Feminine Hygiene Products Market Size:

Get More information on Feminine Hygiene Products Market - Request Sample Report

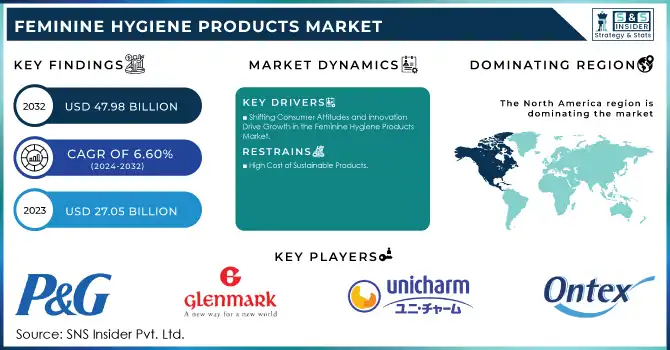

The Feminine Hygiene Products Market Size was valued at USD 27.05 billion in 2023 and is expected to reach USD 47.98 billion by 2032 and grow at a CAGR of 6.60% over the forecast period 2024-2032.

The feminine hygiene products market continues to experience significant growth, driven by rising awareness of menstrual health, innovations in product offerings, and changing consumer preferences. A 2024 report by the World Health Organization (WHO) highlights persistent gaps in menstrual health and hygiene management, particularly in educational institutions, where millions of girls and women still lack access to essential products. Nearly 500 million women and girls worldwide face challenges in accessing menstrual products, contributing to poor health, missed school days, and limited opportunities. The issue of "period poverty" has become a critical focus of organizations like UN Women, which reports that approximately one in four girls in low-income communities lacks access to basic menstrual products.

Recent trends show an increased demand for organic, reusable, and eco-friendly products. A 2023 study found that reusable feminine hygiene products, such as menstrual cups and cloth pads, have a significantly lower environmental impact compared to disposable alternatives, driving the popularity of sustainable products among environmentally-conscious consumers. Furthermore, in the U.S., the so-called "pink tax" continues to impact the price of feminine hygiene products, with a 2023 report from U.S. News noting that inflation and higher manufacturing costs are contributing to the rising prices of products, making it difficult for some women to afford the options they need.

The growing recognition of menstrual health as a crucial aspect of women's well-being has also led to an increase in government and institutional support. For example, California implemented a policy in 2021 requiring schools to provide free menstrual products to low-income students, a move aimed at addressing period poverty and improving the educational outcomes of girls. A study published by the American Medical Association underscores the positive impact of such initiatives, noting that access to free menstrual products significantly enhances the health and academic success of students in low-income areas.

E-commerce has emerged as a key driver of market expansion, offering convenient access to a wide variety of menstrual products, especially in regions with limited access to physical stores. Subscription services and direct-to-consumer sales have made it easier for women to receive products regularly, providing a consistent and reliable solution to menstrual care. As consumer demand for innovation, sustainability, and accessibility grows, the feminine hygiene products market is expected to continue its upward trajectory, with companies focusing on product development, affordability, and overcoming barriers to access.

Market Dynamics

Drivers

-

Shifting Consumer Attitudes and Innovation Drive Growth in the Feminine Hygiene Products Market

There is a significant shift in consumer attitudes towards menstrual health, with increasing awareness about the importance of hygiene, which has led to higher demand for quality and safe products. This is complemented by the growing popularity of eco-friendly and organic products. As more women opt for natural materials, such as organic cotton pads and biodegradable tampons, brands are focusing on sustainability to meet this rising demand, appealing to environmentally-conscious consumers.

Another major driver is the growing emphasis on women’s health and wellness. With an increasing number of women prioritizing their overall health, there is a surge in demand for hypoallergenic, chemical-free, and non-toxic products that promote comfort and prevent health issues like irritation or allergic reactions. Alongside this, advancements in product innovation, including menstrual cups and period underwear, offer long-term cost-effective solutions and have become increasingly mainstream, driving market expansion.

The rise of e-commerce has also been a crucial factor in market growth. Online retail platforms provide consumers with greater access to a wide range of products, offering the convenience of home delivery and competitive pricing. Subscription models, which deliver products regularly to consumers' doors, have enhanced customer loyalty and ensured consistent sales for brands. Additionally, ongoing government initiatives aimed at combating period poverty and providing menstrual products to low-income communities have supported the growth of the market, ensuring greater accessibility to essential hygiene products. These factors, combined with growing awareness and product innovation, are propelling the market forward.

Restraints

-

High Cost of Sustainable Products

The premium pricing of eco-friendly and organic menstrual products, such as organic cotton pads and biodegradable tampons, can limit their accessibility to a broader range of consumers, especially in price-sensitive markets.

-

Cultural and Societal Barriers

In certain regions, cultural taboos and stigmas surrounding menstruation can hinder open discussions about menstrual health, restricting the adoption of new and innovative menstrual products.

Key Segmentation

By Product

In 2023, the menstrual care products segment dominated the feminine hygiene products market, holding the largest share due to the consistent demand for sanitary pads, tampons, menstrual cups, and other period care products. This category benefited from increasing awareness around menstrual hygiene and the widespread adoption of convenient, reliable products. Menstrual care products accounted for approximately 65.0% of the market share in 2023. Among these, sanitary pads and tampons were the most popular due to their convenience, wide availability, and cultural acceptance across different regions. This segment's dominance is further supported by innovations in product offerings, such as organic and eco-friendly options, which are attracting health-conscious consumers.

The cleaning & deodorizing products segment, though a smaller portion of the market, is experiencing rapid growth. Products such as intimate wipes, sprays, and cleansers are witnessing increased usage, especially as consumers become more conscious about personal hygiene and odor control. This segment's growth is driven by changing lifestyles, increased hygiene awareness, and the growing preference for multi-purpose, on-the-go products.

By Distribution Channel

Online retail stores emerged as the fastest-growing channel, driven by the growing preference for convenience and the increasing availability of subscription models. Online shopping allows customers to access a wide range of feminine hygiene products with ease, making it a preferred choice for many. This channel’s growth is also fueled by the increasing penetration of internet access, particularly in developing regions, and the demand for doorstep delivery.

Supermarkets remained the dominant distribution channel for feminine hygiene products in 2023, with a 45.0% share of the market. This segment's success is attributed to the convenience of in-store purchases and the ability to see a variety of products in one location. However, the shift toward online retail has slightly reduced the dominance of physical stores.

Regional Analysis

In 2023, the North American region led the feminine hygiene products market, driven by high awareness of menstrual health and the presence of major industry players. The demand for organic and eco-friendly products has been a significant growth factor, with consumers in the U.S. and Canada increasingly favoring sustainable alternatives. Government policies in several states aimed at providing menstrual products in schools and public spaces have further supported market growth.

Europe also played a crucial role in the market, with countries like the UK, Germany, and France showing strong demand for conventional and organic feminine hygiene products. There has been a rising focus on sustainability, with more consumers opting for eco-friendly and reusable products. The growing awareness about health and wellness has led to a shift in consumer preferences toward natural, hypoallergenic, and chemical-free options.

The Asia-Pacific region, including India, China, and Japan, is witnessing rapid market expansion. Factors such as increasing urbanization, higher disposable incomes, and a growing awareness of menstrual health are driving the demand for feminine hygiene products. With a large, young population and more access to education, awareness campaigns have contributed to changing cultural perceptions about menstruation, further boosting product adoption.

Need any customization research on Feminine Hygiene Products Market - Enquiry Now

Key Feminine Hygiene Products Companies

-

-

Tampax (Tampons)

-

Always (Sanitary Pads, Pantyliners, and Period Underwear)

-

-

-

Fem Soft (Sanitary Pads)

-

Fem Hygiene Wipes

-

-

Unicharm Corporation

-

Sofy (Sanitary Pads, Pantyliners, Tampons)

-

Merries (Baby Diapers, Feminine Hygiene)

-

-

Unilever

-

Comfort (Fabric Softener, used with feminine hygiene)

-

Libresse (Sanitary Pads, Tampons, Pantyliners)

-

-

Maxim Hygiene

-

Maxim Hygiene (Organic Cotton Sanitary Pads, Tampons, and Wipes)

-

-

-

Huggies (Baby Diapers)

-

Kotex (Sanitary Pads, Tampons, Pantyliners)

-

-

Edgewell Personal Care

-

Playtex (Tampons, Feminine Wipes)

-

-

Premier FMCG (Pty) Ltd.

-

Always (Sanitary Pads, Pantyliners, Tampons)

-

-

Essity Aktiebolag

-

Libresse (Sanitary Pads, Pantyliners, Tampons)

-

TENA (Adult Incontinence Products)

-

-

Ontex BV

-

Bodyform (Sanitary Pads, Tampons, Pantyliners)

-

Dr. P (Menstrual Cups, Pantyliners)

-

-

Bodywise (UK) Limited

-

Natracare (Organic Cotton Sanitary Pads, Tampons, Wipes)

-

-

Kao Corporation

-

Laurier (Sanitary Pads, Tampons, Pantyliners)

-

Magiclean (Feminine Hygiene)

-

-

Prestige Consumer Healthcare Inc.

-

Summer's Eve (Feminine Hygiene Wipes, Cleansers)

-

-

Johnson & Johnson

-

Carefree (Pantyliners, Feminine Wipes)

-

-

Daio Paper Corporation

-

Okaasan (Sanitary Pads, Pantyliners)

-

-

Hengan International Group Company Ltd.

-

Forever Young (Sanitary Pads)

-

-

Drylock Technologies

-

MyDry (Sanitary Pads, Pantyliners)

-

-

Natracare LLC

-

Natracare (Organic Cotton Sanitary Pads, Tampons, Pantyliners, Wipes)

-

-

First Quality Enterprises, Inc.

-

Prevail (Adult Incontinence Products, but some sanitary products)

-

-

Bingbing Paper Co., Ltd.

-

Bingbing (Sanitary Pads)

-

Recent Development

-

In Dec 2024, Edmontonians raised USD 2,200 to support the provision of feminine hygiene products for the city's vulnerable population. The funds will help ensure access to essential menstrual products for those in need.

-

In May 2024, Pee Safe launched a campaign on Menstrual Hygiene Day aimed at debunking common menstrual myths. The initiative focuses on educating a wider audience while promoting the benefits and accessibility of Pee Safe's menstrual hygiene products.

-

In May 2024, Carefree, a leading feminine care brand, expanded its product range to include pads, complementing its existing liners. The new product line aims to address the toughest feminine care needs for moms and is now available both in stores and online. The brand also launched a core Mission Video to support the expansion.

-

In Aug 2023, DIAL, the operator of Delhi's Indira Gandhi International Airport, partnered with Sirona to install vending machines offering feminine hygiene products. These machines will provide a range of items, including menstruation cups, tampons, and sanitary pads, for female travelers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.05 billion |

| Market Size by 2032 | USD 47.98 Billion |

| CAGR | CAGR of 6.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Menstrual Care Products (Sanitary Napkins, Tampons, Menstrual Cups, Others), Cleaning & Deodorizing Products (Feminine Powders, Soaps and Washes, Others)] • By Distribution Channel (Supermarkets, Drug Stores, Online Retail Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Procter & Gamble, GLENMARK PHARMACEUTICALS LTD, Unicharm Corporation, Unilever, Maxim Hygiene, Kimberly-Clark, Edgewell Personal Care, Premier FMCG (Pty) Ltd., Essity Aktiebolag, Ontex BV, Bodywise (UK) Limited, Kao Corporation, Prestige Consumer Healthcare Inc., Johnson & Johnson, Daio Paper Corporation, Hengan International Group Company Ltd., Drylock Technologies, Natracare LLC, First Quality Enterprises, Inc., and Bingbing Paper Co., Ltd. |

| Key Drivers | • Shifting Consumer Attitudes and Innovation Drive Growth in the Feminine Hygiene Products Market |

| Restraints | • High Cost of Sustainable Products • Cultural and Societal Barriers |