Hybrid Fiber Coaxial Market Size & Growth:

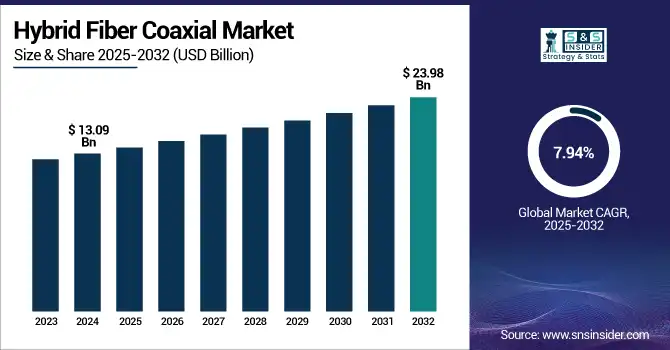

The Hybrid Fiber Coaxial Market Size was valued at USD 13.09 billion in 2024 and is expected to reach USD 23.98 billion by 2032 and grow at a CAGR of 7.94% over the forecast period 2025-2032. The worldwide Hybrid Fiber Coaxial market is on a roll, with rising demand for high-speed internet, digital TV and VoIP services. Growth is supported by the upgrading of networks by cable operators, increasing penetration of broadband, and technological advancements in DOCSIS. The market is driven by its cost-effective fiber/coaxial infrastructure mixture that accelerates the bandwidth delivery at a scale. According to research, Global fixed broadband subscriptions surpassed 1.4 billion in 2023, with fiber and HFC leading last-mile delivery. Video streaming traffic accounts for over 65% of global internet traffic, necessitating high-bandwidth networks like HFC.

To Get more information on Hybrid Fiber Coaxial Market - Request Free Sample Report

The U.S. Hybrid Fiber Coaxial Market size was USD 3.99 billion in 2024 and is expected to reach USD 6.49 billion by 2032, growing at a CAGR of 6.34% over the forecast period of 2025–2032.

The U.S. Hybrid Fiber Coaxial market continues to grow gradually on the back of growing demand for broadband, escalating high-definition content consumption, and continued network upgrading by cable operators. Adoption of DOCSIS 3.1 and 4.0 technologies helps boost performance and capacity, and heavy investment in infrastructure fuels long-term expansion. Smart home uptake and integration of digital services also positively affect the market.

According to research, In 2024, over 57% of U.S. households use smart home devices, requiring high-speed, low-latency connections & Average monthly data usage per broadband subscriber in the U.S. exceeded 650 GB in 2024.

Hybrid Fiber Coaxial Market Dynamics

Key Drivers:

-

Rising Demand for High-Speed Internet and Streaming Services Drives the Market Growth.

Increased video streaming, online work, and cloud gaming has played an important role in asking for high-speed, high-quality broadband. The economical way of offering services with HFC is to entirely replace existing coaxial network rather than its complete replacement. HFC has been used by the cable operators for bandwidth extension through DOCSIS 3.1 and 4.0 to increase speed in the data transmission process. This increasing need for continuous connectivity is among the key drivers of the growth of the HFC market in both commercial and residential segments.

According to research, upgrading HFC networks to DOCSIS 3.1 costs up to 40% less than full fiber rollout while supporting gigabit speeds.

Restrain:

-

Regulatory Compliance and Spectrum Allocation Issues Restrict the Growth of the Market.

There are government regulations on spectrum allocation, data privacy, and infrastructure sharing, but the rules differ from country to country. Such regulatory complications may slow the introduction of HFC upgrades, and the associated costs of compliance. Competition for spectrum with other communication services is further likely to restrict the availability of required bandwidth for HFC operators, and this may in turn limit performance/congestion and the ability to expand in certain urban and rural areas.

Opportunities:

-

Gradual network upgrades ensuring scalability and future-proof growth for cable operators in a competitive market

Cable operators have a prime opportunity to evolve their infrastructure without major churn or large capital expenses to respond to increasing bandwidth needs. Modular, flexible solutions enable operators to evolve from GPON to more advanced technologies such as XGS-PON and 25G PON without network disruption, and be ready for the future. This approach enables operators to expand their network capacity in a step by step manner, avoiding high capital investments and ensuring service and performance quality. Because of this, they can provide faster, more consistent services to residential and enterprise customers and remain competitive in a challenging market. The scalability of these "upgrades", set operators up for long term growth and flexibility as the technological tectonics continue to shift and rumble.

Nokia's 25G PON technology is revolutionizing fiber broadband, enabling cable operators to offer ultra-fast, scalable networks that meet growing customer demands. This solution supports seamless upgrades and broadens market opportunities with minimal disruption.

Challenges:

-

Competition from Fiber-to-the-Home (FTTH) and Wireless Technologies Challenges the Market Stability.

The increasing demand for fibre-to-the-home (FTTH) and next-generation wireless technologies, such as 5G, represents a considerable challenge for HFC networks. Note that such technologies provide high bandwidth, low delay/latency, and can be made to scale long-term, showing them to be a better choice are desirable. With consumers and businesses demanding future-proof connectivity solutions, HFC operators need to innovate new ways to offer value. The market is struggling between the cost to upgrade and the potential of losing customers to more advanced fully fiber based solutions.

Hybrid Fiber Coaxial Market Segmentation Outlook:

By Type

Multi-mode hybrid fiber coaxial cable segment dominated the overall market with revenue share of 67.95% in 2024 and is gaining popularity on account of its cost-effectiveness and wide deployment across the residential and commercial broadband networks. Hybrid fiber coaxial companies such as Actelis Networks have launched product like the GigaLine 800 Hybrid-Fiber, improving last-mile broadband that combines fiber optics with other types of transmission. Also, CommScope's introduction of amplifier and optical node platforms with DOCSIS 4.0 support in October 2023 has supported network capacity, allowing multi-mode HFC cables to dominate high-speed internet service delivery.

The hybrid fiber coaxial cable single-mode segment is expected to fastest CAGR of 9.16% from 2025 to 2032 due to its high bandwidth capabilities and suitability for long-distance data transmission. Corning Incorporated's growth in optical cable manufacturing, with AT&T, reflects the sector's move towards single-mode solutions to address growing data needs. Additionally, Nokia's launch of the Beacon 10, a Wi-Fi 6E gateway that can deliver 10Gbps performance, complements single-mode HFC infrastructure, improving network efficiency and supporting the hybrid fiber coaxial market growth.

By Technology

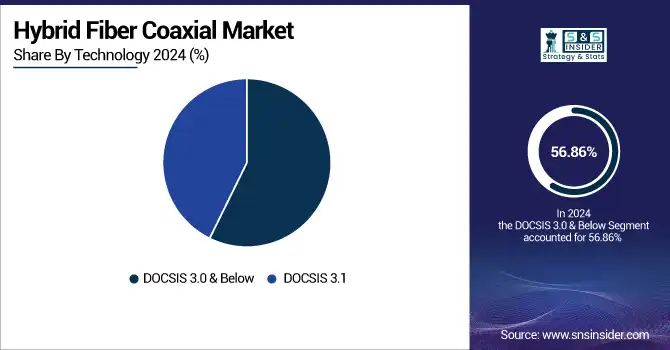

DOCSIS 3.0 & below segment dominated in Hybrid Fiber Coaxial, commanding 56.86% of revenue in 2024. It is well-liked because it is mature, cost-effective, and backwards compatible with the ubiquitous existing infrastructure. Operators such as Spectrum and Cox Communications continue to run much of their network on DOCSIS 3.0, with an eye to maximizing ROI before upgrading to newer technologies. This established foundation serves to maintain customer satisfaction while deferring costly overhauls, particularly in areas where gigabit demand is still developing.

The DOCSIS 3.1 segment is expected to the fastest growth rate, with a projected CAGR of 8.91% from 2025 to 2032, driven by increasing bandwidth requirements. The technology provides multi-gigabit speeds, lower latency, and energy efficiency perfect for contemporary digital applications. Operators such as Comcast and Liberty Global have introduced DOCSIS 3.1-based services to provide future-proof broadband infrastructure. Operators are upgrading rapidly to DOCSIS 3.1, driven by mounting consumer demands for ubiquitous connectivity, to remain competitive in the dynamic hybrid fiber coaxial market scenario.

By Component

The CMTS/CCAP segment dominated in Hybrid Fiber Coaxial market share in 2024 at 27.31% due to its position at the center of broadband traffic management. The components provide streamlined signal processing and integration in high-capacity networks. CommScope and other companies continue to drive this front with DOCSIS 4.0-ready CMTS and CCAP solutions, facilitating smoother upgrade of services. Their innovation reinforces the backbone of HFC infrastructure, in line with growing internet demand and creating a foundation for cable systems to be future-proof.

The Fiber Optic Cable segment is projected to have the fastest CAGR of 9.33% during 2025-2032, driven by the global hybrid fiber coaxial market trends toward high-speed, low-latency broadband. These wires are the main line in HFC systems on which data is transmitted. Companies such as HFCL are introducing high-count ribbon cables optimized for the urban density, such as IBR cables in the UK. Such trends promote the densification of fiber networks consistent with the overall HFC migration and scalable approach to internet delivery.

Hybrid Fiber Coaxial Market Regional Analysis:

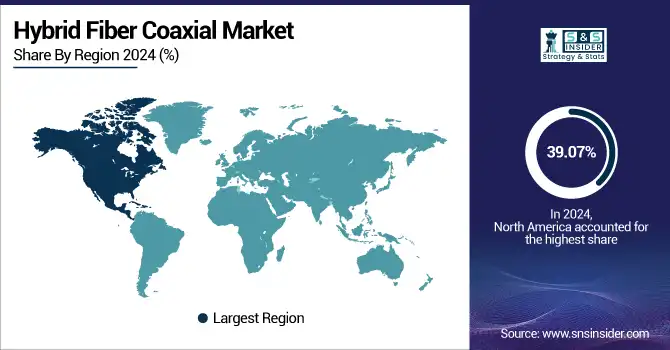

North America dominated the highest share of revenue at 39.07% in 2024 due to well-established cable networks and steady investment in HFC upgrades in the region. Service providers in the U.S. and Canada are pushing DOCSIS 3.1 and 4.0 upgrades in a bid to cater to explosive broadband demand. Altice USA, for example, has been upgrading its hybrid networks to provide faster gigabit internet in suburban and rural communities. These developments reinforce North America’s leadership in adopting cutting-edge hybrid fiber coaxial technologies to maintain service quality.

-

The U.S. leads the North American market owing to its superior broadband infrastructure, early introduction of DOCSIS technologies, and ongoing investment by large cable operators in network upgrades to meet high-speed internet and digital service needs.

Asia Pacific region is expected to have the fastest CAGR of 9.34% during 2025 to 2032. The region's boom is fueled by emerging economies such as India, Indonesia, and Vietnam's growing need for broadband access. Players like Sterlite Technologies are investing in fiber deployment as well as hybrid access networks that will allow carriers to provide high-speed internet without higher infrastructure expense. Government-sponsored digital projects further drive HFC uptake throughout this vast and fast-developing region.

-

China dominated the Asia Pacific market on account of the huge population, strong government supported broadband programs, increasing rate of urbanization, and aggressive expansion of fiber and hybrid network infrastructure by the telecom operators to meet the rising need for digital connectivity.

Europe holds a significant share in the market, due to an increasing requirement for high-speed broadband and investments for upgrading the existing cable infrastructure. The likes of Germany, the UK and France are equally actively launching DOCSIS 3.1-enhanced and fiber-rich HFC networks as part of continued regulatory drives to boost digital access and a competitive telecom market throughout the region.

-

Germany holds the highest market share of European market because of its robust broadband structures and huge investments of telecom companies. The nation is among the region’s HFC market leaders in terms of network upgrade and advanced technology deployment.

The Middle East & Africa and Latin America HFC (Hybrid Fiber Coaxial) market is growing. The UAE as well as Saudi Arabia are also promoting HFC utilization in the Middle East. Countries in Latin America region, such as Brazil and Argentina, are engaged in the deployment of broadband to meet the growing demand for connectivity.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Hybrid Fiber Coaxial Market are:

Major Key Players in Hybrid Fiber Coaxial Market are Huawei Technologies Co Ltd, Nokia Networks, Cisco System Inc, Technicolor SA, Corning Incorporated, Cyan Corporation, ZTE Corporation, Infinera Corp, Finisar Corporation, Skyworks Solutions Inc and others.

Hybrid Fiber Coaxial Market Recent Trends:

-

March 2025, Cisco launched advanced DOCSIS 4.0 solutions, enabling faster broadband speeds and optimized network efficiency, supporting the evolution of HFC networks to meet growing data demands.

-

January 2025, Skyworks announced new products tailored for 5G infrastructure and IoT applications, which can enhance the performance and capabilities of HFC networks in delivering high-speed connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 13.09 Billion |

| Market Size by 2032 | USD 23.98 Billion |

| CAGR | CAGR of 7.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Single-mode hybrid fiber coaxial cable, Multi-mode hybrid fiber coaxial cable) •By Technology (DOCSIS 3.0 & Below and DOCSIS 3.1) •By Component (CMTS/CCAP, Fiber Optic Cable, Amplifier, Optical Node, Optical Transceiver, Splitter, and CPE) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Huawei Technologies Co Ltd, Nokia Networks, Cisco System Inc, Technicolor SA, Corning Incorporated, Cyan Corporation, ZTE Corporation, Infinera Corp, Finisar Corporation, Skyworks Solutions Inc |