Defoamers Market Report Scope & Overview:

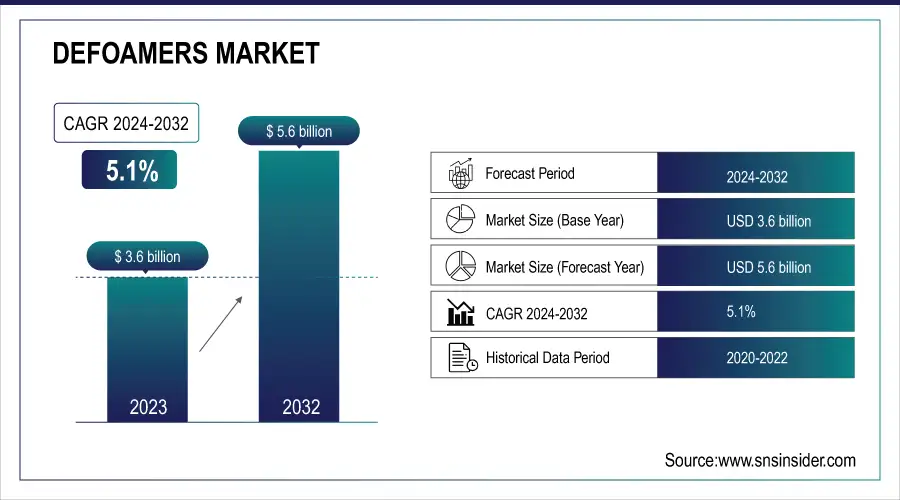

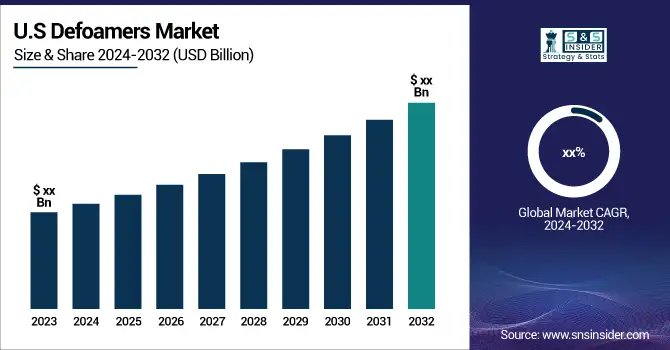

The Defoamers Market Size was valued at USD 3.6 billion in 2023, and is expected to reach USD 5.6 billion by 2032, and grow at a CAGR of 5.1% over the forecast period 2024-2032.

Advancement of innovations in the defoamers market was caused by a variety of industries trying to establish an effective foam-management solution. Defoamers are important as they support the prevention and control of foam production in the industries and companies that deal with food production and processing, pharmaceuticals, and manufacturing. The technology within the market was also affected principally by the latest technological improvements as numerous companies and industries worked toward developing new for-defoaming solutions to meet the new parameters and demands of their industries. This development underscores the important function of defoaming agents in preserving operational effectiveness and product excellence in various uses.

An important development in the defoamers industry occurred in June 2023 with the introduction of Evonik Industries' innovative wafer-cutting solutions. This advancement signifies a notable improvement in accuracy and productivity for the manufacturing of semiconductor wafers, where managing foam is crucial for achieving top-notch results. Evonik's latest technology includes innovative defoaming agents designed specifically for the difficulties of wafer fabrication. This new development highlights the company's dedication to improving performance in advanced technology uses, addressing the distinct issues with foaming that arise in semiconductor production.

Get E-PDF Sample Report on Defoamers Market - Request Sample Report

Concentrol has made considerable progress in the food processing sector with its custom defoaming solutions tailored for different food production settings. The defoamers made by the company are specially crafted to address foam-related problems in sectors such as brewing and dairy processing, where excessive foam can negatively impact productivity and uniformity. Concentrol's customized method for defoaming emphasizes the significance of upholding both product quality and operational efficiency in the food sector. Concentrol helps the food industry by offering solutions that adhere to strict standards, aiding in reliable foam control.

The defoamers market is impacted by various important factors, such as the rising complexity of industrial processes and the increasing need for greater efficiency. The requirement for advanced defoaming solutions has become clear as industries aim to enhance both their operations and product quality. Both Evonik's innovations in wafer cutting and Concentrol's emphasis on food-safe defoamers represent an overall shift toward creating specialized and efficient products to meet distinct industry demands.

Sustainable practices and adherence to regulations are also important factors influencing the defoamers market. There is an increasing focus on creating environmentally friendly defoamers that lessen the environmental effect of industrial operations, in line with wider industry trends toward sustainability. Moreover, the need for defoamers that meet strict safety and quality standards is also driven by regulatory requirements in fields such as food processing. Companies such as Concentrol are leading the way in meeting regulations and offering efficient foaming solutions that align with the market's shift towards sustainable and compliant technologies.

Market Dynamics:

Drivers:

-

Increasing demand for defoamers from various industries

The growing need for defoamers in different sectors is a key factor in the market, highlighting the important function these chemicals serve in improving operational effectiveness and product standards. As sectors like chemicals, pharmaceuticals, textiles, and pulp and paper advance, their demand for efficient foam control solutions increases. In August 2023, BASF launched a new series of defoaming agents tailored for the textile sector, aiming to address the issue of foam interference in dyeing procedures and its impact on color consistency. These new additives were created to fulfill the strict demands of textile producers, emphasizing the industry's necessity for specialized defoaming remedies. In October 2023, Dow Chemical also introduced a specialized defoamer formula designed for the pulp and paper sector. This product deals with usual foaming problems in paper production, which can lead to inefficiencies and impact paper quality. Dow’s statement demonstrates an increasing demand for defoamers in different industries where controlling foam is critical for maintaining excellent production levels as well as performance. Generally, organizations seek advanced and custom defoaming solutions to streamline operations, maintain top quality, and keep in line with stringent standards of different sectors, contributing to the cited trend.

-

Growing demand for the defoamers in water treatment

The rising need for defoamers in water treatment is a major factor driving the market, indicating a growing necessity for efficient foam regulation in different water management procedures. As water treatment facilities in both industrial and municipal arenas aim to increase their efficiency and maintain high water quality levels, the demand for defoamers is increasing. In March 2024, Solvay introduced a new range of defoamers specifically designed for the treatment of wastewater. The company produced defoamers which are intended to prevent foam in large municipal wastewater treatment facilities. One of the specific problems associated with foam in such plants is that this foam generated can prevent effective water treatment and can significantly decrease the efficiency of various filtration systems. In July of 2024, Clariant introduced a new high-tech product, which is used as a defoamer for industrial water recycling. Foaming is a problem in the recycling of water products, since the foam generated by recycling clogs any water reclamation machines and reduces the efficiency of the water reclamation and reutilization process. This demonstrates the trend that more and more defoamer producing companies are attempting to create defoaming products which would assist both industrial settings and communities by improving the water management processes, reducing operational interruptions and meeting water quality standards. This trend is partially driven by the increasing demand for ecologically sound and resource conserving products.

Restraints:

-

High cost associated with the production and quality control of the defoamers

The significant barrier in the market is the expensive production and quality control of defoamers, affecting both manufacturers and end-users. In February 2024, Evonik Industries saw an increase in production expenses for their high-tech defoaming agents because of higher prices of raw materials and strict quality control steps. The expenses are caused by the necessity of using high-quality ingredients and strict testing to guarantee that defoamers are efficient and safe for a wide range of uses. Likewise, in April 2024, Huntsman Corporation encountered difficulties due to rising costs associated with the creation and production of their new defoamer formulas for the chemical sector. The overall pricing of their products has been impacted by the expensive upkeep of high-quality standards and compliance with regulatory requirements, which may hinder their market reach. This economic strain is transferred throughout the supply chain, impacting the cost and uptake of specialized defoamers, especially for smaller companies and industries with limited financial resources.

Opportunities:

-

Increasing demand from the packaging industry for paper-based products Challenges

The increasing demand for paper-based items in the packaging sector creates an excellent opportunity for the defoamers market, as these items require effective foam control during their production processes. The increasing demand for environmentally friendly packaging solutions has resulted in the escalation of the paper production, which, in turn, triggered people’s increased reliance on defoamers as a tool to address the threats of foaming that could expose the final result of the product to possible reduction in efficiency and quality. One such defoamer was presented by AkzoNobel in January 2024, the use of which can be recommended in the production of paper and packaging. AkzoNobel’s defoamer is specifically created to enhance the production of packaging based on paper a material, which, when being exposed to foaming, can become flawed, and the process can be negatively affected. Kemira also put in place a new defoamer in May 2024 to satisfy the demand for environmentally friendly packaging materials, recyclable or biodegradable. This item assists in controlling foam in paper packaging production, leading to smoother processes and improved output quality. The growing emphasis on sustainability in the packaging sector highlights the rising demand for efficient defoaming solutions, as companies aim to comply with environmental laws while improving manufacturing productivity and product quality. This trend allows defoamer manufacturers to create customized products for the changing demands of the packaging industry, presenting a valuable opportunity.

Challenges:

-

Stringent regulations imposed by environmental agencies regarding the use of defoamers

The strict regulations enforced by environmental agencies on defoamer usage present a major obstacle for manufacturers in the industry, affecting product development and market dynamics. In June 2024, BASF encountered regulatory challenges in the European Union as new limitations on the utilization of specific chemicals in defoamers were implemented based on environmental and health worries. The ECHA imposed stricter restrictions on the level of volatile organic compounds (VOCs) allowed in defoaming agents, forcing BASF to adjust their product formulations to meet these new rules. This change in regulations not only raised the expenses and intricacy of product creation but also required thorough testing and certification procedures. Also, in August 2024, Dow Chemical faced difficulties due to new regulations in the United States that limited the use of certain surfactants in defoamers for industrial purposes. The goal of these rules was to reduce the environmental effects of defoaming agents, necessitating Dow to dedicate resources to developing new formulations that adhere to the updated guidelines. The strict regulatory landscape compels businesses to swiftly adjust, finding a balance between utilizing efficient defoaming strategies and staying in line with regulations to prevent legal consequences and market entry barriers. This challenge highlights the increasing significance of creating environmentally friendly defoamers and successfully navigating intricate regulatory environments to guarantee both environmental safety and market competitiveness.

KEY MARKET SEGMENTS

By Product

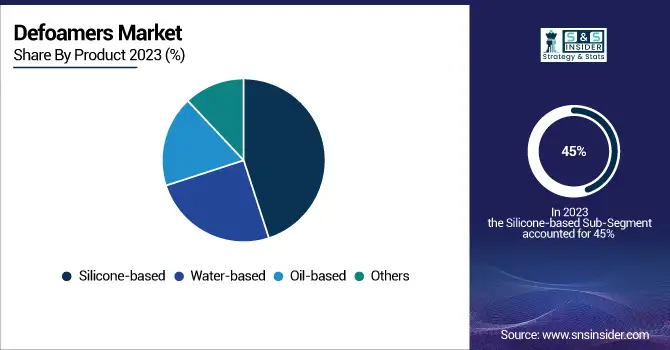

In 2023, the silicone-based defoamers sector was the leading in the defoamers market, showcasing their extensive utility and efficiency in multiple industries. Silicone-based antifoaming agents are recognized for their excellent effectiveness, especially in uses that demand resistance to high temperatures and chemicals, making them well-suited for sectors like automotive, oil and gas, and textiles. In March 2023, Momentive Performance Materials saw a large uptick in the need for silicone-based defoamers, mainly due to their use in high-quality coatings and industrial procedures. This portion's superior position is also backed by its expected market share of around 45%, showing its wide range of uses and the continued favor of silicone-based options because of their improved performance qualities over other varieties. The significant market influence of silicone-based defoamers showcases their crucial importance in addressing the challenging needs of different industrial uses.

By Application

The water treatment sector dominated the defoamers market in 2023, due to the growing demand for efficient foam management in municipal and industrial water treatment plants. Defoamers are necessary for water treatment to avoid foam formation in activities like wastewater treatment and water recycling, which can affect effectiveness and system operation. In February 2023, Solvay noted a significant increase in demand for their defoamers used in water treatment, underscoring their important function in handling foam in municipal water treatment facilities on a large scale. This portion commanded about 40% of the market, showcasing its strong influence from the extensive use of defoamers in ensuring efficiency and meeting regulations in water treatment systems. The importance of the water treatment sector highlights its crucial role in dealing with foam-related issues in key environmental management procedures.

Regional Analysis

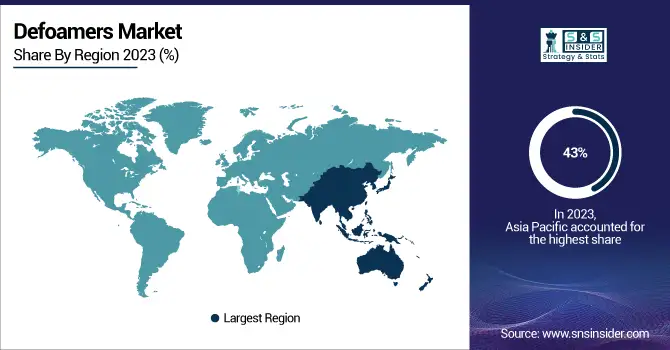

In 2023, Asia Pacific dominated the defoamers market and accounted for around 43% of the revenue share. The chemicals, paints, coatings, food, and beverages sector played a vital role in increasing the need for defoamers. These industries face the problem of foam formation during their manufacturing process, and hence, need defoamers to increase their operational efficiency. Scenario, the high rate of economic development of countries such as China, India, and Japan has also increased the need for defoamers. The rate of industrial development and urban expansion of these countries has increased the need for defoamers in wastewater treatment, pulp and paper production, oil, and gas refining. By increasing the number of research and development activities of major industries, the defoamers market has grown.

Moreover, in 2023, Europe emerged as the second leading region in the defoamers market, mainly because of its strong industrial foundation and strict environmental rules that are increasing the need for more advanced defoaming options. The diverse industrial sectors in Europe, such as automotive, pharmaceuticals, and food and beverages, contribute to its substantial market presence due to the need for efficient foam control. In Germany, BASF increased manufacturing of defoamers in April 2023 because the pharmaceutical and food industries, which are two of the major industries of the country, need these products. Moreover, Europe has sustainability concerns and requires environmentally friendly deforming agents to meet its strict environmental regulations. By 2023, Europe is expected to amount to the defoamers market share of around 30% due to many reasons that contribute to this region’s importance in the global market. These reasons include the strong industrial sector and the need for environmentally friendly deservers that can satisfy the severe regulations of the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

The major key players are BASF SE, Clariant AG, Merck KGaA, Ashland Inc., Dow Corning Corporation, Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Kemira Oyj, Baker Hughes, Eastman Chemical Company, Air Products and Chemicals, and other key players mentioned in the final report.

Recent Development:

-

April 2024: Evonik Coating Additives unveiled TEGO Foamex 16 and TEGO Foamex 11 at the American Coatings Show to improve the green credentials and performance of water-based architectural coatings.

-

November 2023: BASF expanded defoamer production at its Dilovasi plant in Turkey to meet rising demand and improve delivery schedules in Southeast Europe, the Middle East, and Africa.

-

June 2023: Elementis Plc introduced DAPRO BIO 9910, a bio-derived defoamer made from renewable vegetable oil, serving as a sustainable option to traditional defoamers.

-

May 2023: BRB International B.V. introduced Akasil Antifoam XP 20, a newly developed alkali-stable silicone-based anti-foam emulsion, suitable for surfactant-rich formulations.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.6 Billion |

| Market Size by 2032 | US$ 5.6 Billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Oil-based, Water-based, Silicone-based, and Others) • By Application (Pulp & Paper, Water Treatment, Oil & gas, Paints & Coatings, Agrochemicals, Pharmaceuticals, Detergents, Food & Beverages, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Clariant AG, Merck KGaA, Ashland Inc., Dow Corning Corporation, Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Kemira Oyj, Baker Hughes, Eastman Chemical Company, Air Products and Chemicals and other players |

| Key Drivers | • Increasing demand for defoamers from various industries • Growing demand for the defoamers in water treatment |

| RESTRAINTS | • Volatility of raw material prices • High cost associated with the production and quality control of the defoamers |