Finished Vehicle Logistics Market Report Scope & Overview:

To get more information on Finished Vehicle Logistics Market - Request Free Sample Report

The Finished Vehicle Logistics Market Size was esteemed at USD 188.79 billion in 2023 and is supposed to arrive at USD 356.46 billion by 2032 and develop at a CAGR of 7.33% over the forecast period 2024-2032.

The Finished Vehicle Logistics (FVL) market is driven by the increasing demand for efficient, streamlined logistics solutions due to the rise of global vehicle production and trade. As automakers focus on reducing production costs, there is a greater emphasis on optimizing transportation routes and employing advanced logistics technologies to ensure vehicles are delivered swiftly and safely. Another key trend is the adoption of digitalization and automation in the logistics process. Technologies such as Internet of Things (IoT), artificial intelligence (AI), and big data analytics are transforming how finished vehicles are tracked, monitored, and transported. These technologies enable real-time monitoring of vehicles, enhancing visibility and reducing the risk of delays. Automated systems in vehicle handling and storage are also improving efficiency and reducing operational costs.

Sustainability is also becoming a crucial factor in the FVL market. As environmental concerns rise, automotive manufacturers and logistics providers are shifting toward eco-friendly transportation methods. The use of electric vehicles for logistics and exploring alternative, greener routes are gaining traction. This trend is supported by government regulations and consumer demand for environmentally responsible practices. In addition, the rise of e-commerce and online vehicle sales is influencing the FVL market. More automakers are adopting direct-to-consumer models, which has led to an increased need for logistics companies to provide specialized services, including last-mile delivery and customization of vehicles before they reach consumers.

MARKET DYNAMICS

DRIVERS:

-

The rise in global automotive production and sales, especially in emerging markets, drives the increased demand for finished vehicle logistics services, fueling market growth.

The growth of the Finished Vehicle Logistics (FVL) market is closely tied to the increasing global demand for automobiles. As more vehicles are produced to meet consumer needs, there is a corresponding rise in the demand for efficient transportation and delivery services. This trend is particularly pronounced in emerging markets such as Asia-Pacific, Latin America, and Africa, where rising disposable incomes and urbanization drive automotive sales. With manufacturers expanding their production capacities in these regions, the need for timely and secure delivery of finished vehicles becomes critical, directly contributing to the growth of the FVL market.

Additionally, the automotive industry’s shift toward more complex and diverse vehicle types, including electric and autonomous vehicles, requires specialized logistics solutions. The increasing global sales of these high-value vehicles further amplify the need for customized transport services that can handle various vehicle sizes, weight specifications, and unique transportation demands. However, the market is also likely to face challenges related to this growth. With rising automotive production, logistics companies will experience greater pressure to scale operations and improve efficiency. This could lead to bottlenecks in the supply chain and higher transportation costs due to the need for more specialized equipment and skilled personnel. The industry will need to invest in innovative technologies such as AI, automation, and improved fleet management to meet the growing demand while managing costs and ensuring timely deliveries. Therefore, while growth is expected, it will be accompanied by the challenge of meeting increasing complexities in logistics.

-

The global expansion of automakers, with new production facilities in various regions, is driving the demand for efficient logistics solutions

The global expansion of automakers has significantly contributed to the growth of the finished vehicle logistics market. As automotive manufacturers establish new production facilities across various regions, especially in emerging markets, they aim to meet the growing demand for vehicles in local markets. This expansion often involves building plants in regions like Asia-Pacific, Latin America, and Africa, where the automotive industry is experiencing rapid growth. As a result, manufacturers face increased pressure to establish efficient logistics systems that can manage the transportation of vehicles between production sites, distribution centers, and end customers.

With the expansion of automotive plants in different parts of the world, the need for advanced and reliable vehicle distribution networks has surged. Efficient logistics solutions are essential to handle the movement of finished vehicles across borders, ensuring timely deliveries, reducing costs, and maintaining customer satisfaction. Logistics providers are increasingly focusing on optimizing their transportation routes, utilizing automation and real-time tracking technologies to enhance operational efficiency.

RESTRAIN:

-

Rising fuel prices and the need for specialized transportation equipment increase operational costs, potentially hindering growth in the finished vehicle logistics market.

The rising costs of transportation and fuel represent significant challenges for the finished vehicle logistics market, impacting its growth trajectory. As fuel prices fluctuate, logistics providers face increased operational expenses, which can directly affect the cost of transporting vehicles from manufacturers to dealerships or customers. The automotive logistics sector relies heavily on transportation methods like road, rail, and sea, all of which are sensitive to fuel price changes. When fuel costs rise, these price hikes are often passed along to customers, potentially increasing the overall cost of finished vehicle delivery and reducing profitability for logistics companies. Additionally, the need for specialized transportation equipment—such as enclosed carriers for luxury or electric vehicles—adds to these expenses. These specialized vehicles are costly to maintain and fuel, further driving up logistics costs.

As a result, the finished vehicle logistics market may experience slower growth, especially as margins tighten for service providers who must balance rising operational costs with customer demands for competitive pricing. Companies in this sector may also be forced to explore alternative fuel solutions, like electric trucks, to mitigate these expenses, though the initial investment in such technologies can be significant. Furthermore, fluctuations in fuel costs can lead to supply chain disruptions, as logistics companies may struggle to maintain consistent delivery schedules while managing cost variability. This growing pressure on logistics providers to maintain cost-effectiveness and meet customer demands while managing fuel and transportation costs will be a critical factor influencing the market's future growth.

KEY SEGMENTATION

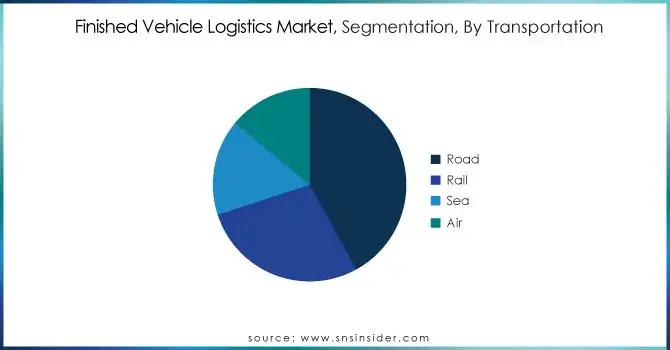

By Transportation

The road transportation segment dominated with the market share over 42% in 2023, due to its unmatched flexibility and efficiency in vehicle delivery. Road transport allows for the movement of vehicles over short to medium distances, making it ideal for regional distribution and transportation between manufacturing facilities and dealerships. This mode offers greater accessibility, as it can reach areas that other transportation methods may not, such as remote locations or regions with limited rail or sea connectivity. Additionally, road transport is well-suited for just-in-time deliveries, which is crucial for meeting consumer demand in the automotive sector. The infrastructure of highways, roads, and the availability of dedicated vehicle carriers further enhance the convenience and cost-effectiveness of road logistics.

By Vehicle

The Passenger vehicle segment dominated with the market share over 55% in 2023, due to its large share of the overall vehicle market. This dominance is largely driven by the strong and consistent demand for passenger cars globally, which are the most commonly produced and sold vehicle category. The demand is particularly pronounced in emerging economies, where rising incomes and expanding middle-class populations are driving the growth in automotive ownership. As more people in these regions gain access to cars, the need for efficient logistics and transportation of passenger vehicles increases. Additionally, established markets in developed economies continue to see strong sales of passenger cars, further cementing the segment’s dominance in the FVL sector.

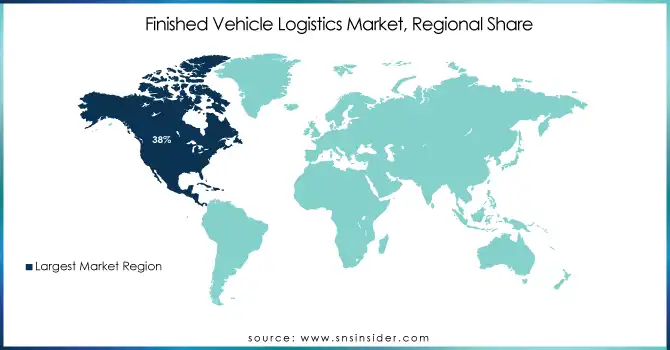

KEY REGIONAL ANALYSIS

North America region dominated with the market share over 38% in 2023, primarily due to its well-established automotive industry and robust logistics infrastructure. The United States and Canada are home to some of the world’s largest automotive manufacturers, including General Motors, Ford, and Stellantis, which have extensive production networks and distribution systems. This strong automotive presence drives a high demand for efficient vehicle logistics to transport finished vehicles across regions and global markets. Additionally, North America boasts advanced transportation networks, including highways, railways, and ports, ensuring smooth and timely delivery of vehicles. Significant investments in logistics infrastructure, including warehousing and vehicle handling facilities, further enhance the region's logistics capabilities.

The Asia Pacific region is experiencing rapid growth in the Finished Vehicle Logistics (FVL) market, primarily driven by a surge in automotive production and export activities across countries like China, India, Japan, and South Korea. These nations are key players in global automotive manufacturing, contributing significantly to the region's logistics demands. As the middle class continues to expand, there is an increased demand for vehicles, particularly in emerging economies, further propelling the market’s growth. Additionally, advancements in logistics infrastructure, such as enhanced road networks, ports, and rail systems, are streamlining the movement of finished vehicles. Technological innovations, including automation and digitalization of logistics operations, are also playing a critical role in improving efficiency and reducing costs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of Finished Vehicle Logistics Market:

-

United Parcel Service (UPS) (Vehicle transportation, supply chain solutions)

-

DHL Supply Chain (Vehicle logistics, transportation management)

-

XPO Logistics (Finished vehicle delivery, transport and warehousing services)

-

Kuehne + Nagel (End-to-end vehicle logistics, distribution services)

-

Ceva Logistics (Vehicle transportation, logistics services, warehousing)

-

DB Schenker (Automotive logistics, vehicle transportation)

-

DSV (Finished vehicle transport, supply chain solutions)

-

Nippon Express (Vehicle logistics, supply chain services)

-

GEFCO (Automotive logistics, vehicle transportation, supply chain solutions)

-

Ryder System, Inc. (Fleet management, vehicle transportation services)

-

Gefco Group (Automotive logistics, finished vehicle transportation)

-

Xerox Logistics (Fleet management, vehicle transportation)

-

TSE Express (Finished vehicle logistics, delivery and distribution)

-

Kerry Logistics (Automotive logistics, vehicle transportation services)

-

Hitachi Transport System (Automotive logistics, vehicle shipping)

-

Yusen Logistics (Finished vehicle logistics, distribution, warehousing)

-

Schenker AG (Finished vehicle transport, logistics services)

-

Wallenius Wilhelmsen (Automotive logistics, roll-on/roll-off shipping)

-

Ziegler Group (Automotive logistics, finished vehicle distribution)

-

Logwin AG (Automotive logistics, finished vehicle transportation)

Suppliers for Specializes in finished vehicle logistics, offering sea, air, and land transportation for automotive manufacturers of Finished Vehicle Logistics Market

-

Kuehne + Nagel International AG

-

DB Schenker

-

XPO Logistics

-

CEVA Logistics

-

DHL Supply Chain

-

Geodis

-

Schenker AG

-

Penske Logistics

-

Nippon Express

-

Kintetsu World Express

RECENT DEVELOPMENT

In June 2023: The Automotive Industry Action Group (AIAG) published four new guidelines for Finished Vehicle Logistics (FVL), including an updated directive on handling transportation damage. These guidelines are designed to enhance clarity and standardize processes within the transportation industry.

In March 2024: CEVA Logistics and the Port of Dunkirk entered into a contract to set up a new FVL operation focused on sea-based imports and exports. CEVA Logistics, a prominent FVL provider, offers comprehensive services for both new and used vehicles, including transportation, storage, customization, and preparation.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 188.79 billion |

|

Market Size by 2032 |

USD 356.46 billion |

|

CAGR |

CAGR of 7.33% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Transportation (Road, Rail, Sea, Air) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

United Parcel Service (UPS), DHL Supply Chain, XPO Logistics, Kuehne + Nagel, Ceva Logistics, DB Schenker, DSV, Nippon Express, GEFCO, Ryder System, Inc., Gefco Group, Xerox Logistics, TSE Express, Kerry Logistics, Hitachi Transport System, Yusen Logistics, Schenker AG, Wallenius Wilhelmsen, Ziegler Group, Logwin AG. |

|

Key Drivers |

• The rise in global automotive production and sales, especially in emerging markets, drives the increased demand for finished vehicle logistics services, fueling market growth. |

|

RESTRAINTS |

•Digitalization and automation, through tools like WMS and TMS, are boosting operational efficiency, reducing labor costs, and improving service reliability, while the market will face challenges related to high technology investments and the need for a skilled workforce. |