Financial Analytics Market Report Scope & Overview:

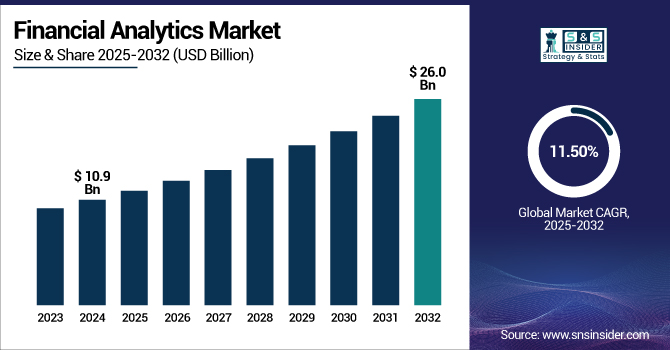

The Financial Analytics Market size was valued at USD 10.9 billion in 2024 and is expected to reach USD 26.0 billion by 2032, growing at a CAGR of 11.50% from 2025-2032.

To Get more information on Financial Analytics Market - Request Free Sample Report

The financial analytics market growth is driven by the increasing demand for data-driven decision-making, incorporation of advanced technologies, and the increasing requirement for real-time financial analytics. With the automation in all aspects of finance, such as fraud detection, forecasting, and anomaly detection, an increasing number of organizations are leveraging artificial intelligence and machine learning to improve the financial analytics tools.

According to a 2024 research, artificial intelligence has now been adopted by 58% of finance functions, a big jump, up 21% points from 2023. Intelligent process automation is the most common, with 44% adoption, followed by anomaly and error detection implementation at 39%. Currently, 28% of finance functions have implemented AI for advanced analytics in forecasting, while 27% are using AI for operational tasks and process augmentation. These numbers demonstrate the impact that AI has on the finance industry and how automating repetitive tasks enable operational efficiency while advanced data analysis improves decision-making.

Another significant factor is the fast transition from on-premises systems to cloud-based solutions, which provide greater scalability, cost-effectiveness, and immediate access to data. Moreover, companies are utilizing financial analytics to improve their risk management and regulatory compliance as new laws and regulations emerge.

The U.S. financial analytics market is projected to expand from USD 1.5 billion in 2024 to USD 3.8 billion by 2032, growing at a CAGR of 12.55% during 2025 to 2032. This growth is primarily driven by the increasing use of data-driven approaches, real-time financial insights, and the incorporation of advanced technologies, such as AI and machine learning.

Financial Analytics Market Dynamics:

Drivers:

-

Financial Analytics Market is Being Significantly Driven by Integration of Advanced Technologies

Technological advancements, such as adopting artificial intelligence, machine learning, and predictive analytics, are the main factors driving the financial analytics market. These technologies improve a financial analytics platform's capacity to handle vast amounts of real-time data, provide precise predictions, automate normal procedures, and proactively find anomalies and fraud. A growing number of businesses are adopting these tools to get better visibility into their finances, mainstream processes, and enable strategic planning. AI and ML have resulted in predictive and prescriptive analytics that help gain a head start on customer behavior and market changes that the financial institution could face in the future.

Restraints:

-

Rising Concerns Over Data Privacy and Cybersecurity Hinder Financial Analytics Market Expansion

As financial analytics solutions consist of confidential details, including customer information, transaction history, and market data, consequently, these solutions are a prime target for malicious attackers who intend to extract data. Regulatory frameworks, such as GDPR and CCPA have compliance requirements that need to be followed, making it one more responsibility for enterprises to ensure data integrity and confidentiality. Non-compliance with these requirements can result in steep, quantifiable fines, and reputational damage. All these are the reasons why some organizations are still reluctant to completely embrace financial analytics platforms, particularly the ones that are cloud-based and have delayed implementation rates despite the obvious advantages that insights extract from analytics.

A 2024 study found that 61% of organizations experienced a third-party data breach or other security incident in the past 12 months, underscoring the significant risk posed by third-party vendors.

Opportunities:

-

Increasing Demand for Real-Time Financial Insights Presents a Major Opportunity for the Financial Analytics Market

With the fast pace of today’s business environment, enterprises need timely financial data to make rapid but informed decisions and to stay ahead of changing market dynamics. Real-time analytics facilitate ongoing tracking of performance, scenario modeling in a matter of seconds, and the ability to rapidly respond to risks or opportunities. This is vital in industries, such as BFSI, retail, and healthcare, where decisions affect the bottom line and need to be made quickly. Vendors are responding by creating intuitive dashboards and tools that are mobile-friendly, and automated alerts.

Challenges:

-

Complexity of Integrating Financial Analytics Tools with Existing Legacy Systems and Data Sources Poses a Major Challenge

This reflects a common scenario of many organizations whereby IT infrastructures with repeated silos and multiple data stores make it hard to bring financial data together to analyse efficiently. Seamless integration is hindered even more by the absence of standardization across platforms, which results in delays, higher costs, and the risk of data misinterpretation. Real-time analysis requires a lot of speed and great connectivity, which legacy systems do not provide. This gap in technology also needs investments in IT upgrades and human resources for the changes that large-scale entrepreneurs make overnight, making it a barrier for small-scale and medium-scale entrepreneurs.

Financial Analytics Market Segmentation Analysis:

By Application

The revenue management segment dominated the financial analytics market with the largest share in 2024, owing to the increasing demand for real-time monitoring and optimization of revenue streams. Companies are being helped out by analytics tools these days with pricing strategy, billing systems, and maximizing profitability over multiple channels. AI, together with predictive analytics, allows more accurate forecasts and margin control in markets with high variability, such as retail and telecom. As competition intensifies and margins continue to be under pressure, enterprises will likely spend more on revenue intelligence tools to remain financially viable.

According to a study, 73% of retailers have adopted AI-powered chat technologies, signaling a major move toward enhancing customer engagement and streamlining operations through AI-driven solutions.

The audit & compliance segment is expected to be the fastest-growing during the 2025-2032 period, owing to increased regulatory complexities and enhanced data protection legislation, such as GDPR and CCPA. As a result, financial analytics platforms have become a fundamental part of any organization as they help automate audit trails and spot anomalies and enable timely compliance reporting.

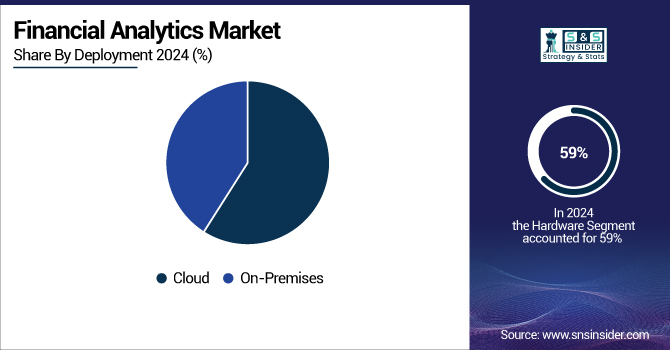

By Deployment

The cloud segment dominated the financial analytics market and accounted for 58% of revenue share in 2024 and is also expected to register the fastest CAGR during the forecast period as it provide a cost-effective and scalable solution with access to real-time data. As more and more organizations are moving toward cloud-based platforms to support remote work models and streamline digital transformation. Moreover, cloud-based analytics are more rapidly integrated with useful technologies, such as AI and machine learning with big data, which makes actionable insights faster to achieve on the part of the firms.

By Enterprise Size

Large enterprises segment dominated the market and accounted for 69% financial analytics market share in 2024 owing to the larger operational span, high data volume, and well-developed IT infrastructure. Such companies invest heavily in advanced analytics solutions to support strategic financial planning concerning the trade-off between risk and regulatory compliance. Big corporations have this entire financial analysis team that works in hundreds of financial departments, but there was enough space in the market for real-time insights that can help the big enterprises to increase profitability, performance, and competitive advantages using analytics.

A 65% of SMEs reported receiving government funding for digitization at least once, indicating the effectiveness of programs, such as Digital India and Startup India in supporting SMEs' digital transformation efforts.

SMEs segment is expected to register the fastest CAGR during the forecast period of 2025-2032 due to the availability of low-cost cloud-based analytics solutions with growing adoption of the idea of data-driven financial planning, Thanks to affordable and scalable SaaS platforms available today, a larger share of SMEs are using financial analytics to improve forecasting, manage expenses in moments, and help predict cash flow. For Instance, A 2023 survey revealed that 80% of SMEs believe government funding is crucial for unlocking digitalization. Cost-affordable subscription models, along with government initiatives to fast-track digital transformation, will make it imperative for small firms to leverage financial analytics, thus becoming a key growth segment in the ensuing years.

By Industry

In 2024, the IT & Telecom segment dominated the financial analytics market and accounted for the largest share due to the growing volume of transactional data generated by this sector and the requirement to continuously monitor financial performance in real-time. In an ever-changing context, these organizations rely on advanced analytics solutions that use the insights of revenue, cost structure, and demand forecasting.

The BFSI segment is expected to register the fastest CAGR during the forecast period of 2025-2032, with demand for fraud detection, regulatory compliance, and customized financial services growing rapidly. Increasing numbers of organizations are using AI-based analytical tools to score borrowers, assess portfolio risk, and analyze customer behavior. Real-time intelligence solution plays an important role in overcoming the risks, and it is being purchased to check customer retention.

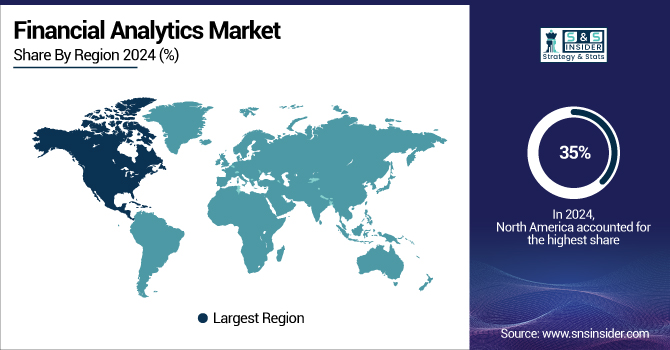

Regional Analysis

North America dominated the financial analytics market in 2024 and accounted for 35% of revenue share due to early digital transformation, high cloud adoption, and large AI and big data technology investments in this region.

In the North America region, Canada is the fastest-growing nation, owing to its growing fintech industry, government support for digital innovation, and the increasing acceptance of cloud-based financial analytics amongst SMEs. Canada is likely to experience impressive growth by 2025-2032, as organizations will invest in the use of predictive analytics to manage risks and improve operational performance.

Asia Pacific is expected to achieve the fastest CAGR during the forecast period, owing to increasing economic growth and digitization, along with increasing IT spending by enterprises. Industry verticals, such as banking, retail, and manufacturing are also witnessing higher adoption due to the increasing demand for real-time insights.

In the Asia-Pacific region, China dominated the market in 2024 due to the country with the largest digital economy in the world adopting wide-scale initiatives, and enterprises with the largest volume embracing and embarking on the initiatives for smart government-funded financing.

For Instance, in November 2024, the People's Bank of China, in collaboration with the National Development and Reform Commission, introduced a strategic action plan to fast-track the development of digital finance infrastructure across the country.

The financial analytics market growth in Europe is due to the regulatory-driven requirements for stricter compliance of solutions, such as MiFID II and GDPR, which drive the adoption of financial analytics. A high focus on sustainability reporting and ESG analytics in the region is another driver of demand. The market growth is supported by a rise in cloud adoption, increasing digital transformation of banking and manufacturing sectors, and growing investments in automated financial tools driven by AI.

In Europe, Germany dominated the market owing to well-established financial infrastructure, strong industrial base and high adoption rate of the analytical solutions to optimise financial operations and ensure compliance.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major financial analytics market companies are IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., TIBCO Software Inc., Tableau Software LLC, FIS Global, QlikTech International AB, Hitachi Vantara LLC, Google LLC. and others.

Recent Developments:

-

December 2024: Oracle announced new AI agents within its Cloud ERP, including tools for anomaly detection, forecasting, and generative AI capabilities aimed at optimizing finance processes and supporting industry-specific needs.

-

November 2024: FIS acquired Dragonfly Financial Technologies, enhancing its cash management capabilities for large and complex businesses, which it is integrating into its Digital One Commercial offering.

-

July 2024: Hitachi announced the general availability of Hitachi iQ and introduced a new AI Discovery Service to help businesses become AI-ready, providing infrastructure and services to support advanced AI workloads.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 10.9 Billion |

| Market Size by 2032 | US$ 26.0 Billion |

| CAGR | CAGR of 11.50 % From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Revenues Management, Expenses Management, Audit & Compliance, Wealth Management, Customer and Product Profitability, Portfolio Management, Others [Cash Flow Management]), • By Deployment (On-premises, Cloud) • By Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises) • By Industry (Healthcare, BFSI, Retail and Consumer Goods, Energy & Power, IT & Telecom, Automotive and Manufacturing, Others [Aviation, Government]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., TIBCO Software Inc., Tableau Software LLC, FIS Global, QlikTech International AB, Hitachi Vantara LLC, Google LLC. and others in report |