Oat Milk Market Report Scope & Overview:

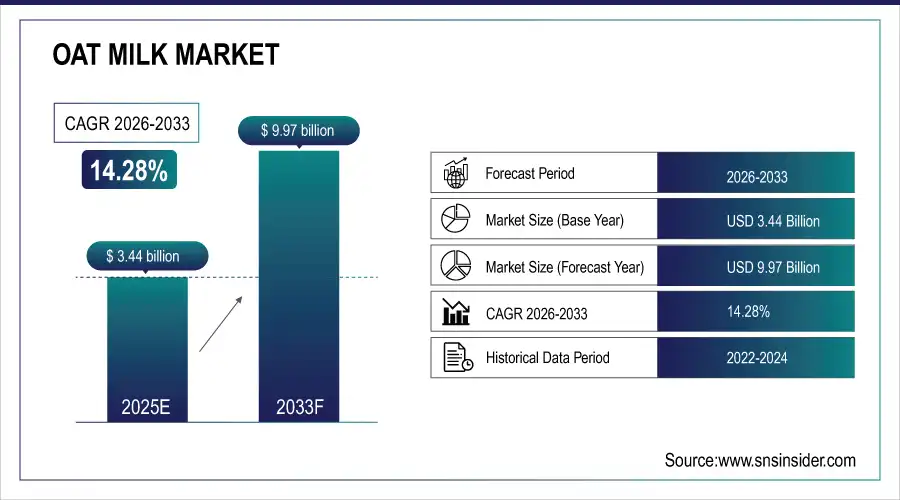

The Oat Milk Market size was valued at USD 3.44 Billion in 2025E and is projected to reach USD 9.97 Billion by 2033, growing at a CAGR of 14.28% during 2026-2033.

The Oat Milk Market analysis highlights the widespread development of plant-based options due to rise in lactose intolerance and surge in veganism. Demand in developed and developing countries is driven by increasing consumer concerns about sustainability and health. By snaring various consumers through fortifies, flavored and barista-quality innovation manufacturers are innovating. Increasing online sales outlets also make the brand more available and visible. All in all, oat milk has gone from a marginal to mainstream dairy substitute that is likely to have lots of strong growth ahead.

Lactose Intolerance Prevalence: Over 68% of the global population experiences lactose malabsorption, driving demand for dairy alternatives like oat milk, especially in Asia and Africa. Vegan Population Growth: The number of vegans in the U.S. alone grew by over 300% between 2004 and 2024, significantly boosting plant-based milk consumption.

Market Size and Forecast:

-

Market Size in 2025E: USD 3.44 Billion

-

Market Size by 2033: USD 9.97 Billion

-

CAGR: 14.28% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Oat Milk Market - Request Free Sample Report

Oat Milk Market Trends

-

Increasing consumer inclination interest in plant-based diet is also driving the oat milk demand as a sustainable and healthy alternative to dairy worldwide.

-

The growth in product innovation such as fortified, flavored and barista application oat milk continues to broaden the consumer base for this plant-based milk.

-

Growing café culture coupled with coffee chain partnership is supporting oat milk adoption as a favorite non-dairy option in beverages.

-

Growing e-commerce websites and subscription models are benefiting product availability, convenience and global health brand awareness for health-driven consumers.

-

Market players that use sustainable production processes and also offer eco-packaging innovations would encourage the creation of a loyal customer base as well as an impact on consumer preference towards environmentally friendly oat milk brands.

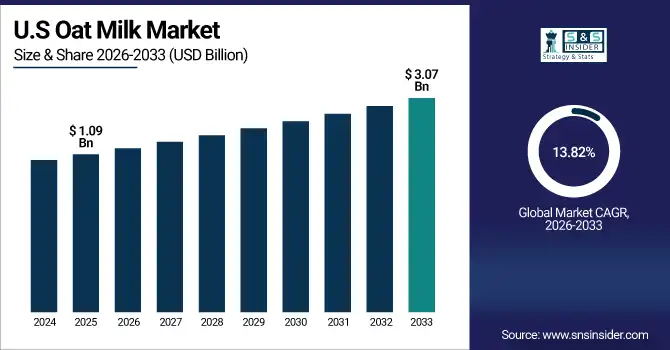

The U.S. Oat Milk Market size was valued at USD 1.09 Billion in 2025E and is projected to reach USD 3.07 Billion by 2033, growing at a CAGR of 13.82% during 2026-2033. Oat Milk Market growth is driven by Increasing consumer demand for plant-based and lactose-free dairy alternative options is likely to spur growth of the US oat milk market. Growing concern about the environment and conscience about food purchases also drives market demand. Large retail and café chains are broadening their oat milk selections, increasing access across the country. Healthier products, fortified and low-sugar versions, appeal to health-conscious consumers.

Oat Milk Market Growth Drivers:

-

Rising Health Consciousness and Shift Toward Sustainable, Plant-Based Dairy Alternatives Among Global Consumers

The awareness of lactose intolerance, control on cholesterol and care towards environment sustainability are few of the drivers for consuming plant based milk. Oats milk has become popular recently, and with good reason: it’s creamy (like whole-milk products), nutritious and environmentally friendly. Growing vegan population, urbanization, and product penetration across supermarkets, coffeehouses and online shopping trends are some of the drivers which has support demand for global coffee markets.

Cholesterol Management: Over 40% of adults in high-income countries monitor dietary cholesterol; oat milk’s beta-glucan content helps lower LDL cholesterol, aligning with heart-health goals.

Oat Milk Market Restraints:

-

Limited Consumer Awareness and High Price Compared to Traditional Dairy and Other Plant-Based Milks

Although the oat milk industry has been on a trajectory of rapid growth, it still needs to overcome obstacles, including slow publicity in emerging regions and higher retail prices. Budget-conscious folks are also reluctant, which is why many consumers still opt for cheap dairy and soy milk substitutes. In addition, shorter shelf-life and uneven presence in rural regions limit prospects for more widespread use by slowing market penetration and overall growth in some areas.

Oat Milk Market Opportunities:

-

Expansion Through Product Innovation, Fortification, and Entry into Emerging Health-Conscious Global Markets

Oat milk manufacturing companies are focusing more on fortified, flavored, and barista oat milk products to receive the attention from a wider variety of customers. There are significant opportunities in emerging markets, especially Asia-Pacific and Latin America where health consciousness is increasing. Strategies such as partnerships with coffee chains, environment-friendly packaging efforts and growth in e-commerce also help enhance reach of the market, marking oat milk's status as an adaptable and sustainable dairy substitute that has strong potential for the future.

Fortified Product Adoption: Over 60% of oat milk brands in Europe and North America now offer calcium- and vitamin D-fortified versions to match dairy’s nutritional profile and appeal to health-conscious buyers.

Oat Milk Market Segment Analysis

-

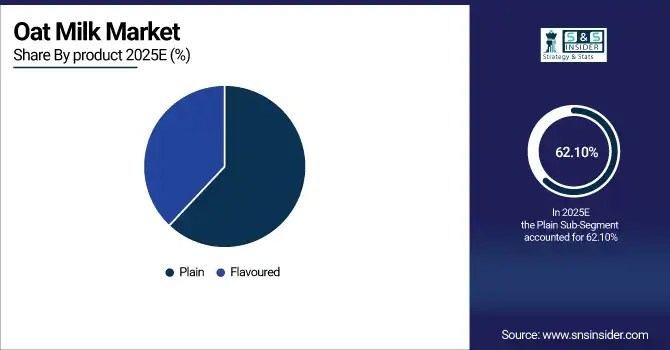

By product, plain oat milk led the market with a 62.10% share in 2025, while flavored oat milk is the fastest-growing segment, registering a CAGR of 8.50%.

-

By source, conventional oat milk dominated 70.21% of the market in 2025, whereas organic oat milk is the fastest-growing segment with a CAGR of 9.20%.

-

By packaging, bottles led the market with a 55.46% share in 2025, while cartons are the fastest-growing segment, growing at a CAGR of 7.80%.

-

By distribution channel, supermarkets and hypermarkets held 60.50% of the market in 2025, whereas online retail is the fastest-growing channel with a CAGR of 11.47%.

By Product, Plain Leads Market While Flavoured Registers Fastest Growth

In 2025, Plain oat milk leads the market due to the original alternative mild taste that stands up to coffee, cereal and cooking. Consumers love the fact that it has no taste and can be used in other diets without any problem. Meanwhile, Flavoured oat milk is growing fastest, due to growing consumer demand for flavor diversity and innovation. Brands are even surfacing with affordable, chocolate, vanilla and coffee-flavoured takes so that everyone can enjoy delicious plant-based options.

By Source, Conventional Dominate While Organic Shows Rapid Growth

Conventional segment is leading the market, due to its low price, widespread availability and reliable taste. Those retail customers who want ease and the same old thing choose conventional options, thus further establishing its place on the market. While, Organic segment is on the rise and growing fast, driven by a growing consumer interest in wellness and sustainability. Consumers are showing more interest in clean-label and chemical-free products, as well as sustainable sourcing. The organic category is emerging as a key driver of innovation and consumer adoption in the plant-based beverage space.

By Packaging, Bottle Lead While Cartons Registers Fastest Growth

In 2025, The bottled oat milk is dominating packaging style, due to of convenience, enclosable and quality perception in its consumption. It carried out in both retail and foodservice settings due to its convenience and durability. While, Cartons segment is growing faster, partly in response to their eco-friendly packaging, lightweight nature and recyclability. More and more consumers and vendors are choosing cartons as they result in less waste and reduced transportation pollution. Packaging technology such as sustainable inks and renewable materials is facilitating growth of the carton segment within in the oat milk market.

By Distribution Channel, Supermarkets & Hypermarkets Lead While Online Retail Grow Fastest

Supermarkets and hypermarkets continues to dominate market due to their convenience, range of products and competitive prices. They offer a reliable shopping experience for consumers who want to taste test the various oat milk brands and types. Meanwhile, Online Retail is growing fastest as customers love the convenience of having items delivered right to their front door in addition to signing-up for subscriptions and finding unique off-beat product. On e-commerce websites, customers can compare products, read reviews and experiment with new flavors. This has been driving the growth of oat milk among a more tech-savvy audience.

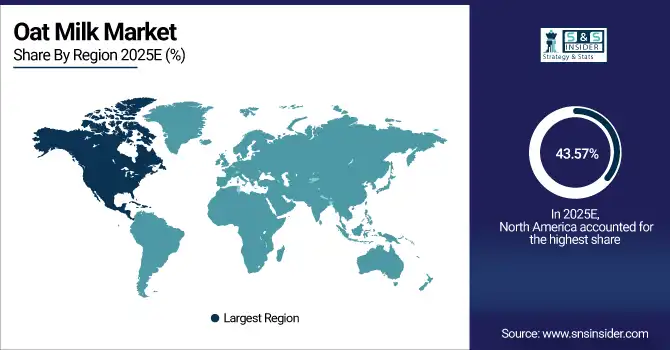

Oat Milk Market Regional Analysis:

North America Oat Milk Market Insights

In 2025 North America dominated the Oat Milk Market and accounted for 43.57% of revenue share, this leadership is due to the increasing demand for plant-based drinks in the United States. It is a crowded field, with the market having everything from oat milk to flavored and organic varieties. Retailers and restaurants are adding options to keep up with consumer demand for nondairy. This is also supported by growing awareness of lactose intolerance and diet trends that are favouring plant-based alternatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Oat Milk Market Insights

U.S. is leading the North America due to growing health and environmental consciousness linked with plant-based diets. Oat milk is also gaining traction because it aligns with a variety of dietary preferences such as vegan, lactose-free, or gluten free. Oat milk category is seeing new product introductions such as flavored and fortified oat milks.

Asia-pacific Oat Milk Market Insights

Asia-pacific is expected to witness the fastest growth in the Oat Milk Market over 2026-2033, with a projected CAGR of 14.87% due to growing health consciousness and changing food habit to adopting plant-based diets. Nations such as China, Japan, South Korea and Australia are seeing large acceptance of oat milk given lactose-intolerance or concern for their health or being vegan which keeps them away from conventional dairy. Oat milk, for instance, surged in China after international brands such as Oatly entered the market and established a foothold.

China Oat Milk Market Insights

Chine is leading the Asia pacific due to rising health awareness, spike in lactose intolerance, and impact of global plant-based brands. Cities are experiencing skyrocketing sales of milk substitutes, from oat to almond. The market is further encouraged by the increasing popularity of veganism and plant-based diets among younger people.

Europe Oat Milk Market Insights

In 2025, Europe emerged as a promising region in the Oat Milk Market, due to high consumer demand for plant-based beverages. Countries including Germany, the UK and Sweden are at the forefront of oat milk consumption in light of health trends and environmental considerations. There is organic, and flavored, versions of oat milk available on the market. Stores are increasing their selection of plant-based varieties to serve the increasing number of consumers interested in this category.

Germany Oat Milk Market Insights

Germany Is leading Europe in Oat Milk market due to its adoption in products as an alternative to cow’s milk, particularly in coffee and tea. Some large coffee chain in Germany have introduced oat milk to their menus by teaming up with these prominent suppliers.

Latin America (LATAM) and Middle East & Africa (MEA) Oat Milk Market Insights

The Oat Milk Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing awareness about plant-based diet and its health benefits. In countries such as Brazil, Argentina, South Africa and the UAE that is more demand for alternatives to dairy milk like oat milk. The market is seeing an increasing number of local and global brands entering these markets as a response to the evolving taste of consumers. More and more new sales outlets are being developed, and you can now find the product increasingly in commercial stores, hypermarkets or on the Internet.

Oat Milk Market Competitive Landscape:

Califia Farms, a leading North American plant-based beverage company, has experienced impressive success in the oat milk category. During 2022 the company has grown market share from 3% to 12% in just over a year with a sales increase of 242% YOY. Their out of the box marketing strategies and product facilities have added to this fast expansion.

-

In July 2025, Califia Farms introduced two new nut-flavored oat barista blends pistachio and hazelnut to the UK market. These additions aim to diversify their product line and cater to the growing demand for plant-based coffee alternatives.

Danone has taken steps to dominate international oat milk ingredient supply. The company transformed a dairy yogurt plant in France into an oat milk producing facility as recently as 2024, demonstrating a dedication to plant-based alternatives. This is in line with Danone's overall sustainability and health related efforts.

-

In August 2025, Danone's Alpro brand began sourcing 100% British oats for its UK oat milk range. This move reduces emissions, water usage, and land impact, aligning with Danone's commitment to sustainability and local sourcing.

Elmhurst 1925 has received praise for the quality of its products. In September 2022, they released an oat milk product line to cater to dairy allergics. Elmhurst prides itself on using clean ingredients and minimal refinement in its offerings.

-

In August 2025, Elmhurst 1925 expanded its product line to include a variety of plant-based milks such as almond, oat, walnut, pistachio, cashew, and hazelnut. This diversification reflects the company's commitment to catering to diverse consumer preferences.

Happy Planet Foods has also been adding new products to the oat milk category. The company had market share of more than 45% in the oat milk category in 2021, indicating significant presence in this large opportunity. Happy Planet is committed to creating organic, sustainable beverages made from only the finest ingredients.

-

In September 2025, Happy Planet Foods launched a new oat milk recipe focusing on clean labeling with fewer ingredients. The company emphasizes the use of Canadian-grown oats and 100% renewable energy in production, reinforcing its commitment to sustainability.

Oat Milk Market Key Players:

Some of the Oat Milk Market Companies are:

-

Califia Farms

-

Danone

-

Elmhurst

-

Happy Planet Foods

-

HP Hood LLC

-

Oatly

-

Pacific Foods

-

Rise Brewing

-

The Coca-Cola Company

-

Thrive Market

-

Planet Oat

-

Chobani

-

Alpro

-

Blue Diamond Growers

-

Minor Figures

-

Dream

-

Silk

-

Forager Project

-

Good Karma

-

Planet Almond

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.44 Billion |

| Market Size by 2033 | USD 9.97 Billion |

| CAGR | CAGR of 14.28% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Flavoured, Plain) • By Source (Conventional, Organic) • By Packaging (Bottle, Cartons, Others) • By Distribution Channel (Convenience Stores, Supermarkets & Hypermarkets, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Califia Farms, Danone, Elmhurst, Happy Planet Foods, HP Hood LLC, Oatly, Pacific Foods, Rise Brewing, The Coca-Cola Company, Thrive Market, Planet Oat, Chobani, Alpro, Blue Diamond Growers, Minor Figures, Dream, Silk, Forager Project, Good Karma, Planet Almond |