Almond Products Market Report Scope & Overview:

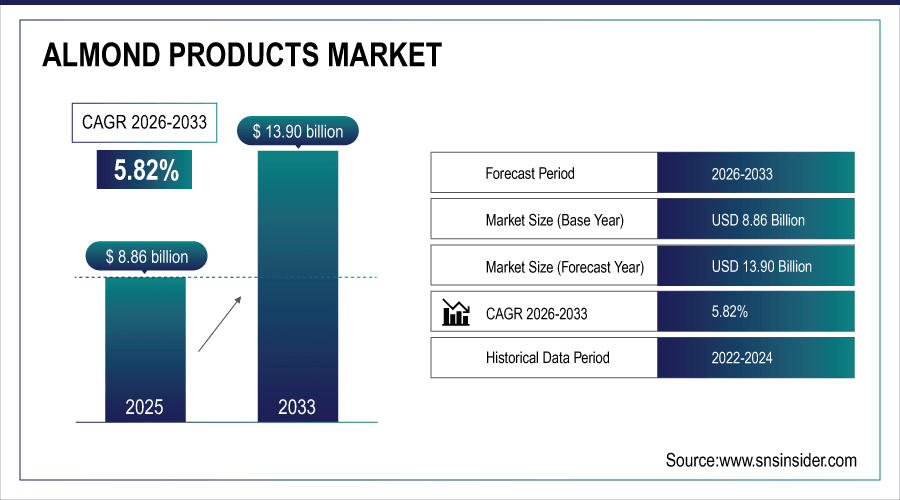

The Global Almond Products Market size was valued at USD 8.86 Billion in 2025E and is projected to reach USD 13.90 billion by 2033, growing at a CAGR of 5.82% during the forecast period 2026–2033.

Almond products are in high demand worldwide while consumers shift toward a health and wellness and plant-based way of living. Almond milk, butter, flour and roasted snacks are hot for nutritional qualities and fit in food and drink. Growing lactose intolerant population, shift towards vegan way of life and trend of clean label product are the factors driving the market. Increased distribution via supermarkets, specialty outlets, as well as e-commerce channels present brands with compelling prospects for innovation and market growth on a global scale.

Around 40% of health-conscious consumers purchase almond-based products like milk, butter, and snacks regularly through supermarkets and online channels.

To Get More Information On Almond Products Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 8.86 Billion

-

Market Size by 2033: USD 13.90 Billion

-

CAGR: 5.82% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Almond Products Market Trends:

-

Consumers are trading up to plant-based and dairy-free, with almond milk projected to account for 60% of U.S. plant-based milk sales by 2025, while almond butter demand continues to rise steadily as more consumers adopt vegan and lactose-free lifestyles.

-

Health is spreading almond snacks and flour, with almonds shown as the No.1 nut for global snack launches and suggested by 70% of dietitians for protein, fiber, and vitamin E.

-

Innovation is ramping up with 1,200+ new almond-based products introduced in 2024, including flavored almond milk, organic butter and gluten-free flour.

-

Distribution is broadening, with 65% of sales in supermarkets and online orders of almond milk and almond snacks rising 30% in 2025.

-

Brand loyalty and repeat business are being reinforced by the growing trends of premiumization and sustainability, with 55% of brands implementing eco-friendly packaging and sustainable sourcing.

U.S. Almond Products Market Insights

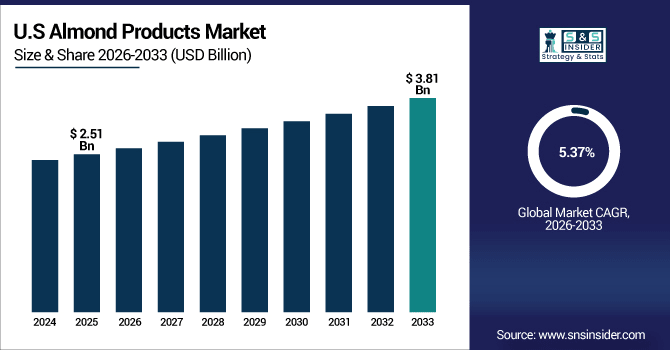

The U.S. Almond Products Market is expected to increase at a compound annual growth rate (CAGR) of 5.37% from its 2025E valuation of USD 2.51 billion to USD 3.81 billion by 2033. Almond flour in baking, clean-label snacking, and plant-based dairy substitutes are driving growth. While e-commerce, foodservice development, and environmental programs boost customer trust and promote long-term market growth nationwide, California's robust domestic production guarantees supply.

Almond Products Market Growth Drivers:

-

The Rise of Plant-Based Diets and Lactose-Free Lifestyles Is Fueling Strong Demand for Almond Milk and Other Almond-Based Products Worldwide.

As consumer’s search for dairy alternatives that are sustainable and better for you, demand for almond products is driven by the rise of plant-focused diets and dairy alternative lifestyles. Because it’s better for you, versatile, and less harsh on the environment than traditional dairy options, almond milk in particular has become a go-to. Driving this trend are expanding vegan, vegetarian and flexitarian populations throughout the world, which is fueling the demand for almond-based innovations.

Over 65% of global consumers choosing plant-based beverages cite almond milk as their preferred dairy alternative, making it the leading segment in the non-dairy milk category.

Almond Product Market Restraints:

-

Water-Intensive Farming and High Production Costs are Key Restraints, Raising Sustainability Concerns and Limiting Affordability in the Almond Products Market.

Almond growing is expensive, and environmentally troublesome, because of its intensive water needs and because it is largely done in drought-prone California, the source of most almonds. These sustainability challenges have drawn more awareness from both regulations and the environmentally-conscious consumers. Meanwhile, it becomes difficult for manufacturers to keep their products affordable as the raw material prices change. The almond milk market is hugely limited by expense and environmental impact, limiting their use.

Almond Product Market Opportunities:

-

Growing Demand for Plant-Based Protein and Clean-Label Foods is Creating Strong Opportunities for Innovation in Almond-Based Products.

The almond and almond products market are slated to accelerate on the back of increasing demand for clean label food and plant-based protein. It is no wonder that healthy “real food” alternatives to traditional dairy and grain-based products are increasingly in demand. Almonds make a great snack, and a versatile ingredient for all types of dishes and drinks including macaroons and marzipan. Almond ingredients are increasingly being used worldwide, partly due to the drive for healthier and clean-label ingredients.

Over 55% of global consumers are willing to pay a premium for plant-based and clean-label products, boosting demand for almond-based snacks, beverages, and baking ingredients.

Almond Product Market Segmentation Analysis:

-

By Product Type, almond milk is the largest segment in 2025E with 42.00% of all products in the top dairy alternative category, almond flour and snacks are the fastest-growing segment, projected to increase at a CAGR of 6.8% during 2026–2033.

-

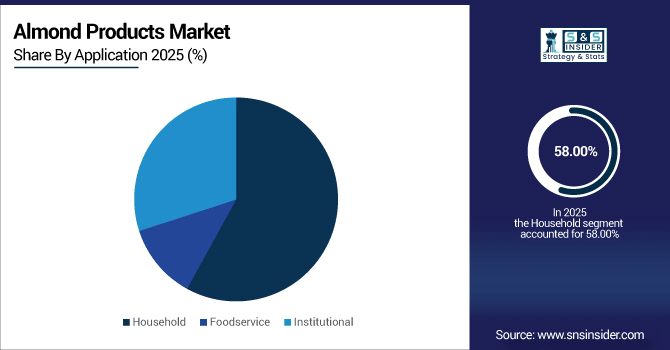

By Application, household consumption in 2025E has a dominant share of 58.00% and is a common diet staple in most households, with foodservice being the fastest growing segment at a 6.5% CAGR, due to the increasing number of cafés, bakeries, and restaurants amongst others.

-

By Distribution Channel, Supermarkets and hypermarkets occupy 50.00% share in 2025E, however, online retail is the fastest growing segment registering 7.2% CAGR driven by e-commerce and subscription models.

-

By Form, liquid (almond milk, almond oil) which commanded 48.00% volume share in 2025E with a CAGR of 8.0% whereas solids (almond flour, roasted almonds, spreads) is growing at a CAGR of 6.3% during the forecast period.

By Application, Household Consumption Dominates While Foodservice Expands Quickly:

Household use leads because consumers increasingly include almond products in their everyday diets, valuing their nutritional profile, plant-based protein, and versatility across meals. Today, almond milk and almond flour and snacks are a bright spot in a landscape where convenience is everything, and healthy is close behind. With the opening of cafes, bakeries and restaurants featuring baked goods, confections and beverages made from almonds, the foodservice channel is expanding rapidly. The top contributors to this trend are increasing vegan demand and an appetite for imaginative menus.

By Product Type, Almond Milk Leads While Almond Flour and Snacks Grow Rapidly:

The market is dominated by almond milk since it is generally accepted as a better, dairy-free substitute. Its use in vegetarian and vegan diets, cooking and as a beverage makes it a popular choice among those on a dairy-restricted diet and the health-conscious. With more people seeking gluten-free baking alternatives and high-protein snacks, almond flour and snacks are growing fast. Strong global demand is also being driven by their natural, clean-label positioning, which fits perfectly with current health and wellness ideals.

By Distribution Channel, Supermarkets Lead While Online Retail Grows Fastest:

Supermarkets dominate as they provide easy access to a wide range of almond products, catering to both premium and mass-market consumers. Supermarkets are the choice of consumers to buy the huge number of items and brands we can rely on. But because of the convenience and the home delivery and the availability of specialty or niche almond items, e-commerce is growing the fastest. Subscription offerings and direct-to-consumer business models have also made the cigars more accessible as well—for tech-savvy, younger consumers who rate convenience and customization as their top priority.

By Form, Liquid Products Dominate While Solid Forms Show Strong Growth:

Liquid products such as almond milk and oil dominate due to their versatility across food, beverage, and personal care applications. They are very popular with health-conscious consumers seeking natural cooking oils and plant-based dairy alternatives. Almond flour, dry-roasted almods, and spreads are all examples of solids which are growing rapidly due to their utility in gluten-free baking, high-protein snacking, and healthy living packaged goods. They are widely accepted worldwide because of their multiple uses and nutritional value.

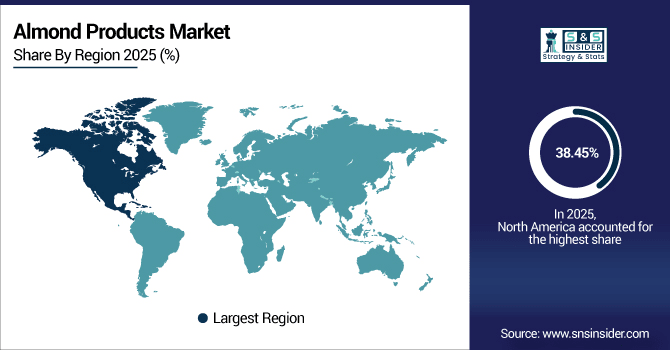

Almond Product Market Regional Analysis:

North America Almond Products Market Insights:

North America dominates the global almond products market, holding a 38.45% share in 2025E. A robust retail-foodservice that champions plant-based offerings and the widespread consumption of almond milk, almond snacks and almond flour are key factors contributing to the region’s strength. US-Made As the world’s largest producer of almonds, you can count on the USA for a constant supply and continuous product improvement. North America is the undisputed market leader today because of its sturdy e-commerce implementation, increasing Vegan sector and health obsessed clienteles.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Almond Products Market Insights

The United States is expanding, thanks to almonds’ rise to almond milk, flour, and snack nirvana, with California being the undisputed almond champion country. Increasing consumer confidence and market penetration is underpinned by continued innovation and sustainability drives, and robust health consciousness, dairy-free demand and vibrant retail and online sales.

Asia-Pacific Almond Products Market Insights:

The Asia-Pacific almond products market is the fastest-growing globally, projected to expand at a CAGR of 6.31% during 2026–2033. Expanded awareness of plant-based nutrition, urbanization, and increasing incomes are the core fuelers of growth among countries such as China, India and Japan. While almond milk is increasingly being used as an alternative to dairy, almond flour and dairy treats continue to rise in popularity for both bakery and health food use. The Asia-Pacific region has become the world’s main industry growth driver, bolstered by expanding e-commerce channels and supportive government policies.

China Almond Products Market Insights

The market for almond products in the Asia-Pacific region is dominated by China due to factors like urbanization, rising affluence, and increased health consciousness. Many people are consuming almond milk, and it is rapidly becoming a common drink and baked good and snack ingredient. China –Due to the strong demand of e-commerce, and the huge demand from the high-end import.

Europe Almond Products Market Insights:

Europe represents a significant share of the almond products market, supported by strong consumer preference for vegan, vegetarian, and clean-label foods. Demand for almond milk and flour is riding on the coattails of increasing number of lactose intolerance patients seeking organic and fortified products. The region boasts an advanced confectionary and bread subsector which uses almonds in many product segments. With strict food safety regulations and increasing demand for sustainability, Europe is an important market for premium almond products.

Germany Almond Products Market Insights

Germany is the market leader for almond products in Europe, thanks to the high demand for almond flour, milk, and marzipan in confections and bakeries. Due to its strong retail and e-commerce networks, predilection for organic and clean-label foods, and overall dominance, Germany is the main force behind regional growth.

Latin America Almond Products Market Insights:

Almond usage is on the rise in Latin America as well in response to increased consumer demand for dairy alternatives and health factors. The two biggest markets are Brazil and Mexico, and almond milk and snacks are gaining popularity in the cities. Larger supermarkets are opened and e-commerce has taken off, where both are driving regional growth to support broader product availability.

Middle East and Africa Almond Products Market Insights:

Evolving middle class, urbanization and increasing demand for premium health foods are fueling the growth of nascent almond product markets across Middle East and Africa. Availability is growing in modern trade and specialized stores across the region, and almond milk and roasted almonds are popular with health-conscious youth.

Almond Product Market Competitive Landscape:

Blue Diamond Growers, a leading almond cooperative based in California, dominates the almond products market with its extensive range of almond milk, snacks, and ingredients. Its almond-based treats appeal to consumers’ demands for convenience and health and its Almond Breeze brand is a top performer in the global dairy alternatives category. Along with its farmer-owners, the company has the ability to provide a steady, reliable supply of high-quality cheese products, and its focus on innovation and global markets brings a higher level of competition to the retail and food service channels.

-

In June 2025, Blue Diamond Growers unveiled a refreshed logo and brand persona, updating packaging and visual identity to rejuvenate consumer engagement with its Almond Breeze milk and snack offerings.

The Wonderful Company is a major player in the almond products market, leveraging its vertically integrated operations to control production, processing, and distribution. Its premium almond offers are assisted by the company’s strong global footprint and excellent reputation for quality. Through innovative marketing and sustainable growing practices, The Wonderful Company is increasing demand for almonds worldwide. It will continue to be a major player in the global market for almonds, with a robust competitive position built off of superior branding and product quality.

-

In August 2025, The Wonderful Company reaffirmed its commitment to premium almond products by expanding sustainability initiatives across its orchards, ensuring quality and long-term supply.

ADM is a global food processing leader with a strong footprint in almond-based ingredients, including flours, proteins, oils, and specialty blends. The brand is utilizing almonds in a variety of food and beverage applications to meet the growing need for plant-based, clean label offerings. Using its R&D capabilities, ADM creates innovative almond replacements for bakery, snacking and dairy. ADM's network and sustainability focus are driving growth in the almond sector.

-

In July 2025, ADM released its 2025 Protein Report, highlighting rising demand for plant-based proteins suggesting strong potential for expanding almond-based protein ingredients in their innovation pipeline.

Almond Product Market Key Players:

Some of the Almond Product Market Companies are:

-

Blue Diamond Growers

-

The Wonderful Company

-

Archer Daniels Midland Company (ADM)

-

Olam International Limited

-

Barry Callebaut Group

-

John B. Sanfilippo & Son, Inc.

-

Treehouse California Almonds, LLC

-

Borges Agricultural & Industrial Nuts (Borges Group)

-

Savencia SA

-

Kanegrade Limited

-

Modern Ingredients

-

Royal Nut Company

-

Döhler GmbH

-

Harris Woolf California Almonds

-

Wonderful Pistachios & Almonds

-

Select Harvests

-

Panoche Creek Packing

-

Mariani Nut Company

-

Waterford Nut Company

-

RPAC LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 8.86 Billion |

| Market Size by 2033 | USD 13.09 Billion |

| CAGR | CAGR of 5.82% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Almond Milk, Almond Flour, Almond Snacks, Almond Butter & Spreads, Almond Oil) • By Application (Household, Foodservice, Institutional) • By Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Direct Sales) • By Form (Liquid, Solid, Powder, Paste/Oil) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Blue Diamond Growers, The Wonderful Company, Archer Daniels Midland Company (ADM), Olam International Limited, Barry Callebaut Group, John B. Sanfilippo & Son, Inc., Treehouse California Almonds, LLC, Borges Agricultural & Industrial Nuts (Borges Group), Savencia SA, Kanegrade Limited, Modern Ingredients, Royal Nut Company, Döhler GmbH, Harris Woolf California Almonds, Wonderful Pistachios & Almonds, Select Harvests, Panoche Creek Packing, Mariani Nut Company, Waterford Nut Company, RPAC LLC. |