Fixed Line Communication Market Report Scope & Overview:

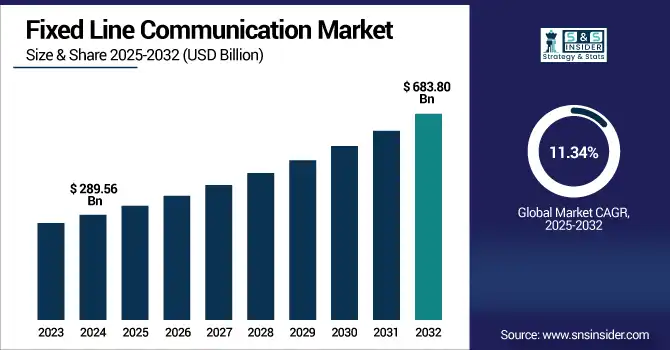

The fixed line telecommunications market size was valued at USD 289.56 billion in 2024 and is expected to reach USD 683.80 billion by 2032, expanding at a CAGR of 11.34% over the forecast period of 2025-2032.

To Get more information on Fixed-Line-Communication-Market - Request Free Sample Report

The fixed line telecommunications market continues to be the basis of stable, high-speed voice and data services to residential and business customers alike. Even with the expansion of mobile networks, Fiber Optic, DSL and VoIP technologies are vital for organizations seeking stable, high-bandwidth connections. Rising bandwidth consumption, digital transformation, and growing demand for fiber-optic-based infrastructure, particularly in urban areas, are driving the market. Steps are being taken to upgrade and modernize the copper network to fiber, which is a much faster and cost-efficient solution. Government projects in emerging markets and the energy-efficient nature of fixed networks also boost expansion. The fastest expansion is in Asia Pacific, while North America and Europe have mature infrastructure.

According to research, in 2024, nearly 62% of enterprises relied on fixed-line infrastructure as their primary channel for accessing cloud platforms, highlighting its critical role in digital operations. This preference is further supported by fiber-optic networks offering an average latency of just 12 ms, 65% lower than traditional DSL connections.

The U.S Fixed Line Communication Market size reached USD 54.67 billion in 2024 and is expected to reach USD 119.17 billion in 2032 at a CAGR of 10.24% from 2025 to 2032.

U.S. has maintained its control on the market due to its well-established telecom infrastructure base, early adoption of advanced technologies such as fiber optic networks and investments in digital transformation in various industries. The strong regulatory environment in the country makes it easier for service providers to set up their business, helping in the fixed-line communication market growth in the country. Factors driving the market are the demand for high-speed internet service in the residential and business sectors, the growing FTTH services, greater industry uptake powered by cost reduction, cloud computing, which needs a more settled connection, and government initiatives for the broadcasting services.

Market Dynamics

Drivers:

-

Key Drivers of Fixed-Line Communication Market Growth Amid Technological Advancements and Infrastructure Expansion.

The fixed-line communication market is also expanding due to the growing requirement for high-speed internet. Fiber Optic Technology and Up-gradations in Network Infrastructure: A must for ever-changing business and consumer demands. The numerous data-hungry apps, online services, and cloud solutions require relentless fixed-line communications for ideal workflow. Fiber-optic-based networks and advanced technologies are driving service that is responsive service in an increasingly competitive environment that prizes innovation and customer service.

According to research, over the past two years, enhanced fixed-line fiber connectivity has boosted remote workforce productivity for over 60% of businesses, while supporting more than 75% of IoT devices in smart cities, powering critical infrastructure like traffic systems and energy grids.

Restraints:

-

High Infrastructure Costs and Regulatory Challenges Impeding Market Expansion.

The fixed voice communication market is particularly challenged by the need to invest in costly infrastructure and maintenance, for instance, fiber optics. These cost concerns make it prohibitive for small players and regional implementations. Moreover, in the expansion and operation of a network, compliance and the acquisition of necessary licenses are both very complicated and very expensive efforts. The combined impact of these factors can completely retard the market's growth and curtail the development of fixed-line communication services.

Opportunities:

-

Integration of Fixed-Line Networks with Emerging Technologies Enhancing Service Offerings.

Merging of fixed line networks with new technologies like 5G, IoT, and smart home systems provides a huge opportunity for market growth. This convergence makes it possible for operators to provide end-to-end connectivity solutions that meet the swarming demand for smooth and reliable communication services. The use of such related technologies can enable a variety of distinctive applications and services, and can effectively expand such customer universe and stimulate the revenue growth of the fixed-line communication industry.

Challenges:

-

Competition from Wireless Technologies and Market Consolidation Affecting Fixed-Line Services.

The fixed communication market is competitive due to competition from wireless technologies, which include 5G networks, and is expected to have a significant impact on the demand for FTTP transmission products. This race could reduce demand for conventional fixed-line services as consumers and companies increasingly turn to wireless options. Furthermore, industry consolidation via M&A could lead to dominant players on the market and mean less competition and less innovation. These things are tough to control as a fixed-line provider in terms of market share and margins.

Segment Analysis

By Technology

The Voice over IP (VoIP) segment commands the largest revenue share of 31.38% in 2024, driven by increasing enterprise use of low-cost, scalable communication systems. Major players have launched updated VoIP systems with artificial intelligence-based call management and security, improving the overall call experience. The market for this segment is also dependent on the fixed-line communication market’s acceptance of digitalization as VoIP utilizes the POTS infrastructure for delivering reliable and flexible voice services, a pervasive need due to the rising necessity of continuous networking across industries.

The Fiber Optic segment is projected to grow at the highest CAGR of 12.86%, propelled by the widespread rollout of fiber-to-the-home (FTTH) networks and increasing demand for high-speed, low-latency connectivity. The Fixed Line Communication Market companies, such as Corning and Nokia, have launched next-generation fiber optic cable and network gear to facilitate expanded broadband services. This expansion mirrors a wider trend in the fixed-line communication market towards network infrastructure upgrades in conjunction with fiber technology, which delivers increased bandwidth to urban and rural marginal areas to support data-rich applications and digital transformation across all regions.

By Service Type

Leased Line Services dominate with a 20.36% revenue share, driven by the demand of companies for secure, dedicated communication channels that guarantee a continuous delivery of information. The top-tier carriers, such as AT&T and Verizon, have also extended their menu of leased lines; they have added SD-WAN services and have used them to provide more flexible network connections. This service category is currently in the spotlight as the fixed line communications industry focuses on delivering a strong and reliable foundation for business, with cloud integration and real-time data sharing continuing to drive investment in leased line solutions that facilitate greater connectivity.

Fixed Broadband Services are growing rapidly at a 12.05% CAGR, on increased internet demand from residential users and small- and medium-sized enterprises (SMEs). Firms including Comcast and BT have rolled out gigabit broadband packages and fiber-to-the-premises fixed broadband expansions. It is in line with the broader trend in the fixed-line communications market of the accelerated rollout of high-speed internet services, with the demand for digital lifestyle and teleworking services, and providers’ need to expand high-speed internet access to lacking areas, as the two providers spent significantly on investment in expanding their broadband footprint.

By End User

Large enterprises account for the largest share of 22.90%, highlighting their need for large, secure fixed-line communications networks to underpin cloud computing, data centers, and global operations. Specific, customized connectivity solutions and hybrid communication systems have been offered by firms such as IBM and Microsoft to provide the custom solutions that businesses require. This part reinforces the fixed-line communication market, which is driven by providing scalable and dependable infrastructure for large organizations, as digital transformation and business continuity are the two major factors for all large enterprises.

The Small and Medium Enterprises (SMEs) segment is growing at a 12.56% CAGR. The growth is led by the rapid uptake of cost-effective, scalable fixed-line services, enabling business expansion and digital take-up. Companies such as RingCentral and Zoom now offer SME-focused unified communications products combining VoIP with broadband.” This is supplemented by the growing focus on inclusivity and digital access in the fixed-line communication market, with SMEs now requiring always-on access to join in on collaborative projects, rely on cloud services, and take up remote working.

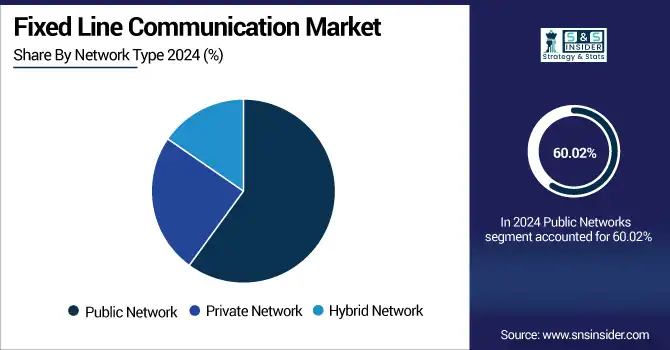

By Network Type

The public networks maintain a dominating position with a Fixed Line Communication Market share of 60.02% due to a broad infrastructure of public networks and their availability among individuals and businesses. WRT Giants such as AT&T and BT are still taking public fixed-line networks to a new level with IPv6-capable and higher-bandwidth last-mile fixes. The segment’s primacy mirrors the fixed-line communications market’s continued growth to address the requirements of mass-market connectivity, for various applications such as based internet and enterprise telecommunication.

The Hybrid Network segment is estimated to expand at a CAGR of 13.08%, due to the rise in demand for networks with characteristics of both fixed-line infrastructure and wireless. Companies such as Cisco and Ericsson have developed hybrid networking offerings combining fixed broadband and 5G for innovation in performance. This fixed line communication market trend is part of the move of the fixed-line communications market to hybrid connectivity models that make it easy to create scalable, resilient communication frameworks that meet the needs of today’s enterprise and consumer.

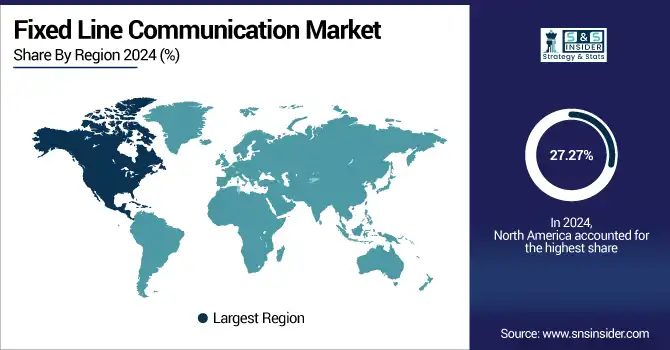

Regional Analysis

North America captured the largest market share of 27.27% in 2024 due to the strong telecom infrastructure in place, early fiber deployments, and high enterprise demand for high-speed connectivity. The market is mature, with the digital transformation, the familiarisation with online transactions in general, and the use of VoIP and fixed broadband services all continuing to expand due to investment.

The U.S. dominates the regional market. Investment in fiber-optic infrastructure and cloud-based communication solutions has already made the US the hub of the region.

Europe is growing at a steady rate owing to government-funded broadband expansion projects and an increasing focus on sustainable high-speed connectivity. Fiber deployment, particularly in urban areas, and business dependence on robust data networks are other key catalysts throughout the region.

Germany is leading with fast-paced FTTH/B deployments, progressive telecom regulations, and steady demand for business leased and broadband lines.

Asia Pacific is the fastest-growing region with a projected CAGR of 12.13%, due to Urbanization, Increasing Internet Penetration and Govt initiatives of Digitalization Growth Factors: The Asia Pacific region will show a fast growth in the digital transformation market due to the presence of the technologically advanced economies like China, Japan, and South Korea. The area is ripe with fiber optics and increasingly, the take-up of VoIP and hybrid comms strategies by small, medium, and corporate-sized businesses.

China is the leading country in the region, due to extensive fiber optic builds, government-supported broadband push, and the control the domestic telco giants, China Telecom and China Unicom, hold.

The Middle East & Africa and Latin America regions are witnessing developments in fixed-line networks, mainly owing to increasing broadband penetration, growing VoIP subscribers, and growing digital investments. Both regions are experiencing fast-growing market potential driven by city expansion, fiber network deployment, and strong enterprise demand for a reliable connection.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Fixed Line Communication Market are Verizon Communications, China Unicom, Telstra, KT Corporation, NTT Corporation, Deutsche Telekom, AT&T, Orange, Comcast, BT Group, and others.

Key Developments

-

In May 2025, Deutsche Telekom revealed fresh strategic collaborations with local councils and utility groups in efforts to ramp up fiber-optic network builds in Germany, intending to expand national FTTH penetration and upgrade high-speed connectivity infrastructure.

-

In May 2025, Verizon announced its acquisition of Frontier Communications for USD 20 billion, effectively doubling its fiber footprint and solidifying its fixed-line presence. The acquisition is set to enhance Verizon's competitiveness and reach.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 289.56 Billion |

| Market Size by 2032 | USD 683.80 Billion |

| CAGR | CAGR of 11.34% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Voice over IP, Digital Subscriber Line, Fiber Optic, Integrated Services Digital Network) •By Service Type (Fixed Voice Services, Fixed Broadband Services, Leased Line Services) •By End User (Residential, Small and Medium Enterprises, Large Enterprises, Government) •By Network Type (Public Network, Private Network, Hybrid Network) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Verizon Communications, China Unicom, Telstra, KT Corporation, NTT Corporation, Deutsche Telekom, AT&T, Orange, Comcast, BT Group |