Software Defined Data Center Market Report Scope & Overview:

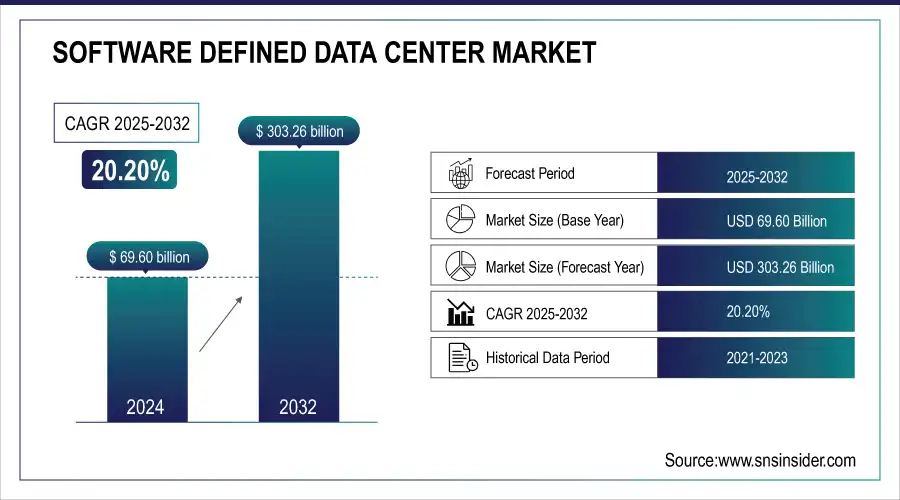

The Software Defined Data Center Market was valued at USD 69.60 billion in 2025E and is expected to reach USD 303.26 billion by 2033, growing at a CAGR of 20.20% from 2026-2033.

The Software-Defined Data Center (SDDC) market is witnessing rapid growth, driven by the increasing adoption of multi-cloud strategies, integration of emerging technologies like 5G and IoT, and the growing need for scalable, resilient infrastructures. Over 60% of enterprises have deployed or plan to deploy SDDCs, with BFSI, IT, and telecommunications sectors leading adoption due to agility and enhanced operational efficiency. Incorporating AI and machine learning enables intelligent automation and optimized resource allocation, while energy-efficient designs reduce power consumption by approximately 35%, supporting sustainability goals. Edge computing adoption by around 45% of enterprises facilitates real-time data processing, particularly from IoT devices.

Software Defined Data Center Market Size and Forecast

-

Software Defined Data Center Market Size in 2025E: USD 69.60 Billion

-

Software Defined Data Center Market Size by 2033: USD 303.26 Billion

-

CAGR: 20.20% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Software Defined Data Center Market - Request Sample Report

The U.S. Software Defined Data Center (SDDC) market size was valued at an estimated USD 31.80 billion in 2025 and is projected to reach USD 138.90 billion by 2033, growing at a CAGR of 19.8% over the forecast period 2026–2033. Market growth is driven by increasing demand for agile, scalable, and cost-efficient IT infrastructure across enterprises and cloud service providers. Rising adoption of cloud computing, virtualization, and software-defined networking (SDN) and storage (SDS) solutions is accelerating market expansion. Additionally, the growing need for improved data center efficiency, enhanced security, and automation, along with strong investments in hyperscale data centers and digital transformation initiatives, further strengthen the robust growth outlook of the U.S. software defined data center market during the forecast period.

Software Defined Data Center Market Trends

-

Rising adoption of cloud computing and virtualization is driving the software-defined data center (SDDC) market.

-

Integration of AI, automation, and analytics is enhancing resource management, scalability, and operational efficiency.

-

Growing need for agile, flexible, and cost-effective IT infrastructure is boosting market growth.

-

Increasing focus on security, compliance, and disaster recovery is shaping adoption trends.

-

Expansion of hybrid and multi-cloud environments is accelerating SDDC deployment.

-

Rising demand from enterprises across BFSI, IT, healthcare, and telecom sectors is fueling market growth.

-

Collaborations between hardware vendors, software providers, and cloud service companies are fostering innovation and comprehensive solutions.

Software Defined Data Center Market Growth Drivers:

-

Organizations are increasingly using multiple cloud platforms to optimize resources and ensure business continuity, which drives the need for SDDCs to manage these complex environments efficiently.

-

The critical need for continuous service availability and robust disaster recovery solutions is pushing businesses to adopt SDDCs, which enhance infrastructure resilience and minimize downtime.

-

SDDCs enable significant cost reductions through automation and improved energy efficiency, making them an attractive choice for businesses looking to optimize operational expenses.

Multi-cloud adoption has become the significant driver of Software-Defined Data Center (SDDC) market. In recent years, Enterprises increasingly have turned on multi-cloud environments to maximize resource utilization benefit and flexibility as well ensuring business continuity. More than 90% of them are leveraging multiple clouds to avoid vendor lock-in and take advantage of the best features of different cloud providers. Multi-Cloud approach allows organizations to distribute workloads across various cloud platforms like AWS, Azure or Google Cloud to keep workloads distributed across different public clouds helping in mitigating outage risks and achieving high availability. This approach has driven demand for SDDCs which can automate the scalability and centralized management need to handle the complexities of multi-cloud workloads.

It is also important to note that almost 80% of IT decision makers believe that managing a multi-cloud environment are a key requirement, which have further expedited the demand for SDDCs as they provide critical role in streamlining operations across various cloud infrastructure. The ability of SDDCs to provide a unified interface for managing multiple clouds has become essential for businesses seeking to maintain agility and operational efficiency in an increasingly complex digital landscape.

Software Defined Data Center Market Restraints:

-

The increased virtualization and cloud integration in SDDCs expands the attack surface, leading to significant security challenges that require substantial investment to mitigate.

-

The significant upfront costs associated with SDDC setup, including specialized software, hardware, and skilled personnel, can be a barrier, especially for smaller organizations.

-

Lack of global acceptance of virtualization standards to stifle market growth

Despite the rising popularity of software-defined data centers, no internationally recognized software-defined data center standard exists. Because there is no single virtualization standard in a multi-controller SDN architecture, SDN controllers manufactured by different manufacturers may exhibit inconsistent or deceptive behavior. Using many controllers at once might result in network traffic restrictions. Because of this lack of standardization, transitioning traditional data centers to SDDCs presents significant interoperability challenges. Due to a lack of internationally agreed virtualization standards, integration, and interoperability challenges limit the usage of multi-controller SDN architecture in SDDCs and are projected to hinder industry development.

Software Defined Data Center Market Segment Analysis

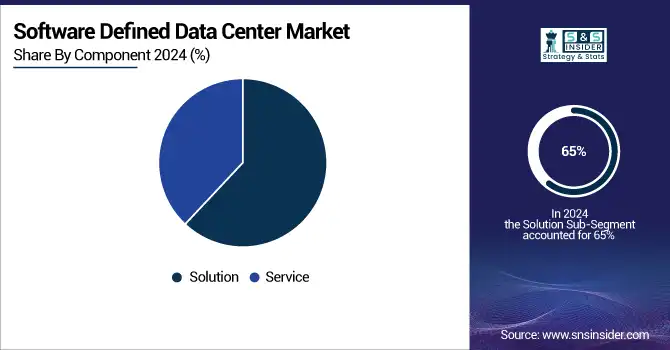

By Component, Solution segment dominates the Software-Defined Data Center (SDDC) market. Services are expected to grow fastest.

on the basis of component, solution segment held the highest revenue share more than 65% in 2025. Factors such as the need for agile and flexible IT environments, demand for cost-effective data center solutions, and growing adoption of cloud computing are driving the growth of the solution segment. The need for advanced data center management solutions has also been heightened by the increasing prevalence of big data and Internet of Things.

The service segment is expected to grow at a significant CAGR during the forecast period. The services segment in the SDDC market includes various separate but connected services such as consulting, implementation, integration, and managed services. Consulting services provide enterprises with explanations regarding the benefits and consequences of integrating SDDC technologies, in addition to planning and strategizing for a proper plan. The implementation and integration services ensure that the SDDC solutions are well integrated within the current IT infrastructure of the enterprise before the switch to minimize operation disruption.

By Type, Software-Defined Compute dominates the SDDC market. Software-Defined Networking (SDN) is expected to grow fastest.

The market led by the software-defined compute segment owing to the presence of key drivers such as cloud adoption, operational efficiency requirements, and the need for IT infrastructure to be agile and scalable. With the introduction of Software-Defined computing, enterprises are also able to take advantage of reduced costs and better process utilization. The manipulation of computing workloads with artificial intelligence and machine learning is another key driver, making data center operations more intelligent and autonomous. The segment and software are further gaining more significant traction and the key reason for developing at a large compounded annual growth rate through the forecast years.

On the other hand, the software-defined networking segment is the fastest-growing one and a large reason behind this fact is the increase in the need for network agility and flexibility, implementation of cloud services, and network security need. SDN is more dynamic and responsive to other network infrastructures as it can be tailored to support other dynamic workloads and different types of traffic patterns. In addition, network function virtualization is turning out to be a growing trend, complementing SDN by the induction of virtualization of network services. The segment develops at a highly compounded annual growth rate through the forecast years.

By Deployment, Public SDDCs dominate the market. Hybrid SDDCs are expected to grow fastest.

The public segment had the largest revenue share of about 48.90% in 2025. Public SDDCs are usually provided by third parties and provide a flexible and cost-effective solution for companies wishing to outsource data center management. On top of the increased use of cloud computing, flexibility and on-demand scalability, and the need to reduce capital investments have increased the adoption of this model. Additionally, public SDDCs offer superior disaster recovery and business continuity solutions which are essential for companies interested in uninterrupted operations. The hybrid segment is projected to grow with a significant CAGR during the forecast period. Hybrid SDDCs are provided by a hybrid approach, combining the advantages of private and public data centers while eliminating their limitations. As such, it allows companies to maintain control over sensitive information and operations while still getting the flexibility and cost-effectiveness provided by the public model. Key drivers of hybrid SDDC adoption include legislation, data sovereignty, and the ability to split workloads between different SDDCs for optimal performance.

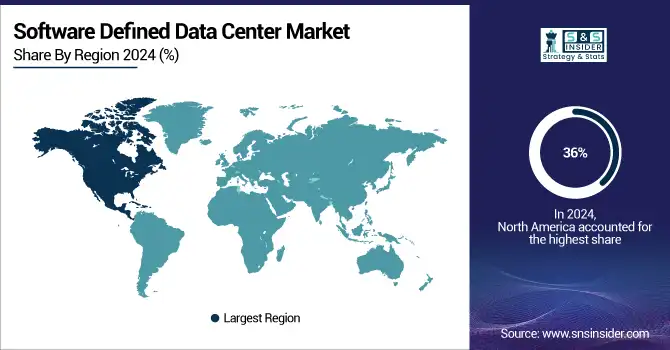

Software Defined Data Center Market Regional Analysis

North America Software Defined Data Center Market Insights

The software-defined data center market is dominated by North America and held a revenue share of more than 36% in 2025. The North American market is poised for tremendous growth due to a highly developed technological infrastructure and the rapid pace of cloud computing adoption. The key market growth factors include the presence of top tech companies, significant investments in data center technologies, and the need for efficient, automated, and scalable IT infrastructure. Rising use of technology across all regional sectors drives AI and machine learning integration within the SDDC, increasing automation and operation efficiency. Therefore, these are the key factors contributing to the market’s growth in North America. In the U.S., almost all industries are going through the process of digital transformation. Finance, healthcare, and retail must have available and viable data centers, supporting these changes. The U.S. government supports and promotes smart cities projects and fast expansion of digital infrastructure. Furthermore, the other drivers on the U.S. market include a growing trend of using edge computing centers, combined with SDDCs, and a rising adoption of hybrid cloud environments overall.

Need any customization research on Software Defined Data Center Market - Enquiry Now

Asia Pacific Software Defined Data Center Market Insights

The Asia Pacific Software-Defined Data Center (SDDC) market is expanding rapidly, driven by growing IT infrastructure investments, cloud adoption, and digital transformation initiatives. Strong presence of technology vendors, rising demand for scalable and automated data centers, and increasing integration of AI, IoT, and 5G technologies support market growth. Countries like China, India, Japan, and Australia lead adoption, with enterprises seeking efficiency, flexibility, and cost-effective infrastructure solutions.

Europe Software Defined Data Center Market Insights

Europe holds a significant position in the Software-Defined Data Center (SDDC) market, driven by advanced IT infrastructure, strong cloud adoption, and regulatory compliance requirements. Increasing demand for scalable, flexible, and energy-efficient data centers, along with integration of AI, IoT, and 5G technologies, fuels growth. Countries such as Germany, the UK, and France lead adoption, supported by investments from enterprises and technology providers focusing on digital transformation and automation.

Middle East & Africa and Latin America Software Defined Data Center Market Insights

The Middle East & Africa and Latin America are emerging markets in the Software-Defined Data Center (SDDC) industry, driven by growing cloud adoption, digital transformation initiatives, and expanding IT infrastructure. Investments in smart city projects, edge computing, and energy-efficient data centers are fueling growth. Countries like Brazil, Mexico, UAE, and Saudi Arabia are witnessing increased deployment of SDDC solutions across BFSI, telecom, and enterprise sectors, highlighting strong market potential.

Software Defined Data Center Market Competitive Landscape:

IBM Corporation

IBM Corporation is a global technology and consulting company providing IT solutions across cloud computing, artificial intelligence, enterprise software, and networking services. IBM focuses on enabling digital transformation for businesses through innovative hardware, software, and services, helping organizations optimize operations, enhance security, and improve network and infrastructure performance. Its offerings support industries including BFSI, healthcare, manufacturing, and telecommunications.

-

In February 2024, IBM Corporation broadened its enterprise networking offerings to include Software Defined Data Center (SDDC) and Software Defined Networking (SDN) solutions, emphasizing Cisco networking. The new offerings feature IBM's Support and Implementation Services for SDN and an IBM Network Health Check service aimed at improving network integration, performance, and reliability.

Cisco Systems

Cisco Systems is a leading global provider of networking, cybersecurity, and IT infrastructure solutions. The company offers routers, switches, software-defined networking, security solutions, and hybrid cloud services, enabling enterprises to modernize IT, improve connectivity, and enhance operational efficiency. Cisco serves multiple sectors, including BFSI, telecommunications, government, and enterprise IT, focusing on innovation, network automation, and intelligent infrastructure.

-

In January 2024, Cisco Systems teamed up with Nutanix to offer hybrid cloud services to a global customer base. This collaboration integrates Cisco’s Hyperconverged Compute with Nutanix’s capabilities to manage infrastructure, application operations, and cloud operations.

Rackspace Technology Inc.

Rackspace Technology Inc. is a managed cloud services provider specializing in hybrid, multi-cloud, and enterprise IT solutions. The company delivers cloud hosting, infrastructure management, and consulting services across public and private cloud environments. Rackspace enables businesses to optimize workloads, secure IT operations, and integrate cloud-native technologies, serving sectors such as BFSI, healthcare, retail, and manufacturing.

-

In December 2023, Rackspace Technology Inc. introduced SDDC enterprise and business solutions for SAP. These solutions, built on VMware's virtualized storage, compute, cloud, and networking management, include VMware vRealize Suite, physical and virtual operations management, Rackspace data protection for disaster recovery, and VMware hybrid cloud extension.

Key Players

Some of the Software Defined Data Center Market Companies

-

Fujitsu

-

IBM

-

Microsoft

-

Commvault

-

Dell Technologies

-

Oracle

-

Nutanix

-

Cisco

-

Citrix

-

Huawei

-

VMware

-

Juniper Networks

-

Arista Networks

-

DataCore Software

-

Scality

-

HPE

-

SUSE

-

DriveNets

-

Lightbits

-

NetApp

-

Nuage Networks

-

Lenovo

-

Stratoscale

-

HiveIO

-

TidalScale

-

Portworx

-

Arrcus

-

Vexata

-

Hammerspace

-

Cohesity

-

Lumina Networks

| Report Attributes | Details |

| Market Size in 2025E | USD 69.60 Bn |

| Market Size by 2033 | USD 303.26 Bn |

| CAGR | CAGR of 20.20% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Type (Software Defined Compute, Software Defined Networking, Software Defined Storage, Others) • By Deployment (Public, Private, Hybrid) • By Industry (IT & Telecom, BFSI, Government, Healthcare, Retail, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Fujitsu, IBM, Microsoft, Commvault, Dell Technologies, Oracle, Nutanix, Cisco, Citrix, Huawei, VMware, Juniper Networks, Arista Networks, DataCore Software, Scality, HPE, SUSE, DriveNets, Lightbits, NetApp, Nuage Networks, Lenovo, Stratoscale, HiveIO, TidalScale, Portworx, Arrcus, Vexata, Hammerspace, and Cohesity, Lumina Networks |