Food Amino Acids Market Key Insights:

Get More Information on Food Amino Acids Market - Request Sample Report

The Food Amino Acids Market size was valued at USD 25.21 billion in 2023 and is expected to grow to USD 47.01 billion by 2032, with a growing CAGR of 8.1% over the forecast period of 2024-2032.

The increased demand for amino acids as functional foods and the expanding usage of glutamic acid as a taste enhancer in a variety of foods and beverages are expected to propel market growth during the upcoming years. Amino acids are used for a variety of purposes, including the development and maintenance of flavours, as nutrients or protein building blocks, and in specialty products like aspartame. It is predicted that these usage would propel the sector.

Protein powders constituted the bulk of protein supplements bought in Australia in 2022, according to 58% of respondents who said they had recently bought one. Comparatively, just 13% of customers purchased protein-based ready-to-drink products. The growing preference to include protein in daily meals has facilitated the development of dietary amino acids.

Consumer interest and demand are rising as a result of amino acids' numerous health advantages. It is understandable why athletes, bodybuilders, and fitness fanatics adore them because they are crucial for muscle development, regeneration, and maintenance. Leucine, valine, and isoleucine are among the most prized branch-chain amino acids (BCAAs) for building muscle protein.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing consumer demand for dietary supplements:

-

Growing knowledge of the advantages of amino acids for health

Amino acids are included in many functional foods and drinks, which are frequently advertised for their health advantages. The availability of amino acid supplements is expanding, and they are frequently touted for their potential to enhance health. Only 25% of respondents were aware of the advantages amino acids have for health. This number had climbed to 50% by 2022. More than 75% of individuals will reportedly be aware of amino acids' positive effects on health by 2025.

RESTRAIN:

-

Strict labeling and regulatory restrictions.

-

Changing the flavor of food items.

A developing trend in the food business is the use of amino acids to alter the flavor of food products. Foods that are tasty and healthy are in demand as people grow more health-conscious. According to research from the University of Toronto, arginine upped the perceived meatiness of vegetarian burgers by 20%.

OPPORTUNITY:

-

Increasing consumer demand for nutrient-dense functional meals.

-

Individualized diet and health are receiving more attention.

Individualized nutrition and health are getting increased attention for a variety of reasons. People's growing awareness of the significance of diet for their general health is one factor. Another factor is that technological advancements are making it simpler to gather and analyze personal data that can be used to develop customized diets and healthcare regimens. According to a poll conducted in 2022 by the International Food Information Council Foundation, 70% of Americans think their diet is individualized to meet their requirements. From 2022, 63% of Americans are interested in custom nutrition regimens.

CHALLENGES:

-

Preserving the flavor and consistency of food after adding amino acids.

-

Balancing affordability and manufacturing expenses.

Use of environmentally friendly production techniques A 2021 World Economic Forum research found that employing sustainable manufacturing techniques can cut manufacturing costs by up to 20%. For instance, utilizing recycled materials may save material prices by up to 10%, while using renewable energy sources can cut energy expenses by up to 15%. Effective manufacturing techniques A McKinsey Global Institute research from 2022 claims that effective production techniques may save manufacturing costs by up to 30%. Lean manufacturing approaches, for instance, may cut waste by up to 20% while reducing labor costs by up to 25%.

IMPACT OF RUSSIAN-UKRAINE WAR

The Russian-Ukrainian war had a considerable influence on the market for food amino acids, both in terms of supply and demand. Cost increases because Russia and Ukraine are major producers of food amino acids, and as a result of the conflict, their costs have increased. For instance, the price of lysine has increased by 20% since the dispute started. Because of the war's interruption of exports from Russia and Ukraine, food amino acids are now less easily accessible. For instance, since the start of the war, exports of methionine, which is manufactured in significant amounts in Ukraine, have decreased by 50%.

The war has also increased the demand for dietary amino acids as individuals look for ways to improve their diets and fortify their immune systems. For instance, sales of protein powders have increased by 10% since the crisis began. The Russian-Ukrainian war is expected to have a detrimental effect on the market for food amino acids soon. The war's long-term impact will depend on a number of factors, including how long it lasts, how much the supply chain is disrupted, and how it affects consumer demand.

IMPACT OF ONGOING RECESSION

The present recession may have an impact on the market for food amino acids, possibly leading to a fall in demand as individuals prioritize essential requirements over luxury products. Due to economic considerations, manufacturers may also search for less expensive components, which might affect the amount of amino acids used in food products.

The market for food amino acids is predicted to expand between 2-3% less than anticipated due to the current recession. Food amino acids are projected to become more expensive as a result of increased raw material prices and declining production capacity. For instance, lysine, a crucial dietary amino acid, has seen a 15% price increase in the last year.

The demand for dietary amino acids is predicted to fall by 5–10% as a result of the recession. The price of food amino acids is expected to increase by 10% to 15% as a result of the recession. Consumers are expected to spend less on luxuries like food and amino acids as they prioritize more important purchases. For instance, shoppers are expected to cut down on their discretionary spending by 10% on average in 2023, according to data from the National Retail Federation.

KEY MARKET SEGMENTS

By Application

-

Nutraceuticals & dietary supplements

-

Infant formula

-

Food fortification

-

Convenience food

-

Others

By Type

-

Glutamic acid

-

Lysine

-

Tryptophan

-

Methionine

-

Phenylalanine

-

Others

By Source

-

Plant

-

Animal

-

Synthetic

REGIONAL ANALYSIS

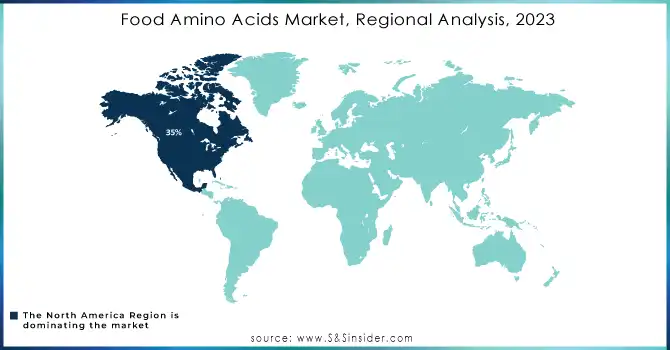

North America continues to be the world's largest market for food amino acids, with a market share of 35% in 2022. The demand for functional foods and beverages is growing in North America, and consumer knowledge of the beneficial benefits of amino acids on health is also rising.

Asia Pacific constitute the second-largest market for food amino acids in 2022, with a share of 25%. Due to rising disposable incomes, a rise in the demand for convenience foods, and increased awareness of the benefits of amino acids for health, the market in Asia Pacific is growing.

Europe is the third-largest market for amino acids used in food in 2022, with a market share of 20%. The demand for functional foods and beverages is growing in Europe, and people are becoming more aware of the benefits of amino acids for their health.

Need Any Customization Research On Food Amino Acids Market - Inquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players:

Some major key players in the Food Amino Acids Market are Ajinomoto Co. Inc. (Japan), Kyowa Hakko Kirin Co., Ltd. (Japan), Sigma-Aldrich, Co. LLC. (US), Prinova Group LLC. (US), Daesang Corporation (Korea), CJ Cheiljedang Corp., Wacker Chemie AG, IRIS Biotech GmBH, Evonik Industries AG, and other players.

RECENT DEVELOPMENTS

-

On March 8, 2023, Ajinomoto Corporation announced that it has reached a deal with DuPont to work together to develop and market innovative culinary items based on amino acids.

-

On February 25, 2023, Kyowa Hakko Kirin said that it has created a new technique for creating threonine, a crucial dietary amino acid.

| Report Attributes | Details |

| Market Size in 2023 | US$ 25.21 Billion |

| Market Size by 2032 | US$ 47.01 Billion |

| CAGR | CAGR of 8.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Nutraceutical & Dietary Supplements, Infant Formula, Food Fortification, Convenience Foods) • By Type (Glutamic Acid, Lysine, Tryptophan, Methionine) • By Source (Plant, Animal, Synthetic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Ajinomoto Co. Inc. (Japan), Kyowa Hakko Kirin Co., Ltd. (Japan), Sigma-Aldrich, Co. LLC. (US), Prinova Group LLC. (US), Daesang Corporation (Korea), CJ Cheiljedang Corp., Wacker Chemie AG, IRIS Biotech GmBH, Evonik Industries AG |

| Key Drivers | • Increasing consumer demand for dietary supplements: • Growing knowledge of the advantages of amino acids for health |

| Market Opportunity | • Increasing consumer demand for nutrient-dense functional meals. • Individualized diet and health are receiving more attention. |