Data Centre Support Infrastructure Market Report Scope & Overview:

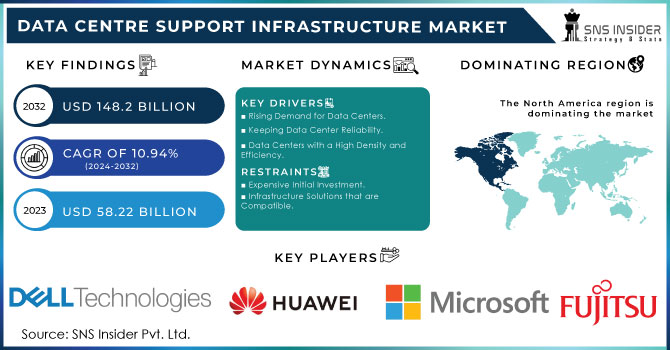

The Data Center Support Infrastructure Market Size was valued at USD 55.98 Billion in 2023 and is expected to reach USD 126.87 Billion by 2032 and grow at a CAGR of 9.6% over the forecast period 2024-2032.

The Data Center Support Infrastructure Market is evolving rapidly, driven by the surging demand for high-performance computing, cloud storage, and increased internet penetration. In addition to conventional metrics, key statistical insights include the average power usage effectiveness (PUE) across facilities, which has improved from 1.67 in 2013 to around 1.55 in recent years, indicating better energy efficiency. Another vital parameter is the uptime reliability rate, with Tier IV data centers offering 99.995% availability, reducing potential annual downtime to just 26.3 minutes. The market also reflects growth in rack density, now averaging over 8kW per rack in enterprise setups, pushing investments in advanced cooling systems. Environmental metrics like carbon footprint per megawatt are also increasingly tracked as sustainability becomes a strategic priority.

Get more information on Data Centre Support Infrastructure Market - Request Sample Report

The U.S. Data Center Support Infrastructure Market size was USD 15.04 billion in 2023 and is expected to reach USD 30.48 billion by 2032, growing at a CAGR of 8.23% over the forecast period of 2024–2032.

The U.S. Data Center Support Infrastructure Market is experiencing steady growth, driven by the increasing demand for reliable, scalable, and energy-efficient data center environments. As digital transformation accelerates across industries, the need for advanced cooling systems, power management solutions, and security infrastructure is on the rise. The adoption of edge computing, AI, and cloud services further fuels the market, prompting continuous infrastructure upgrades. Emphasis on sustainability and operational efficiency is also influencing investment in greener technologies. Additionally, the integration of smart monitoring and DCIM tools is enhancing infrastructure performance and visibility across data center operations.

Market Dynamics

Key Drivers:

-

Rising Adoption of Cloud Computing and AI Technologies Drives Growth of the Data Center Support Infrastructure Market

The rapid adoption of cloud computing, big data analytics, and artificial intelligence across industries is significantly driving the demand for robust data center support infrastructure. Enterprises are increasingly relying on digital platforms to manage and store enormous volumes of data, which requires reliable, scalable, and secure data center environments. This surge in digital dependency has fueled investments in support systems such as precision cooling, UPS systems, rack solutions, and intelligent power distribution units. Additionally, hyperscale data centers and colocation facilities are expanding to accommodate the needs of global cloud providers. These developments demand advanced infrastructure capable of ensuring high uptime, energy efficiency, and operational stability. As organizations modernize their IT ecosystems, the need for high-performance support systems continues to escalate. This ongoing transformation is positioning data center support infrastructure as a foundational element in enabling business continuity, high-speed connectivity, and data-driven decision-making across the digital economy.

Restrains:

-

High Capital and Operational Expenditure Restrains Expansion of the Data Center Support Infrastructure Market

Despite the market’s growth, the high capital investment required for developing and maintaining advanced data center support infrastructure is a significant restraint. Establishing a new data center or upgrading existing infrastructure entails substantial costs, including those for power systems, cooling equipment, physical security, and monitoring tools. Moreover, operational expenditures such as energy consumption, regular maintenance, skilled labor, and compliance with regulatory standards can strain budgets, particularly for small and medium-sized enterprises. These costs may deter potential entrants and slow down expansion plans for existing providers, especially in developing regions.

Additionally, the return on investment for data center infrastructure often unfolds over a longer period, making it less appealing for short-term-focused investors. Financial barriers, combined with the complexity of managing integrated infrastructure systems, pose considerable challenges. As a result, some businesses may opt for cloud services or colocation facilities, reducing direct demand for standalone support infrastructure solutions.

Opportunities:

-

Rising Emphasis on Sustainability and Energy Efficiency Creates New Opportunities in the Data Center Support Infrastructure Market

Growing environmental awareness and stringent sustainability regulations are creating promising opportunities for innovation in the data center support infrastructure market. Organizations are under increasing pressure to reduce their carbon footprint and adopt eco-friendly practices, making energy-efficient infrastructure a top priority. This trend is driving the development and deployment of green cooling systems, advanced power management tools, and infrastructure components with lower environmental impact. Innovations like liquid cooling, renewable energy integration, and AI-driven energy optimization are being explored to enhance sustainability.

Furthermore, data center operators are investing in modular and prefabricated infrastructure that reduces material waste and speeds up deployment while offering better energy performance. This shift toward greener operations not only supports compliance with environmental standards but also helps reduce operational costs over time. Vendors that offer sustainable, future-ready solutions stand to gain a competitive edge as businesses and governments alike prioritize climate goals and long-term resource efficiency.

Challenge:

-

Growing Complexity In Managing Multi-Layered Infrastructure Presents A Challenge for the Data Center Support Infrastructure Market

As data centers become more complex and layered with new technologies, managing the associated support infrastructure has become a major challenge. The integration of cloud services, edge computing, IoT devices, and AI-powered operations necessitates highly sophisticated infrastructure that can support varied workloads and real-time data processing. This complexity requires advanced monitoring, predictive maintenance, and seamless coordination across power, cooling, and security systems. However, many organizations lack the internal expertise or tools to effectively manage such a dynamic environment.

Furthermore, legacy infrastructure often cannot scale or adapt to modern requirements, creating compatibility issues and operational inefficiencies. The risk of downtime due to mismanagement, cyber threats, or system overloads becomes increasingly significant as operations scale. These challenges are prompting a demand for smarter infrastructure management platforms and skilled professionals, but talent shortages and integration difficulties remain barriers to efficient infrastructure performance and reliability in the evolving digital landscape.

Segment Analysis

By Industry Vertical

The BFSI sector holds the largest revenue share in the Data Center Support Infrastructure Market, accounting for 34% in 2023. This dominance is driven by the sector’s critical need for secure, high-performance, and always-available data infrastructure to handle vast volumes of financial transactions, sensitive customer data, and real-time processing requirements. As digital banking and fintech services continue to grow, so does the need for resilient support systems, including advanced cooling, power backup, and monitoring solutions.

Moreover, banks are focusing on data center modernization with edge computing capabilities and DCIM tools to streamline operations. The demand for regulatory compliance, especially regarding data privacy and uptime, further fuels investment in robust support infrastructure, positioning BFSI as a major driver of the market's technological evolution.

The IT & Telecom segment is projected to grow at the highest CAGR of 12.1% in the Data Center Support Infrastructure Market during the forecast period. This rapid growth is propelled by the expansion of 5G networks, increased cloud adoption, and the surge in data traffic driven by mobile and internet-based services. Telecom operators and IT service providers require ultra-low latency and high-availability infrastructure to support real-time applications and continuous connectivity. Recent product developments include the launch of edge-ready modular data center support systems by industry leaders to meet the dynamic needs of telecom operators.

With data centers becoming more distributed, the IT & Telecom sector is prioritizing infrastructure that can support scalable, remote, and software-defined environments. This sector’s embrace of AI, IoT, and hybrid cloud strategies demands resilient support systems, making it a fast-emerging growth area for vendors offering next-generation data center support infrastructure solutions.

By Infrastructure

In 2023, the Power Distribution Systems segment led the Data Center Support Infrastructure Market with a dominant 32% revenue share, reflecting its critical role in ensuring seamless and reliable data center operations. As modern data centers demand uninterrupted power flow to support 24/7 workloads, scalable and intelligent power distribution has become essential. This includes advanced solutions like intelligent power distribution units (PDUs), busway systems, switchgear, and remote power panels that enable real-time energy monitoring, load balancing, and fault detection.

Notable developments include modular power solutions that offer scalability and simplified integration into existing setups, supporting growing rack densities and high-performance computing. With rising energy costs and sustainability mandates, efficient power management is a top priority for operators. Data centers are increasingly adopting renewable energy-compatible and low-loss power distribution systems to reduce operational expenditure and carbon footprint.

By Tier Level

Tier 3 data centers held the largest share of 59% in the Data Center Support Infrastructure Market in 2023, owing to their balance of performance, availability, and cost-efficiency. These facilities offer a minimum of 99.982% uptime and are designed to support concurrent maintenance without service disruption, making them ideal for enterprises seeking reliable infrastructure at a manageable cost.

Recent product innovations include modular power and cooling solutions tailored for Tier 3 standards, enabling faster deployment and lower energy consumption. Several data center providers have upgraded existing Tier 2 facilities to Tier 3, enhancing system redundancy and infrastructure resilience. As digital services scale, businesses increasingly prioritize fault tolerance and availability, making Tier 3 the go-to choice for long-term infrastructure investment.

Tier 4 data centers are projected to grow at the highest CAGR of 10.9% during the forecast period, reflecting an increased demand for ultra-reliable infrastructure in mission-critical applications. These data centers are designed for fault tolerance and offer 99.995% uptime, appealing to industries that require near-zero downtime, such as government, healthcare, and global finance. The market has seen increased activity in launching fully redundant power and cooling systems to meet Tier 4 standards. While cost remains high, the long-term benefits of reliability and operational stability are prompting greater adoption, making Tier 4 a critical growth area in the evolving data center ecosystem.

By Organization Size

Large enterprises dominated the Data Center Support Infrastructure Market with a 79% revenue share in 2023, driven by their extensive IT workloads, global operations, and stringent uptime requirements. These organizations are at the forefront of digital transformation, leveraging AI, big data, and hybrid cloud solutions that necessitate scalable and secure data center environments. To support this, they invest heavily in advanced power and cooling systems, multi-layered security, and real-time infrastructure monitoring. Many large enterprises have rolled out smart DCIM tools to optimize resource usage and reduce energy costs. Companies in sectors such as BFSI, healthcare, and e-commerce are building or upgrading Tier 3 and Tier 4 facilities with support infrastructure capable of handling mission-critical processes.

Small and medium enterprises (SMEs) are expected to grow at the highest CAGR of 11.8% in the Data Center Support Infrastructure Market over the forecast period. As digital transformation becomes accessible to smaller players, SMEs are increasingly adopting cloud computing, SaaS platforms, and data analytics tools. This trend necessitates reliable support infrastructure to ensure system uptime, data security, and scalability. The market has witnessed the introduction of cost-effective, plug-and-play modular systems specifically designed for SMEs, allowing easier and faster deployment. With limited in-house IT resources, SMEs are also leveraging DCIM-as-a-service and outsourced infrastructure management solutions. Several vendors have launched compact UPS units, edge-ready cooling systems, and integrated monitoring tools tailored for small-scale data environments.

Regional Analysis

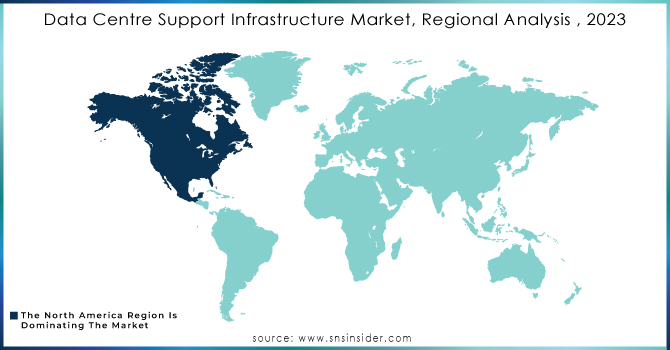

In 2023, North America dominated the Data Center Support Infrastructure Market with an estimated market share of over 38%, driven by its highly developed digital ecosystem, early adoption of advanced technologies, and presence of major cloud and colocation providers. The region is home to tech giants like Amazon Web Services (AWS), Google, Microsoft, and Meta, all of which are heavily investing in hyperscale and edge data centers. These data centers demand sophisticated power, cooling, and monitoring systems, directly fueling the growth of the support infrastructure market.

Additionally, stringent government regulations around data security and energy efficiency have accelerated the adoption of smart infrastructure solutions. For example, Equinix and Digital Realty have expanded their North American footprints with new data center campuses, integrating modular power systems and AI-powered cooling. The high concentration of enterprise IT operations, coupled with continued digital transformation across sectors such as BFSI, healthcare, and retail, reinforces North America’s leadership position in the global market.

In 2023, the Asia Pacific region emerged as the fastest-growing market, projected to expand at an impressive CAGR of around 10.6% during the forecast period. This rapid growth is driven by increased internet penetration, the rise of cloud-native businesses, government-led digital initiatives, and a growing user base demanding faster data access. Countries like China, India, Japan, and Singapore are witnessing a surge in data center development, supported by favorable regulatory policies and strategic investments.

Meanwhile, Singapore, despite space constraints, continues to be a data center hub due to its connectivity advantages and regulatory support for green infrastructure. Local players and global giants are launching modular, energy-efficient, and AI-integrated infrastructure to meet growing demands. The increasing presence of tech startups and expanding 5G networks further amplify the need for scalable and efficient support infrastructure, making the Asia Pacific a key growth engine for the market.

Need any customization on Data Centre Support Infrastructure Market - Enquiry Now

Key Players

-

Cisco Systems Inc. (Cisco UCS Servers, Nexus Switches)

-

Dell Technologies Inc. (Dell PowerEdge Servers, Dell EMC PowerVault Storage)

-

Fujitsu Ltd. (Fujitsu PRIMERGY Servers, Fujitsu ETERNUS Storage Systems)

-

Hewlett Packard Enterprise Co. (HPE ProLiant Servers, HPE Nimble Storage)

-

Lenovo Group Ltd. (Lenovo ThinkSystem Servers, Lenovo TruScale Infrastructure Services)

-

Microsoft Corp. (Azure Stack HCI, Microsoft System Center)

-

Vertiv Group Corp. (Liebert UPS Systems, Vertiv SmartRow DCR)

-

Huawei Investment & Holding Co. Ltd. (Huawei FusionModule Data Center, Huawei OceanStor Storage)

-

IBM Corp. (IBM FlashSystem Storage, IBM Cloud Infrastructure)

-

Schneider Electric SE (EcoStruxure IT, Galaxy VX UPS)

-

Corning (EDGE Data Center Solutions, Corning Pretium EDGE HD)

-

Leviton (Atlas-X1 Copper Systems, Leviton Opt-X Fiber Enclosures)

-

Legrand (Nexpand Server Cabinets, Legrand PDUs)

-

Eaton (Eaton 9PX UPS, Eaton Intelligent Power Manager)

-

ABB (ABB PowerWave 33 UPS, ABB Data Center Automation)

Recent Trends

-

February 2025: Cisco introduced the N9300 Series Smart Switches, integrating AMD Pensando Data Processing Units (DPUs). These switches aim to enhance data center architectures by embedding services directly into the network, offering improved scalability and adaptability for AI workloads.

-

December 2024: Dell Technologies celebrated its 40th anniversary by launching the Dell AI Factory, which includes AI PCs and GPU-enabled servers. This initiative has contributed to a 34% increase in Infrastructure Solutions Group revenue in the third quarter of 2024.

-

August 2023: Fujitsu was recognized as a Visionary in Gartner's Magic Quadrant for Data Center Outsourcing and Hybrid Infrastructure Managed Services. This acknowledgment reflects Fujitsu's strategic approach to Hybrid IT and its commitment to delivering transformative solutions in the data center domain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 55.98 Billion |

| Market Size by 2032 | US$ 126.87 Billion |

| CAGR | CAGR of 9.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Infrastructure (Power Distribution Systems, Network and System Management, Racks and Enclosures, Site and Facility Infrastructure, Security Systems) • By Tier Level (Tier 1, Tier 2, Tier 3, Tier 4) • By Organization Size (Small and Medium Enterprises, Large Enterprises) • By Industry Vertical (BFSI, Retail, IT & Telecom, Healthcare, Energy, Government, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems Inc., Dell Technologies Inc., Fujitsu Ltd., Hewlett Packard Enterprise Co., Lenovo Group Ltd., Microsoft Corp., Vertiv Group Corp., Huawei Investment & Holding Co. Ltd., IBM Corp., Schneider Electric SE, Corning, Leviton, Legrand, Eaton, ABB. |