Flight Simulator Market Report Scope & Overview:

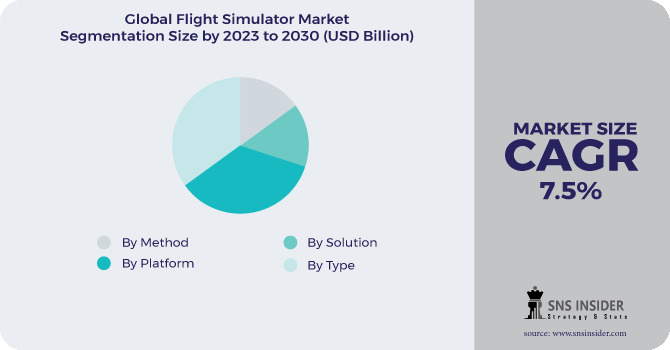

The Flight Simulator Market Size was valued at USD 7.1 billion in 2022 and is expected to reach USD 12.66 billion by 2030 with a growing CAGR of 7.5% over the forecast period 2023-2030.

The Flight Simulator Market is expected to be driven by an increase in the adoption of simulation in the aviation industry as a result of growing concerns about aviation safety and rising demand for better and more effective pilot training in the coming years. The Flight Simulator Market report provides a thorough examination of the market. The report examines key segments, trends, drivers, restraints, the competitive landscape, and market-significant factors in detail. Simulations are used to replicate or recreate a system or an event in order to gain experience and knowledge in the field. Simulations are essential for experimenting with complex situations while reducing risks.

.png)

To get more information on Flight Simulator Market - Request Free Sample Report

A flight simulator is an electrical and mechanical system that simulates flight conditions to train pilots and other crew members. It helps the trainers become acquainted with actual flight conditions, handling, and operations. Flight simulators are independent of any external environmental conditions and allow for flight practise repetition. The market is divided into four types: flight mission simulators, full flight simulators, fixed base simulators, and others. The market is divided into Simulator Hardware, Simulation Software, and Services based on the solution.

MARKET DYNAMICS

KEY DRIVERS

-

Acceptance of Virtual Pilot Training in the Interest of Aviation Safety

-

Pilots are in high demand in the aviation industry.

RESTRAINTS

-

Product Life-cycle Extension

-

Interoperability Issues

OPPORTUNITIES

-

Air Accident Investigation Using Flight Simulators

-

Simulators for Unmanned Aerial Systems are being developed.

CHALLENGES

-

Manufacturers' Difficulties in Keeping Up With Advances in the Aviation Industry

-

The country's economy suffered a significant loss as a result of the Covid-19 pandemic.

THE IMPACT OF COVID-19

COVID-19 has had a negative impact on the global aviation industry. During the epidemic, only a few countries allowed air travel. Due to the dramatic decline in air travel, most airlines have suspended flights. In addition to the decline in air travel, the epidemic has created a negative image for airlines, which are already on fire with large facilities to keep their vessels afloat. Revenue for airline passengers worldwide is expected to drop by almost 50%, according to the International Air Transport Association. Because airlines are heavily indebted to employers, they are now turning to the government for financial assistance in the form of loans, financial assistance, and tax exemptions to survive the epidemic. Airlines have also stopped hiring new pilots, which has led to a decline in the demand for aircraft models. Flight simulation training has been postponed by many flight simulation companies.

The market is divided into four types: fixed base simulators, flight mission simulators, full flight simulators, and others. The Full Flight Simulators segment is expected to have the largest market share because it accurately simulates the aircraft and its environment, providing high fidelity and reliability. They generate motion, sound, visuals, and all other aircraft operations to create a realistic training environment that ensures thorough pilot training.

The market is divided into Simulator Hardware, Simulation Software, and Services based on the Solution. Due to the rise in flight simulator maintenance costs and the rapid advancement of simulation technology and its applications, the services segment is expected to have the highest CAGR during the forecasted period.

Flight simulators can be used on a variety of platforms, including military planes, commercial planes, unmanned aerial vehicles, helicopter simulators. During the forecast period, the commercial aircraft segment is expected to lead the flight simulator market. The increase in global air passenger traffic is propelling the aviation industry forward, resulting in increased demand for commercial aircraft deliveries. This increase in demand for new aircraft creates additional demand for commercial pilots, which contributes significantly to the growth of the flight simulator market.

As the airline industry continues to face a global shortage of certified pilots, the aviation industry has recently been rocked by a surge in demand for new pilots. Many airline carriers have been forced to reduce the number of flight schedules due to a pilot shortage, as the size of the aircraft fleet continues to grow globally, combined with the yearly increased growth rate of global air traffic passenger demand.

KEY MARKET SEGMENTATION

By Platform

-

Commercial

-

Military

-

UAVs

By Solution

-

Products

-

Services

By Method

-

Synthetic

-

Virtual

By Type

-

Full Flight Simulators

-

Fixed Base Simulators

-

Flight Training Devices

-

Full Mission Flight Simulators

Need any customization research on Flight Simulator Market - Enquiry Now

REGIONAL ANALYSIS

North America emerged as a significant market flight accounted for highest market share of global revenue in 2022 and is expected to prove a slight growth in the forecast period. This is due to the early adoption of technology by manufacturers and consumers. In addition, strict laws are enforced by the Federal Aviation Administration (FAA) and the Federal Aviation Regulations including Sec. 61.64 the use of aircraft simulation for training purposes may promote regional growth. In addition, the acquisition of improved military and commercial infrastructure is expected to boost the growth of the aircraft market in the region.

Asia Pacific is projected to show higher growth in the forecast period due to increased demand for these devices especially in developing countries such as India and China. The start of production in China in early are further fuel demand in the region. Growth in the Asia Pacific region is due to the high demand for air travel in terms of increased trade and tourism. North America may see slower growth, which could be largely due to concerns about air safety and the strict air safety standards imposed by the FAA in the U.S.

Furthermore, civil aviation travel increased by approximately highest percentage in the United States, Europe, and Latin America during the first quarter of 2022. As one of the major contributors to the aviation industry, China continues to adhere to the Zero-COVID policy, with Beijing and Shanghai tightening restrictions on business and travel, which is expected to impact flight simulator sales.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Collins Aerospace, L-3 Communications, Raytheon Company, Precision Flight Controls, SIMCOM Aviation Training, Frasca International,CAE, Boeing Company, FlightSafety International and Other Players

L-3 Communications-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 7.1 Billion |

| Market Size by 2030 | US$ 12.66 Billion |

| CAGR | CAGR of 7.5% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Platform (Commercial, Military, UAVs) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Collins Aerospace, L-3 Communications, Raytheon Company, Precision Flight Controls, SIMCOM Aviation Training, Frasca International,CAE, Boeing Company,FlightSafety International, |

| DRIVERS | • Acceptance of Virtual Pilot Training in the Interest of Aviation Safety • Pilots are in high demand in the aviation industry. |

| RESTRAINTS | • Product Life-cycle Extension • Interoperability Issues |