Food & Grocery Retail Market Report Scope & Overview:

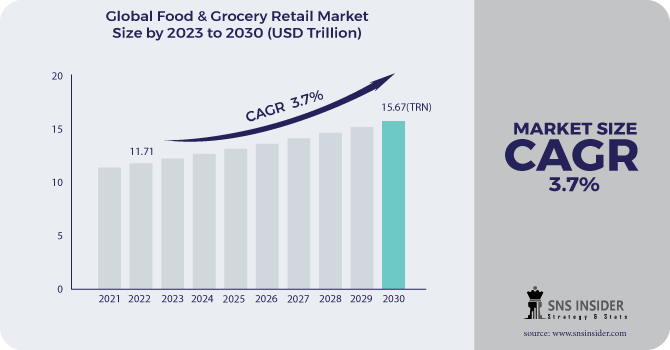

Food & Grocery Retail Market Size was valued at USD 11.71 trillion in 2022 and is expected to reach USD 15.67 trillion by 2030, and grow at a CAGR of 3.7% over the forecast period 2023-2030.

Food & Grocery Retail Market is a market that sells food and other small household items including meat, fresh dairy goods, fresh dairy produce, bakery goods, baby foods, cleaning supplies, drinks, fresh produce, frozen foods, and more. Food and grocery retailers help meet all of these needs in one location by providing appropriate price reductions and a variety of other offerings.

Individuals regularly eat an assortment of food and staple things for their day-to-day living necessities. Such things are of various classifications like new food, frozen food sources, beauty care products, individual consideration and home consideration items, refreshments, and others. Execution of a satisfactory cost item blend by the food and staple retailers assists them with accomplishing the incomes from such things.

These days, organizations related with food and staple retailing centre around dealing with their inventories to create required incomes from such items. Also, they carry out different insightful measures to follow the shopper's conduct towards purchasing such things from their shops.

These days, retail organizations are directing various types of classes, rebate pop-ups and occasions connected with the staple things in their retail outlets. Developing patterns of eating dietary and frozen food things among the worldwide populace are further liable to drive such items' incomes.

Market Dynamics:

Driving Factors:

-

In emerging countries, rising middle-income consumer demand has increased demand for quality consumables and grocery retail.

The growing middle-class population in emerging nations is having a significant impact on the retail food and grocery business. There is a notable increase in demand for high-quality groceries and commodities as disposable incomes rise. Retailers are carefully adjusting their product lines to cater to the interests of this expanding sector as a result of the shift in consumer behaviour. Retailers are expanding their product portfolios as a result of the growing demand for healthier, more expensive, and more diverse food options. This shifting environment emphasizes how the growing middle-income customer base is playing a critical role in determining the course of these economies' food and grocery retail industries.

-

Expanding customer demand for private label goods, rising consumer expenditure on food products, and a growing supermarket shopping culture.

Restraining Factors:

-

The sector is experiencing issues such as inadequate supply chains and the danger of unorganized companies.

Unorganized businesses and insufficient supply chains are two issues the retail food and grocery sector must deal with. While poorly managed enterprises can harm consumer confidence and competition, insufficient supply networks result in product disruptions and increased prices. In order to address these concerns and assure quality and safety, supply chains must be better coordinated and regulations must be met. Additionally, operational effectiveness and customer happiness may be improved by implementing technology-driven solutions.

-

The market's main restraints are a lack of supply chain effectiveness and the danger of unregulated food sellers.

Opportunities:

-

Increased urbanization and industrialization, prompting people to seek high-quality food items.

-

Consumers' lifestyles are changing, and they desire more convenient, aesthetically appealing, and high-quality meals.

The retail environment for food and groceries is changing as a result of modern consumers' evolving tastes. The need for quick, attractive, and high-quality meals is growing. Retailers are supplying this demand with high-quality ready-to-eat and ready-to-cook options. Choices that can be customized, are healthy, and are sustainable are also becoming more popular, thanks to technology and an emphasis on wellbeing. As a result, the market is developing to offer compelling in-store experiences that cater to a variety of lifestyles and values in addition to products.

Challenges:

-

Unemployment and inflation, have kept the influence of increased consumer spending on the medium in the near term.

The retail food and grocery business have to deal with a considerable problem as a result of the long-term impacts of particular factors like unemployment and inflation. Although rising consumer spending may eventually fuel sector expansion, these economic considerations have restrained it in the medium to short term. Consumer purchasing power is severely impacted by unemployment rates, which reduces their capacity to make significant individual purchases of food and grocery

-

The food and grocery industries are governed by a number of laws and requirements including food safety, labelling, packaging, and advertising.

Impact of COVID-19:

Customers hurried to stock up on goods at supermarkets and online during the initial wave of the epidemic, while restaurants, companies, and schools were mainly shuttered in most countries. To fulfill customer demand, food stores were obliged to restructure their supply chains, investigate private-label items, and extend their supplier networks as a result of market instability induced by the COVID-19 epidemic. The key drivers driving market expansion include shifting consumption spending from food service to food retail owing to COVID-19 pandemic-induced lockdowns, increased usage of online channels for grocery purchases, and consumer polarization brought on by income shifts.

This resulted in unanticipated variations in grocery sales, as bare store shelves revealed shifting consumer preferences in real-time. Sales of nostalgic and hedonistic goods like confectionery, sweets, and salty snacks increased during the recessionary pantry-stocking period.

IMPACT OF RUSSIAN UKRAINE WAR:

The world's food supply is being disrupted by Russia's invasion of Ukraine, particularly that of corn, wheat, and sunflower oil. If Ukrainian farmers are unable to produce crops like maize during the following harvest season, the number of raw materials available for human and animal use will be reduced, making the conflict's effects on the food and grocery sector more noticeable. Such a lack of grain feed would increase the cost of dairy and meat, putting additional strain on consumer spending.

Prior to the war, a third of the world's requirement for wheat was met by Russia and Ukraine's combined production. The two countries are also significant producers of feed grains including corn, cooking oil, and fertilizer. Additionally, they are crucial suppliers to several nations in the Middle East and Africa.

The fact that global food prices were already at record highs as a result of a string of prior droughts and subpar harvests in other nations that are also significant suppliers, particularly the United States, made matters more difficult. There wouldn't be enough food in the reserves to handle a sudden decline in supply from Russia and Ukraine.

As a result, "food prices were quite high and quite volatile" in the initial months following Russia's invasion. Wheat futures increased by over 60%. The first week or so saw a 15 to 20% increase in corn and soybean prices.

IMPACT OF ONGOING RECESSION

The Bureau of Labor Statistics estimates that food prices rose by 10.9 % between October 2021 and October 2022 due to the impact of recession.

Offering clients cheaper alternatives in the form of private label and discount options is one strategy to stop this deterioration of the connection. For instance, Walmart has been absorbing some of the costs associated with inflation in order to cut prices for their private label products and increase consumer loyalty.

Although smaller retailers might not be able to manage customer loyalty in this particular manner, the fact that CPG categories have generally been experiencing some of the highest rates of inflation in food means that consumers will naturally turn to less expensive, private-label products as alternatives, even if they increase in price along with more expensive name-brands. Therefore, investing in private label and inexpensive products is a wise move.

Product Type:

The fine food sector has placed a greater emphasis on nutrition and provenance, but demand for high-quality, long-lasting food pantry items is projected to rise as more people buy locally and less frequently. The beverages category, on the other hand, is expected to increase at the quickest rate throughout the projection period. Due to the closure of restaurants, bars, pubs, and cafés during the pandemic, off-trade purchases of beer, wine, and non-alcoholic beverages increased dramatically. As new trends compel producers to find new strategies to enhance sales, the beverage industry has experienced major changes. The beverage industry, like others, has seen a surge in health and wellness goods recently. While traditional beverage sales are declining, alternative items such as natural and organic drinks are growing in popularity.

Distribution Channel:

The key reason for its significant market share is a large number of supermarkets and hypermarkets throughout the world. One of the primary motivators for people to frequent their local supermarkets and hypermarkets is the convenience of having a wide variety of food and beverage goods in one location. Furthermore, store owners are coming up with creative marketing and promotional activities to guarantee that consumers' in-store purchase habits are maintained.

Key Market Segmentation:

By Type:

-

Fresh Food

-

Frozen Food

-

Food Cupboard

-

Beverages

-

Cleaning & Household

-

Others

By Category:

-

Packed

-

Unpacked

By Distribution Channel:

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Stores

-

Others

.png)

REGIONAL ANALYSIS

Asia Pacific accounted for highest percentage. The key factor contributing to this region's domination is the abundance of supermarkets in its developing nations. Urbanization and rising disposable incomes on the demand side, Foreign Direct Investment (FDI), format diversification, domestic investments, and modernization of procurement systems to lower supply-side costs are all factors that have contributed to the growth of supermarkets in Asia Pacific. Online food purchases have grown as a result of rising mobile usage and broadband penetration, particularly in developing nations.

The North American retail market for food and groceries is the second largest market and is primarily driven by the U.S. and Canada's strong increase in food retail. The largest market share of the retail food and grocery market in the area is owned by the United States.

The European market for food and groceries in is expected to expand at a significant CAGR, during the forecast period as a result of the expansion of online grocery retail in the area. Because of the convenience, greater product range, and choices for home delivery, consumers are increasingly choosing to purchase online. Over the projected period, it is expected that the U.K. food and grocery retail industry would expand at the highest CAGR. The sector is expanding as the nation's online sales of food and groceries increase. In addition, Germany will hold the greatest proportion of the retail food and grocery sector. A vast network of supermarkets, hypermarkets, discount shops, and convenience stores characterize Germany's well-developed retail infrastructure. This infrastructure offers consumers easy access to diverse range of food and grocery options.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Player:

Walmart, Costco Wholesale Corporation, 7-ELEVEN Inc, Amazon.com Inc, The Kroger Co., Target Brands, Inc, ALDI, AEON Co Ltd, CA Carrefour, Schwarze Gruppe.

Walmart-Company Financial Analysis

RECENT DEVELOPMENT

-

The Kroger Co. and Albertsons Companies, Inc. announced a binding agreement to integrate their businesses in October 2022.

-

The first hybrid store powered by Trigo's checkout-free system will be opened by discount grocery chain Netto, a member of the Edeka Group, in Munich, Germany, in December 2021.

-

Walmart revealed a new technology named Alphabot for its supermarket division in January 2020. As the firm strives to maintain its position as the largest grocery retailer in America, the technology will enable speedier picking, packing, and delivery of customers' online food orders.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 11.71 Trillion |

| Market Size by 2030 | US$ 15.67 Trillion |

| CAGR | CAGR 3.7% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fresh Food, Frozen Food, Food Cupboard, Beverages, Cleaning & Household, Others) • By Category (Packed, Unpacked) • By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Walmart, Costco Wholesale Corporation, 7-ELEVEN Inc, Amazon.com Inc, The Kroger Co., Target Brands, Inc, ALDI, AEON Co Ltd, CA Carrefour, Schwarze Gruppe. |

| Key Drivers | • In emerging countries, rising middle-income consumer demand has increased demand for quality consumables and grocery retail. • Expanding customer demand for private label goods, rising consumer expenditure on food products, and a growing supermarket shopping culture. |

| Market Opportunities | • Increased urbanization and industrialization, prompting people to seek high-quality food items. • Consumers' lifestyles are changing, and they desire more convenient, aesthetically appealing, and high-quality meals. |