Freezer Bags Market scope & overview:

Get more information on Freezer Bag Market - Request Free Sample Report

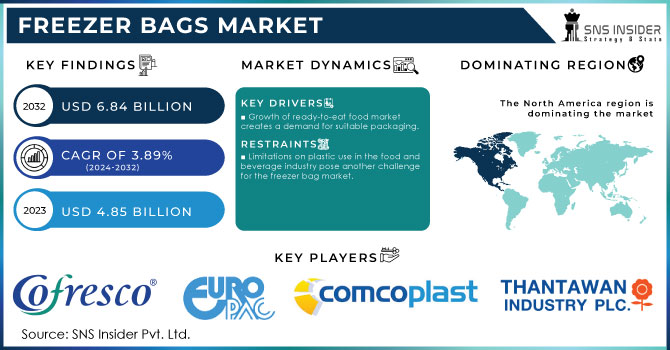

Freezer Bags Market Size was valued at USD 4.85 billion in 2023 and is expected to reach USD 6.84 billion by 2032 and grow at a CAGR of 3.89% by 2024-2032

The freezer bag market is experiencing a surge due to a confluence of favourable trends. Consumers are demanding convenient, eco-friendly ways to store food, which is driving innovation in sustainable packaging solutions. Freezer bags play a vital role in both the food industry and the healthcare sector. Major players are constantly improving quality and durability, as seen with Johnson and Johnson's introduction of high-quality freezer bags in 2015. With the food and beverage industry's continued growth and rising disposable income globally, the future looks bright for the freezer bag market. The rise of ready-to-eat meals further strengthens this demand. For instance, in January 2021, The Taste Company's entry into the market created a surge in the need for freezer bags specifically for soups. Similarly, a Mumbai-based company's launch of healthy frozen meals in double-sealed freezer bags in June 2022 highlights this growing synergy between ready-to-eat food and innovative freezer bag solutions. As more companies offer convenient meal options, expect the market for these specialized freezer bags to keep growing.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growth of ready-to-eat food market creates a demand for suitable packaging.

Convenience, food safety, and optimal storage are top priorities for today's consumers, driving the demand for airtight freezer bags. This trend is expected to boost sales of BPA-free freezer bags with moisture barriers, particularly as companies launch more ready-to-eat food options. The market for these innovative freezer bags is poised for significant growth in the coming years.

-

The projected increase in retail locations worldwide is expected to significantly drive the market for freezer bags.

RESTRAINTS:

-

Limitations on plastic use in the food and beverage industry pose another challenge for the freezer bag market.

Plastic restrictions in the food and beverage industry pose a double threat to the freezer bag market. Limitations on plastic packaging for fruits directly hinder sales of freezer bags designed for storing them. Secondly, these restrictions could limit the types of plastic used in all freezer bags, creating difficulties for producers and distributors of slider bags, a popular freezer bag option.

-

Reusable bags can offer cost savings and efficiency in the long run, pressuring traditional freezer bags.

OPPORTUNITIES:

-

The expanding food industry might lead to a rise in demand for freezer bags for storing and transporting food items.

Beyond the food industry, the growth of both food and pharmaceutical sectors is expected to fuel the demand for freezer bags. Self-sealing freezer bags, in particular, are gaining traction in new areas due to their improved durability, toughness, and resistance to punctures. This wider range of applications, along with the expansion of food and pharmaceutical industries, is projected to significantly contribute to the overall growth of the freezer bag market in the coming years.

-

Growing environmental awareness might encourage companies to adopt reusable options for freezer bag needs within their supply chains.

CHALLENGES:

-

Stricter Plastic Regulations Pose Challenges for Freezer Bag Industry.

Stricter regulations on plastic storage bags, including those targeting materials like polycarbonate, could pose a challenge for the reusable freezer bag industry. Companies might be deterred from using these materials due to compliance hurdles or potential bans. This could dampen the overall growth of the reusable bag market in the forecast period.

-

Depending on regulations and consumer preferences, alternative packaging materials or designs might emerge for food storage.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war's impact on the freezer bag market remains uncertain. While the conflict has caused a surge in oil and gas prices, potentially affecting plastic resin costs, a key material in freezer bags, sanctions haven't significantly disrupted trade yet. Industry players point to Iran's experience with sanctions as a potential indicator despite being a larger polyethylene exporter, sanctions had minimal impact on their exports. Therefore, the freezer bag market's future trajectory depends on how the conflict unfolds and whether trade restrictions escalate.

IMPACT OF ECONOMIC SLOWDOWN

A weakening global economy might pose a challenge for the freezer bag market. Particularly in developing countries. The World Bank's forecast of slower growth, especially for developing nations 3.9% and low-income countries 5.5%, potential decrease in consumer spending on non-essential items like freezer bags. This could be further amplified in countries like Bangladesh, where high inflation and import restrictions might specifically target discretionary spending. While India's projected growth of 6.4% offers a brighter outlook, overall economic slowdowns could still lead to tighter household budgets, potentially impacting the demand for freezer bags.

KEY MARKET SEGMENTS:

By Product Type

-

Flat

-

Satchel

-

Block Bottom

-

PP

-

Nylon

-

Polyester

The flat bag design dominates in the freezer bag market, capturing the largest share of revenue. These versatile bags excel in usefulness and adaptability, making them suitable for a wide range of applications across various industries. Their affordability, ease of packing, and convenient storage further solidify their dominance as the preferred choice for freezer bag users.

By Material Type

-

HDPE

-

MDPE

-

LDPE

HDPE takes the dominant position in the freezer bag market with 50% of share. This high-density polyethylene offers several advantages, including rigidity, better shape retention, and improved resistance to chemicals compared to other options. These qualities make HDPE the go-to choice for the strength and durability needed in most freezer bag applications.

By Application

-

Freezer Bags for Food

-

Dairy Products

-

Seafood

-

Meat & Poultry

-

Fresh Vegetables & Fruits

-

Ready-to-Eat Food

-

Others

-

-

Freezer Bags for Non-food Articles

Freezer bags for food dominating in the market, generating the most revenue. This makes perfect sense, as freezer bags excel at preserving food for extended periods. From meats and veggies to seafood, poultry, and even prepared meals, these bags lock in freshness for months when stored properly in a freezer.

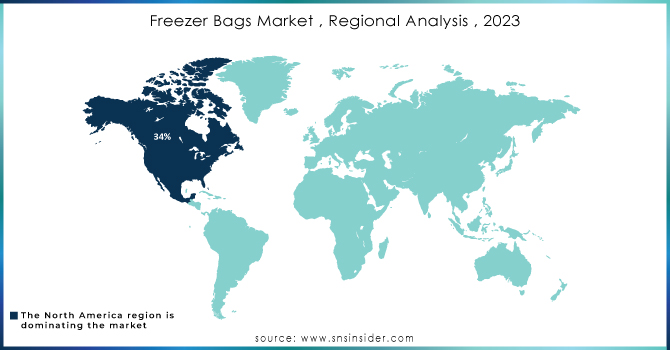

REGIONAL ANALYSES

North America holding a dominant 34% market share due to its high consumer spending power. This trend is fueled by strategic marketing in the region, with companies like Tyson Foods launching innovative frozen food options like air-fried chicken bits, perfectly suited for freezer bag storage. This focus on convenience food is likely to propel the North American freezer bag market even further.

Europe stands as a strong second behind North America, holding a solid 27% share of the global freezer bag market. This region is expected to stay on North America's heels in the coming years. Notably, there's a growing shift towards eco-friendly freezer bag options across Europe, with key players like Germany and the UK potentially driving the market with innovative solutions like color-coded freezer bags. The Asia Pacific region is poised for a surge in freezer bags, particularly bulk options. Emerging giants like India, China, and Japan are expected to lead this growth. The booming trade of perishable goods is driving demand for heavy-duty freezer bags, while the strong pharmaceutical presence in China and India is fueling the need for writable label freezer bags. This combination makes Asia Pacific a highly profitable market for the foreseeable future.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are GELU- PLAST packaging films GmbH & Co.KG, Plastic Slovakia s.r.o., EURO - pac Unterrainer GmbH, Comcoplast Comco Commercial Cooperation GmbH, Cofresco Frischhalteprodukte GmbH & Co. KG, DUO-PAck Co. Ltd., CeDo Ltd., Thantawan Industry Plc., Keller GmbH, Sun Plast (India), Teong Chuan Plastic (M) Sdn Bhd., American Bag Company, Shanghai Huitai Packaging Co, LTD. and other key players.

RECENT DEVELOPMENT

-

Great American Packaging, a leader in custom packaging, launched its innovative OneEarth Packaging solutions in June 2023. This new line caters to the growing consumer demand for sustainable packaging by eliminating harmful PFAS chemicals and providing both compostable and recyclable options. OneEarth Packaging embodies Great American Packaging's commitment to environmental responsibility and empowers consumers to make eco-conscious choices.

-

A collaborative effort for sustainable seafood packaging emerged in May 2023. Sabic, Estiko, and Coldwater Prawns of Norway joined forces to create a new pouch for frozen prawns. This eco-friendly solution utilizes a multilayered film with a remarkable 60% recycled ocean-bound plastic content. Estiko, the film producer, leverages Sabic's certified circular polypropylene (PP) Qrystal for this innovative pouch.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.85 Bn |

| Market Size by 2032 | US$ 6.84 Bn |

| CAGR | CAGR of 3.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Flat, Satchel, Block Bottom, PP, Nylon, Polyester) • By Material Type (HDPE, MDPE, LDPE) • By Application [Freezer Bags for Food (Dairy Products, Seafood, Meat & Poultry, Fresh, Vegetables & Fruits, Ready-to-Eat Food, Others), Freezer Bags for Non-food Articles] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GELU- PLAST packaging films GmbH & Co.KG, Plastic Slovakia s.r.o., EURO - pac Unterrainer GmbH, Comcoplast Comco Commercial Cooperation GmbH, Cofresco Frischhalteprodukte GmbH & Co. KG, DUO-PAck Co. Ltd., CeDo Ltd., Thantawan Industry Plc., Keller GmbH, Sun Plast (India), Teong Chuan Plastic (M) Sdn Bhd., American Bag Company, Shanghai Huitai Packaging Co, LTD |

| Key Drivers | • Growth of ready-to-eat food market creates a demand for suitable packaging. • The projected increase in retail locations worldwide is expected to significantly drive the market for freezer bags. |

| Key Restraints | • Limitations on plastic use in the food and beverage industry pose another challenge for the freezer bag market. • Reusable bags can offer cost savings and efficiency in the long run, pressuring traditional freezer bags |