Consumer IoT Market Key Insights:

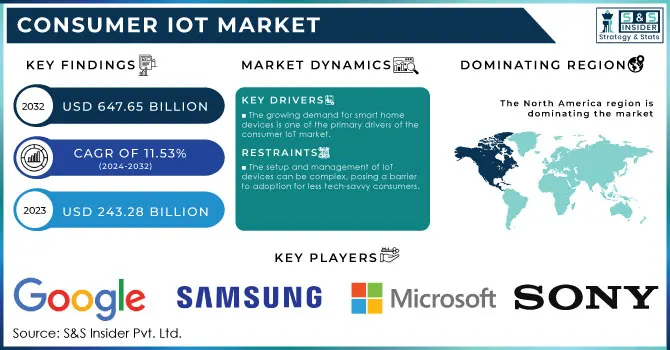

The Consumer IoT Market size was valued at USD 243.28 billion in 2023 and is expected to reach USD 647.65 billion by 2032, growing at a CAGR of 11.53% over the forecast period 2024-2032. The Consumer IoT market is experiencing rapid growth, driven by technological advancements and the increasing adoption of high-speed internet. Consumer demand for connected devices and intelligent IoT solutions continues to rise, with the core promise of seamless automation and control across various applications. Many Consumer IoT devices now integrate advanced AI capabilities that enable predictive analytics and personalized user interactions.

To Get More Information on Consumer IoT Market - Request Sample Report

For instance, smart home systems can adjust lighting, temperature, and security settings based on user behavior and preferences, providing an automated and tailored experience. In 2024, it is projected that around three in five U.S. consumers adopt smart home technology. Among smart home users, 75% are under the age of 55, with 40% aged 18-34. Younger consumers prioritize energy savings and environmental benefits. Additionally, 78% of home buyers and 82% of renters express a preference for smart home features like voice control, smart appliances, and smart lighting. Importantly, 79% of smart home users report positive lifestyle impacts such as enhanced happiness, safety, and productivity. Furthermore, 71% of users found smart home devices more beneficial than anticipated, noting convenience, usefulness, and time savings as key advantages. The Consumer IoT ecosystem is expanding as devices become increasingly sophisticated and accessible to the average consumer, offering enhanced interoperability across brands and platforms. By utilizing data collection and machine learning algorithms, these devices learn individual routines and adapt to user lifestyles, creating a more convenient and energy-efficient environment.

Market Dynamics

Drivers

- The growing demand for smart home devices is one of the primary drivers of the consumer IoT market.

Consumers are more and more integrating IoT devices such as smart thermostats, security systems, and voice assistants into their lives, providing increased convenience, security, and energy efficiency. These devices work together effortlessly, forming a connected ecosystem that improves user experience and management of home settings. Key companies in the industry, like Google, Amazon, and Apple, consistently introduce creative products to satisfy changing consumer needs, prompting increased usage. The trend is further accelerated by the widespread availability of high-speed internet and 5G networks, which enable quicker and more dependable communication among devices. Governments and utility companies are also encouraging energy-efficient solutions, supported by smart devices, which are driving market growth even further.

- The consumer IoT market is experiencing significant growth due to the increasing focus on health and wellness applications.

Wearable devices enabled with IoT technology, like fitness trackers and smartwatches, enable users to track their physical activity, heart rate, sleep patterns, and various health data. These gadgets offer immediate feedback, motivating individuals to opt for healthier habits. Following the COVID-19 outbreak, there has been increased attention to personal health, leading to more individuals purchasing health-oriented IoT devices. The incorporation of IoT in healthcare uses, such as remote monitoring and telemedicine, has extended beyond conventional medical environments, enabling people to oversee their health at home as well. This will likely lead to increasing interest in consumer IoT devices, especially as they evolve to monitor a broader range of health data.

Restraints

- The setup and management of IoT devices can be complex, posing a barrier to adoption for less tech-savvy consumers.

A lot of IoT devices need to be set up, regularly maintained, and updated with new software, which can be overwhelming for people without tech knowledge. Consumers may be deterred from purchasing more IoT devices if they struggle to use or control them effectively. Moreover, having to control numerous devices using different applications or platforms can result in annoyance, reducing the attractiveness of a smart home system. Streamlining device configuration and administration procedures is crucial to overcoming this obstacle and growing the Consumer IoT industry.

Market Segmentation

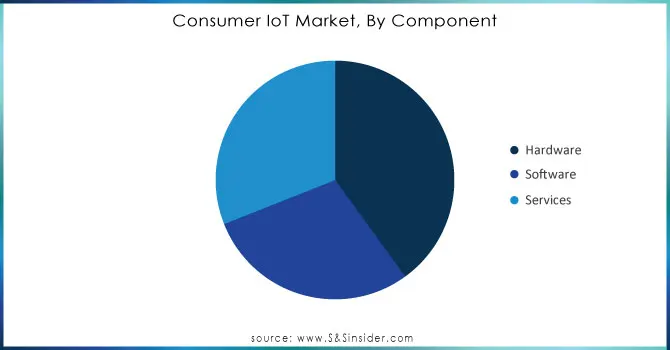

By Component

In 2023, the hardware segment dominated the consumer IoT market, capturing a considerable 40% of the market share. This portion consists of tangible devices and components, like sensors, smart home devices, wearables, and connected appliances. These devices allow for the gathering and sending of data, establishing the basis for consumer IoT applications. Notable contributors in the technology industry, such as Apple with its Apple Watch and Samsung with its SmartThings line, offer reliable and innovative hardware solutions that encourage consumer adoption. Hardware solutions frequently blend easily with everyday activities, improving customer satisfaction and promoting market expansion.

The services sector is projected to have the most rapid expansion from 2024 to 2032, as it aids the hardware and software elements in the Consumer IoT ecosystem. This portion encompasses services such as installation, upkeep, and customer support that are necessary for the efficient functioning of IoT devices. Amazon and Google provide services for installing and maintaining IoT devices through Amazon Home Services and Nest Pro respectively, serving both experienced and inexperienced users. These services improve IoT products, increasing customer satisfaction and promoting long-lasting engagement with IoT ecosystems.

Do You Need any Customization Research on Consumer IoT Market - Inquire Now

By Technology

In 2023, the consumer IoT market was predominantly led by the wired segment, which held a substantial 55% market share. This part takes advantage of the dependability and steadiness of wired connections, which are perfect for tasks needing constant performance like smart home gadgets, security systems, and industrial automation. Ethernet and fiber optics are essential for real-time applications due to their high-speed data transmission and minimal latency. For instance, Amazon and Google use wired connections to boost the performance and security of their products, like smart home devices and Nest.

The wireless section is expected to experience a significant growth rate during 2024-2032. The rise in popularity is fueled by the growing need for mobile and remote connectivity to IoT devices, enabling users to manage and oversee their smart devices from any location. Wireless technologies like Wi-Fi, Bluetooth, and Zigbee are attractive choices for consumer applications such as wearables, smart appliances, and connected health devices due to their ability to allow for flexibility in device positioning and setup. For example, Apple and Samsung use wireless technology to ensure smooth connection and integration among different smart devices in their HomeKit and SmartThings ecosystems.

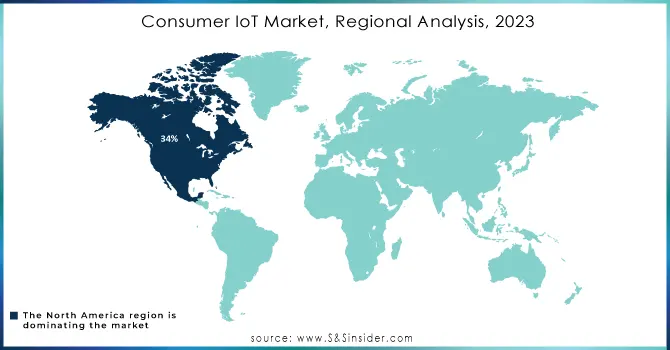

Regional Analysis

North America led the consumer IoT market with a 34% market share in 2023, powered by strong consumer adoption, major technological progress, and a solid digital infrastructure. The forefront in IoT device integration across different sectors, such as smart home devices, wearables, and connected appliances, is being led by the United States and Canada. Big companies like Amazon, Google, and Apple are always finding new ways to improve how consumers interact with their products for more convenience. Additionally, supportive government policies encouraging technology innovation and investments in research and development strengthen North America's dominant position even more.

The APAC region is anticipated to become the fastest-growing during 2024-2032 in the consumer IoT market, driven by rapid urbanization, rising disposable incomes, and a growth in technological uptake. Nations such as China, India, and Japan are leading the way, creating a need for smart devices and IoT-based solutions in households and individual lifestyles. Xiaomi, Samsung, and Alibaba are showing notable progress in the market by providing various smart home products and services to meet the increasing demand for automation and connectivity among consumers. The increased use of mobile devices and improved internet access is also speeding up the adoption of IoT in this area.

Key Players

The major key players in the Consumer IoT Market are:

-

Amazon (Echo Dot, Ring Video Doorbell)

-

Google (Nest Hub, Nest Thermostat)

-

Apple (HomePod, Apple TV)

-

Samsung (SmartThings Hub, Galaxy SmartTag)

-

Microsoft (Azure IoT Central, Microsoft Surface Hub)

-

Bosch (Bosch Smart Home Controller, Bosch Smart Home Camera)

-

Philips (Philips Hue Smart Bulbs, Philips Hue Bridge)

-

Honeywell (Home Security System, Smart Thermostat)

-

Sony (Sony Smart Speaker, Sony Aibo Robot Dog)

-

Fitbit (Fitbit Charge, Fitbit Versa)

-

Xiaomi (Xiaomi Mi Smart Speaker, Xiaomi Mi Band)

-

TP-Link (TP-Link Kasa Smart Plug, TP-Link Kasa Smart Bulb)

-

Nestlé (Nespresso Expert, Nespresso Vertuo)

-

LG (LG Smart Oven, LG Smart Refrigerator)

-

Nokia (Nokia Smart Lighting, Nokia Home Security Camera)

-

IBM (IBM Watson IoT, IBM Maximo)

-

Cisco (Cisco Jasper, Cisco Webex)

-

Qualcomm (Qualcomm QCS605, Qualcomm Snapdragon 8cx)

-

Broadcom (Broadcom IoT SoC, Broadcom Bluetooth Modules)

-

Zebra Technologies (Zebra ZQ520 Mobile Printer, Zebra TC52 Touch Computer)

Suppliers of Software/Components

-

ARM (Cortex-M Series Microcontrollers)

-

Texas Instruments (CC26xx Low-Power Wireless MCUs)

-

Intel (Intel Edison, Intel IoT Gateway)

-

NXP Semiconductors (NXP Kinetis Microcontrollers)

-

Atmel (Atmel SAM D21 Microcontroller)

-

STMicroelectronics (STM32 Microcontroller)

-

Microchip Technology (PIC Microcontrollers)

-

Broadcom (Broadcom Wireless Communication Chips)

-

Qualcomm (Qualcomm IoT Platform)

-

Dialog Semiconductor (Dialog SmartBond Bluetooth Low Energy Solutions)

Recent Developments

-

September 2024: Zoho introduced Vikra, a seller application on the ONDC network, and Zoho IoT, a user-friendly and scalable low-code platform for creating and implementing custom IoT solutions.

-

September 2024: Havells India has launched two additional air purifiers, the Studio Meditate AP 400 and AP 250, expanding on the popularity of the original Studio Meditate model. These updated purifiers come with advanced SpaceTech Air Purification technology, which draws inspiration from the International Space Station, and offers IoT connectivity for seamless integration into smart homes.

-

October 2024: Tata Consultancy Services (TCS) recently revealed the opening of the Bringing Life to Things Lab in Cincinnati, Ohio. The laboratory is created to assist in the quick development, testing, and extensive deployment of AI, GenAI, and IoT engineering solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 243.28 Billion |

| Market Size by 2032 | USD 647.65 Billion |

| CAGR | CAGR of 11.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (Wired, Wireless) • By Application (Consumer Electronics, Healthcare, Wearable Devices, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon, Google, Apple, Samsung, Microsoft, Bosch, Philips, Honeywell, Sony, Fitbit, Xiaomi, TP-Link, Nestlé, LG, Nokia, IBM, Cisco, Qualcomm, Broadcom, Zebra Technologies. |

| Key Drivers | • The growing demand for smart home devices is one of the primary drivers of the consumer IoT market. • The consumer IoT market is experiencing significant growth due to the increasing focus on health and wellness applications. |

| RESTRAINTS | • The setup and management of IoT devices can be complex, posing a barrier to adoption for less tech-savvy consumers. |