Financial Advisory Services Market Report Scope & Overview:

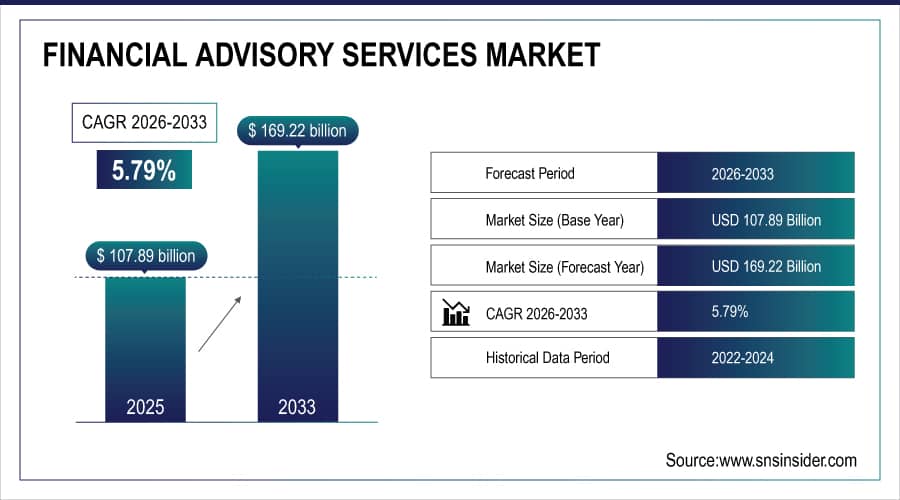

The Financial Advisory Services Market size was valued at USD 107.89 Billion in 2025 and is expected to reach USD 169.22 Billion by 2033, growing at a CAGR of 5.79% over the forecast t period 2026–2033.

To Get More Information On Financial Advisory Services Market - Request Free Sample Report

The Financial Advisory Services Market is experiencing robust growth, fueled by rising demand for tailored financial solutions and digital advisory platforms. Increasing client sophistication, volatile markets, and regulatory complexity are driving reliance on professional advisors. Services include wealth management, investment planning, M&A guidance, tax advisory, and retirement solutions.

Financial Advisory Services Market Size and Forecast:

-

Market Size in 2025E: USD 107.89 Billion

-

Market Size by 2032: USD 169.22 Billion

-

CAGR: 5.79% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Financial Advisory Services Market Trends

-

Rising demand for digital financial planning tools and robo-advisory platforms is transforming service delivery and client engagement models.

-

Increased focus on ESG and sustainable investing is shaping portfolio strategies and advisory mandates.

-

Growing complexity of regulations is driving demand for compliance advisory and risk management services.

-

Expansion of hybrid advisory models combines automated tools with personalized advice for diverse client needs.

-

Surge in M&A advisory as companies pursue strategic realignment amid market volatility.

-

Shifting client demographics, including millennials and Gen Z, are prompting new service offerings and digital experience enhancements.

U.S. Financial Advisory Services Market Insights

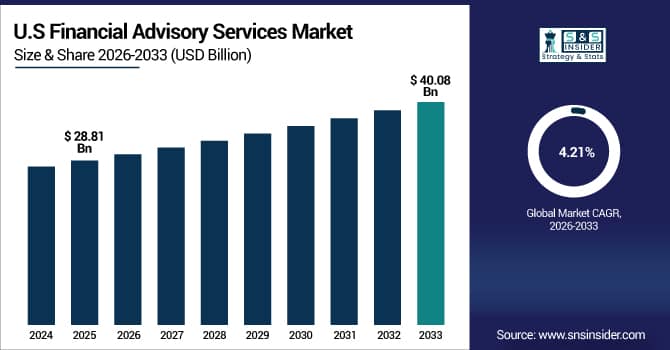

The U.S. Financial Advisory Services Market size was USD 28.81 billion in 2025E and is expected to reach USD 40.08 billion by 2033, growing at a CAGR of 4.21% over the forecast period of 2025–2033.

According to a study, the U.S. market’s expansion is attributed to the upsurge in digitally delivered advisory services, increasing complexity of individual portfolios, and heightened demand for retirement planning. This cause, changing investor preferences and regulatory stringency, effects rising reliance on advisors to optimize financial outcomes, especially as digital tools and wealth technologies enhance transparency, accessibility, and portfolio performance for both individual and institutional clients.

Financial Advisory Services Market Drivers:

-

Increasing Demand for Personalized Financial Planning Drives Market Expansion

The growing complexity of investment options and a volatile macroeconomic environment are prompting more clients to seek tailored financial planning and advisory services. This cause, heightened financial uncertainty and evolving investor life goals, effects the adoption of sophisticated advisory models emphasizing individual risk tolerance, retirement objectives, and multigenerational wealth transfer. In March 2025, several U.S.-based advisory firms unveiled new AI-powered planning tools engineered for real-time customization and seamless multi-channel access, simplifying comprehensive financial planning for a diverse client base.

For instance, in March 2025, a top U.S. firm introduced an interactive, AI-driven client portal that delivers personalized retirement projections, scenario analysis, and goal-tracking dashboards, resulting in improved client satisfaction and enhanced retention rates.

Financial Advisory Services Market Restraints:

-

Rising Regulatory Compliance Burden Limits Advisory Firm Expansion

The surge in regulatory requirements, such as data protection mandates, fiduciary duties, and transparency norms, is increasing costs for financial advisory firms. This cause, expanding compliance workload and audit risks, effects additional operational complexity and resource diversion from client-centric initiatives to regulatory management. Small and medium-sized advisory practices, in particular, struggle with the expense and technical expertise required for ongoing compliance, slowing their expansion and technological innovation.

For example, in January 2025, several boutique advisory firms in Europe reported postponing digital onboarding and new product launches, citing higher costs of meeting updated MiFID II data retention rules and cybersecurity protocols.

Financial Advisory Services Market Opportunities:

-

Expansion of Hybrid Advisory Models Creates New Revenue Streams

The integration of human expertise with digital and automated tools is opening new market opportunities. This cause, evolving client expectations for both personalized advice and cost-effective solutions, effects the rise of hybrid advisory models where advisors leverage robo-platforms, AI analytics, and real-time support. Firms investing in these blended offerings are attracting tech-savvy younger investors while retaining HNWI and institutional clients through relationship-based guidance.

In June 2025, a leading global financial institution launched a hybrid wealth platform combining AI-driven portfolio construction with live advisor video consultations, enabling scalable high-touch services for a broader range of clients and increasing cross-selling rates.

Financial Advisory Services Market Segmentation Analysis:

By Service Type, Wealth Management Dominates Market While Investment Advisory Registers Fastest Growth

The Wealth management segment commands 29% of revenue in 2025E, retaining its lead due to growing demand for holistic financial stewardship covering investments, estate planning, tax strategy, and intergenerational wealth transfer. High-net-worth and emerging affluent clients are turning to wealth managers for personalized strategies in uncertain economies, driving innovation in digital client reporting, ESG portfolio curation, and goals-based planning tools.

In contrast, the Investment advisory segment records the highest growth at a CAGR of 8.13% in the forecasted period 2026–2033, propelled by expanding retail participation in capital markets and increasing awareness of passive and active investing solutions. Technological advances in risk profiling, digital onboarding, and analytics are empowering more investors to access diversified portfolios and real-time insights, supporting market expansion.

By Asset Class, Equities Dominate Market While Alternative Investments Register Fastest Growth

The Equities segment captures 44% of market revenue in 2025E, remaining dominant as equity investments form the backbone of global portfolios amid pursuit of higher returns. Widespread adoption of direct equity, ETFs, and systematic equity allocation strategies is reinforcing advisory focus on equities.

The Alternative investments segment reports the highest CAGR of 9.89% in the forecasted period, driven by demand for diversification, inflation hedging, and enhanced yield. Advisors are guiding clients into private equity, real estate, hedge funds, and infrastructure, leveraging digital platforms for access, education, and risk management.

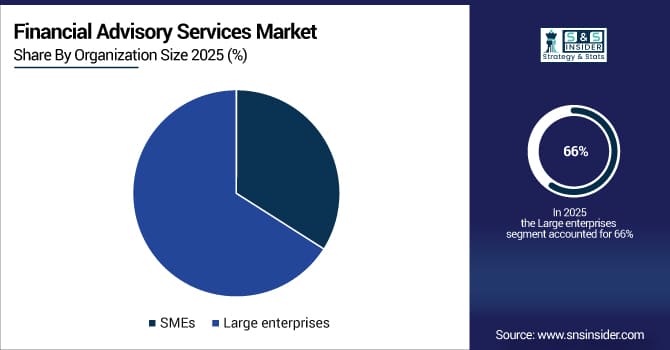

By Organization Size, Large Enterprises Lead Market While SMEs Register Fastest Growth

Large enterprises account for 66% of revenue in 2025E, driven by their capacity to adopt sophisticated advisory services, engage specialized teams, and meet complex regulatory needs. The ability to implement multi-asset solutions, global compliance standards, and in-house analytics cements the leadership of large organizations.

SMEs are witnessing the fastest growing CAGR with 7.48%, driven by rising awareness of business succession, tax optimization, and employee benefit planning. Digital advisory solutions are broadening access, helping SMEs cost-effectively manage financial complexity and compliance burdens.

By End-User, BFSI Dominates Market While Healthcare Registers Fastest Growth

The BFSI sector commands 42% revenue share in 2025E, reflecting its status as the primary consumer of financial advisory services for capital markets activity, risk management, and compliance consulting. Banks and insurers utilize advanced advisory tools for treasury, investment, and client portfolio mandates, reinforcing segment dominance.

Healthcare emerges as the fastest-growing CAGR with 11.25% in the forecasted period 2026–2033, reflecting the sector’s rising focus on M&A, fundraising, and retirement planning for medical professionals. Advisors are supporting hospitals, clinics, and practices in navigating regulatory, tax, and capital markets challenges.

Financial Advisory Services Market Regional Analysis:

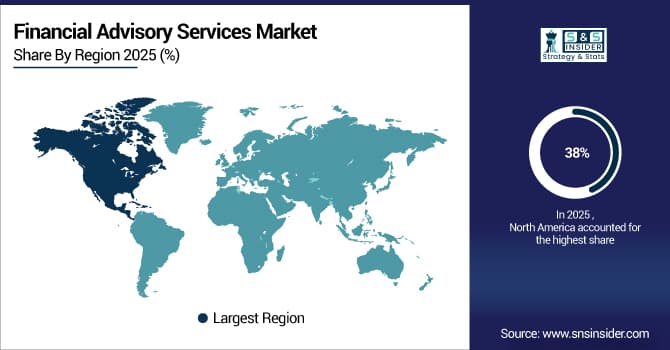

North America Dominates Financial Advisory Services Market in 2025E

In 2025E, North America holds an estimated 38% share of the Financial Advisory Services Market, driven by rapid digitalization, high wealth concentration, and regulatory emphasis on fiduciary responsibilities. Increasing household wealth and retirement assets, resulting in greater advisory demand.

Get Customized Report as Per Your Business Requirement - Enquiry Now

United States Dominates North America’s Financial Advisory Services Market

The U.S. anchors the region’s dominance due to an expansive advisor network, supportive regulatory reforms (such as the SEC’s Best Interest Regulation), and early adoption of digital advisory tools. The ecosystem’s diversity, from private wealth managers to institutional consultants, enables tailored, tech-driven offerings, wider market penetration, and reliable client outcomes.

Asia Pacific is the Fastest-Growing Region in 2025E

Asia Pacific records the fastest growth, with a projected CAGR of 8.67% in the forecasted period 2026–2033, fueled by expanding middle class, rising affluence, and technology-driven service rollout. Rising disposable incomes and wealth digitization, resulting in increased adoption of advisory services.

China Dominates Asia Pacific’s Financial Advisory Services Market

China dominates on account of accelerated wealth creation, widespread fintech adoption, and government-driven investment literacy programs. Major urban centers witness surging demand for wealth management and investment advice, while new regulatory standards and expanding digital platforms drive rapid advisory market expansion.

Europe Financial Advisory Services Market Insights, 2025E

Europe maintained a significant market presence in 2025, supported by stringent investor protection rules, green finance policies, and a mature wealth management infrastructure. Evolving regulatory landscape and ESG investment mandates, resulting in widespread demand for specialized advice.

Germany Dominates European Financial Advisory Market

Germany is the leading country in the European financial advisory market, driven by its well-established bancassurance sector, which integrates banking and insurance services seamlessly. The widespread adoption of advanced digital advisory platforms has enhanced customer engagement and service efficiency. Additionally, Germany benefits from a strong network of institutional investors, providing substantial investment opportunities and financial stability. These factors collectively position Germany as a key hub for financial advisory services in Europe, attracting both domestic and international clients.

Middle East & Africa and Latin America Financial Advisory Services Market Insights, 2025E

The Financial Advisory Services Market in the Middle East & Africa and Latin America showed steady growth in 2025, driven by evolving capital markets, rising affluence, and digital financial literacy initiatives. In Latin America, Brazil’s expanding wealth sector and pension reforms spur advisory demand, while the UAE Dominates MEA growth through wealth migration, innovation in Islamic finance advisory, and supportive government regulations.

Competitive Landscape for the Financial Advisory Services Market:

Ameriprise Financial

Ameriprise Financial is a leading U.S.-based financial advisory and asset management firm, specializing in personalized wealth management, retirement planning, and insurance consulting. With a vast network of certified advisors, Ameriprise offers fee-based and transactional services to individuals, families, and institutions. Its comprehensive platform integrates digital planning tools and robust compliance frameworks, helping clients achieve financial goals with transparency and confidence.

-

In May 2025, Ameriprise launched a new AI-powered financial planning module, enhancing scenario analysis and client communication functionalities.

Bank of America Merrill Lynch

Bank of America Merrill Lynch is a global financial advisory powerhouse, providing tailored services across investment banking, wealth management, and corporate finance. The firm leverages advanced technology, research, and cross-border expertise to deliver holistic advice for individuals, corporations, and institutional investors. Its commitment to digital transformation, ESG advisory, and global compliance solidifies its leadership position in the sector.

-

In June 2025, Bank of America Merrill Lynch expanded its digital wealth advisory capabilities, rolling out machine-learning-based portfolio rebalancing across its client platform.

BlackRock

BlackRock is the world’s largest asset manager, specializing in investment advisory, risk management, and ESG solutions. Its Aladdin platform integrates portfolio analytics, compliance, and reporting across institutional and wealth management segments. BlackRock’s scale and innovation enable access to alternative investments, multi-asset solutions, and sustainable strategies for diverse client needs.

-

In April 2025, BlackRock announced new ESG integration tools for advisory partners, supporting climate-aligned portfolio construction and reporting.

Charles Schwab

Charles Schwab is a leading U.S. investment and advisory platform, providing a full spectrum of financial planning, brokerage, and wealth management services. Renowned for low-cost, digital-first offerings and educational resources, Schwab enables self-directed investors and advisory clients to achieve financial independence through intuitive platforms and responsive client support.

-

In March 2025, Charles Schwab launched a digitalized onboarding and retirement advisory center, expanding accessibility and client convenience for its U.S. wealth management clients.

Financial Advisory Services Market Key Players:

-

Ameriprise Financial

-

Bank of America Merrill Lynch

-

BlackRock

-

Charles Schwab

-

Citigroup Inc.

-

Edward Jones

-

Fidelity Investments

-

Goldman Sachs

-

JPMorgan Chase & Co.

-

LPL Financial

-

Morgan Stanley

-

Raymond James Financial

-

UBS Group AG

-

Vanguard Group

-

Wells Fargo Advisors

-

PwC (PricewaterhouseCoopers)

-

Deloitte

-

Ernst & Young (EY)

-

KPMG

-

BNY Mellon Wealth Management

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 107.89 Billion |

| Market Size by 2032 | US$ 169.22 Billion |

| CAGR | CAGR of 5.79 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Investment advisory, Tax planning, financial planning, Risk management, Business & corporate finance, Wealth management, Others) • By Asset Class (Equities, Fixed income, Real estate, Alternative investments, Commodities, Others) • By Organization Size (SMEs, Large enterprises) • By End Use (Healthcare, E-commerce & retail, BFSI, IT & telecom, Manufacturing, Transportation & logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ameriprise Financial, Bank of America Merrill Lynch, BlackRock, Charles Schwab, Citigroup Inc., Edward Jones, Fidelity Investments, Goldman Sachs, JPMorgan Chase & Co., LPL Financial, Morgan Stanley, Raymond James Financial, UBS Group AG, Vanguard Group, Wells Fargo Advisors, PwC (PricewaterhouseCoopers), Deloitte, Ernst & Young (EY), KPMG, BNY Mellon Wealth Management |