Mining Software Market Report Scope & Overview:

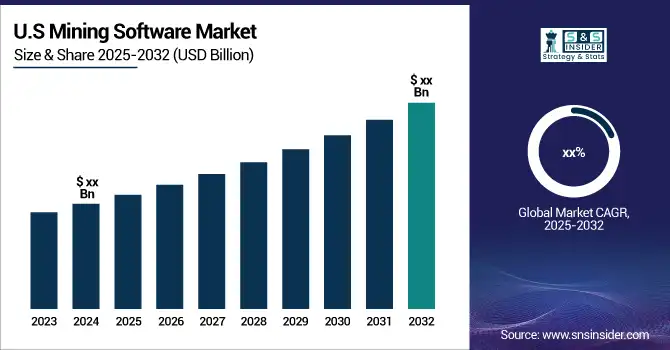

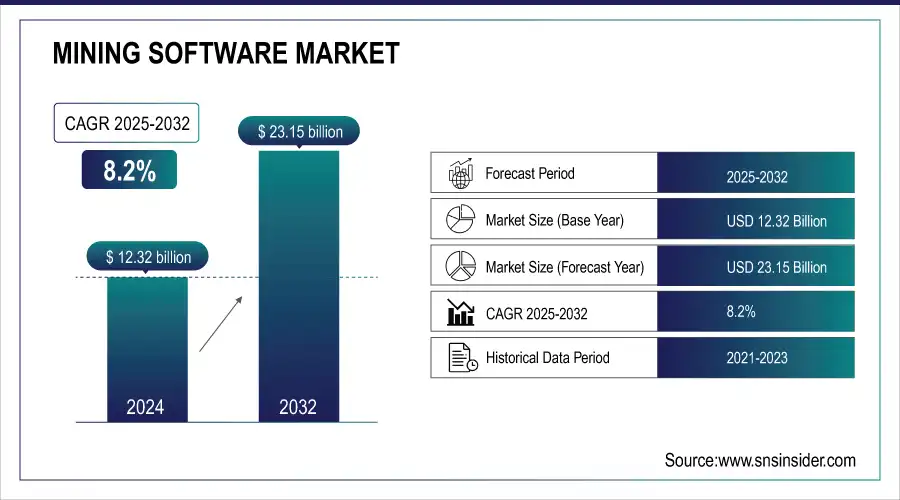

The Mining Software Market Size was valued at USD 12.32 Billion in 2025E and is expected to reach USD 23.15 Billion by 2033 and grow at a CAGR of 8.2% over the forecast period 2026-2033.

The Mining Software Market is experiencing significant growth, driven by the increasing adoption of digital technologies, automation, and data analytics in the mining industry. Mining software plays a pivotal role in streamlining operations, improving efficiency, and ensuring compliance with environmental and safety standards. As mining companies face mounting pressure to enhance productivity, reduce costs, and minimize environmental impact, the demand for advanced software solutions escalates. Technological advancements, such as integrating artificial intelligence (AI) and machine learning (ML), enable predictive maintenance and data analytics, thereby optimizing mining operations. Adopting automation and robotics, including autonomous vehicles and robotic process automation, enhances safety and operational efficiency.

Mining Software Market Size and Forecast:

-

Market Size in 2025E: USD 12.32 Billion

-

Market Size by 2033: USD 23.15 Billion

-

CAGR: 8.2% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Mining Software Market - Request Sample Report

Mining Software Market Highlights:

-

Technological advancements drive efficiency with AI, ML, automation, robotics, and IoT enabling predictive maintenance, real-time monitoring, resource optimization, and improved operational performance in mining operations

-

Automation enhances safety and productivity through autonomous vehicles, robotic process automation, and remote monitoring systems that reduce labor-intensive processes and increase overall efficiency

-

Cloud computing supports collaboration by providing scalable data storage and processing, allowing remote access to critical data and software for better decision-making across mining operations

-

Sustainability and environmental compliance are strengthened as mining software tracks emissions, manages waste, and monitors environmental conditions in real time, ensuring adherence to strict regulations and promoting eco-friendly practices

-

Operational cost and resource optimization are achieved with advanced software tools that enable efficient resource management, predictive analytics, automated reporting, and reduced downtime and energy consumption

-

High implementation and maintenance costs remain a challenge due to significant upfront investments, ongoing maintenance, integration issues with legacy systems, and the need for skilled personnel, particularly affecting small and medium-sized enterprises

The U.S. Mining Software market size was valued at an estimated USD 4.70 billion in 2025 and is projected to reach USD 8.85 billion by 2033, growing at a CAGR of 7.5% over the forecast period 2026–2033. Market growth is driven by increasing adoption of digital solutions to optimize mining operations, improve resource planning, and enhance safety and compliance. Rising use of mine planning, fleet management, geological modeling, and asset management software is accelerating market expansion. Additionally, advancements in cloud computing, AI-driven analytics, and integration with automation and IoT technologies, along with growing focus on cost efficiency and sustainability in mining activities, further support the steady growth outlook of the U.S. mining software market during the forecast period.

Mining Software Market Drivers:

-

Growing Adoption of Automation and Advanced Technologies Drives the Mining Software Market Growth

The increasing integration of automation and advanced technologies is a key driver for the mining software market. Automation has transformed traditional mining operations by enabling the use of autonomous vehicles, robotics, and remote monitoring systems, which enhance operational efficiency and reduce labor-intensive processes. Advanced technologies like artificial intelligence (AI), machine learning (ML), and internet of things (IoT) enable predictive maintenance, resource optimization, and real-time decision-making. For instance, AI-powered software applications help in analyzing large datasets to identify mineral-rich zones, optimize drilling processes, and reduce downtime.

Moreover, IoT-enabled devices collect real-time data from equipment and environmental conditions, enhancing safety, productivity, and compliance with regulatory standards. These innovations cater to the rising demand for efficient and sustainable mining operations, driving the adoption of mining software across the industry. The focus on reducing costs, improving safety, and achieving higher resource recovery rates is further propelling this trend.

-

Increased Emphasis on Environmental Compliance and Sustainability Fuels Market Growth for Mining Software

The growing emphasis on environmental compliance and sustainability has become a major driver of the mining software market. Governments worldwide are implementing stringent regulations to mitigate the environmental impacts of mining, prompting companies to adopt software solutions that ensure compliance. Mining software helps track emissions, manage waste, and monitor environmental factors in real time, supporting companies in achieving sustainability goals.

Additionally, these solutions assist in efficient resource management, reducing waste and energy consumption while promoting eco-friendly practices. With stakeholders and investors increasingly prioritizing sustainable operations, mining companies are compelled to adopt tools that enable transparency and adherence to environmental standards. By facilitating automated reporting, real-time monitoring, and predictive analytics, mining software plays a crucial role in helping companies navigate the complexities of regulatory requirements. This growing focus on sustainability aligns with global efforts to combat climate change and protect natural ecosystems, making mining software an essential tool for the industry's future.

Mining Software Market Restraints:

-

High Costs of Implementation and Maintenance Pose Challenges to Mining Software Market Growth

One of the major restraints impacting the mining software market is the high cost associated with its implementation and maintenance. Advanced mining software solutions often require substantial upfront investments in hardware, software licenses, and training for personnel to effectively utilize these tools. Small and medium-sized enterprises (SMEs) in the mining sector, which may operate on limited budgets, often struggle to adopt these technologies due to the financial burden.

Furthermore, the continuous maintenance and upgrades necessary to keep the software functional and up-to-date add to the operational costs. Integration challenges with existing legacy systems and the need for skilled professionals to manage and operate the software further escalate expenses. These financial constraints can deter companies from adopting mining software, particularly in regions where access to capital or technological infrastructure is limited. While the benefits of mining software are significant, the high costs remain a critical barrier to widespread adoption, especially among smaller players in the industry.

Mining Software Market Segment Analysis:

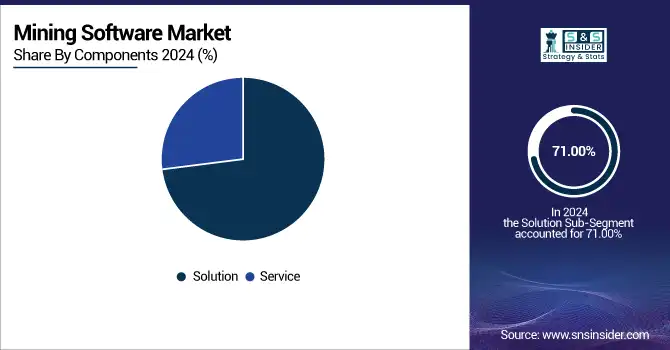

By Components

The solution segment holds the largest revenue share of 71.00% in the mining software market in 2025, primarily driven by the increasing adoption of advanced software solutions that enhance operational efficiency, resource management, and compliance. These solutions include mine planning, exploration software, fleet management systems, and environmental monitoring tools, which are essential for optimizing mining processes.

For instance, Hexagon AB launched an upgraded version of its mine planning and scheduling solution, HxGN MinePlan, in 2023, which incorporates AI-driven analytics for precision planning.

The service segment of the mining software market is growing at the fastest CAGR of 9.15%, driven by the increasing demand for consulting, implementation, and support services. As mining companies adopt complex software solutions, the need for professional services to ensure seamless integration, customization, and maintenance has grown significantly.

RPMGlobal introduced new service models in 2025 to support the implementation of its mine scheduling software, focusing on end-to-end customer support. Similarly, Caterpillar’s Mining Technology Solutions division has enhanced its service portfolio to include comprehensive training and maintenance programs.

By Mining Type

The Underground mining segment dominates the mining software market with the largest share of 62.00% in 2025, driven by the inherent complexity and demands of underground mining operations. This segment includes software solutions designed for underground mine planning, safety monitoring, ventilation control, and real-time asset tracking, which are essential for optimizing productivity and ensuring worker safety.

For instance, Hexagon AB’s HxGN MinePlan offers enhanced underground mine planning capabilities, incorporating features like 3D modeling and automated scheduling. Sandvik also introduced new functionalities to its AutoMine system, which automates and optimizes underground mining operations with real-time monitoring and autonomous equipment control.

The Surface mining segment is experiencing the largest CAGR of 9.11% within the forecast period 2026-2033, driven by increased surface mining activities and the demand for more efficient resource extraction processes. Surface mining, which includes operations like open-pit mining and quarrying, requires software solutions for planning, resource management, haulage, and equipment optimization.

For example, developed advanced tools within its GEOVIA suite for surface mine planning and geospatial analysis, enhancing efficiency and reducing costs. RPMGlobal’s upgrade to its surface mine scheduling software in 2023 allows for improved operational visibility and decision-making.

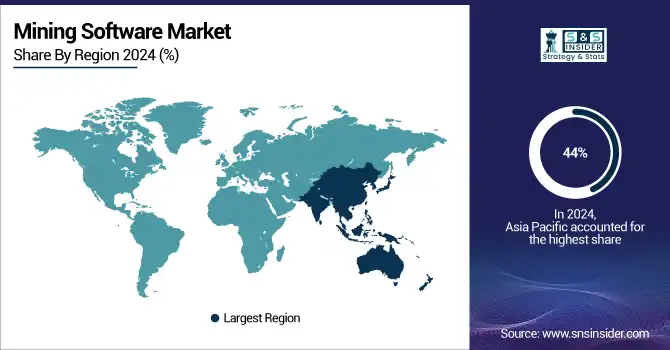

Mining Software Market Regional Analysis:

Asia-Pacific Mining Software Market Trends:

In 2025, the Asia Pacific (APAC) region dominated the mining software market estimated market share of 44%. holding the largest share due to its robust mining industry and increasing adoption of technology to improve mining operations. The APAC region is home to some of the world’s largest mineral producers, including China, India, Australia, and Indonesia, which contribute significantly to global mining activities.

Additionally, the implementation of digitalization and automation in APAC’s mining industry, coupled with government initiatives to modernize mining practices, is further boosting the demand for mining software solutions in this region.

Do You Need any Customization Research on Mining Software Market - Enquire Now

North America Mining Software Market Trends:

North America is the fastest-growing region in the mining software market in 2025, with an estimated CAGR of 10.58% during the forecast period. The rapid growth can be attributed to the increasing investments in technological advancements, the rising demand for efficient mining practices, and the push toward sustainability in the region.

Additionally, Caterpillar’s continuous innovations in autonomous mining trucks and equipment are being supported by robust software solutions, driving demand for mining software. Furthermore, the region's strict environmental regulations are encouraging the adoption of software solutions to ensure compliance with sustainability and safety standards.

Europe Mining Software Market Trends:

In 2025, Europe held a significant share of the mining software market due to its advanced mining technology adoption and strong regulatory framework. Countries such as Germany, Sweden, and Finland are focusing on modernizing mining operations and enhancing safety standards. The increasing implementation of digital solutions, automation, and AI-driven analytics in mining operations, along with government support for sustainable mining practices, is fueling the demand for mining software solutions across the region.

Latin America Mining Software Market Trends:

Latin America is witnessing steady growth in the mining software market in 2025, driven by large-scale mining operations in countries like Brazil, Chile, and Peru. The rising adoption of automation, real-time monitoring, and predictive analytics in mining operations is improving productivity and efficiency. Additionally, governments are encouraging modernization of mining practices and environmental compliance, boosting the need for advanced mining software solutions to optimize resource management and ensure sustainability.

Middle East & Africa (MEA) Mining Software Market Trends:

In 2025, the MEA region is gradually expanding its mining software market due to growing investments in mining infrastructure and modernization projects. Countries such as South Africa, Saudi Arabia, and UAE are increasingly adopting digital tools, IoT, and automation to enhance operational efficiency and safety. The rising focus on sustainability, environmental monitoring, and regulatory compliance is also encouraging mining companies in the region to implement software solutions for better resource management and operational control.

Mining Software Market Key Players:

-

Hitachi (Lumada IoT Platform, Hitachi Mine Performance Analytics)

-

SAP (SAP S/4HANA, SAP Integrated Business Planning)

-

Microsoft (Microsoft Azure, Dynamics 365)

-

IBM (IBM Maximo, IBM Watson IoT Platform)

-

Hexagon AB (HxGN MinePlan, HxGN MineProtect)

-

Komatsu (Komatsu Autonomous Haulage System, Komatsu FrontRunner)

-

Epiroc AB (Epiroc Mobilaris Mining Intelligence, Epiroc Boomer Series Drills)

-

Sandvik AB (AutoMine, OptiMine)

-

RPM Global (RPM XECUTE, RPM HAULSIM)

-

Trimble (Trimble Connected Mine, Trimble MineStar Terrain)

-

Rockwell Automation (FactoryTalk InnovationSuite, Rockwell PlantPAx DCS)

-

Siemens (Siemens SIMINE, Siemens Teamcenter)

-

ABB (ABB Ability MineOptimize, ABB SmartVentilation)

-

Cisco (Cisco IoT Control Center, Cisco Cyber Vision)

-

Accenture (Accenture Industry X, Accenture Applied Intelligence)

-

Caterpillar (Cat MineStar, Caterpillar Command for Hauling)

Mining Software Market Competitive Landscape:

Hexagon AB, a global leader in digital reality solutions, acquired Mine Design Solutions (MDS) in June 2025. Founded in 1995 by Liam Murray, MDS specializes in engineering solutions for the mining and aggregate industries. This acquisition enhances Hexagon's portfolio, integrating MDS's expertise in mine planning and design with Hexagon's advanced technology offerings.

-

In January 2023, Hexagon acquired Mine Design Solutions (MDS), a Canadian mining software company that specializes in mine design and planning software. This acquisition will allow Hexagon to expand its mine planning and optimization software portfolio. And Hexagon launched a new mine planning and optimization software solution called Hexagon PPM.

MineSight, founded in 1984, is a leading mining software company providing comprehensive tools for mine planning, modeling, and design. Caterpillar, established in 1925, is a global manufacturer of construction and mining equipment. Both companies operate in the mining sector, with MineSight offering software solutions to optimize operations and Caterpillar providing the machinery and technology that power mining projects worldwide.

-

In April 2023, MineSight announced a partnership with Caterpillar to integrate MineSight software with Caterpillar's mining equipment. This partnership will allow MineSight customers to use MineSight software to control and monitor Caterpillar equipment.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 12.39 Billion |

| Market Size by 2033 | USD 23.15 Billion |

| CAGR | CAGR of 8.2 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Solutions, Services) • By Mining Type Surface [Strip Mining, Open-pit Mining, Other Surface Mining Types], Underground [Room and Pillar Mining, Other Underground Mining Types]) • By Application Exploration, Discovery/Assessment, Development, Production Operations, Reclamation/Closure) • By Deployment Mode Cloud, On-premises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hitachi, SAP, Microsoft, IBM, Hexagon AB, Komatsu, Epiroc AB, Sandvik AB, RPM Global, Trimble, Rockwell Automation, Siemens, ABB, Cisco, Accenture, Caterpillar. |