Food Robotics Market Size & Trends:

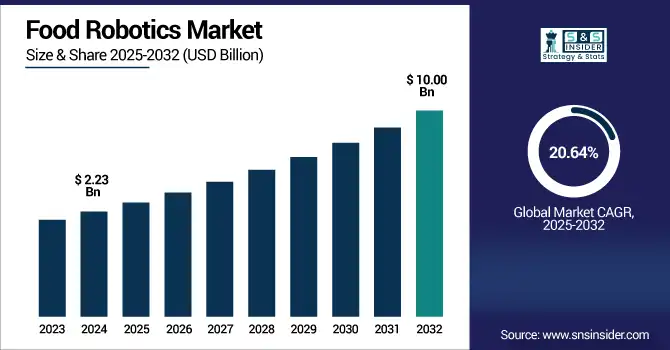

The Food Robotics Market size was valued at USD 2.23 Billion in 2024 and is projected to reach USD 10.00 Billion by 2032, growing at a CAGR of 20.64% during 2025-2032. The food robotics market is experiencing significant growth, fueled by with the increasing automation at various levels of food processing, packaging, and handling to maximize productivity, hygiene, and efficiency. The rising consumption of ready-to-eat and packaged food, and the implementation of strict food safety regulations, leads manufacturers to adopt robotics in order to minimize human error and the risk of contamination.

To Get more information on Food-Robotics-Market - Request Free Sample Report

Technologies including AI, machine vision, and smart sensors are all creating new horizons in robotics and have broadened the spectrum of robotics from applications including cutting, sorting, pick-and-place, palletizing to much more. Additionally, skilled personnel shortages in food processing are increasing rapidly in developed economies and older societies, such as Japan accelerating robotization in these sectors. This is leading to robust investment in food automation in both developed and emerging markets, and creating a foundation for robotics to be a key component of next-generation food production.

Feb 21, 2024 Uber Eats to Launch Autonomous Food Delivery Robots in Tokyo, Japan -Uber Eats, Mitsubishi Electric, and Cartken announced the rollout of AI-powered sidewalk delivery robots in Tokyo to tackle local labor shortages and boost delivery efficiency.

The U.S Food Robotics Market size was valued at USD 0.67 Billion in 2024 and is projected to reach USD 2.47 Billion by 2032, growing at a CAGR of 17.73% during 2025-2032. The market growth is fueled by increasing labor shortages, rising automation needs, and a strong demand for hygiene and efficiency in food processing. Food Robotics Market trends shaping the market include the adoption of collaborative robots (cobots) for flexible operations, AI-powered vision systems for enhanced precision, and autonomous food delivery robots for last-mile logistics. Additionally, the integration of robotics with smart kitchen technologies, real-time inventory tracking systems, and contactless service models is transforming how food is prepared, packaged, and delivered accelerating the shift toward fully automated food production and service environments.

Food Robotics Market Dynamics:

Drivers:

-

Rising Urban Delivery Challenges Fuel Adoption of Food Robotics Solutions

The food robotics market has been witnessing a dynamic growth due to rising need for efficient, environment-friendly and contactless delivery solutions in crowded urban areas. They are motivated by labor shortages, delivery costs, and sustainability business issues to implement more AI-driven delivery robots. With consumers now demanding faster and greener delivery, many have turned to robotics for seamless last-mile solutions in food and logistics companies. As sidewalk robots and drones sprout up on every corner, the evolution of urban food logistics is urging the need for a new food delivery ecosystem, one in which robotics fit right into place.

In April 10, 2025, DoorDash has partnered with Coco Robotics to launch AI-powered sidewalk food delivery robots in Los Angeles, offering sustainable and cost-efficient service to eligible customers.

Restraints:

-

High Costs and Integration Complexities Restrain Food Robotics Market Growth

The food robotics market faces several restraints that limit its broader implementation across the Robotics in Food Industry Market processing. The high capital cost of robotic systems, and the other costs of installation, and customization with maintenance, can cost-prohibitive for small and medium sized enterprises. Incorporating robots into current workflows is a technical challenge, particularly for delicate or oddly shaped food items. Availability of technically qualified personnel to operate and maintain such advanced robotic systems is limited and this further slows down adoption. In addition, very specific hygienic robot designs to satisfy stringent food safety and sanitation standards, adds complexity and expense to the engineering of such robots. Such challenges, however, are not new and pose an even greater issue within more cost-sensitive segments of the food industry, where any movement to automate must be tempered with operational and financial reality.

Opportunities:

-

Growing Demand for Speed and Automation Sparks New Opportunities in Food Robotics Market

The increasing need for faster service, labor efficiency, and operational consistency is creating strong growth opportunities in the food robotics market. Increasing consumer demand for speed and quality in meals are leading foodservice operators to consider robotics for more complex tasks including food prep, assembly, and customization. They are also great in a fast-paced environment such as in a quick-service restaurant and commercial kitchens as robotics allow them to operate 24/7, provide accurate handling, and require less labor. With increased urbanization and the rapid proliferation of digital ordering platforms, the need for higher through-put, automated solutions will increase. Radical innovation in areas including AI, machine vision, and collaborative robotics, led by companies including x, has pushed the capability envelope for food automation systems, generating life-changing application opportunities in many traditional and non-traditional foodservice models.

May 07, 2025, Powered by ABB Robotics, California’s new Burger Bots restaurant uses fully automated robot chefs to prepare and serve burgers in just 27 seconds.

Challenges:

-

Complex Technical and Regulatory Demands Hinder Widespread Adoption of Food Robotics

The food robotics market faces several key challenges that could limit its growth despite rising demand. Implementation costs increase due to the availability of some technical constraints in delivering delicate, irregular, or perishable food items, which need technological customizations and a complex effort to deliver. The need for specialized and compliant robot designs owing to the strict demands on food safety and hygiene, further complicates the challenge. They also need to disrupt operations by having very little integration in existing infrastructure and workflows, as it requires a lot of reconfigurations. Another reason for this hesitance to continue onward is the lack of skilled labor to program, operate, and maintain advanced robotic systems, especially among small and mid-sized enterprises. Social challenges also include worries about job replacement and acceptance by employees and consumers. All these factors together make it very hard to widely and seamlessly adopt robotics into food.

Food Robotics Market Segmentation Analysis:

By Robot

The Articulated segment held a dominant food robotics market share of around 48% in 2024, due to their versatility, accuracy, and load-carrying capabilities. For instance, these robots can be used for packaging, palletizing, and cutting, and are commonly used within the facilities of large-scale food processors. This realism enable them in carrying out complicated movements hence are well suited to automate repetitive tasks in harsh production environments.

The SCARA segment is expected to experience the fastest growth in food robotics market over 2025-2032 with a CAGR of 28.30%, due to its speed, compact shape, and efficiency for pick-and-place and assembly operations. Its rapid growth across Robots in Food Processing Market is driven by growing need for lightweight, accurate automation in packaging, and sorting applications, especially in tight spaces.

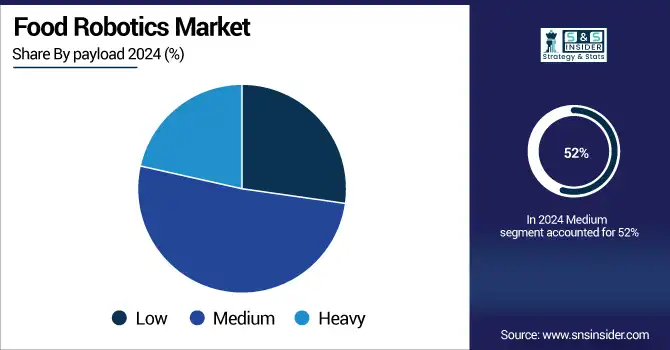

By Payload

The Medium segment held a dominant food robotics market share of around 52% in 2024, owing to their versatility, which makes them ideal for several types of food processing applications. They provide the perfect combination of speed, load capacity, and accuracy, making them ideal for end-of-line and in-line applications, such as packaging, palletizing and medium-weight food handling, in either fully automatic or semi-automatic production lines.

The Heavy segment is expected to experience the fastest growth in food robotics market over 2025-2032 with a CAGR of 25.90%, owing to increased demand for automation in bulk packaging, palletizing, and meat processing. They have high load capacity and high durability, making them suitable to improve labor-intensive processes in huge food processing factories.

By Application

The Packaging segment held a dominant food robotics market share of around 22% in 2024, owing to the increasing need for automation in primary and secondary packaging. The application of robotics to packaged food handling has accelerated speed, improved consistency, and enhanced hygiene measures to meet the growing expectations of consumers and regulatory demands. The rising trend of e-commerce, convenience food and labor shortages are also speeding up packaging line automation.

The Picking segment is expected to experience the fastest growth in food robotics market over 2025-2032 with a CAGR of 30.18%, due to the increasing demand for speed, precision, and hygiene when it comes to the sorting and handling of sensitive food products. The increasing sophistication in artificial intelligence, computer vision systems and sensor fusion are making it feasible to use robots for higher complexity pickings in diverse food processing scenarios.

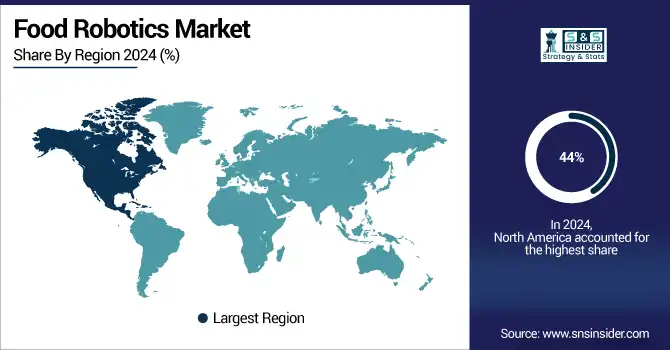

Food Robotics Market Regional Outlook:

In 2024, North America dominated the food robotics market and accounted for 44% of revenue share, due to strong technological infrastructure, early warmth toward automation, and the growing labor shortages faced by the food-processing sector. Additionally, Higher R&D investment, existence of major robotic manufacturers along with rising demand for packaged & ready to eat foods would continue to drive the regional leadership throughout the food robotics deployment.

Asia-Pacific is expected to witness the fastest growth in the food robotics Market over 2025-2032, with a projected CAGR of 22.52%, due to rapid industrialization, increasing demand for processed foods, and higher adoption of automation in countries, such as China, Japan, and India. The increasing adoption of smart manufacturing, followed by government support and the surge in food safety and efficiency, is further propelling the smart factories market growth in the region.

In 2024, Europe emerged as a promising region in the food robotics market, supported by a strong focus on food safety, automation, and sustainability. The presence of advanced manufacturing infrastructure, increasing labor costs, and stringent hygiene regulations are driving robotic adoption across food processing facilities. Additionally, rising demand for high-quality packaged foods and smart factory initiatives are boosting regional market growth.

LATAM and MEA are experiencing steady growth in the food robotics market, due to investments in food processing infrastructure, urbanization, and growing consumer demand for packaged and processed foods. Automation benefits are becoming more apparent in this region, with labor shortages and the need for better food safety fueling gradual adoption across key food industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Food Robotics Market Companies are ABB, KUKA AG, Kawasaki Heavy Industries, Ltd., Fanuc Corporation, Rockwell Automation, YASKAWA ELECTRIC CORPORATION, Denso Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, JR Automation (Hitachi, Ltd.). and Others.

Recent Developments:

-

In Nov 2024, FANUC has launched the M-950iA/500 serial-link robot, offering a 500 kg payload, wide motion range, and high durability for heavy-duty tasks in demanding environments.

-

In June 2025, Melco Mobility Solutions, a Mitsubishi Electric Group Company, has ordered nearly 100 Cartken Hauler robots to enhance autonomous logistics across industrial sites in Japan.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.23 Billion |

| Market Size by 2032 | USD 10.00 Billion |

| CAGR | CAGR of 20.64% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robot (Articulated, Parallel, SCARA, Cylindrical and Others) • By payload (Low, Medium and Heavy) • By Application (Packaging, Repackaging, Palletizing, Picking, Processing and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Food Robotics Market Companies are ABB, KUKA AG, Kawasaki Heavy Industries, Ltd., Fanuc Corporation, Rockwell Automation, YASKAWA ELECTRIC CORPORATION, Denso CorporatioN, Mitsubishi Electric Corporation, Universal Robots A/S, and JR Automation (Hitachi, Ltd.). |