Freelance Platforms Market Report Scope & Overview:

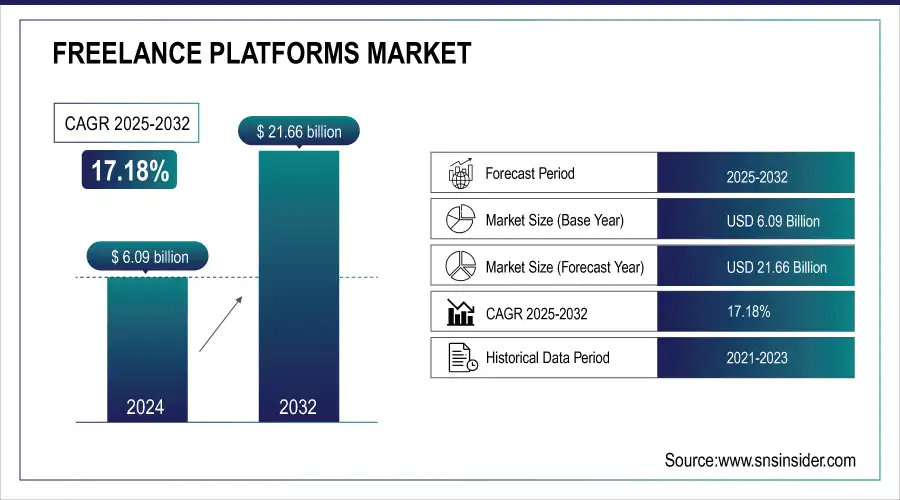

The Freelance Platforms Market was valued at USD 6.09 billion in 2024 and is expected to reach USD 21.66 billion by 2032, growing at a CAGR of 17.18% from 2025-2032.

To Get more information on Freelance Platforms Market - Request Free Sample Report

The Freelance Platforms Market is witnessing notable growth driven by the shift toward flexible work models and digital transformation. The freelance workforce is expanding across regions, with North America and Asia-Pacific leading the adoption due to rising gig opportunities. Income trends vary based on service categories, with high demand in areas like software development, digital marketing, and graphic design. Client spending on freelance services is also increasing, particularly in tech-driven economies where remote talent is becoming essential. Additionally, the adoption of AI-powered tools is reshaping the freelancing landscape, enhancing job matching, productivity, and financial tracking. A fresh perspective in the market report includes rising demand for specialized freelancers, increasing gig economy contributions to GDP, and emerging innovations within freelance platforms.

Freelance Platforms Market Trends

-

Growing demand for flexible, remote, and project-based work is fueling the expansion of freelance platforms.

-

Integration of AI-driven matching algorithms is improving talent–project alignment and efficiency.

-

Increasing adoption across IT, marketing, design, writing, and consulting sectors is boosting platform usage.

-

Rising number of skilled professionals seeking independent careers is enhancing workforce participation.

-

Enhanced payment security, digital contracts, and compliance features are strengthening trust and adoption.

-

Enterprises are increasingly leveraging freelance platforms to reduce costs and access global talent pools.

-

Integration of collaboration tools, communication suites, and project management features is shaping next-gen freelance ecosystems.

-

Growth of niche and specialized freelance marketplaces is providing tailored solutions for industry-specific needs.

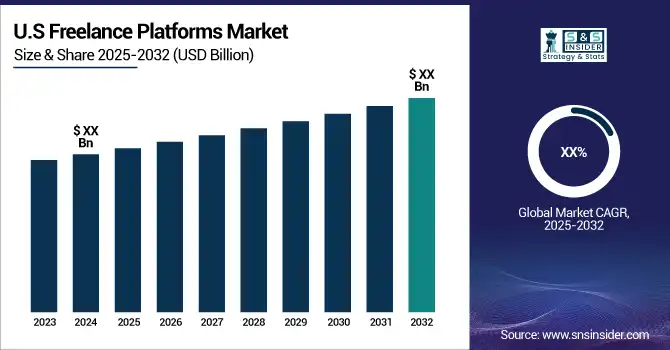

Growth in the U.S. The Freelance Platforms Market was valued at USD 1.3 billion in 2023 and is expected to reach USD 5.2 billion by 2032, growing at a CAGR of 16.91% from 2024-2032, driven by increasing demand for flexible work arrangements, technological advancements enabling remote collaboration, and rising adoption of AI-powered freelance tools. The gig economy's contribution to the U.S. GDP is expanding, with a growing shift toward skilled freelancing in sectors like IT, design, and consulting. Future forecasts indicate sustained growth due to workforce digitization, higher freelance platform adoption, and the continued rise of specialized freelancers.

Freelance Platforms Market Growth Drivers:

-

Increasing demand for flexible work, remote collaboration, and specialized freelancing is driving market growth.

The increasing shift toward flexible work models and the growing digital economy are key drivers of the freelance platforms market. Many businesses are embracing remote work to access a global talent pool, reduce operational costs, and enhance productivity. The rising number of professionals opting for freelancing, driven by job flexibility, autonomy, and improved work-life balance, is accelerating the adoption of freelance platforms. Additionally, advancements in technology, such as AI-powered job matching, productivity tools, and cloud-based collaboration platforms, are further fueling market growth. Sectors like IT, design, content creation, and digital marketing are particularly driving demand for freelancing services in the global and regional markets.

Freelance Platforms Market Restraints:

-

Inconsistent income, lack of job security, and unclear tax regulations hinder wider market adoption.

While this represents a significant growth opportunity, the freelance platforms market also has its shortcomings, most notably the income insecurity and job security for freelancers. Unlike traditional full-time employment, freelancing faces irregular workloads, which leads to a lack of income stability. But many workers are turning to freelancing, partly because they no longer have benefits like health insurance, paid time off or retirement plans. Further limiting market growth are regulatory obstacles with unclear taxation for freelancers in some countries. Freelancers can also have trust issues with businesses because of worries about work quality, reliability, and confidentiality. All of these factors together contribute to stunting the wider acceptance of freelance platforms, particularly in areas with conventional employed worker bias.

Freelance Platforms Market Opportunities:

-

Rising demand for niche skills, AI-driven tools, and freelancing in emerging markets offer growth potential.

The freelance platforms market offers significant growth opportunities due to the rising demand for specialized talent in sectors like IT, AI, cybersecurity, and blockchain. Businesses increasingly rely on freelancers for short-term, high-skill projects, which creates opportunities for niche platforms catering to specific skill sets. Additionally, the growing integration of AI and automation in freelance platforms enhances efficiency, providing personalized job recommendations, secure payment options, and real-time project tracking. Emerging markets in Asia-Pacific, Latin America, and Africa present untapped potential as digital infrastructure improves and freelancing gains traction. Partnerships between freelance platforms and businesses can also create innovative solutions to bridge skill gaps and enhance workforce flexibility.

Freelance Platforms Market Challenges:

-

Intense competition, quality control issues, freelancer burnout, and cybersecurity risks pose market challenges.

The freelance platforms market faces several challenges, including intense competition and freelancer-client disputes. As the number of freelancers increases, competition for jobs rises, potentially leading to downward pressure on earnings. Quality control remains an issue, as not all freelancers meet client expectations, which can impact platform reputation. Freelancer burnout due to inconsistent work-life boundaries and the gig economy's lack of formal labor protections are also growing concerns. Moreover, cybersecurity risks, such as data breaches and payment fraud, threaten the trust and security of freelance transactions. Addressing these challenges through enhanced verification, transparent policies, and improved digital safeguards is essential for long-term market sustainability.

Freelance Platforms Market Segmentation Analysis

By Component, Platform segment dominated in 2024 with a 54.0% revenue share.

In 2024, the platform segment dominated the market with over a 54.0% revenue share. Based on the platform, the market is segmented into project-based, solution-based, talent-based, and hybrid. Freelance platforms function as online marketplaces, connecting qualified freelancers and potential employers with access to work and payment transactions. Freelancer platforms, by using prospective customers, directly connect freelancers without going through mediation platforms such as recruitment or talent search agencies. They simplify the entire how it works, including job posting, proposal submission, messaging, project management, and secure payment transactions.

The services segment is expected to register the fastest CAGR during the forecast period. While the freelance platform market has a range of offerings, dividing them between technological and managed services, they all ultimately serve different sides of the same freelance coin. These include talent engagement, strategy consulting, org consulting, engineering support, freelance recruitment, etc.

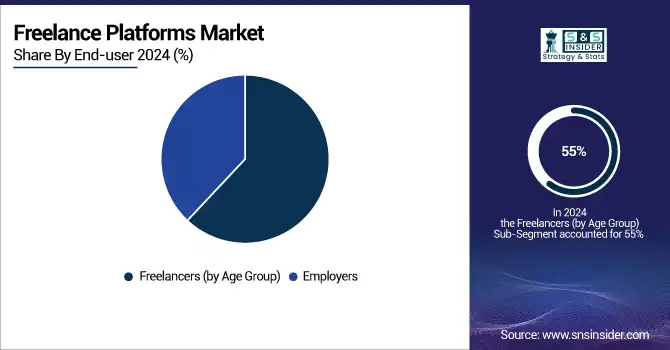

By End-User, Freelancers segment dominated in 2024 with 55% revenue share.

In 2024, the freelancers segment dominated the market and accounted for 55% of the revenue share. The freelancer portion is classified by age groups: 18 - 34; 35 - 54; and over 55. Flexible working hours, working from anywhere, access to a global talent marketplace, and the option to choose preferred work are some of the reasons for this trend. The determination of this age group to upskill and adapt to challenges like late payments, unstable client retention, and employment uncertainties will contribute to the growth of the freelance platform market, even during the forecast period. Their entrepreneurial spirit and interest in creating their career path is also a good fit for freelancing.

The employer's segment is projected to grow at a considerable CAGR during the forecast period. The market is divided into SMEs and large enterprises in the employer segment. Segment growth is also driven by the increasing entrepreneurship and start-ups. Start-ups and small businesses typically have restricted financials and do not have sufficient manpower to employ full-time employees in all positions.

By Application, Project management segment led in 2024 with the highest share

In 2024, the project management segment held a commanding revenue share. An increasing need for niche project management skills is one of the key drivers of the freelance platforms segment. Most sectors need certain project management knowledge and skills pertinent to their field to handle and manage more complex projects. Freelance platforms have removed the barriers to businesses by making it easy to search for project managers with the niche skills required in these industries. Instead of onboarding full-time employees with general project management experience, organizations are turning to freelancers with specific skill sets that can offer them personalized solutions and add value when they need it to complete projects successfully.

The web & graphic design segment is anticipated to register the fastest CAGR throughout the forecast period. The increasing demand for web and graphic designers is propelled by a migration to digital marketing and branding. As companies move towards increasingly digital marketing strategies, there has been a demand for visually impactful and engaging content.

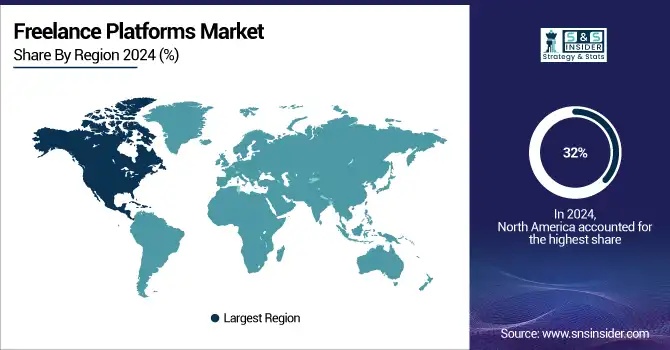

Freelance Platforms Market Regional Analysis

North America Freelance Platforms Market Insights

North America dominated the market and accounted for 32% of the revenue share in 2023. Increase in gig economy – The emergence of the gig economy is a key factor propelling the growth of the freelance platforms industry in North America. In recent years, the gig economy, based on short-term contracts and freelancing rather than permanent full-time jobs, has really taken off. There are several workers who want to get involved in the flexible and diverse work environment where they can learn.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Freelance Platforms Market Insights

Asia Pacific is expected to register the fastest CAGR during the forecast period, driven by the proliferation of remote and flexible work policies adopted by countries in APAC. With economies across the region undergoing further digitalization, companies are more receptive to remote collaboration, allowing freelancers to work with clients all over the world. Countries such as India, China, and the Philippines have huge numbers of skilled professionals in various fields, including IT, graphic design, digital marketing, and customer service.

Europe Freelance Platforms Market Insights

Europe in the Freelance Platforms Market is witnessing steady growth driven by rising demand for flexible work arrangements, digital transformation, and a skilled remote workforce. Businesses across IT, design, content creation, and consulting increasingly rely on freelance platforms to access specialized talent. Government support for digital innovation and the surge in cross-border collaboration further enhance adoption, positioning Europe as a key region shaping the freelance economy’s future.

Middle East & Africa and Latin America Freelance Platforms Market Insights

The Freelance Platforms Market in the Middle East & Africa and Latin America is witnessing strong growth driven by digital transformation, rising internet penetration, and a young, skilled workforce. Governments’ push for digital economies, remote-first adoption, and entrepreneurship support further accelerate platform usage. Countries like Brazil, Mexico, and emerging African markets are becoming attractive hubs for global outsourcing, offering cost-effective, specialized freelance services to businesses worldwide.

Freelance Platforms Market Competitive Landscape:

Upwork Inc.

Upwork Inc. is a leading player in the Freelance Platforms Market, connecting businesses with independent professionals across diverse industries. The platform enables companies to scale projects efficiently while offering freelancers global exposure and flexible opportunities. With advanced collaboration tools, secure payments, and AI-driven talent matching, Upwork drives digital workforce transformation. Its strong brand presence and wide service portfolio position it as a dominant force in the evolving gig economy.

-

Upwork Inc. (2025) Introduced “Upwork Updates: Summer 2025” with over 75 new features, including AI-powered Uma for instant interviews, unified app workflows, enhanced messaging, and Business Plus tools that streamline hiring and collaboration.

Fiverr International Ltd.

Fiverr International Ltd. is a prominent player in the Freelance Platforms Market, renowned for its gig-based model that connects businesses with freelancers offering services across creative, digital, and professional domains. The platform’s simplicity, transparent pricing, and AI-driven matching tools have strengthened its global user base. By empowering freelancers with visibility and businesses with quick access to talent, Fiverr continues to reshape the digital economy with innovation and scalable freelance solutions.

-

Fiverr International Ltd. (2025) Launched Fiverr Go, a new AI-driven platform empowering creators to scale services while retaining creative rights and autonomy over their work. Fiverr Investors

-

Fiverr International Ltd. (2025) Rolled out a Freelancer Equity Program, offering U.S.-based top-performing freelancers equity stakes recognizing their contributions and aligning incentives with corporate success.

Key Players

The major key players along with their products are

-

Fiverr International Ltd.

-

Toptal, LLC

-

Freelancer.com (Freelancer Limited)

-

PeoplePerHour Ltd.

-

Guru.com

-

99designs (by Vista)

-

FlexJobs

-

SimplyHired (by Recruit Holdings)

-

Outsourcely

-

AngelList

-

Hubstaff Talent

-

Behance (by Adobe)

-

Truelancer Internet Pvt. Ltd.

-

DesignCrowd Pty Ltd

-

Catalant Technologies, Inc.

-

Crowded Inc.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 6.09 Billion |

|

Market Size by 2032 |

US$ 21.66 Billion |

|

CAGR |

CAGR of 17.18 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Platform, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Upwork Inc., Fiverr International Ltd., Toptal, LLC, Freelancer.com (Freelancer Limited), PeoplePerHour Ltd., Guru.com, TaskRabbit, Inc., 99designs (by Vista), FlexJobs, SimplyHired (by Recruit Holdings), Outsourcely, AngelList, Workana, Hubstaff Talent, Behance (by Adobe), Truelancer Internet Pvt. Ltd., DesignCrowd Pty Ltd, Catalant Technologies, Inc., Crowded Inc. |