Industrial Radiography Market Report Scope & Overview:

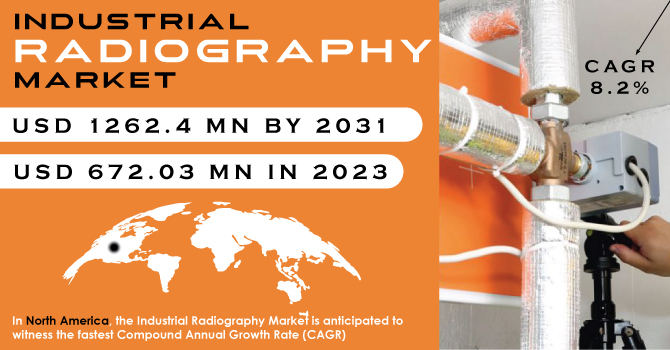

The Industrial Radiography Market Size was valued at USD 672.03 million in 2023 and is expected to reach USD 1262.4 million by 2031 and grow at a CAGR of 8.2% over the forecast period 2024-2031.

Industrial radiography is a technique that uses short-wavelength electromagnetic radiation to inspect materials for internal flaws. Industrial radiography is used to detect defects that are not visible to the naked eye. It is used in manufacturing plants to detect flaws, cracks, and surface contamination of products. In chemical plants, industrial radiography is used to inspect oil and gas pipelines as well as pressure vessels.

Get more information on Industrial Radiography Market - Request Sample Report

An anticipated surge in the size of commercial and military aircraft fleets is expected to generate significant opportunities within the industrial radiography market. Data from Boeing suggests a substantial increase in aircraft deliveries across key regions, with the Asia Pacific leading the way (17,645 deliveries projected between 2021-2040), followed by North America and Europe. This growth trajectory within the aviation sector is likely to translate into a heightened demand for industrial radiography services.

Furthermore, the International Energy Agency (IEA) forecasts a robust and accelerated growth in global electricity demand (approximately 3% annually) over the period 2023-2025, surpassing the growth rate observed in 2022. Additionally, the IEA estimates significant investments in the energy sector reaching USD 2.8 trillion in 2023. These trends are expected to fuel the industrial radiography market, as this technology plays a vital role in the petrochemical, gas, and energy & power sectors. Industrial radiography is extensively employed within the energy industry to identify and locate defects within critical infrastructure and equipment, ensuring their safety and reliability. In conclusion, the combined growth anticipated in the aviation and energy sectors is poised to propel the industrial radiography market forward.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increased demand for improved and efficient productivity from manufacturing units, as well as increased adoption of testing technology by automotive and aerospace & defence manufacturing companies to correct defects and flaws

-

Strict government safety regulations and high-precision inspection by various manufacturers

RESTRAINTS:

-

Exposure to radiation and high implementation costs.

The growth of the industrial radiography market. The use of ionizing radiation in industrial radiography presents health risks, including cell damage and increased cancer risk without proper safety measures. Stringent government regulations mandate specialized training for workers, requiring adherence to radiation safety protocols and the use of expensive protective gear. Moreover, the high implementation costs stem from the expensive equipment, specialized disposal procedures for radioactive sources, and the need for dedicated facilities with radiation shielding. These factors collectively contribute to the perception of industrial radiography as a complex and costly process, deterring smaller companies from investing despite its undeniable benefits in ensuring product quality and safety. The growth of the industrial radiography market. The use of ionizing radiation in industrial radiography presents health risks, including cell damage and increased cancer risk without proper safety measures. Stringent government regulations mandate specialized training for workers, requiring adherence to radiation safety protocols and the use of expensive protective gear. Moreover, the high implementation costs stem from the expensive equipment, specialized disposal procedures for radioactive sources, and the need for dedicated facilities with radiation shielding. These factors collectively contribute to the perception of industrial radiography as a complex and costly process, deterring smaller companies from investing despite its undeniable benefits in ensuring product quality and safety.

OPPORTUNITIES:

-

Opportunities in the industry are created by the automation of testing and inspection processes, industrialization in developing economies, and the provision of customized solutions.

CHALLENGES:

-

Fluctuations in raw material prices directly influence the overall cost of radiography equipment manufacturing, thereby affecting the accessibility and affordability of the technology.

Radiography equipment requires various raw materials for its construction, including metals, electronic components, and specialized materials for radiation shielding. Any changes in the prices of these raw materials can significantly affect the overall production cost of the equipment. When raw material prices increase, manufacturers may face higher production expenses, leading to elevated prices for radiography equipment. This, in turn, can make the technology less accessible and affordable for potential buyers, including industrial facilities and inspection service providers. Conversely, when raw material prices decrease, manufacturers may be able to offer radiography equipment at lower costs, potentially increasing its accessibility and affordability. Therefore, fluctuations in raw material prices directly impact the economic feasibility of manufacturing radiography equipment and can influence market dynamics, including demand and competition within the industry.

IMPACT OF RUSSIA UKRAINE WAR

Sanctions and trade disruptions limit access to crucial equipment, potentially causing a 20% price increase for Cobalt-60 sources. Shortages of films and detectors could delay projects by months. The economic fallout in Ukraine and Russia is expected to decrease demand for these services by 10-15%. Disruptions also lead to price fluctuations, potentially inflating operational costs by 5-10% for service providers. Skilled worker displacement due to the war can exacerbate these issues by creating labor shortages and driving up labor costs. These combined effects create a challenging environment for the industrial radiography market in Eastern Europe.

IMPACT OF ECONOMIC SLOWDOWN

Budgets cuts could lead to a 15-20% drop in capital expenditure for projects, reducing demand for inspection services. Project delays and cancellations might further impact demand by up to 30%. Key sectors like oil & gas, which rely heavily on radiography, could see a 10-15% activity decline, translating to revenue losses for service providers. Increased competition in a sluggish market could force service providers to cut prices by 5-10%, squeezing their margins.

Companies might still prioritize essential maintenance and safety inspections (5-10% of demand) to avoid costly breakdowns. Additionally, the cost-effectiveness of industrial radiography in preventing accidents could see some companies (5-7%) continue utilizing these services at a reduced rate.

MARKET SEGMENTATION:

BY IMAGING TECHNIQUE

-

Digital Radiography

-

Film-based Radiography

The segmentation of the Industrial Radiography Market, based on technology, comprises film-based radiography and digital radiography. Within this segmentation, the digital radiography segment has emerged as the top revenue generator. Digital radiography, the latest non-destructive testing inspection technique, instantly produces digital images on a computer, eliminating the need for an intermediate cassette to transfer examinations. The adoption of digital radiography is on the rise due to its numerous advantages, including faster exposure times, real-time applications, advanced analysis and defect-recognition tools, enhanced detail detectability, improved SNR and linearity, portability, and rapid feedback.

BY RADIATION TYPE

-

Gamma Rays

-

X Rays

Segmentation of the Industrial Radiography Market based on radiation type includes X-rays and Gamma rays. Among these segments, the X-rays category has emerged as the top revenue generator, driven by ongoing technological advancements, intensified product development, and increased government funding and investment. The market's focus on enhancing and innovating X-ray units further fuels the growing adoption of this segment. Industrial radiography primarily employs industrial X-ray machines, which come in various sizes and capacities.

BY END USER

-

Petrochemicals & Gas

-

Power Generation

-

Aerospace

-

Consumer Electronics

-

Manufacturing

-

Automotive & Transportation

-

Others

The industrial radiography market is segmented into Petrochemicals & Gas, Power Generation, Aerospace, Consumer Electronics, Manufacturing, Automotive & Transportation, and Others. During the forecast period, the market for petrochemicals and gas end users is expected to grow at the fastest rate. In this end user, industrial radiography testing includes monitoring pipelines, storage tanks, and refining equipment to measure internal corrosion without externally damaging the material. The deep-sea oil and gas industry relies heavily on industrial radiography. Oil leaks or spills can occur over time in this industry if refinery infrastructure is not carefully monitored, resulting in extremely high cleanup costs.

REGIONAL ANALYSIS:

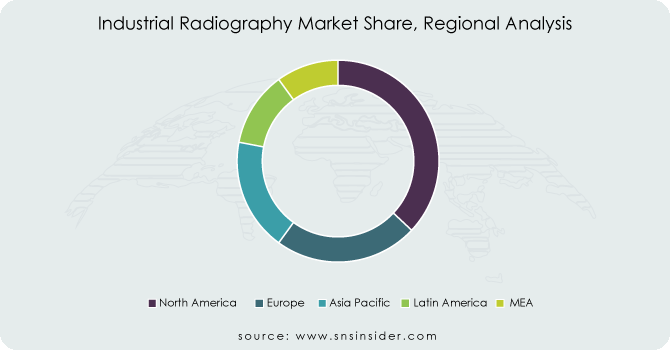

The Asia-Pacific Industrial Radiography market is poised to dominate, driven by stringent government safety regulations, which have spurred significant demand for industrial radiography equipment. In Europe, the Industrial Radiography market holds the second-largest market share, attributed to the region's prominent aerospace industry. Within Europe, the German Industrial Radiography market commands the largest market share, while the UK Industrial Radiography market exhibits the highest growth rate.

In North America, the Industrial Radiography Market is anticipated to witness the fastest Compound Annual Growth Rate (CAGR), fueled by advancements in the automotive, aerospace, manufacturing, and oil sectors. These industries extensively utilize industrial radiography techniques for maintenance, inspection, and dimensional measurement purposes.

Get Customized Report as per Your Business Requirement - Request Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The key players in the industrial radiography market are 3DX-RAY Ltd., Anritsu Corporation, PerkinElmer Inc., Shimadzu Corporation, Nikon Corporation, COMET Holding AG, Bosello High Technology SRL, General Electric, FUJIFILM Holdings Corporation, Mettler-Toledo International Inc & Other Players.

PerkinElmer Inc-Company Financial Analysis

RECENT DEVELOPMENT

In February 2023: Carestream Health India introduced The DRX Compass, a precise, straightforward, and flexible digital radiography solution designed to elevate radiologists' productivity to a new level.

In March 2023: Fujifilm Medical Systems USA announced the official launch of the Fujifilm FCR Vixera G300D. This groundbreaking digital radiography system offers top-notch image quality, rapid acquisition rates, and improved workflow efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 672.03 million |

| Market Size by 2031 | US$ 1262.4 million |

| CAGR | CAGR of 8.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Imaging Technique (Digital Radiography, Film-Based Radiography) • By Radiation Type (Gamma Rays, X Rays) • By End-User (Petrochemicals & Gas, Power Generation, Aerospace, Consumer Electronics, Manufacturing, Automotive & Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3DX-RAY Ltd., Anritsu Corporation, PerkinElmer Inc., Shimadzu Corporation, Nikon Corporation, COMET Holding AG, Bosello High Technology SRL, General Electric, FUJIFILM Holdings Corporation, and Mettler-Toledo International Inc. |

| Key Drivers | • Strict government safety regulations and high-precision inspection by various manufacturers |

| RESTRAINTS | • Exposure to radiation and high implementation costs. |