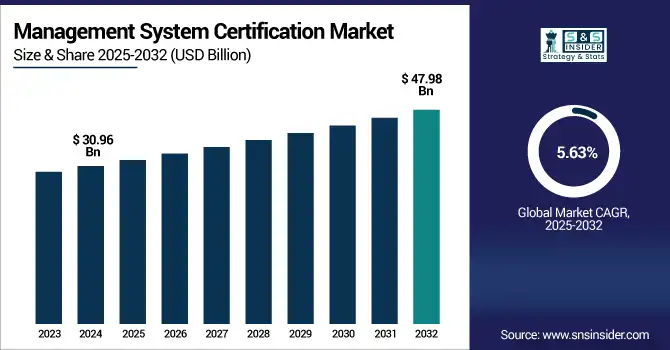

Management System Certification Market Size & Growth:

The Management System Certification Market size was valued at USD 30.96 Billion in 2024 and is projected to reach USD 47.98 Billion by 2032, growing at a CAGR of 5.63% during 2025-2032.

To Get more information on Management System Certification Market - Request Free Sample Report

The Management System Certification (MSC) market is experiencing robust growth as as businesses continue to prioritize compliance for environmental reasons, manage risk, and pursue more sustainable operations. Emerging regulatory demands and the movement towards local responsibility, are prompting burgeoning organizations to embrace conventions of the management framework. Such a trend is increasing transparency, operational efficiencies, and aiding companies in complying with local and international environmental standards. With a keeping pace trajectory, industries, world-wide will expand the needs of certification services that provide least structured certification services that presents potential opportunities for certifiers and related solutions platforms over the entire certification lifecycle in the coming years.

On January 20, 2025, China launched a zone-specific environmental management system covering 4,406 zones with tailored restrictions to promote high quality, eco-sensitive development. By 2025, the system aims to be fully established and integrated with marine and groundwater management, setting red lines for ecosystem protection and sustainable resource use.

The U.S Management System Certification Market size was valued at USD 5.54 Billion in 2024 and is projected to reach USD 9.00 Billion by 2032, growing at a CAGR of 6.25% during 2025-2032. Factors like increasing regulatory compliance requirements, digital transformation, and increased focus on operational efficiency and sustainability are driving this growth. Major trends applicable to the market include integrated management systems, remote auditing technologies, and sector-specific certification demand by manufacturing, healthcare, and IT sectors.

Management System Certification Market Dynamics:

Drivers:

-

Growing Risk Management and Compliance Needs Fuel Demand for Integrated Management System Certifications

The increasing need for comprehensive risk management, regulatory compliance demand and operational efficiency across industries having high-risk nature. Seamless integration is vital in areas like quality, environmental, occupational health, and industrial safety, and organizations in oil and gas, energy, and heavy manufacturing sectors are harnessing this through integrated management system (IMS) frameworks. It allows businesses to eliminate duplication of effort, increase transparency within operations and better resource reporting against global compliance standards. With rise in Investor and Stakeholder expectations on ESG performance and safety standards, companies are also moving toward having unified certification systems. The combination of these market pressures is fast-tracking adoption of multi-standard certifications, at a time when IMS is also emerging as a potent lever to achieve sustainment, a clearer pathway to maintaining competitive advantage and confidence level with regulatory agencies, in the increasingly patchy global Management System Certification market.

On March 13, 2025, Ukrnafta completed certification of its Integrated Management System, aligning with international standards for quality, environmental, occupational health, and industrial safety. Conducted by TÜV Austria’s subsidiary, the certification strengthens the company’s commitment to global best practices, operational excellence, and stakeholder trust.

Restraints:

-

High Implementation Complexity and Cost Hindering Widespread Adoption of Management System Certifications

The Management System Certification market is high complexity and cost towards implementing and maintaining certified systems. Reducing such overheads can be a challenge, primarily for small and medium-scale enterprises (SMEs), which may lack the financial and human resources for documentation, audits, training, and continuous improvement processes. Further, having multiple standards in a single system can be cumbersome and time-consuming to operate, particularly in a legacy or non-digital environment. This reluctance stems from not only the long-standing nature of current ways of working but also a contextual awareness of the long-term benefits of a profitable and compliant organization; rigidity in compliance structure, and a reactive nature towards technology, signaling a lack of awareness about long-term benefits further slows adoption. While global standards on compliance, safety, and sustainability are gaining more attention in recent years, these challenges pose entry barriers to organizations, especially in emerging economies and therefore leading the market to restraint.

Opportunities:

-

Surge in Renewable Energy Development Drives Demand for Certified Management Systems

The growing expansion of renewable energy projects, such as floating solar and tidal energy, is unlocking significant opportunities for the Management System Certification market. As companies in the clean energy sector scale their operations, there is an increasing need to implement standardized management frameworks that ensure quality, safety, and environmental responsibility. The pursuit of internationally recognized certifications enables these organizations to streamline internal processes, enhance credibility with stakeholders, and meet strict regulatory and sustainability requirements. With the global push toward clean energy transitions, companies are adopting triple certifications across quality, environmental, and occupational health systems to demonstrate compliance and leadership. This trend presents a rising opportunity for certification bodies to cater to the evolving demands of the fast-growing renewable energy sector.

June 13, 2025—Nova Innovation, based in Scotland, achieved a rare "triple ISO certification" for its quality, environmental and health & safety management systems. This restoration is emblematic of the company's commitment to operational excellence, sustainability and workplace safety.

Challenges:

-

Shortage of Qualified Auditors Limits Certification Capacity and Slows Market Expansion

The Management System Certification market is facing a growing challenge due to the shortage of qualified and accredited auditors, particularly in developing and remote regions. The growing demand for certifications in industries like manufacturing, energy, and healthcare has outpaced the relatively low pool of skilled workers who can perform thorough audits, creating bottlenecks in the certification process. The consequence is that it delays project times; it increases operational expenses for enterprises, and it limits scale for the certifiers to be efficient on what they do. Furthermore, the absence of on-ground presence may compromise continuity and reliability of audits, which is crucial for intricate or multi-standard systems. Tackling the homicide rate will take focused action: investing in training auditors, developing accreditation infrastructure, and embracing the digitalization of the audit.

Management System Certification Market Segmentation Insights:

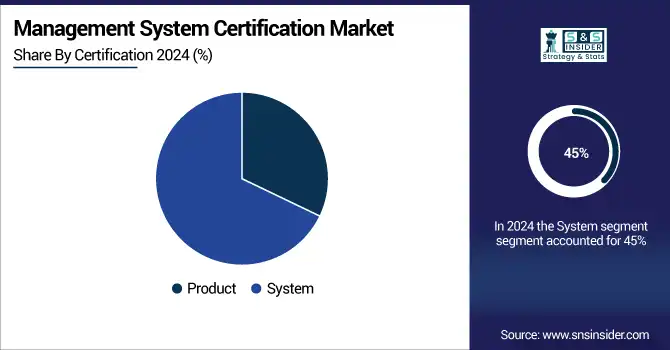

By Certification

The System segment held a dominant Management System Certification Market share of around 45% in 2024 and expected to be fastest growing with CAGR 6.61% during the forecast period 2025-2032. This strong growth is driven by the increasing demand for structured and integrated management frameworks that enhance operational efficiency, ensure regulatory compliance, and support sustainability goals. Organizations across sectors are adopting system-based certifications to streamline processes, reduce risks, and meet industry-specific standards, boosting the segment's long-term market potential.

By Service

The Certification & Verification segment held a dominant Management System Certification Market share of around 72% in 2024, due to increasing focus on regulatory compliance, quality assurance, and risk management across industries. Due to hectic competition and regulatory systems, organizations are relying on third-party certification to prove that they are complying with international standards, to be recognized as truly credible and to meet customer and stakeholder aspirations.

The Training & Business Assurance segment is expected to experience the fastest growth in the Management System Certification Market over 2025-2032 with a CAGR of 6.95%. This is due to the growing demand for resilience, workforce upskilling, and continuous improvement activities from organizations. With a focus on fortifying internal capabilities and aligning to international norms, the need for training and assurance services is increasing across industries.

By Application

The Quality Management Systems segment held a dominant Management System Certification Market share of around 34% in 2024, due to the growing emphasis on process optimization, product consistency, and customer satisfaction across all industries. As quality frameworks become popular among organizations for improved operational efficiencies, compliance, and greater competitive advantage internationally and locally, organizations are making use of quality frameworks.

The Cyber Security segment is expected to experience the fastest growth in the Management System Certification Market over 2025-2032 with a CAGR of 11.65%. The increasing prevalence of cyber threats, regulatory pressure for data protection, and the growing need for organizations to protect digital assets, ensure compliance, and maintain stakeholder trust in an increasingly interconnected world, are driving the rapid growth.

By Industry

The Manufacturing segment held a dominant Management System Certification Market share of around 34% in 2024, owing to the strong emphasis on quality control, operational efficiency, and compliance with global standards within the Manufacturing industry. More manufacturers are implementing certified systems which have been recognized for their role in increasing productivity, decreasing waste, and meeting customer and regulatory requirements, and are critical in maintaining global competitive edge and sustainable production practices in various sectors of manufacturing.

The Information Technology & Telecommunication segment is expected to experience the fastest growth in the Management System Certification Market over 2025-2032 with a CAGR of 9.61%. Due to growing concern for data security, digital transformation, and requirement of standardization. In order to provide high-quality service in a competitive landscape, companies in this sector are embracing certifications to facilitate compliance and develop customer confidence.

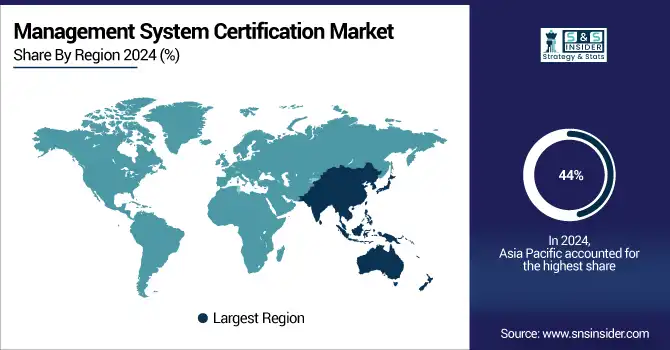

Management System Certification Market Regional Analysis:

In 2024, Asia Pacific dominated the Management System Certification market and accounted for 44% of revenue share, driven by fast industrialization, increased regulatory compliance needs, and the acceptance of international standards in manufacturing and IT & energy sectors. Additionally, given the rise in national government initiatives favoring such quality and environmental management, this would lead to an increased demand for certification from developing economies including China, India, and Southeast Asian nations.

China's strong industrial base, regulatory reforms and government-backed quality and sustainability initiatives have fueled rapid certification adoption across key sectors.

North America is expected to witness the fastest growth in the Management System Certification Market over 2025-2032, with a projected CAGR of 7.28%, This growth is fueled by increasing regulatory enforcement, rising focus on ESG compliance, and strong demand for cybersecurity, quality, and environmental management frameworks. The region’s advanced industrial landscape, digital transformation initiatives, and emphasis on risk management are driving businesses to adopt internationally recognized certification systems for enhanced credibility and performance.

In 2024, Europe emerged as a promising region in the Management System Certification Market, owing to stringent regulatory frameworks, high focus on sustainability, and prevalence of quality and environmental standards. With the green transition, digital compliance, and workplace safety, the region has experienced high demand for certified management systems, particularly in industries such as automotive, energy, healthcare and information technology.

LATAM and MEA is experiencing steady growth in the Management System Certification market, due to growing industrial sectors, rising international standards awareness, and increasing regulatory compliance pressure. Increasing demand for certification services driven by the government initiatives, foreign investments and improving quality, environment and safety in manufacturing and energy and infrastructure projects are supporting demand for certification services in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Management System Certification Market Companies are SGS SA, Bureau Veritas, Intertek Group plc, TÜV Rheinland, TÜV SÜD, DEKRA, DNV GL, UL LLC, Applus+, Eurofins Scientific.and Others.

Recent Developments:

-

On January 20, 2025, Switzerland’s SGS SA announced merger talks with France’s Bureau Veritas to form Europe’s largest inspection and certification firm, valued at USD 35 billion. The deal’s completion depends on approvals from key stakeholders, including Wendel SE and the French government.

-

On March 4, 2025, DEKRA concluded its participation at ELECRAMA 2025, showcasing innovations in electrical safety and announcing a new advanced product testing lab in Pune to support India's growing electronics sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 30.96 Billion |

| Market Size by 2032 | USD 47.98 Billion |

| CAGR | CAGR of 5.63% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Certification(Product, System) • By Service(Certification & Verification, Training & Business Assurance) • By Application(Quality Management Systems, Occupational Health & Safety, Cyber Security, Information Security, Food Safety, Environmental Management, Others) • By Industry(Aerospace & Defense, Automotive & Transportation, Construction, Consumer Goods & Retail, Energy & Utilities, Healthcare & Life Sciences, Information Technology & Telecommunication, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Management System Certification Market companies are SGS SA, Bureau Veritas, Intertek Group plc, TÜV Rheinland, TÜV SÜD, DEKRA, DNV GL, UL LLC, Applus+, Eurofins Scientific.and Others. |