Market Scope:

Get More Information on EV Composites Market - Request Sample Report

The EV Composites Market size is projected to reach USD 6.45 billion by 2032, was valued at USD 1.8 billion in 2023 and will grow at a CAGR of 17.3% over the forecast period.

Globally, the EV composites market is presently experiencing an upswing due to a combination of factors. Fuel efficiency and emission reduction standards set by governments are the main contributing factors for this growth, accounting for about 35% of it. Automakers have been forced to adopt lighter materials by these regulations to increase electric vehicle (EV) range. Another important factor is rising fuel costs that affect approximately 20% of the market drivers. With high gasoline prices, customers demand better fuel economy leading them to consider EVs as an alternative. Additionally, there is also a growing consumer preference for sustainable mobility solutions which accounts for 18% of the force driving this market. They are seen as cleaner compared to gasoline powered vehicles and thus preferred by environment conscious consumers among other factors such as government regulations on emissions. Technological advances also play a critical role with about 17% contribution towards driving the market forward. Battery technology improvements enabling longer-distance travel and lighter and stronger composites materials development are some examples of these advances being referred here. Lastly, nearly 10% of the market drivers consist of government incentives targeting EV adoption and infrastructure development which stimulate both manufacturers and consumers through financial encouragements.

The rise of carbon fiber over fiberglass is another trend. These two materials are light, but carbon fiber has a better strength-to-weight ratio, which makes it a favorite for high-performance EVs. Here, the growing premium and luxury EV segment will be interested in this because customers are looking for high-end electric vehicles. A move towards lighter and intricate designs may also be achieved through using 3D printing technology for manufacturing complex composite parts in EVs. This would make them not only more environment-friendly and efficient but also lighter.

Market Dynamics:

Drivers:

-

Composites, notably such as carbon fibers are far much lighter than steel or aluminum that have traditionally been used without compromising on strength. This enables the car manufacturers to squeeze more power into the batteries of the vehicle without losing on performance.

-

Many countries are now enforcing stricter emission limits thereby compelling automakers to produce more electric vehicles (EVs). Also, consumers’ interest about EV’s is increasing due to their environmental concerns and potential savings they can make.

Automakers innovate and shift production towards electric vehicles due to stricter emission standards. For instance, the European Union set a 45% reduction in CO2 emissions from new cars by 2030 as opposed to its 2019 levels. On another front, the US Environmental Protection Agency (EPA) has adopted rules aimed at increasing the number of EVs sold such that by 2032 it is estimated that 70% of all sales will be electric. This regulatory pressure coincides with a growing consumer interest in EVs. Environmental consciousness as well as potential cost savings are driving this demand. Customers want to reduce their carbon footprints and see electric cars as being cheaper in terms of running costs because electricity is typically less expensive than gasoline. This combination of factors has led to an EV boom and its reverberations have been felt in the types of materials used for making them.

Restrain:

-

Composite materials generally cost more than traditional ones such as steel or aluminum metals.

-

There are currently no adequate recycling methods available for composite materials. This can pose a challenge for manufacturers who wish to minimize their environmental impact.

As opposed to traditional materials such as steel and aluminum that enjoy well-established recycling systems, composites tend to be broken down into fibers and resins in use hence making separation for reprocessing difficult and costly. Further, lower production volumes together with an emerging stage of recycling technology has seen less economically viable recycled composites compared to virgin materials. In addition, the absence of a widespread understanding and knowledge on options available when it comes to composite recycling is among the reasons why closed-loop system creation for these substances has been hindered. As a result, overcoming these obstacles is important for reducing manufacturers’ environmental footprint while keeping pace with increasing demand for environmentally friendly products by consumers.

Market Segmentation:

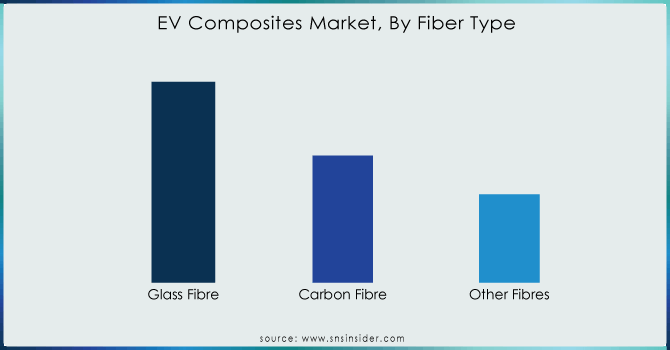

By Fiber Type

The glass fiber is the king of the hill with around 65% of market share. It is this dominance that can be ascribed to because it is cheap, easy to process and has well-established manufacturing processes. However, its use in high-performance EVs may be limited by its relatively lower strength-to-weight ratio compared to carbon fiber. The premium applications are covered by carbon fibers which constitute about 20% of the market share. This means that it’s a good material for lighter components in order to improve driving range and general vehicle performance due to its excellent strength-to-weight ratio. Consequently, manufacturers of high-end electric vehicles and racing cars find it more appealing. On the other hand, expensive cost and complex manufacturing processes hinder a wider adoption of carbon fiber. Other fibers take up 15% of the EV composites market such as natural fibers like flax, basalt fiber, aramid fibers amongst others.

Need any customization research on EV Composites Market - Enquiry Now

By Resin Type

Approximately 65% of material segment accounts show that thermoplastics are favored by EV composites market. Such dominance is due to their recyclable nature, flexibility in design, and high-volume manufacturing processes like injection molding which are efficient enough. On the other hand, 35% still remains of thermosets. This makes them a perfect choice for high performance EV components that experience extreme thermal stress because they have great heat resistance and structural rigidity. Nevertheless, their cross-linked molecular structure hampers recyclability.

By Type

The overall market is expected to be dominated by the non-premium segment which will occupy up to 25% of the total market. This domination is mainly driven by a high-production-volume of electric vehicles targeting mass markets where cost effectiveness is a major factor. By contrast, niche ultra-premium EVs that have advanced technology and are also very fast, will have approximately 35% market share. In this category, lightweighting and superior mechanical properties are crucial which has caused an increase in demand for high performance composites such as carbon fiber. The premium segment makes up about 40 percent of the market striking a balance between affordability and performance using various composite materials combinations for weight reduction and aesthetics.

By Application

It is the exterior segment of EV composites that takes the largest share of 30%, due to a demand for lightweight and fashionable car designs. It is closely followed by powertrain and chassis sector registering at 25% where composites improve handling and overall vehicle performance. Battery enclosures, which are critical for safety and range account for 20% of the market with a lot of growth potential ahead. Lastly, interior segment captures a quarter of the market, which will likely see more use of composite materials in things like headliners and seat parts as passenger comfort and cabin acoustics take center stage there. This segmentation shows how composites play many roles in EVs; they must be able to lose weight, increase speeds and allow flexible design changes since these factors are crucial in the changing electric mobility scene.

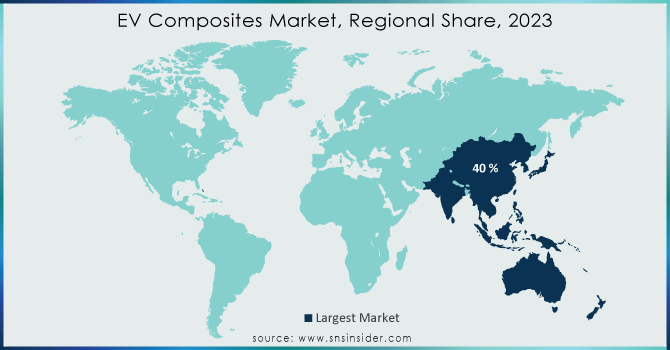

Regional Analysis:

The area of the APAC is the leader in the EV composites market, with many things put together. One of these factors is government policies that are tightening towards environmental protection as such the Chinese legislation mandates 35% of all new car sales to be electric by 2030. The increase in China’s projected electric vehicle production by 2025 will be approximately 80%. Additionally, cost competitiveness is a crucial factor. This directly translates into an up to 50% weight reduction compared to traditional steel thereby substantially increasing driving range which remains a chief consumer concern for EVs. Research conducted by SNS Insider indicated that reducing vehicle weight by 10% could extend battery life by around six percent. In light of this, there is a growing demand for affordable electric cars among APAC’s emerging middle class especially those in India. These markets can substitute expensive carbon fiber or fiberglasses used in manufacturing vehicles making them more appealing to producers who target budget-conscious customers and hence go for composites as a solution. Therefore, APAC’s EV composites market has great prospects for growth beyond today.

Key Players:

Toray Industries, Teijin Limited, Syensqo, Piran Advanced Composites, HRC, Envalior, Exel Composites, Kautex Textron, SGL Carbon, Polytec Holding AG, Plastic Omnium and others.

Recent Developments:

Toray Industries Inc.: In February 2023, it provided a new method of joining Carbon Fiber Reinforced Plastic (CFRP) for molding automotive parts. The technology is expected to speed up the process of molding in comparison with traditional processes.

Hexcel Corporation: Hexcel worked together with HP Composites S.p.A. on the development of class A body panels for supercars using advanced composites and technology from Hexcel. Class A panels are those that have a high-quality surface finish, suitable for the exterior of a vehicle.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.8 billion |

| Market Size by 2032 | US$ 6.45 Billion |

| CAGR | CAGR of 17.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Fiber Type (Glass Fibre, Carbon Fibre, Other Fibres) By Resin Type (Thermoplastics, Thermosets) By Manufacturing Process (Compression Molding, Injection Molding, RTM) By Type (Ultra-Premium, Premium, Non-Premium) By Application (Interior, Exterior, Battery Enclosure, Powertrain & Chassis) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toray Industries, Teijin Limited, Syensqo, Piran Advanced Composites, HRC, Envalior, Exel Composites, Kautex Textron, SGL Carbon, Polytec Holding AG, Plastic Omnium and others. |

| Key Drivers | Many countries are now enforcing stricter emission limits thereby compelling automakers to produce more electric vehicles (EVs). Also, consumers’ interest about EV’s is increasing due to their environmental concerns and potential savings they can make |

| RESTRAINTS | Composite materials generally cost more than traditional ones such as steel or aluminum metals. |