Menstrual Care Products Market Report Scope & Overview:

Get more information on Menstrual Care Products Market - Request Sample Report

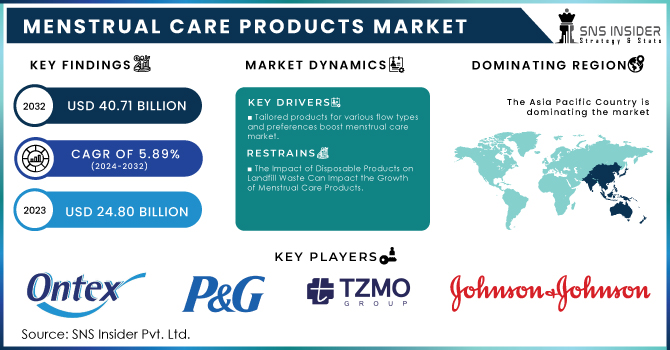

The Menstrual Care Products Market Size was valued at USD 24.80 Billion in 2023, and is expected to reach USD 40.71 Billion by 2032, and grow at a CAGR of 5.89% over the forecast period 2024-2032.

The rise in consumer awareness of female hygiene, and their proliferated income level across developed nations are some of the drivers fuelling demand for feminine care products especially tampons; sanitary pads and menstrual cups have figured prominently these years globally. In addition, officials from several countries are queuing up to give out free sanitary pads. For example, in March 2021 the Japanese government earmarked JPY 1.3 billion to support women who require menstrual products. The government also provided sanitary pads and tampons free of charge to the public in local municipalities. There are also measures being put in place by the Government to promote awareness of menopausal health and symptoms among women.

On the other hand, in India, a few fifty percent of the reduction within available disposable napkins is given directly from the Government side along with various privation sectors steps and racial group enterprises for increasing costs on educating that sanitary pad must-have commodities first to poor rural women. This includes the Reproductive and Child Health Programme, Eco Femme, and My Pad. This was a wake-up call among women and there was an insatiable demand for cheap sanitary pads because by then they had become staple goods.

This is anticipated to fuel the growth of the feminine hygiene products market due to rising awareness about personal care and a surge in new low-cost product offerings. Additionally, demand for products such as tampons and sanitary pads or towels but also internal cleansers/shower gels/sprays will be higher in the more developed world regions of North America (18-19%) and Western Europe. Sanitary pads and many other products consist of toxic, carcinogenic synthetic materials such as rayon, deep wood porcelain (mostly too), metal dyes, or highly processed wood pulp that can cause irritation and wheal in the genital organs of women. This in turn is increasing the demand for organic raw material-based sanitary napkin products.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increased Participation of Women in The Workforce and Urban Living Leading to Greater Demand for Convenient and Effective Menstrual Care Solutions Boost Market Growth.

-

Tailored Products Catering to Different Flow Types, Preferences, and Needs, Enhancing Consumer Satisfaction and Product Adoption Are Responsible for the Menstrual Care Products Market.

RESTRAINTS:

-

Stigma and Lack of Open Discussion About Menstruation Hinder the Menstrual Care Products Market Growth.

-

The Impact of Disposable Products on Landfill Waste Can Impact the Growth of Menstrual Care Products.

OPPORTUNITY:

-

Government Initiatives Promoting Menstrual Hygiene are Expected to Drive the Growth of the Menstrual Care Products Market.

-

Advertisement and Promotional Campaigns Raising Awareness Regarding Menstrual Hygiene Provide Opportunities for Market Expansion.

KEY MARKET SEGMENTATION:

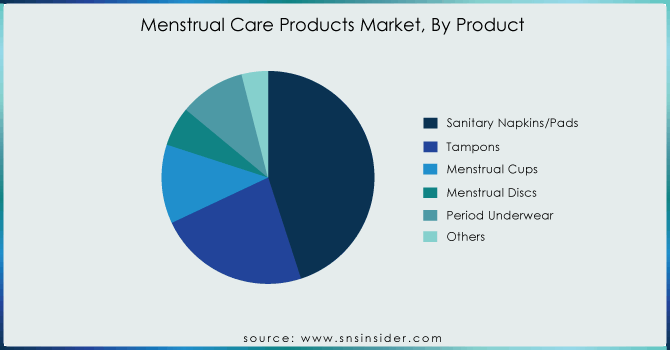

By Product

The sanitary napkins and pads segment was the largest in the global menstrual care products market during 2023 with 45%, responsible for about nearly half of all market revenues. For example, the Menstrual Hygiene Management Scheme in India was scaled up dramatically in 2023 to offer subsidized sanitary napkins as part of their aim to provide over 60 million women and girls living across rural areas. Further, the step taken by the UK government to provide menstrual products free of cost in schools and public facilities has encouraged market growth for sanitary pads & napkins Such government-sponsored schemes reveal the long trail of arduous struggle periods for sanitary napkins and pads emphasizing their prominence in the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Distribution Channel

By distribution channel, hypermarkets and supermarkets account for the largest sales of menstrual care products with 36% in 2023 with a wide range of products on offer combined with high foot traffic. These retail outlets can meet the demand for a wide variety of menstrual products (sanitary napkins, tampons, and menstrual cups), providing different brands or classifications concerning absorbency levels. This high footfall which is common in hypermarkets and supermarkets, converts to additional transaction opportunities as more consumers frequent these locations for their regular shopping purposes.

In addition, the economies of scale benefit these big retailers and can result in competitive pricing and amazing promotions on menstrual care products particularly marketed to price-sensitive shoppers. Also, Boosts Impulse Purchases: High placement in outlets leads to greater display of these products. In addition, hypermarkets and supermarkets stock menstruation hygiene management with a never out-of-stock policy to prevent depletion of the inventory which helps engender dependability among consumers. The penetration of these retail chains into emerging markets, especially in Asia-Pacific and Latin America has further accentuated the dominance they hold over this market by increasing the availability of menstrual care products in urban as well as rural regions. This as a whole is prompting hypermarkets and supermarkets to lead in the distribution channel for the menstrual care products market.

REGIONAL ANALYSIS:

In 2023, Asia-Pacific accounted for the largest market share which is 35% of total revenue. The penetration is higher in China as compared to Asian markets where it is very low, but a lot can still be done by organizations. Manufacturers operating in Asia-Pacific are introducing various products, as demand for feminine hygiene items is growing. This however is leading to increased demand for the products in APAC as a lot of governments and NGOs are conducting awareness campaigns throughout their countries on women's menstrual hygiene. For example, in May 2021 UNICEF India started a Red Dot Challenge for promotions & awareness regarding periods. UNICEF partnered with adolescent girls, women, and influencers to launch the campaign promoting hygiene or safety across all domains as well as a broader focus on safe menstrual management (MHM) and sanitation practices.

KEY PLAYERS:

The key market players include Ontex Group NV, Procter & Gamble Company, TZMO SA, Johnson & Johnson Services, Inc., Unilever PLC, Kimberly-Clark Corporation, Unicharm Corporation, Kao Corporation, Edgewell Personal Care Company, Essity AB & other players.

RECENT DEVELOPMENTS

-

In April 2021, Essity signed an agreement to purchase approximately 44% of the shares in the leading top-quality tissue company in Latin America.

-

In May 2022, Think revealed that it would expand its air collection underwear for moisture-free and menstrual days with the addition of a sweat-wicking, breathable, ultra-thin single-use micromesh version.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 24.80 Billion |

|

Market Size by 2032 |

US$ 40.71 Billion |

|

CAGR |

CAGR of 5.89% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Product Type (Sanitary Napkins/Pads, Tampons, Menstrual Cups, Menstrual Discs, Period Underwear and Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Edgewell Personal Care Company, Procter & Gamble Company, TZMO SA, Ontex Group NV, Johnson & Johnson Services, Inc., Unicharm Corporation, Unilever PLC, Kimberly-Clark Corporation, Kao Corporation, Essity AB & other players |

|

Key Drivers |

•Increased Participation of Women in The Workforce and Urban Living Leading to Greater Demand for Convenient and Effective Menstrual Care Solutions Boost Market Growth. |

|

RESTRAINTS |

•Stigma and Lack of Open Discussion About Menstruation Hinder the Menstrual Care Products Market Growth. |