Breakfast Cereal Market Report Scope & Overview:

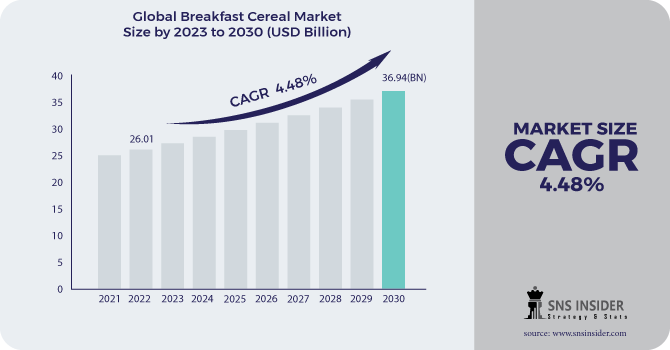

Breakfast Cereal Market Size was valued at USD 26.01 billion in 2022 and is expected to reach USD 36.94 billion by 2030, and grow at a CAGR of 4.48% over the forecast period 2023-2030.

Vast variety of cereal-based goods consumed predominantly for morning, the breakfast cereal market has grown to be a sizable sector within the larger food business. The market has been steadily expanding in recent years as a result of factors like urbanization, changing lifestyles, and rising demand for quick and wholesome breakfast options. Innovative product lines, a wide range of taste options, and successful marketing tactics that target various customer demographics have all contributed to the market's expansion.

The breakfast cereal market has seen significant change as a result of technology. Manufacturers are now able to create cereal products that keep freshness, increase shelf life, and offer improved nutritional content because to advancements in food processing, packaging, and distribution. Furthermore, the way consumers engage with and buy breakfast cereal items has been completely transformed by digitization and e-commerce platforms. Online platforms give businesses a way to communicate with consumers directly and tailor their marketing, which promotes brand loyalty and has an impact on consumer decisions.

Despite the Breakfast Cereal Market's promising expansion, problems still exist. Consumer demands for healthier and more environmentally friendly breakfast options are forcing manufacturers to change their recipes and packaging. Changing laws, interrupted supply chains, and fluctuating raw material costs make things much more difficult. To maintain a competitive edge and satisfy the constantly evolving demands of today's consumers, it is essential to navigate these issues.

Market Dynamics:

Driving Factors:

-

Appealing showcasing and advancing techniques of organizations have helped in expanding well-being and wellness mindfulness among buyers.

Consumer awareness of health and wellness in the breakfast cereal market has increased because to persuasive marketing tactics that promote whole grains, nutritional benefits, and reduced sugar content. Packaging with images of the natural world and words like "organic" strengthens favourable associations. Social media platforms and celebrity endorsements enhance health claims, while ingredient transparency encourages authenticity. This strategy has sparked innovation, providing options for particular dietary preferences and boosting the market's appeal to health-conscious consumers.

-

To adapt to shifting consumer preferences, manufacturers create a variety of flavours.

Restraining Factors:

-

Hardships looked by makers in obtaining or acquisition of unrefined components for breakfast grain and high acquirement costs.

The difficulties in obtaining raw materials and the ensuing high procurement prices are a problem for producers in the breakfast cereal market. There are challenges in procuring the necessary raw materials for morning cereals, which could cause supply chain interruptions. Increased purchase costs make the problem worse and put financial strain on manufacturers. These limitations impede the market's efficient operation by having an effect on production and perhaps influencing product availability and pricing.

-

The consumption of conventional cereal is impacted by busy lives that shift breakfast preferences to quick, portable options.

Opportunities:

-

Demand for healthier, lower-calorie breakfast options is growing as chronic sickness rates rise.

The market for breakfast cereal is seeing a unique opportunity due to the rising prevalence of chronic conditions. There is a growing need for breakfast options that emphasize wellness as more people try to address health issues. The preference shift of consumers toward healthier, lower-calorie options creates opportunities for producers to innovate and offer goods that target this expanding market. Companies can tap into a market segment that prioritizes nutritional value and contribute to both customer well-being and market expansion by aligning their offers with these developing health-conscious trends.

-

Using online channels to connect with more people and provide direct-to-consumer sales.

Challenges:

-

Growing consumer demand for gluten-free goods along with rising production costs.

The growing market for gluten-free products, combined with rising production costs, provide a threat to the breakfast cereal industry. Manufacturers must spend money on specific products and procedures as more customers look for gluten-free options because of dietary preferences or constraints. This may result in increased production costs, which would affect the profitability and price of the products. For businesses in the morning cereal sector, combining cost pressures and the need to satisfy customer expectations for gluten-free options becomes a big challenge.

-

More quick and wholesome breakfast options are becoming available, such as yogurt, bars, and smoothies.

Impact of Covid-19:

With COVID-19 lockdowns provoking an expansion in at-home breakfast eating and a resurgence of grains for breakfast, buyer requests saw a flood. For shoppers', the taste stayed the first concern with regard to breakfast cereals, notwithstanding, with the pandemic, purchasers began putting a more prominent accentuation on health. People have begun getting back to grain because of the episode, as they have been restricted to their homes. It is typical that the penchants made during the pandemic will persevere, with a restored complement on eating suitably at home and be instrumental in market improvement. By late 2019, the worldwide breakfast cereal market had started to recuperate, however, prepared-to-eat has gotten a lift as clients look for natural, encouraging products with a long time span of usability during the COVID-19 flare-up. Kellogg Co. what's more, General Mills, Inc. for instance, has employed extra laborers to assist with satisfying the expanded need.

IMPACT OF RUSSIAN UKRAINE WAR

Global markets have been impacted by the ongoing conflict between Russia and Ukraine due to geopolitical unpredictability. Even while there may not be much of a direct effect on the breakfast cereal sector, general economic instability and changes in trade dynamics could have an impact on consumer behaviour and industrial supply chains.

Food prices are rising globally as a result of Russia's war in Ukraine, which is blocking grain from leaving the "breadbasket of the world" and endangering shortages, starvation, and political instability in developing nations. Together, Russia and Ukraine export more than 70% of the world's sunflower oil, about a third of its wheat and barley, and significant amounts of corn.

Food imports from Ukraine are necessary for 400 million people worldwide. Up to 181 million people in 41 countries might experience a food crisis or even greater levels of famine this year Ukraine has only been able to export 1.5 million to 2 million tonnes of grain a month since the war started, down from more than 6 million tonnes.20 million tonnes of Ukrainian grain were blocked from reaching the Middle East, North Africa, and portions of Asia, the war has exacerbated already rising global food costs.

IMPACT OF ONGOING RECESSION

The prolonged recession has impacted consumer spending and company investment, which has decreased demand across several industries. The recession's economic issues will undoubtedly be made more difficult by unemployment and income insecurity.

In 2022, the weighted average crop price index for cereal crops experienced a 3-4% CAGR. Even in 2023 first nine months, cereal prices increased significantly on-year — by 8–11% for wheat and paddy and by 27–31% for maize, jowar, and bajra. Cereal inflation increased steadily from slightly over 5%, reaching a peak in February 2023 at 14.6% in urban India and 17.8% in rural India. Urban cereal inflation was 9.9% at year's end, while rural cereal inflation was 11.6%.

In 2022, the weighted average crop price index for cereal crops experienced a 3-4% CAGR. Even in 2023 first nine months, cereal prices increased significantly on-year — by 8–11% for wheat and paddy and by 27–31% for maize, jowar, and bajra.

Key Market Segmentation:

By Product Type:

-

Ready-to-eat

-

Hot cereals

By Nature:

-

Conventional

-

Organic

By Distribution Channel:

-

Supermarket/hypermarket

-

Specialty store

-

Online store

-

Others

.png)

REGIONAL ANALYSIS

North America had the highest global market share. With a higher per capita consumption of hot and ready-to-eat cereal than in other regions, the region has the highest penetration in the entire world. However, ready-to-eat sales have been declining in the area, while hopeful growth is being shown in places like Europe and the Asia Pacific.

Asia-Pacific region is the fastest growing market. The increased consumption of processed food in nations like Japan, China, India, and others is a major factor in the industry's rise. Due to the various health problems that customers around the world are experiencing, eating habits have altered. People are switching to eating more nutrient-dense foods. As a result, breakfast cereal consumption is rising everywhere.

In Europe, the breakfast cereal business saw a successful fusion of convenience with health consciousness. The general trend toward healthier eating habits was reflected in consumers' rising interest in cereals that provided nutritional benefits, such as whole grains and low sugar content. In response, the market offered a variety of flavours and ingredients to satisfy different palate preferences. Manufacturers introduced new cereal varieties and adopted eco-friendly techniques during this time due to an increase in innovation and a greater focus on sustainability. The proliferation of private label products and the growth of internet retail have further altered the market environment.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

PepsiCo, Nestlé, Marico, Calbee, Bagrry India Pvt. Ltd., General Mills Inc., Kellogg Co., B&G Foods, Inc., Nature's Path Foods., Bob’s Red Mill Natural Foods.

Marico-Company Financial Analysis

RECENT DEVELOPMENT

-

Shreddies The Honey One, which has whole grain as its primary ingredient, was introduced in February 2022 as part of Nestle SA's debut and expansion of its UK portfolio.

-

In February 2022, Post Holdings announced the release of "Incredi-Bowl," a line of three keto-friendly morning cereals that come in flavours like frosted flakes, chocolate crunch, and honey nut hoops.

-

PepsiCo announced the release of a new, enhanced Pepsi Zero Sugar that proves to have an exceptionally good taste on January 13, 2023. With the option to redeem up to 10 million FREE Pepsi Zero, the brand is demonstrating to consumers that zero sugar has never tasted so wonderful through taste and trial. Starting during the NFL Playoffs and continuing through the Super Bowl, sugar bottles or cans.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 26.01 Billion |

| Market Size by 2030 | US$ 36.94 Billion |

| CAGR | CAGR 4.48% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Nature (Conventional and Organic) • by Product Type (Ready-to-eat and Hot Cereals) • by Distribution Channel (Supermarket/Hypermarket, Specialty Store, Online Store, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | PepsiCo, Nestlé, Marico, Calbee, Bagrry India Pvt. Ltd., General Mills Inc., Kellogg Co., B&G Foods, Inc., Nature's Path Foods., Bob’s Red Mill Natural Foods |

| Key Drivers | • Appealing showcasing and advancing techniques of organizations have helped in expanding well-being and wellness mindfulness among buyers. • To adapt to shifting consumer preferences, manufacturers create a variety of flavours. |

| Market Restraints | • Hardships looked by makers in obtaining or acquisition of unrefined components for breakfast grain and high acquirement costs. • The consumption of conventional cereal is impacted by busy lives that shift breakfast preferences to quick, portable options. |