Factoring Services Market Size & Overview:

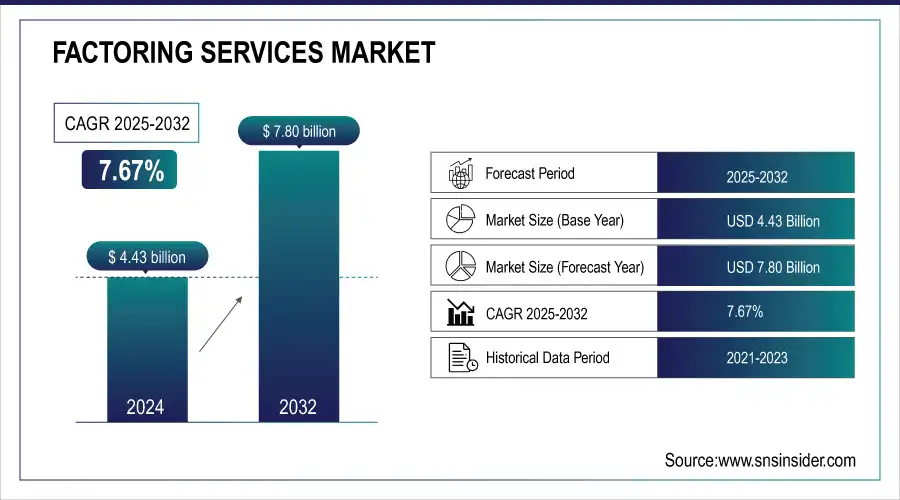

The Factoring Services Market was valued at USD 4.43 billion in 2024 and is expected to reach USD 7.80 billion by 2032, growing at a CAGR of 7.67% from 2025-2032.

Factoring Services Market has grown significantly as businesses seek liquidity and effective cash flow management amid delayed payments and rising operational costs. By converting receivables into immediate cash, factoring supports continuous operations, especially for SMEs. Digital platforms and AI-driven risk assessment are transforming the sector, enabling faster, more efficient access to financing. Technology-driven solutions like export factoring for SMEs are increasing adoption, particularly in emerging markets, while supporting cross-border trade and providing tailored financing options.

Get more information on Factoring Services Market - Request Free Sample Report

As of November 2024, Stenn is expanding its platform to offer faster and more secure financial solutions for SMEs globally. These technological advancements streamline the process and enhance the flexibility of factoring, allowing businesses to choose tailored financing solutions, such as recourse or non-recourse factoring, based on their specific needs.

Factoring Services Market Trends

-

Rising demand for working capital and liquidity solutions is driving factoring services adoption.

-

Increasing use among SMEs and startups for invoice financing is boosting market growth.

-

Integration of digital platforms and fintech solutions is enabling faster, automated factoring processes.

-

Growing focus on cash flow management and credit risk mitigation is encouraging adoption.

-

Expansion of e-commerce and B2B trade is increasing invoice financing opportunities.

-

Regulatory support and streamlined compliance processes are facilitating market penetration.

-

Collaborations between banks, financial institutions, and fintech providers are accelerating innovation and service offerings.

Factoring Services Market Growth Drivers:

-

Focus on Enhanced Cash Flow Management Driving Factoring Services Market Growth

Companies are increasingly prioritizing cash flow management to ensure smooth operations and financial stability. With 82% of businesses failing due to cash flow issues and 69% of small business owners worrying about cash flow at night, addressing this concern is critical. Factoring provides a crucial solution by enabling businesses to quickly convert accounts receivable into immediate working capital, addressing short-term cash flow gaps. This is particularly beneficial for small and medium enterprises, which often face challenges in securing traditional financing options. With the rise of unpredictable payment cycles and the need for quick liquidity, businesses can rely on factoring to meet operational expenses, pay suppliers, and invest in growth opportunities without delay. By converting outstanding invoices into cash upfront, companies avoid cash flow disruptions and continue to thrive.

-

Global Trade Expansion Boosting Factoring Services Market Growth

After stagnating in 2023, international trade is projected to grow by about 2% in real terms in 2024, according to UN Trade and Development. With the rapid expansion of global trade, businesses are increasingly engaging in cross-border transactions, which come with complexities such as currency fluctuations, delayed payments, and the risk of non-payment. Factoring services offer an effective solution by enabling businesses to convert international receivables into immediate cash, thus mitigating these financial risks. Companies can use factoring to improve their liquidity, avoid cash flow disruptions, and continue operations smoothly despite delays in foreign payments. Factoring also provides businesses with the confidence to explore new international markets without the fear of financial strain due to non-payment or slow collections. As global trade continues to grow in 2024 and businesses seek to manage the complexities of international transactions, the demand for factoring services is set to increase, offering greater financial security and flexibility.

Factoring Services Market Restraints:

-

High Fees and Costs Associated with Factoring Services Hindering Widespread Adoption Among SMEs

Factoring services often involve higher fees compared to traditional financing options like bank loans, which can act as a barrier for small and medium-sized enterprises. The service charges, interest rates, and additional costs associated with factoring can be significant, especially for businesses operating with tight margins. Factoring interest rates typically range from 0.7% to 1.5% per month, depending on the business's credit profile, and companies may face processing fees of 0.3% to 1% of the total amount, along with overdue interest of 1-2% for delayed payments. For SMEs, these costs can be prohibitive, making it difficult to justify factoring as a viable financial solution. While factoring offers quick access to capital, the expense involved may outweigh the benefits, particularly for smaller businesses. This financial burden limits the adoption of factoring services, as many SMEs may seek alternative, more affordable funding options, such as lines of credit or loans, to meet their liquidity needs.

-

Challenges of Dependency on Timely Customer Payments in Factoring Services

Factoring services are heavily reliant on the timely payment of receivables by a business's clients. When businesses face delays in customer payments or experience a high rate of defaults, it can undermine the effectiveness of factoring as a reliable liquidity solution. The entire process of factoring depends on the ability of customers to honor their outstanding invoices promptly, meaning that any delays or non-payments can create financial strain for the business seeking factoring services. As a result, companies may find themselves unable to repay their factoring service provider or maintain smooth cash flow. This dependency on external factors, which are often out of the business’s control, limits the appeal of factoring services, especially for businesses in industries prone to payment delays or higher credit risks.

Factoring Services Market Segment Analysis

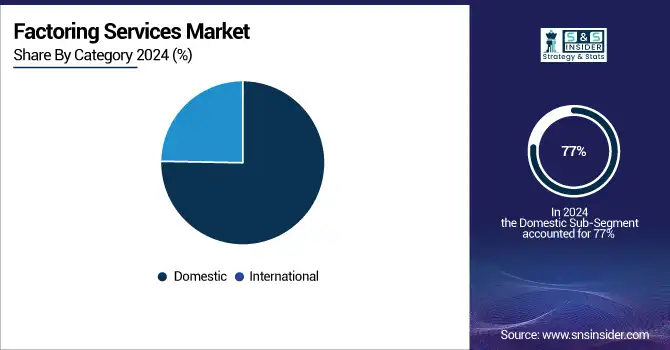

By Category, Domestic segment dominated, International segment is expected to grow fastest.

In 2024, the Domestic segment dominated the factoring services market, accounting for approximately 77% of the total revenue. This dominance can be attributed to the widespread adoption of factoring by local businesses, particularly small and medium enterprises, that face frequent cash flow challenges. The simplicity, speed, and accessibility of domestic factoring services make them a preferred option for businesses seeking immediate liquidity to maintain operations without the complexities of international transactions.

The International segment is expected to grow at the fastest CAGR of about 9.99% from 2025 to 2032. As global trade continues to expand, businesses increasingly require factoring services to manage cross-border transactions, mitigate currency risks, and address delays in international payments. With more companies venturing into international markets, the need for factoring solutions that ensure timely cash flow and financial security in foreign dealings is driving the rapid growth of this segment.

By Type, Recourse segment dominated, Non-Recourse segment is expected to grow fastest.

In 2024, the Recourse segment dominated the factoring services market, holding approximately 64% of the total revenue share. This dominance stems from the preference of businesses for recourse factoring due to its lower cost compared to non-recourse options. In recourse factoring, the risk of non-payment remains with the seller, making it a more affordable and accessible choice for businesses looking to improve cash flow while managing their financial risk.

The Non-Recourse segment is expected to grow at the fastest CAGR of about 9.00% from 2025 to 2032. As businesses seek greater protection against the risks of non-payment and defaults, non-recourse factoring, which transfers the risk to the factor, is becoming increasingly attractive. With rising concerns over credit risk and the expansion of international trade, companies are turning to non-recourse factoring to secure their cash flow with minimal exposure to potential losses, driving its rapid growth.

By Financial Institution, Banking Financial Institutions dominated, Non-Banking Financial Institutions are expected to grow fastest.

In 2024, the Banking Financial Institutions segment dominated the factoring services market, accounting for approximately 71% of the total revenue share. This dominance is largely due to the established infrastructure, regulatory support, and trust that traditional banks offer businesses. With a well-developed network and access to substantial financial resources, banks are able to provide competitive factoring solutions, making them the preferred choice for companies seeking reliable, secure funding.

The Non-Banking Financial Institutions segment is expected to grow at the fastest CAGR of about 9.38% from 2025 to 2032. As businesses seek more flexible and customized financing options, Non-Banking Financial Institutions are stepping in to offer tailored factoring services with fewer restrictions and quicker approval processes. With their ability to cater to underserved markets and provide more agile solutions, Non-Banking Financial Institutions are gaining traction, particularly among small and medium-sized enterprises, driving their rapid growth in the factoring services market.

By Enterprise Size, Large Enterprises segment dominated, SMEs segment is expected to grow fastest.

In 2024, the Large Enterprises segment dominated the factoring services market, capturing about 58% of the total revenue share. This dominance is driven by the significant capital requirements and complex cash flow management needs of large corporations. With established creditworthiness and access to extensive financial resources, large enterprises are more likely to utilize factoring services to optimize their working capital, improve liquidity, and streamline operations without the burden of additional debt.

The SMEs segment is expected to grow at the fastest CAGR of approximately 9.03% from 2025 to 2032. SMEs, often facing limited access to traditional financing and high credit risks, are increasingly turning to factoring services as a flexible and quick source of funding. As SMEs seek to strengthen their cash flow and fuel growth, factoring offers them a viable solution, making this segment a key driver of market expansion in the coming years.

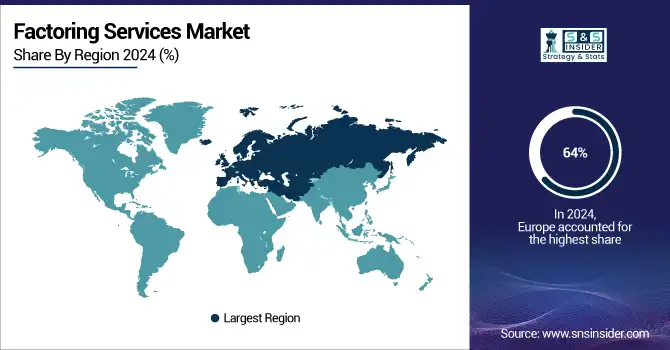

Factoring Services Market Regional Analysis

Europe Factoring Services Market Insights

In 2024, Europe dominated the factoring services market, accounting for approximately 64% of the total revenue share. This dominance is attributed to the region's well-established financial infrastructure, strong regulatory frameworks, and the high adoption of factoring services by businesses across various industries. Europe's mature market, with its large number of small and medium enterprises and multinational corporations, continues to drive significant demand for factoring as a preferred financial tool to manage working capital and optimize cash flow.

Need any customization research on Factoring Services Market - Enquiry Now

Asia Pacific Factoring Services Market Insights

The Asia Pacific region is expected to grow at the fastest CAGR of about 10.00% from 2025 to 2032. As economies in Asia Pacific continue to expand, more businesses, particularly SMEs, are recognizing the benefits of factoring services to enhance liquidity and support growth. The increasing trend of international trade, coupled with the region’s growing manufacturing sector, is driving the demand for factoring as companies seek efficient solutions to manage cross-border transactions and mitigate payment risks, positioning Asia Pacific for rapid market growth.

North America Factoring Services Market Insights

North America holds a significant share in the Factoring Services Market, driven by the presence of established financial institutions, strong SME networks, and advanced fintech adoption. Growing demand for working capital solutions, particularly among small and medium enterprises, is fueling market growth. Digital factoring platforms, AI-driven risk assessment, and supportive regulatory frameworks are enhancing efficiency, transparency, and accessibility, further strengthening the adoption of factoring services across the region.

Middle East & Africa and Latin America Factoring Services Market Insights

Middle East & Africa and Latin America are emerging markets in the Factoring Services Market, supported by increasing SME activity, growing cross-border trade, and limited access to traditional financing. Adoption is driven by digital platforms and fintech solutions that simplify receivables financing. Although infrastructure and regulatory challenges exist, government initiatives, private sector investments, and rising awareness of alternative financing are gradually expanding the factoring services market in these regions.

Factoring Services Market Competitive Landscape:

altLINE

altLINE is a key player in the Factoring Services Market, providing invoice factoring and accounts receivable financing solutions to support SMEs in managing cash flow efficiently. By converting receivables into immediate funds, altLINE helps businesses maintain liquidity, meet operational expenses, and sustain growth. Leveraging flexible financing options and tailored services, the company strengthens SME access to capital, enhancing business continuity and enabling strategic financial planning.

-

In 2024, the altLINE (SBA) introduced a new working capital pilot program aimed at helping small businesses address cash flow challenges and access needed financing.

Factor Funding Co.

Factor Funding Co. is a prominent player in the Factoring Services Market, offering factoring services and purchase order financing to help businesses convert receivables into immediate cash. Its solutions support SMEs and growing enterprises by improving liquidity, mitigating credit risks, and enabling operational continuity. By providing flexible, technology-driven financing options, Factor Funding Co. enhances business efficiency, promotes growth, and strengthens access to working capital for diverse industries.

-

In 2024, Factor Funding Co. launched a new website designed to leverage social media and provide businesses with enhanced resources for cash flow management and financial solutions.

KEY PLAYERS

-

altLINE (The Southern Bank Company) (Invoice Factoring, Accounts Receivable Financing)

-

Barclays Bank PLC (Supply Chain Finance, Invoice Discounting)

-

BNP Paribas (Invoice Factoring, Supply Chain Finance)

-

China Construction Bank Corporation (Domestic Invoice Factoring, Export Factoring)

-

Deutsche Factoring Bank (Factoring Services, Invoice Financing)

-

Eurobank (Receivables Financing, Invoice Factoring)

-

Factor Funding Co. (Factoring Services, Purchase Order Financing)

-

Hitachi Capital (UK) PLC (Invoice Factoring, Asset-based Lending)

-

HSBC Group (Receivables Financing, Export Finance)

-

ICBC China (Invoice Factoring, Trade Finance)

-

Kuke Finance (Supply Chain Finance, Factoring Services)

-

Mizuho Financial Group, Inc. (Trade Finance, Receivables Factoring)

-

RTS Financial Service, Inc. (Invoice Factoring, Payroll Financing)

-

Société Générale S.A. (Factoring Services, Supply Chain Finance)

-

TCI Business Capital (Invoice Factoring, Accounts Receivable Financing)

-

Advanon AG (Invoice Factoring, Receivables Financing)

-

Societe Generale (Factoring Services, Supply Chain Finance)

-

Hitachi Capital PLC (Invoice Factoring, Asset-based Lending)

-

KUKE Finance JSC (Receivables Factoring, Supply Chain Finance)

-

Riviera Finance of Texas, Inc. (Invoice Factoring, Payroll Financing)

-

AwanTunai (Invoice Factoring, Supply Chain Finance)

-

Aldermore Bank (Invoice Factoring, Asset-based Lending)

-

Mizuho Financial Group (Trade Finance, Receivables Factoring)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.43 Billion |

| Market Size by 2032 | USD 7.80 Billion |

| CAGR | CAGR of 7.67% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Category (Domestic, International) • By Enterprise Size (Large Enterprises, SMEs) • By Type (Recourse, Non-Recourse) • By Financial Institution (Banking Financial Institutions, Non-Banking Financial Institutions) • By End-use (Manufacturing, Transport & Logistics, Information Technology, Healthcare, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | altLINE, Barclays Bank PLC, BNP Paribas, China Construction Bank Corporation, Deutsche Factoring Bank, Eurobank, Factor Funding Co., Hitachi Capital (UK) PLC, HSBC Group, ICBC China, Kuke Finance, Mizuho Financial Group, Inc., RTS Financial Service, Inc., Société Générale S.A., TCI Business Capital, Advanon AG, Societe Generale, Hitachi Capital PLC, KUKE Finance JSC, Riviera Finance of Texas, Inc., AwanTunai, Aldermore Bank, Mizuho Financial Group. |