Menstrual Cup Market Report Scope & Overview

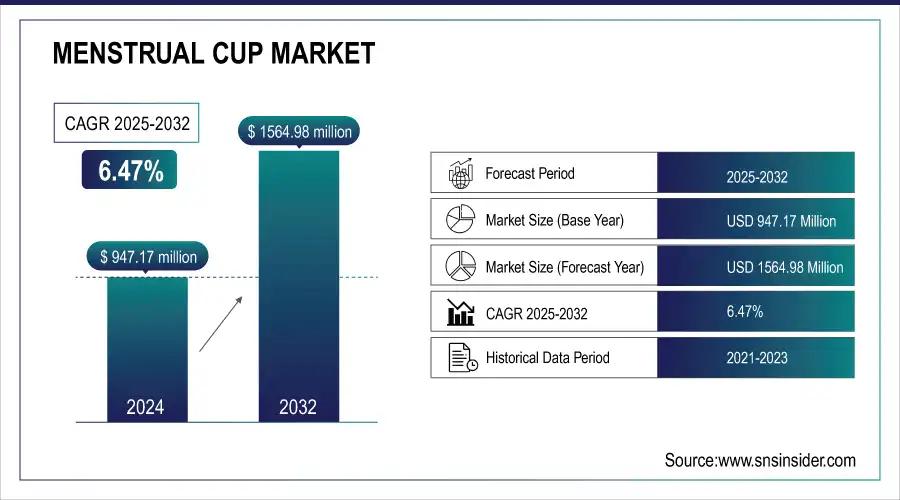

The Menstrual Cup Market was valued at USD 947.17 million in 2024 and is expected to reach USD 1564.98 million by 2032, growing at a CAGR of 6.47% from 2025-2032.

The Menstrual Cup Market is growing rapidly, fueled by rising demand for sustainable and health-conscious menstrual products. Reusable for several years, menstrual cups help reduce the 200,000 tons of annual menstrual waste, offering an eco-friendly alternative to tampons and pads. Health benefits, including a lower risk of Toxic Shock Syndrome and absence of harmful chemicals, attract health-conscious consumers. Cost-effectiveness and long lifespan provide substantial savings compared to disposable products. Market growth is further supported by NGO advocacy, social media campaigns, and influencer endorsements promoting menstrual cups as a solution to period poverty and sustainable hygiene.

Get more information on Menstrual Cup Market - Request Sample Report

Menstrual Cup Market Size and Forecast:

-

Market Size in 2024: USD 947.17 Million

-

Market Size by 2032: USD 1,564.98 Million

-

CAGR: 6.47% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2022

Menstrual Cup Market Trends

-

Rising awareness of sustainable and eco-friendly menstrual products is driving demand.

-

Growing focus on women’s health and hygiene is boosting adoption of menstrual cups.

-

Innovations in medical-grade silicone and ergonomic designs are enhancing comfort and usability.

-

Increasing availability through e-commerce and retail channels is expanding market reach.

-

Rising campaigns and education on reusable menstrual products are promoting acceptance.

-

Supportive government initiatives and NGO programs are encouraging menstrual hygiene management.

-

Collaborations with health brands and NGOs are fostering awareness and product accessibility globally.

Menstrual Cup Market Growth Drivers

-

Eco-Friendly, Health-Conscious, and Cost-Effective Trends Driving the Menstrual Cup Market

Environmental sustainability remains one of the most influential factors, with more consumers turning to reusable options as an alternative to single-use menstrual products. Unlike tampons and pads, menstrual cups can be used for several years, significantly reducing plastic waste and environmental pollution. This growing demand for eco-friendly products aligns with global sustainability initiatives, further pushing the market forward.

Another significant driver is the increasing focus on health and hygiene. Menstrual cups are free from harmful chemicals and synthetic materials often found in disposable products, making them a safer option for women who prioritize natural menstrual care. Additionally, menstrual cups provide longer-lasting protection with fewer changes needed during the day, offering both convenience and comfort.

Cost-effectiveness is also a critical factor fueling the growth of the market. The long-term savings associated with menstrual cups, which can last for up to a decade, are particularly appealing to consumers seeking affordable menstrual solutions. As people become more budget-conscious, particularly in regions with limited access to affordable menstrual products, the cost-benefit of menstrual cups becomes increasingly attractive.

Menstrual Cup Market Restraints

-

Cultural and Social Barriers Limiting the Adoption of Menstrual Cups Across Global Markets

Despite the growing awareness of sustainable and health-conscious menstrual products, cultural taboos and social stigma surrounding menstruation continue to restrict the adoption of menstrual cups in many regions. In societies where menstruation is considered a private or shameful topic, open discussions about menstrual hygiene products are discouraged, limiting consumer education and acceptance. Misconceptions about the safety, usage, and hygiene of menstrual cups further exacerbate these barriers. Consequently, these cultural and social challenges slow market growth, making awareness campaigns, education programs, and community engagement crucial for increasing menstrual cup adoption worldwide.

Menstrual Cup Market Segment Analysis

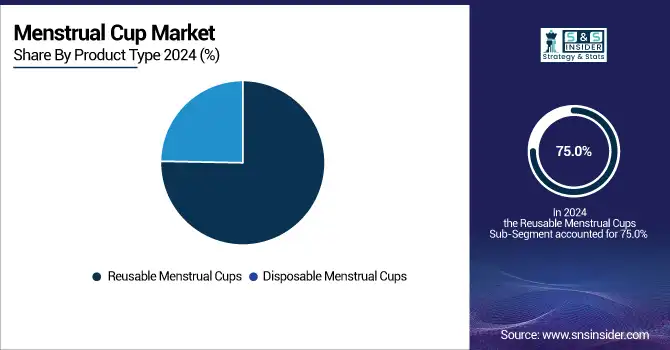

By Product Type: Reusable menstrual cups dominated while Disposable menstrual cups are expected to grow fastest

In 2023, reusable menstrual cups dominated the market, holding a substantial share due to their eco-friendly, cost-effective, and sustainable nature. Reusable cups, which can last for several years, offer long-term savings compared to disposable products, aligning with the growing global trend towards sustainability and reducing plastic waste. They accounted for approximately 75.0% of the market share.

The fastest-growing segment in the menstrual cup market is disposable menstrual cups. This growth is fueled by the convenience they offer, as well as increased awareness of menstrual health and hygiene. Disposable cups are particularly appealing for users who may not have access to water or facilities for cleaning reusable cups. They cater to those looking for a more convenient, single-use option. Disposable cups are becoming increasingly popular in regions with limited access to eco-friendly alternatives.

By Material Type: Silicone dominated while Thermoplastic elastomers (TPE) are projected to grow fastest

Silicone dominated the material type segment in 2024, accounting for 85.0% of the market share. Silicone is the preferred material due to its hypoallergenic properties, durability, and flexibility. It is easy to sterilize, safe for the body, and offers a comfortable and reliable option for menstrual cups, which has made it the material of choice for a majority of consumers.

Thermoplastic elastomers (TPE) are the fastest-growing material segment in the menstrual cup market. TPE offers a more affordable option compared to silicone while maintaining softness, flexibility, and safety for the body. Additionally, TPE is environmentally friendly, being recyclable, and free from harmful chemicals. The increasing demand for budget-friendly menstrual products has driven the growth of TPE-based cups, making them a popular choice among cost-conscious consumers.

Menstrual Cup Market Regional Analysis

North America Menstrual Cup Market Insights

In 2024, North America dominated the menstrual cup market, driven by strong consumer awareness, high disposable income, and a cultural shift towards sustainable and health-conscious products. The region's well-established healthcare infrastructure and the growing trend of eco-friendly solutions have significantly boosted the adoption of menstrual cups. The widespread availability of menstrual cups through retail channels and online platforms, combined with extensive advocacy by influencers and health organizations, has made North America the largest market for menstrual cups. Furthermore, the increasing focus on gender equality and period positivity has further accelerated their adoption, making them a mainstream choice.

Need any customization research on Menstrual Cup Market - Enquiry Now

Europe Menstrual Cup Market Insights

In Europe, the market is also growing steadily, with several countries adopting menstrual cups due to the rising demand for sustainable menstrual products and increasing environmental awareness. The support from public health campaigns and a robust eco-conscious community has helped boost consumer confidence in menstrual cups. Additionally, some countries in Europe, like the United Kingdom and Sweden, are seeing strong sales due to their progressive approach to menstrual health and hygiene.

Asia Pacific Menstrual Cup Market Insights

In the Asia-Pacific region, the market is experiencing significant growth, particularly in India, China, and Japan, where menstrual cups are gaining popularity as an affordable and sustainable solution to address period poverty and limited access to sanitary products. Educational initiatives by global organizations and NGOs are helping to overcome cultural barriers, and the region is expected to see accelerated growth in the coming years.

Middle East & Africa and Latin America Market Insights

The Middle East & Africa and Latin America are emerging markets for menstrual cups, driven by rising awareness of sustainable menstrual hygiene and growing health-conscious consumer segments. However, adoption is restrained by cultural taboos, limited product availability, and low awareness in rural areas. Initiatives by NGOs and social campaigns are gradually improving acceptance, creating opportunities for market expansion in these regions.

Menstrual Cup Market Competitive Landscape

Intimina

Intimina is a leading brand in the menstrual cup market, known for its focus on women’s health and sustainable menstrual products. The company offers high-quality, medical-grade silicone cups that prioritize comfort, safety, and ease of use. With a strong global presence and active awareness campaigns, Intimina promotes eco-friendly alternatives to disposable products, driving adoption among health-conscious consumers and supporting the shift toward sustainable menstrual hygiene solutions worldwide.

-

A survey by Intimina found that 40% of users switched to their Lily Cup to reduce waste, and another 20% cited significant cost savings, highlighting sustainability and affordability as key motivators.

Diva International Inc.

Diva International Inc. is a prominent player in the menstrual cup market, known for its flagship product, the DivaCup. The company focuses on providing safe, reusable, and eco-friendly menstrual hygiene solutions made from medical-grade silicone. Through educational campaigns and partnerships with health organizations, Diva International promotes menstrual health awareness and sustainable practices, driving adoption among environmentally conscious and health-focused consumers worldwide.

-

DivaCup introduced a Bluetooth-enabled smart menstrual cup that syncs with a mobile app to provide real-time cycle tracking and personalized insights.

Saalt

Saalt is a key player in the menstrual cup market, offering high-quality, medical-grade silicone cups that emphasize comfort, safety, and sustainability. The company focuses on promoting eco-friendly menstrual solutions while educating consumers about menstrual health. With a strong commitment to social impact, Saalt also runs initiatives to provide menstrual products to underserved communities, driving adoption and awareness of sustainable menstrual hygiene practices globally.

-

In 2024, Saalt launched a biodegradable, plant-derived menstrual cup, offering eco-conscious users a sustainable yet durable alternative to traditional silicone options.

Key Players in Menstrual Cup Market

-

Diva International Inc

-

Jaguara s.r.o. (LadyCup

-

Lena Cup LLC

-

Silky Cup

-

Chemco Group

-

Mooncup Ltd

-

The Flex Company

-

Me Luna GmbH

-

Soch Green

-

Procter and Gamble

-

The Keeper, Inc.

-

Sirona Hygiene Private Limited

-

Redcliffe Hygiene Private Limited

-

CS Technologies s.r.o.

-

Anigan

-

Ruby Cup

-

Saalt

-

Aisle

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 947.17 Million |

| Market Size by 2032 | USD 1564.98 million |

| CAGR | CAGR of 6.47% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Reusable Menstrual Cups, Disposable Menstrual Cups) • By Material Type (Thermoplastic Elastomer, Rubber, Silicone) • By Sales Channel (Direct Sales, Specialty Stores, Pharmacy / Drug Stores, Departmental Stores, Online Retailers, Other Sales Channel) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Blossom Cup, Diva International Inc., Fleurcup, INTIMINA, Jaguara s.r.o. (LadyCup), Lena Cup LLC, Silky Cup, Chemco Group, Mooncup Ltd, The Flex Company, Me Luna GmbH, Soch Green, Procter and Gamble, The Keeper, Inc., Sirona Hygiene Private Limited, Redcliffe Hygiene Private Limited, CS Technologies s.r.o., Anigan, Ruby Cup, Saalt |