscale data centres and top-tier cloud service providers who are upgrading their servers with AI, the region generates strong demand for smart power management solutions. Solid R&D capabilities and joint development between semiconductor companies and AI hardware manufacturers can speed up innovation in high-current DrMOS chips. Moreover, strict energy efficiency standards and the movement towards green data centers drive the need for power-efficient components.

Get Customized Report as per Your Business Requirement - Enquiry Now

With its advanced AI research, massive hyperscale data centers, and dominant semiconductor industry, the U.S. ruled North America. Increasing adoption of artificial intelligence (AI), investment in cloud infrastructure, and the growing need for high performance and energy-efficient power management solutions, such as DrMOS chips, are fueling growth.

The AI Server DrMOS Power Chip market share in Asia Pacific is expected to grow rapidly, at a CAGR of 16.7% during the forecast period of 2025-2032. The fast growth is driven by investments in AI technological infrastructure, increasing data center developments, and widespread digital transformation from verticals. With both public and private efforts aimed at enhancing AI capabilities in the region, it is quickly turning into an international hotspot for semiconductor manufacturing. The increasing proliferation of AI-powered applications, including smart cities, autonomous systems, and industrial automation, is driving demand for high-efficiency power delivery solutions, such as DrMOS.

The Asia Pacific market was led by China, on the back of its extensive AI investments, coupled with a fast-growing data center footprint and domestic semiconductor ecosystem. It is primarily driven by increasing AI adoption across various industry verticals, government initiatives, and demand for high-efficiency computing infrastructure.

The AI Server DrMos Power Chip market in Europe has principally benefited from the rising trend toward energy-efficient solutions for various applications, such as automotive electronics, industrial automation, and renewable energy. With growing sustainability efforts in the region, joined with fast-paced advancements in electric vehicles and smart grid technologies, Europe has become significant for power management, as these developments are increasing the need for energy-efficient solutions.

The impressive industrial base in Germany, the traditional AI adoption in manufacturing and automotive sectors, and heavy investment in the data center infrastructure made Germany the leader of the European market.

Latin America and the Middle East & Africa show potential for the AI server DrMOS Power Chip market, driven by the growing rate of digitalization and the rising number of investments in data centers and AI infrastructure. The rising cloud adoption along with the emergence of AI servers driven by government initiatives and smart city initiatives, is aiding AI servers’ deployment, resulting in wider adoption of power management solutions to enhance efficiency. These regions are still at an early-stage relative to mature markets, but they are opening up large opportunities as they adopt cost-effective compute architectures and AI-driven technologies.

Key Players Listed in the AI Server DrMos Power Chip Market are:

Some of the major AI Server DrMos Power Chips companies are Infineon, Texas Instruments, Renesas, onsemi, Alpha & Omega, Vishay, ROHM, Diodes Inc., Monolithic Power Systems, and STMicroelectronics.

Recent Developments:

-

In May 2024, Infineon introduced 8kW and 12kW high-efficiency PSUs for AI data centers, reaching up to 97.5% efficiency. These solutions aim to cut CO₂ emissions and meet rising AI server power demands.

-

In January 2025, Alpha and Omega Semiconductor (AOS) launched the AOZ73004CQI, the first four-phase PWM controller optimized for NVIDIA Blackwell GPUs and DrMOS technology. This controller enhances power efficiency and ripple reduction in AI servers and graphics cards.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 296.06 Million |

| Market Size by 2032 | USD 975.57 Million |

| CAGR | CAGR of 16.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (<50A, 50-80A, and >80A) • By Application (CPU+GPU Server, CPU+FPGA Server, CPU+Multiple Accelerator Card Servers, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Infineon, Texas Instruments, Renesas, onsemi, Alpha & Omega, Vishay, ROHM, Diodes Inc., Monolithic Power Systems, and STMicroelectronics. |