Fluoropolymer Processing Aid Market Report Scope & Overview

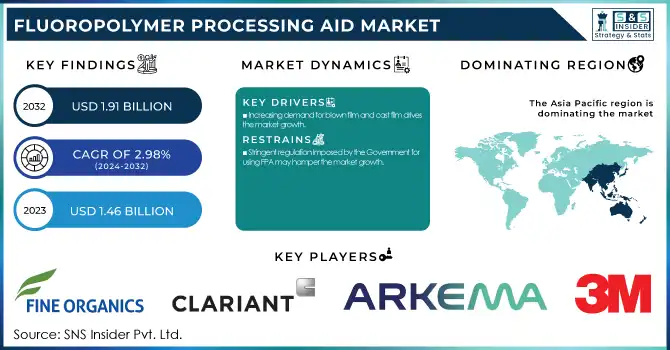

The Fluoropolymer Processing Aid Market size was valued at USD 1.46 billion in 2023 and is expected to reach USD 1.91 billion by 2032, growing at a CAGR of 2.98% over the forecast period of 2024-2032. The report covers key aspects such as production capacity, feedstock prices, regulatory impact, environmental metrics, innovation, and adoption rates. In 2023, China, the U.S., and Germany led in production, with Asia-Pacific showing the highest utilization rates. Feedstock prices fluctuated due to supply chain disruptions and regulatory restrictions. Environmental concerns and stricter regulations in the U.S. and EU accelerated the shift toward low-PFAS and sustainable alternatives. Companies invested in R&D for non-PFAS FPAs, with a focus on bio-based additives and enhanced thermal stability.

Get more information on Fluoropolymer Processing Aid Market - Request Sample Report

Market Dynamics:

Drivers

-

Increasing demand for blown film and cast film drives the market growth.

One of the FPAs outperformance demand drivers is blown film and cast film, these films are assembled with high-performance additives which facilitates the high processing efficiency and quality of end-products. Blown films play an important role in packaging, agricultural, and industrial applications, and thus require FPAs to reduce melt processability, minimize melt fractures, and improve surface smoothness. Cast films, critical for food packaging, medical, and other applications including high-performance coatings, also utilize FPAs to increase consistency in thickness and provide excellent optical clarity. The increased demand for sustainable, premium quality, and ultra-lightweight has contributed to the adoption rate of FPAs in PE (polyethylene) and PP (polypropylene) films. As the Asia Pacific accounts for the largest share in flexible packaging production, high demand for fluoropolymer processing aids is likely to persist, as they enhance the overall polymer extrusion process and reduce production defects.

Restraint

-

Stringent regulation Imposed by the Government for using FPA may hamper the market growth.

The stringent government regulations about the usage of Fluoropolymer Processing Aids (FPA) limit the market growth owing to the rising limitations related to PFAS (per- and poly-fluoroalkyl substances) affecting the production and application. Increasing global environmental and health concerns have led to stringent regulatory guidelines by bodies, including the U.S. Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and China’s Ministry of Ecology and Environment limiting emissions, use, and disposal of fluorinated compounds. The regulations are causing the cost of compliance to rise, the supply chain to be disrupted, and the use of sensitive applications such as food packaging and medical plastics to be curtailed. Market players will have to spend on sustainable and non-PFAS, to stay at par with the current global trends as the governments world over are leveling more strict bans on PFAS.

Opportunities

-

Tremendous demand for FPA from various sectors creates an opportunity for the market.

Fluoropolymer Processing Aids (FPA) are in huge demand across different end-use industries, thereby offering a crucial growth avenue for the market. FPAs have become a critical trigger for a wide variety of manufacturing processes, used primarily in polymer processing and surface quality improvements, with applications in packaging, automotive, electronics, construction, medical devices, and more. The growing requirement for High-Performance Films in food packaging and industrial sectors, along with the growing automotive and aerospace industry, has proliferated the demand for high-performance polymer Processing techniques. The emergence of the electronics sector and the demand for wire and cable insulation has also contributed to the growing use of FPAs in these applications to reduce melt fractures and lead to smooth extrusion processes.

Challenges

-

High costs associated with fluoropolymer processing aid may challenge market growth.

The expensive nature of fluoropolymer processing aids, FPA, has hampered the market growth since they are costly to manufacture and demand specialty raw materials such as PTFE, polytetrafluoroethylene, and other specialty fluorinated compounds. This has further been charged with costs due to the complicated manufacturing processes which may lead to some quality control standards that need to be met and/or regulatory compliance costs. Along with this, the unpredictable prices of readymade feedstock and the supply chain disruptions affect the competition of FPAs, resulting in the unavailability of FPAs for small and medium polymer manufacturing units. Non-fluorinated processing aids may provide cost-effective alternatives for many industries, restricting the market scope of traditional FPAs. This has put pressure on manufacturers to produce cheaper, more sustainable, and PFAS-free solutions to stay competitive and be compliant to regulations.

Segment Analysis:

By Polymer Type

Polypropylene held the largest market share around 28%in 2023. In packaging, automotive, textiles, and consumer goods. PP represents one of the most processed thermoplastics, and persistent production of high volumes demands efficient processing aids to improve melt flow, reduce melt fracture, and improve surface quality. Increased usage of FPAs in PP extrusion is also supported by the significant demand for flexible packaging, nonwoven fabrics, and lightweight automotive components. Also, PP provides high cost-effectiveness, recyclability, and excellent chemical resistance that makes PP a preferred material in many industries.

By Form

Neat/additive FPAs held the largest market share around 64% in 2023. The benefits of high efficacy, ease of blending into LLCs, and especially high performance in polymer processing. These additives are mixed directly into polyethylene (PE), polypropylene (PP), and other thermoplastics to increase melt flow, lower die build-up, and eliminate melt fracture to produce a smoother extrusion process. Neat FPAs yield stable dispersion and compatibility with many polymer matrices, thus being the material of choice in all industrial sectors, including packaging, automotive, and construction. Moreover, the increasing use of neat FPAs in high-performance films, pipes, and molded plastics components is also gaining traction in Asia-Pacific and North America due to expanding polymer processing industries in these regions. Neat/additive FPAs help to drive improvements in processing efficiency with less waste and production downtime which further supports their strong position in the market.

By Application

Blown Film and Cast Film segment held the largest market share around 24% in 2023. Due to the increasing demand for high-quality plastic films in packaging, agriculture, and industrial applications, blown film and cast film applications account for the highest market share in the Fluoropolymer Processing Aid (FPA) market. Functional Polyolefins (FPAs) in Polyethylene (PE) and Polypropylene (PP) films have vital roles to play by reducing melt fracture, enhancing surface smoothness, and improving the efficiency of processing during extrusion. Challenges associated with implementing level I semi-rigid packaging and the increased demand for food packaging, stretch wraps, shrink films, and agricultural films have resulted in the high adoption of FPAs in this segment.

Regional Analysis:

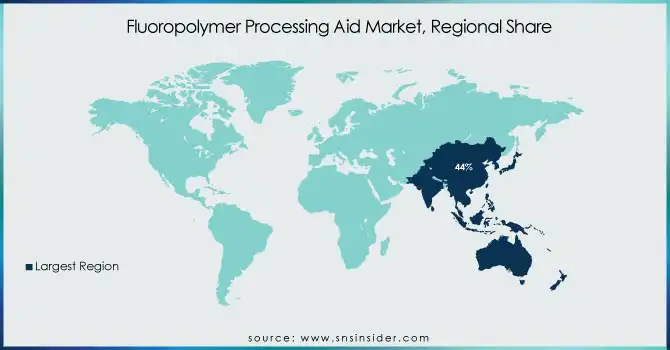

Asia Pacific held the largest market share around 44% in 2023 owing to growing polymer processing industry and the high demand for packaging materials, coupled with strong manufacturing base in the region. Polyethylene (PE) and polypropylene (PP) films, pipes, and molded items are major applications of FPAs in China, India, Japan, and South Korea. Owing to the strengthening industrialization, upscaling demand for flexible packaging, and government initiatives to escalate novel processing technologies for polymers in the region, regional dominance is consummated. Moreover, some of the largest plastic manufacturing hubs are based in the Asia-Pacific region, especially in China and India; therefore, high demand for efficient processing aids is observed in this region. Expansion of several end-use industries such as packaging, automotive, electronics, and construction, along with declining production costs & growing infrastructure, has propelled the region to establish leadership in the FPA market.

North America is the second most lucrative market and is anticipated to grow at a high CAGR throughout the forecast period. The expansion in US wire and cable manufacturing demand is behind this growth. In addition, the rise in construction spending and the growing automotive industry in the country is expected to further propel the regional market growth over the forecast period. The growing demand for wire and cable manufacturing brings increasing demand for high quality processing aids. These processing aids reflect the highest level of performance possible and are used nearly universally in the industry. The fluoropolymer processing aid market is also expected to benefit from this continuous trend which is the major driver for the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

-

3M (Dyneon PPA 5910, Dynamar FX 5920A)

-

Arkema (Kynar 710, Fluorostrip)

-

Clariant AG (Licocene PPA 8102, Exolit OP 1230)

-

Daikin America, Inc. (Neoflon PFA AP-210, Neoflon FEP NP-20)

-

Fine Organics (Finawax E, Finawax O)

-

Micro-Epsilon (thermoIMAGER TIM 40, thermoIMAGER TIM G7)

-

PolyOne Corporation (OnColor PPA, Smartbatch PPA)

-

Tosaf Compounds Ltd. (Tosaf PPA 511, Tosaf PPA 711)

-

Wells Plastics Ltd. (Reverte PPA, Wellstat PPA)

-

BP p.l.c. (BP Oleo PPA, Innovene PPA)

-

TotalEnergies (Total PPA 40, Total Polybatch PPA)

-

Hanwha Group (Hanwha PPA 120, Hanwha PPA 430)

-

Ducor Petrochemicals (Ducor PPA 1200, Ducor PPA 1500)

-

Borealis AG (Borstar PPA, Borflow PPA)

-

MOL GROUP (MOL PPA 550, MOL PPA 750)

-

Solvay (Hyflon PPA, Solef PPA)

-

Dongyue Group (Dongyue PPA DF-820, Dongyue PPA DF-910)

-

AGC Chemicals (Fluon+ PPA, Fluon ETFE PPA)

-

Celanese Corporation (Hostaform PPA, Celanex PPA)

-

LyondellBasell (Adflex PPA, Petrothene PPA)

Recent Development:

In March 2024, 3M introduced the world's first Padded Automatable Curbside Recyclable (PACR) Mailer Material, aimed at enhancing sustainability in packaging. This innovation provides an eco-friendly alternative to traditional mailers, offering improved recyclability and automation compatibility for efficient logistics and waste reduction.

In May 2024, DuPont announced its plan to split into three independent, publicly traded companies, each specializing in electronics, water, and other advanced materials sectors. This strategic move aims to enhance operational efficiency, streamline business focus, and maximize shareholder value in key growth industries.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 1.46 Bn |

|

Market Size by 2032 |

US$ 1.91 Bn |

|

CAGR |

CAGR of 2.98% From 2024 to 2031 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

|

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

3M, Arkema, Daikin America, Inc, Fine Organics, Micro-Epsilon, PolyOne Corporation, Tosaf Compounds Ltd., Wells, Plastics Ltd., BP p.l.c. |

|

Key Drivers |

• Increasing adoption of Fluoropolymer Processing Aid in the packaging industry |

|

Market Opportunities |

• Tremendous demand for FPA from various sectors |