Fleet Management Market Report Scope & Overview:

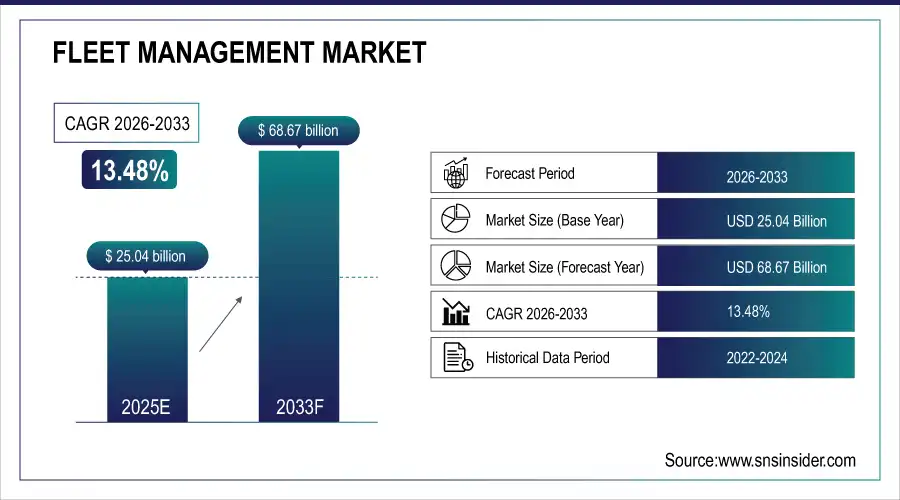

The Fleet Management Market Size was valued at USD 25.04 Billion in 2025E and is expected to reach USD 68.67 Billion by 2033 and grow at a CAGR of 13.48% over the forecast period 2026-2033.

The Fleet Management Market analysis growth is due to Growing adoption of telematics and connected cars and internet of things (IoT) based technologies across commercial and passenger vehicles. This is enabling organizations to leverage vehicle tracking, route optimization and real-time predictive maintenance to enhance operational efficiency and decrease costs. Moreover, the market growth is also boosted by the increasing demand for connected vehicles and smart fleet solutions, as well as government mandate on ensuring fleet safety and emission control. Also, the use of artificial intelligence and big data analytics in fleet management systems has simplified data-driven decisions, thus enhanced production and improving resource utilization. According to study, Companies using AI-powered fleet management systems experience 10–15% improvement in fleet utilization and decision-making efficiency.

Market Size and Forecast:

-

Market Size in 2025: USD 25.04 Billion

-

Market Size by 2033: USD 68.67 Billion

-

CAGR: 13.48% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Fleet Management Market- Request Free Sample Report

Fleet Management Market Trends

-

Adoption of telematics and IoT technologies is increasing across global fleets.

-

AI and big data analytics enhance predictive maintenance and operational efficiency.

-

Connected vehicles and smart fleet solutions drive real-time monitoring demand.

-

Electric and hybrid fleet adoption is rising to reduce carbon emissions.

-

Energy consumption and battery performance monitoring solutions are gaining significant importance.

-

Governments encourage sustainable transportation, boosting advanced fleet management solution adoption.

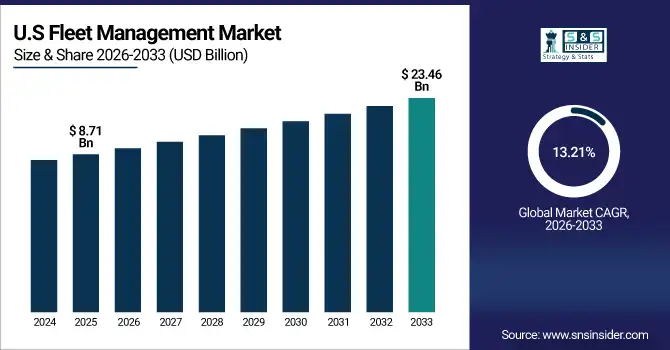

The U.S. Fleet Management Market size was USD 8.71 Billion in 2025E and is expected to reach USD 23.46 Billion by 2033, growing at a CAGR of 13.21% over the forecast period of 2026-2033, driven by widespread adoption of telematics, IoT, and AI-powered fleet solutions, enhancing real-time tracking, predictive maintenance, and operational efficiency, supported by strong regulatory standards and growing demand for connected vehicle technologies.

Fleet Management Market Growth Drivers:

-

Telematics and IoT Adoption Boosts Fleet Efficiency and Operational Productivity

The Fleet Management Market is growing worldwide, driven by the widespread uptake of telematics and IoT based solutions over commercial and passenger vehicles. Fleet operators are using these technologies for real-time vehicle tracking, route optimization, predictive maintenance, and fuel efficiency tracking. Telematics devices gather large amounts of information about vehicle performance, driver behavior, and traffic conditions, allowing businesses to make decisions backed by data. Not only does it help to reduce operational costs but has also enhanced safety and compliance within the fleet. Connected cars, smart fleet systems and favorable trend in AI and big data analytics will create high growth opportunities for the market during the forecast period.

Real-time tracking and route optimization can reduce fleet operational costs by 20–25%.

Fleet Management Market Restraints:

-

High Implementation Costs Hinder Small Fleet Operators’ Technology Adoption Globally

Despite its advantages, Fleet Management Market faces challenges expensive nature of integrating and maintaining fleet management systems. For the small and medium-sized enterprises (SMEs), the MAK of hardware, software, and telematics devices is usually a large investment upfront. Furthermore, deployment of cutting-edge technologies such as AI, IoT, and predictive analytics mandates workforces with relevant skills and continuous system upkeep, all of which train up operating costs. In particular, in developing regions, the fleet operators may be unable to spend on such solutions, and this cost factor acts a barrier and delays adoption, restricting market growth overall.

Fleet Management Market Opportunities:

-

Electric and Hybrid Fleets Create New Growth Opportunities Worldwide

The Fleet Management Market presents a significant opportunity towards electric vehicles (EVs) and hybrid fleets. Environmental regulations introduced by governments across the world are encouraging sustainable transportation, thereby increasing the adoption of Purpose of EV Fleets An increasing number of fleet operators are embracing EVs and hybrids due to the aim of minimizing carbon emissions in a bid to reduce dependence and comply with environmental regulations. These changes increase the necessity for tailored fleet management services that assist in managing battery performance, energy consumption monitoring, charging timelines, and predictive maintenance of electric management fleets. By creating unique EV and hybrid tech from the ground up, companies can take advantage of a growing market share while increasing revenues and developing game-changing technology.

Fleet management systems for EVs can track battery health and charging cycles with 95% accuracy.

Fleet Management Market Segmentation Analysis:

-

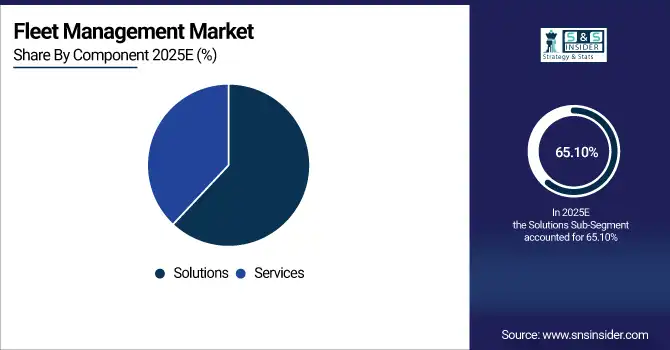

By Component: In 2025, Solutions led the market with a share of 65.10%, while Services is the fastest-growing segment with a CAGR of 15.20%.

-

By Vehicle: In 2025, Commercial Vehicles led the market with a share of 73.80%, while Passenger Vehicles is the fastest-growing segment with a CAGR of 14.80%.

-

By Communication Technology: In 2025, Cellular System led the market with a share of 60.20%, while GNSS is the fastest-growing segment with a CAGR of 14.40%.

-

By Deployment Type: In 2025, Cloud led the market with a share of 63.40%, with is the fastest-growing segment with a CAGR of 15.32%.

-

By Industry Verticals: In 2025, Transportation led the market with a share of 41.08%, while Oil and Gas is the fastest-growing segment with a CAGR of 14.10%.

By Component, Solutions Leads Market and Services Fastest Growth

In the Fleet Management Market, the Solutions lead in 2025, due to the demand for integrated and multi-functional software platforms to support advanced features, enabling real-time vehicle tracking, route optimization, predictive maintenance, and driver behavior monitoring. The solutions enable businesses to minimize operational cost, enhance fleet safety and conform to regulatory compliance efficiently. Meanwhile, Services is the most rapidly growing segment, driven by the growing need for installation, maintenance, and consulting services for fleet management solutions. In addition, cloud-based platforms and managed services are helping organizations especially small and medium enterprises to deploy fleet management solutions with minimal initial investments, leading to increasing development in this segment.

By Vehicle, Commercial Vehicles Leads Market and Passenger Vehicles Fastest Growth

In the Fleet Management Market, the Commercial Vehicles leads in 2025, owing to the high utilization of fleet management services in the transportation, logistics, and delivery domain. Through route optimization, reduced fuel consumption, driver behavior monitoring, and adherence to safety and regulatory standards, these solutions can improve both the efficiency and cost-effectiveness of operations. Meanwhile, Passenger Vehicles Segment is the fastest-growing segment of the market as connected car technologies become more common and ride-sharing services gain popularity, with increasing interest from both private and enterprise users in passenger real-time tracking and telematics solutions. Increasing focus on vehicle safety, fuel efficiency, and smart mobility propels this segment worldwide and in a variety of vehicle categories.

By Communication Technology, Cellular System Leads Market and GNSS Fastest Growth

In the Fleet Management Market, Cellular System leads the market in 2025, due to its keen adoption as a fleet telematics and Real-Time vehicle tracking solution. The connection provided by cellular systems allows fleet owners to monitor the location of vehicles, as well as information on driver habits, fuel consumption, and route optimization with great efficiency. Across the world, they have become the go-to choice for owners of large and medium-sized fleets due to their reliability, scalability, and compatibility with different fleet management platforms. Meanwhile, the GNSS segment has witnessed a tremendous growth due to rising demand for accurate location tracking, navigation, and geofencing functionalities. Technological developments in satellite-based solutions and their integration with the Internet of Things (IoT) are driving global demand for GNSS-based fleet management systems.

By Deployment Type, Cloud Leads Market with Fastest Growth

In the Fleet Management Market, the Cloud leads in 2025, due scalability, the flexibility & cost-effectiveness of the Cloud. This enables organizations to track real time vehicle data, route optimization, fuel consumption analysis and manage driver behaviour without making huge infrastructure investments upfront. In addition, the solutions directly integrate with other business applications and allow for easy operations across different sites of a fleet spread across geographies. Simultaneously, cloud segment is rapidly increasing due to the adoption of Software-as-a-Service (SaaS) models, remote fleet management needs and supportive demand from small and medium enterprises, globally, which typically operate low-maintenance, subscription-based fleet management systems.

By Industry Verticals, Transportation Leads Market and Oil and Gas Fastest Growth

In the Fleet Management Market, the Transportation leads in 2025, due extensively deployed in logistics, public transit, and delivery segment. Such solutions allow operators to improve routing, track driver behavior, cut down on fuel wastage, and remain compliant with regulatory and safety norms, thereby optimizing overall operational efficiency. Meanwhile, Oil and Gas vertical is the fastest growing segment due to growing demand for fleet management in remote and high-risk, and resource intensive operations. The global oil and gas industry is quickly adopting advanced solutions for vehicle monitoring, predictive maintenance, and energy management to improve safety, lower operating costs, and increase productivity.

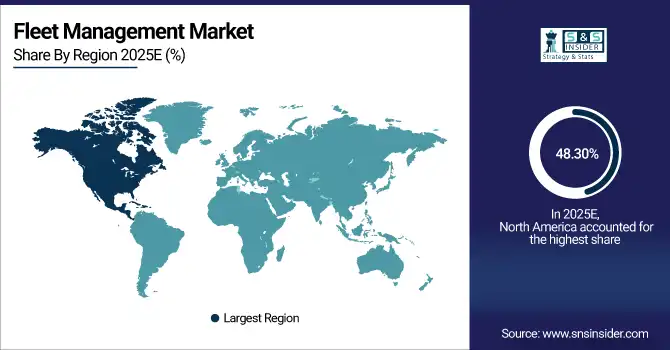

Fleet Management Market Regional Analysis:

North America Fleet Management Market Insights:

The North America dominated the Fleet Management Market in 2025E, with over 48.30% revenue share, due to the rapid acceptance of integrated telematics IOT, AI-based Fleet Management solutions all over North America. With a robust logistics, transportation, and e-commerce sector, the region is witnessing demand for real-time vehicle tracking, route optimization and predictive maintenance systems. Smartphone penetration is high, cellular and GNSS infrastructure continues to strengthen, and regulatory standards for vehicle safety and emissions are strict, all of which support the market. North America is expected to maintain its position at the forefront of the fleet management solution market throughout the forecast period due to the presence of major fleet management solution providers and increasing investments in connected vehicles and smart mobility solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Fleet Management Market Insights

The U.S. leads in mobile app adoption, driven by advanced telematics and IoT adoption, the U.S. market grows through real-time tracking, predictive maintenance, cloud-based solutions, and strong regulatory support for fleet safety and efficiency.

Asia Pacific Fleet Management Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 14.57%, due to increasing urbanization, growing logistics and e-commerce activities, and expanding adoption of connected and smart fleet solutions. Increasing telematics, IoT, and cloud-based fleet management platform investments contribute to operational efficiency, route optimization, and cost-cutting for organizations. Increased focus on vehicle safety, fuel economy, and government regulations is also contributing to the industry growth now and into the future. Moreover, the shift among small and medium-sized enterprises towards subscription-based and scalable fleet management solutions is further causing demand acceleration, which is in turn making the Asia Pacific a global fleet management market growth centre.

-

China and India Fleet Management Market Insights

China and India are rapidly growing markets, driven by rapid digitalization, smart mobility adoption, rising logistics demand, and increasing use of telematics, IoT, and EV fleet solutions for efficiency and sustainability.

Europe Fleet Management Market Insights

The Europe Fleet Management Market is witnessing steady growth, due to the rapid usage of advanced telematics, IoT, and beneficial cloud-based fleet management solutions. Focusing on reducing costs and enhancing the productivity of fleet operators, the region stresses on increased efficiency on the ground, improved fuel efficiency, as well as vehicle tracking in real-time. The high demand for fleet management systems is also supported by the stringent regulatory standards pertaining to the safety, emissions, and compliance of vehicles. Moreover, the market growth is also propelled by rising investments in smart mobility solutions, connected vehicles, and predictive maintenance technologies. Technological developments and regulatory support will continue to help while guaranteeing Europe remains a main and stable player in the global fleet management market.

-

Germany and U.K. Fleet Management Market Insights

Germany and the U.K. hold significant market shares, fueled by stringent emission regulations, advanced telematics adoption, EV fleet integration, and increasing demand for real-time tracking, route optimization, and predictive maintenance solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Fleet Management Market Insights

The Fleet Management Market in Latin America (LATAM) and the Middle East & Africa (MEA) is witnessing steady growth, driven by rising adoption of telematics, GPS tracking, and digital fleet optimization tools. In LATAM, increasing logistics activities, expanding e-commerce, and government initiatives for road safety are boosting demand for advanced fleet solutions. Meanwhile, in MEA, growth is supported by large-scale infrastructure projects, oil and gas industry requirements, and rising investments in smart mobility. Both regions face challenges such as high implementation costs and limited technological infrastructure, but ongoing digital transformation and growing need for efficient fleet operations are creating significant market opportunities.

Fleet Management Market Competitive Landscape

Verizon Connect delivers integrated fleet management solutions that combine telematics, safety monitoring, compliance tools, and advanced video systems. With innovations like Extended View Cameras and customizable DVIRs, Verizon enhances fleet visibility, reduces risks, and improves operational performance, positioning itself as a major player in connected mobility and fleet safety.

-

In January 2025, Verizon Connect launched its Extended View Cameras, providing nearly 360-degree visibility around vehicles to enhance driver safety and accident prevention.

Samsara is a leader in IoT-powered fleet management, offering solutions for real-time vehicle tracking, driver safety, and predictive maintenance. Its platform leverages AI and connected devices to optimize operations, reduce downtime, and ensure regulatory compliance, making it a key innovator in smart fleet technology.

-

In June 2025, Samsara announced a major expansion of its fleet management capabilities by introducing AI-powered safety tools, advanced routing solutions, smart wearables, and predictive maintenance enhancemnts.

Azuga specializes in AI-driven telematics, safety solutions, and asset tracking, enabling fleets to enhance efficiency, reduce accidents, and minimize downtime. With SafetyCam and advanced equipment tracking technologies, Azuga supports sustainability and operational excellence, helping businesses transition toward safer, greener, and more productive fleet operations within the evolving mobility landscape.

-

In April 2025, Azuga launched its new SafetyCam Plus and SafetyCam Pro, introducing AI-powered video telematics to enhance fleet safety by providing real-time risk detection, in-cab driver coaching, and actionable insights to prevent accidents and improve driving behaviors.

Fleet Management Market Key Players:

Some of the Fleet Management Market Companies are:

-

Samsara Inc.

-

Verizon

-

Azuga (Bridgestone Company)

-

Teletrac Navman

-

Trimble Inc.

-

Powerfleet (formerly Fleet Complete)

-

Geotab Inc.

-

Omnitracs LLC

-

Fleetmatics (Verizon Connect)

-

Continental AG

-

MiX Telematics

-

Gurtam

-

TomTom Telematics

-

Zonar Systems

-

Ctrack (Inseego Corp.)

-

Quartix

-

Masternaut

-

ORBCOMM Inc.

-

CalAmp Corp.

-

Magellan GPS

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 25.04 Billion |

| Market Size by 2033 | USD 68.67 Billion |

| CAGR | CAGR of 13.48 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Solutions, Services) •By Vehicle (Passenger Vehicles, Commercial Vehicles) •By Communication Technology (Cellular System, GNSS) •By Deployment Type (On-Premises, Cloud) •By Industry (Construction, Transportation, Government, Logistics, Retail, Automotive, Oil and Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsara Inc., Verizon, Azuga (Bridgestone Company), Teletrac Navman, Trimble Inc., Powerfleet (formerly Fleet Complete), Geotab Inc., Omnitracs LLC, Fleetmatics (Verizon Connect), Continental AG, MiX Telematics, Gurtam, TomTom Telematics, Zonar Systems, Ctrack (Inseego Corp.), Quartix, Masternaut, ORBCOMM Inc., CalAmp Corp., Magellan GPS, and Others. |