Foam Dressing Market Report Size Analysis:

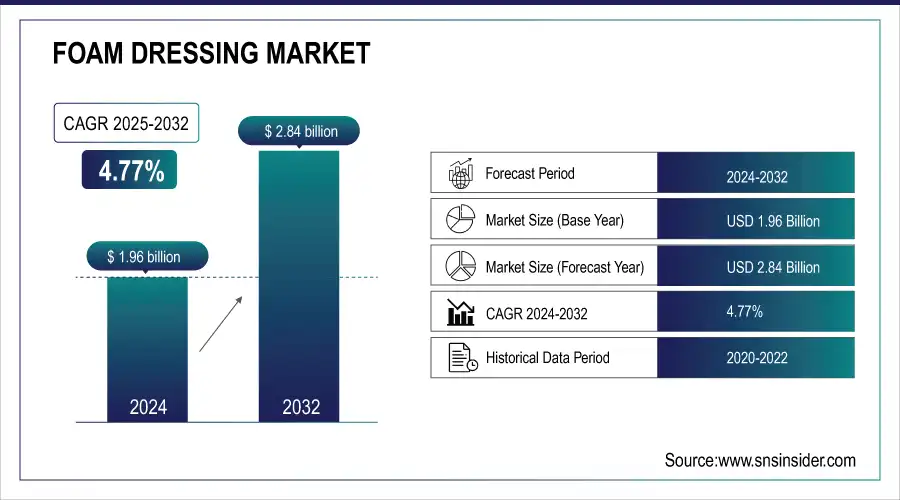

The Foam Dressing Market size was valued at USD 1.96 billion in 2024 and is expected to reach USD 2.84 billion by 2032, growing at a CAGR of 4.77% over the forecast period of 2025-2032.

Foam dressings are derived from hydrocolloids and exhibit amazing expansion with the rise of the global prevalence of chronic wounds and pressure ulcers (affecting over 6.5 million patients in the U.S. alone). One of the market drivers is the advanced wound care market, which is fueled by diabetes, obesity, and vascular diseases. For instance, diabetic foot ulcers occur in 15–25% of diabetic patients, which accounts for a higher need for good wound dressings, including polyurethane and silicone foam. Such as antimicrobial-loaded and five-layer silicone foams (PMC7096556). It can absorb more or less maceration, become more comfortable, and become the clinical choice. An increase in surgeries and geriatric care is driving the demand for foam dressings in the U.S., as is a growing economy that provides access to government and private investment for healthcare.

To Get more information on Foam Dressing Market - Request Free Sample Report

On the supply side, companies are also increasing R&D investments, with clinical trials devoted to foam dressings that have nanotechnology or drug-eluting properties (PMC10588327, PMC8210978). Regulatory clearances, such as 510(k) clearance by the US FDA, enable a fast time-to-market for innovative products. Some of the top foam dressing manufacturers, including Mölnlycke, Smith&Nephew, and 3M, are investing in a cost-effective digital disease-state management approach and incorporating sustainable materials. The shift from traditional dressings to wound care market products is further underscored by the most recent foam dressing market analysis, as reported in academic and clinical publications. Additionally, rising levels of hospital admissions and home healthcare utilization will also drive ongoing growth in the dressing market share.

In 2024, Smith & Nephew introduced a series of bioactive foam dressings with anti-inflammatory peptides for treating chronic wounds, which quickly gained acceptance in European and U.S. hospitals.

Another published study showed that, compared to traditional foam dressings, next-level foams decreased wound healing time by 30%, saving hospitalization costs and improving patient outcomes, further justifying the promising foam dressing market outlook.

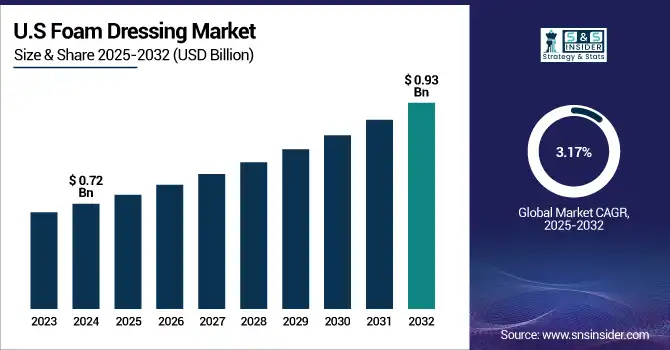

The U.S. Foam Dressing Market size was valued at USD 0.72 billion in 2024 and is expected to reach USD 0.93 billion by 2032, growing at a CAGR of 3.17% over the forecast period of 2025-2032, whereas a large presence of players, including 3M, Medline Industries, Cardinal Health, remains the key factor.

Foam Dressing Market Dynamics:

Drivers:

-

Demand Drivers, Clinical Relevance, Innovation, And Regulatory Facilitation Propelling the Foam Dressing Market Forward

The rapid increase of chronic wounds, burn injuries, and post-operative care set-up in both clinical and home-based environments contributes to the major foam dressings market growth. With an estimated 2.5 million instances of pressure ulcers occurring each year in the U.S., the need for absorbent wound care products with improved performance is increasing. Foam dressings are also preferred due to their ability to balance moisture, reduce pain, and control infection. The foam dressing market size can also be attributed to a growing number of surgical operations, especially in the aging population. More than 48 million inpatient surgeries were performed in the US alone (CDC).

On the supply side, momentum consists of heavy R&D investments, especially on the part of firms such as ConvaTec and Coloplast, that are aimed at creating foam dressings endowed with built-in biosensors and improved antimicrobial layers. Furthermore, regulations drive innovation; recent FDA 510(k) clearances for silver and PHMB foam dressings have facilitated the rapid translation of cutaneous products to clinical use. Furthermore, the increased acceptance of evidence-based clinical protocols for advanced wound care and hospital-acquired pressure injury (HAPI) prevention will enable a robust foam dressing market. The aforementioned have collectively led to steady foam dressing market growth, characterized by expanding application in outpatient facilities, home healthcare, and long-term care institutions across the world.

Restraints:

-

Cost-Related Barriers, Supply Chain Disruptions, and Product Limitations Holding Back the Foam Dressing Market

One of the significant challenges is the expense of advanced foam dressings, which restricts uptake in lower-income healthcare systems and among the uninsured. In contrast to conventional gauze or hydrocolloid dressings, foam dressings are significantly more expensive, being 3 to 5 times more costly per unit, which discourages their use in resource-poor hospitals and rural care environments. In addition, supply chain weaknesses, particularly after COVID-19, have resulted in occasional raw material shortages, such as polyurethane and silicone, hindering production and timely delivery.

Another essential element is the misuse or underutilization of the product resulting from inadequate training of caregivers in home care settings. Even though foam dressing market trends point to increasing preference, improper application causes a delay in healing and, consequently, adverse effects. Moreover, stringent paperwork regulations for antimicrobial types and multilayered designs may delay approvals in certain regions, creating a hindrance to the development of new products.

A 2023 NEJM study reports delays in guideline adaptation and variability in wound care practices among hospitals that continue to hinder uniform adoption, harming the foam dressing market share.

These are complemented by complexity, alongside operational and cost inefficiencies, as major deterrents to unlocking the full potential of the foam dressing market.

Foam Dressing Market Segmentation Analysis:

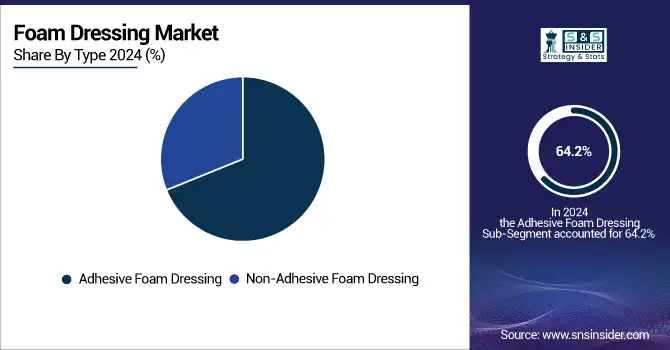

By Type

The adhesive foam dressing dominated the foam dressing market with 64.2% of revenue share in 2024. This is primarily due to the category being so easy to apply, so well-adhering, and such a good barrier against external contamination. These dressings are especially popular in surgical and chronic wound healing, where a sterile and secure environment within the wound bed is crucial to healing. Their use has also been driven by the increasing need for quick and easy-to-install products in outpatient and home environments. For many patients and carers, adhesive foam dressings are a convenient and trusted product, particularly in applications where the dressing change frequency is reduced.

The non-adhesive foam dressing segment, though lagging in terms of market share, is on the verge of considerable growth over the coming years. The dressings are particularly ideal for patients with fragile or sensitive skin, where adhesive products might result in irritation or additional tissue injury. They are widely applied in environments where wounds need to be monitored and dressed frequently, such as in highly exudative wounds or pediatric and geriatric patients. The ability to be fixed with external devices, such as bandages or wraps, provides the option of tailored application depending on wound size and location.

By Application

The chronic wounds application was the highest revenue-generating segment, accounting for a 65.8% share of the foam dressing market in 2024. This awareness could be driven by the increased global incidence of diseases such as diabetes, pressure ulcers, and venous leg ulcers that necessitate regular, extended wound treatment. Chronic wounds generally heal slowly, requiring advanced wound care products such as foam dressings, which provide better exudate absorption, padding, and moisture. These types of dressings are crucial for promoting wound healing, preventing infection, and providing enhanced patient comfort during wear.

The acute wounds segment is expected to expand at the highest rate in the foam dressing market during the forecast period. Acute wounds such as surgical incisions, burns, and traumatic injuries need prompt and effective treatment to hasten healing and avoid complications such as infections or delayed recovery. The expansion in this market is driven by a rise in the number of surgeries being performed across the world, an increase in the incidence of burns, and improved access to emergency and trauma services. Foam dressings are ideal for treating acute wounds due to they are highly absorbent, have a cushioning action, and can be used to keep a moist wound environment that fosters fast tissue repair.

By End-use

Hospitals held a share of 48.9% of the revenue of the foam dressing market in 2024. Such a leadership role is founded on the large number of treated patients in hospital settings, qualified wound care specialists in this country, and modern available therapeutic facilities. Hospitals are frequently the point of entry for individuals with acute and chronic wounds, so they are essential centers for the adoption of foam dressings. These institutions also treat complicated wounds that need the most effective healing assistance and infection management, for which foam is perfect.

The home healthcare segment is also expected to witness the most rapid expansion in the foam dressing market due to the growing trend for decentralized and patient-focused care. This trend is most evident among elderly people and patients with chronic wounds who are looked after from home with the help of easily accessible, budget-friendly solutions. Foam dressings are especially appropriate for use at home due to they have easy-to-use designs, a lower frequency of need for changes, and the capacity to preserve wound cleanliness without professional intervention. Advances in technology have also produced smart and self-adhering foam dressings that make at-home wound care easier.

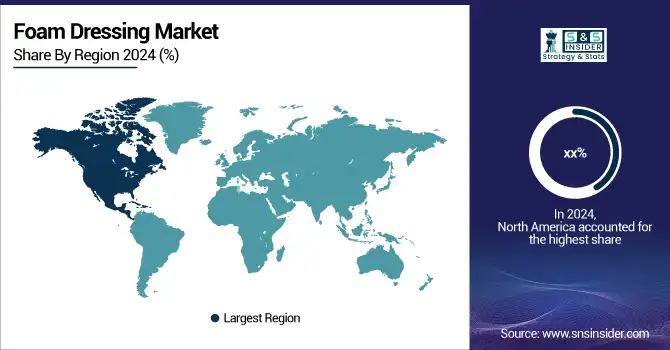

Regional Analysis:

North America dominated the global foam dressing market in 2024 due to increased healthcare spending, the matured infrastructure of wound care, and the increasing incidence of chronic wounds. Growing diabetes and bed sores, with nearly 8 million Americans annually being afflicted, also boost demand. Another major contribution comes from Canada, where there are high reimbursement model frameworks and strong government support for chronic wound care. Mexico is experiencing better-advanced wound care availability via public/private healthcare partnerships, with the market size being less than that of the Brazilian market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe is the second-largest regional market, primarily attributed to the presence of an aging population, established healthcare infrastructure, and the rising demand for advanced wound care products. The UK has the largest share of the European foam dressing market due to an increase in the prevalence of chronic wounds, such as pressure & venous ulcers. Chronic wounds affect approximately 4.5% of the UK population, driving demand for related products. Germany and France are close behind due to good hospital infrastructure and high healthcare spending per capita. Eastern Europe is gaining a strong market due to increased healthcare spending and the wider adoption of advanced wound management in Countries such as Poland and Turkey. Europe also benefits from favorable reimbursement policies and national wound care programs, particularly in Germany and Italy.

The Asia Pacific is the most rapidly expanding foam dressings market, driven by heightened awareness, expanding healthcare infrastructure, and a rising chronic disease burden. The leading country within this region is China, holding more than 35% regional market share in 2024, attributed to a rapidly expanding aging population, increasing incidence of diabetes, and government-imposed healthcare reforms. Growth in diabetic foot ulcers and widening healthcare accessibility in rural districts are propelling India's projected growth at the highest rate. Japan and South Korea also assume important roles, given their high healthcare levels and rising penetration of advanced wound care technologies.

Foam Dressing Market Key Players:

Prominent foam dressing companies in the market include 3M, Coloplast Corp., Medline Industries, Smith & Nephew, Cardinal Health, ConvaTec Group PLC, Derma Sciences Inc. (Integra LifeSciences), Ethicon (Johnson & Johnson), McKesson Corporation, and Mölnlycke Health Care AB.

Recent Developments in the Foam Dressing Market:

-

In Sept 2024, Solventum launched an all-in-one extended wear wound dressing designed for use with V.A.C. Therapy. This innovative dressing aims to enhance patient comfort and reduce dressing changes, supporting long-term wound management.

-

In April 2024, Remedium Healthcare Products announced the launch of NuVeria Labs' innovative sacral silicone dressing, now available for purchase on Amazon Prime.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.96 Billion |

| Market Size by 2032 | USD 2.84 Billion |

| CAGR | CAGR of 4.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Adhesive Foam Dressing, Non-adhesive Foam Dressing) • By Application (Acute Wounds (Surgical & Traumatic Wounds, Burns), Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Other Chronic Wounds)) • By End-use (Hospitals, Specialty Clinics, Home Healthcare, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | 3M, Coloplast Corp., Medline Industries, Smith & Nephew, Cardinal Health, ConvaTec Group PLC, Derma Sciences Inc. (Integra LifeSciences), Ethicon (Johnson & Johnson), McKesson Corporation, and Mölnlycke Health Care AB |