Interactive Packaging Market Report Scope And Overview:

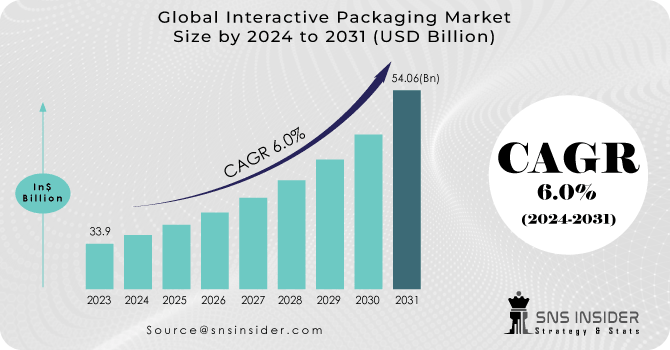

The Interactive Packaging Market size was USD 33.9 billion in 2023 and is expected to Reach USD 54.06 billion by 2031 and grow at a CAGR of 6.0% over the forecast period of 2024-2031.

The market growth of interactive packaging is primarily driven by factors such as enhanced efficiency and reliable output, as well as the increasing need to reduce advertising and sales promotion costs. Additionally, rising consumer demand for fresh and quality packaged food, coupled with the convenience it offers, along with manufacturers' focus on extending the shelf life of food products, contributes significantly to market expansion. Furthermore, the growing demand for self-heating and cooling packaged beverages like tea, coffee, and chocolate also plays a major role. Moreover, factors such as increasing research and development activities, technological advancements, and modernization in packaging techniques, along with rising demand from emerging economies, are expected to create new opportunities for the interactive packaging market.

Get More Information on Interactive Packaging Market - Request Sample Report

Implementing interactive packaging strategies is highly beneficial for brands seeking to distinguish themselves on store shelves and engage users in a novel way. Interactive packaging facilitates a deeper level of interaction between customers and products, fostering a lasting dialogue. This approach not only enhances brand recall for customers but also helps to maintain the brand image over an extended period.

MARKET DYNAMICS

KEY DRIVERS:

-

Consumers are increasingly looking for interactive and captivating interactions with brands.

Utilizing interactive packaging presents brands with a distinctive opportunity to seize consumers' attention, encourage memorable experiences, and cultivate deeper connections with their audience. By incorporating elements that engage the senses or provide interactive features, such as augmented reality or QR code activations, brands can create immersive experiences that leave a lasting impression on consumers. These interactions not only enhance brand recall but also strengthen the bond between the brand and the consumer, promoting loyalty and advocacy in the long term.

-

The global movement towards sustainable packaging solutions has impacted the uptake of interactive packaging.

RESTRAIN:

-

Implementing interactive packaging may involve added costs, including technology integration, content development, and infrastructure requirements.

-

Certain consumers may lack awareness or familiarity with the interactive features integrated into packaging, resulting in underutilization of these functionalities.

OPPORTUNITY:

-

Customized consumer experiences cater to individual preferences and needs.

By utilizing interactive packaging, brands can provide personalized consumer experiences tailored to individual preferences, including customized content, targeted promotions, and interactive games. This personalized approach promotes deeper connections with consumers and enhances brand loyalty.

-

Interactive packaging facilitates data collection for market research, consumer behavior analysis, and targeted marketing.

CHALLENGES:

-

The adoption of interactive packaging may be influenced by the regulatory landscape, especially in regard to privacy and data protection concerns.

-

With consumers becoming more adept at technology and interconnected digitally, their expectations for interactive and personalized experiences are expected to escalate further.

IMPACT OF RUSSIAN UKRAINE WAR

The corrugated board industry is encountering significant challenges attributed to sharp rises in energy prices by 52.33% and impending shortages of raw materials, as outlined by the Association of the Corrugated Board Industry. Prior to the outbreak of war, the market conditions had already been tense, with cost pressures reaching unprecedented levels for several months. The closure of paper mills is attributed to surging gas prices by 8%, compounded by the halt in kraftliner imports from Russia, posing a threat of shortage in corrugated base paper. Logistical delays, limited freight capacity, and interruptions in production are impacting the packaging industry.

IMPACT OF ECONOMIC SLOWDOWN

In a contemporary economic downturn, the impact may vary across different sectors, sparing some while severely affecting others. As commerce adapts post-pandemic, manufacturing, trade, and packaging companies find themselves in a recession not mirrored in other sectors of the global economy. According to the AF&PA(American Forest and Paper Association), the boxboard operating rate for the first quarter also declined compared to last year, dropping by over 6%. Packaging Corp., the third-largest containerboard producer in North America, verified that shipments had decreased by 13%. In response to recessionary pressures, the most successful packaging companies implement measures to minimize costs without compromising quality. Collaborating with a seasoned and flexible packaging provider yields numerous advantages.

KEY MARKET SEGMENTS

By Product Type

-

Folding Cartons

-

Labels & Tags

-

Pouches

-

Posters & Brochures

-

Others

The folding cartons segment dominates the interactive packaging market share. Offering extensive customization options and creative designs, folding cartons enable brands to incorporate interactive elements seamlessly while maintaining the visual appeal of the packaging. Their eco-friendly and sustainable features make them a preferred choice, aligning with the increasing consumer preference for environmentally conscious packaging solutions.

By Package Sound

-

Smell

-

Visual

-

Touch

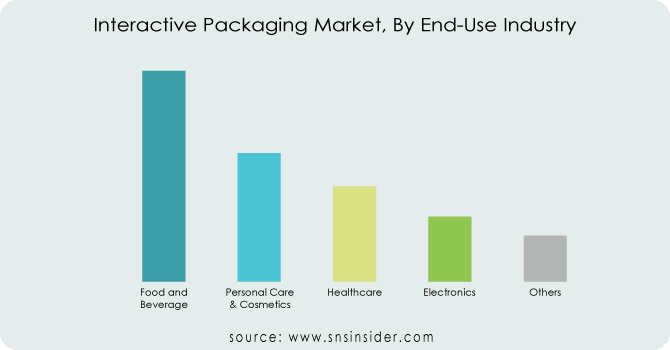

By End-Use Industry

-

Food and Beverage

-

Personal Care & Cosmetics

-

Healthcare

-

Electronics

-

Others

The food and beverage sector commands the largest market share, accounting for 42% of the market. With an increasing focus on food safety and transparency, this industry has adopted packaging solutions to offer consumers immediate access to product details, sourcing information, and nutritional content.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

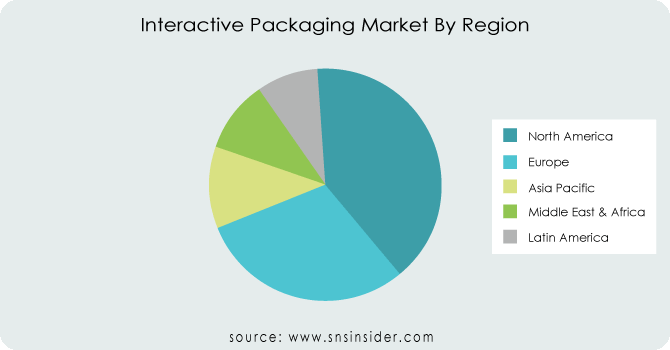

North America and Europe lead the interactive packaging market, driven by heightened research and development efforts in packaging technology, a growing emphasis on reducing advertising and sales promotion costs, and rising demand for self-heating and cooling packaged beverages like tea, coffee, and chocolate within the beverage industry in these regions. The Asia Pacific region presents favorable prospects for interactive packaging, propelled by swift urbanization, increasing disposable incomes, and a burgeoning consumer demographic.

Latin America is experiencing a surge in the adoption of interactive packaging, fueled by evolving consumer expectations, technological advancements, and the ascent of e-commerce. The region's emphasis on innovative packaging solutions and its diverse consumer market further contribute to the expansion of the market. The Middle East and Africa region are showing promising prospects for the growth of interactive packaging. This growth is primarily driven by factors such as the rising rate of urbanization, evolving consumer preferences, and a heightened demand for innovative packaging solutions. As urban centers expand and consumer lifestyles evolve, there is a growing need for packaging that offers engaging and interactive experiences.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Major players in Interactive Packaging Market are Stora Enso, International Paper, 3M, Temptime Corporation, AVERY DENNISON CORPORATION, Emerson Electric Co, BASF SE, R.R. Donnelley & Sons Company, Thin Film Electronics ASA, American Thermal Instruments, and others.

International Paper-Company Financial Analysis

RECENT DEVELOPMENT

-

In September 2023, Bastille Parfums, a French company renowned for its sustainable and natural fragrances, collaborated with Avery Dennison to integrate the latter's RFID (Radio Frequency Identification) sensor technology. This integration aims to track and trace products throughout Bastille's entire supply chain, enhancing inventory management and effectively combating the distribution of counterfeit goods.

-

In September 2023, International Paper inaugurated an advanced corrugated packaging facility in Atglen, Pennsylvania. This advanced facility is dedicated to manufacturing corrugated packaging solutions catering to various industries, such as fresh produce, processed foods, beverages, shipping, distribution, and e-commerce clients.

-

In July 2023, Smurfit Kappa celebrated the opening of its inaugural plant in North Africa. The inauguration of the new integrated corrugated plant in Rabat, Morocco, marked the company's debut operation in the region.

| Report Attributes | Details |

| Market Size in 2023 | US$ 33.9 Billion |

| Market Size by 2031 | US$ 54.06 Billion |

| CAGR | CAGR of 6.0 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Folding Cartons, Labels & Tags, Pouches, Posters & Brochures, Others) • By Package (Sound, Smell, Visual, Touch) • By End-Use Industry (Food And Beverage, Personal Care & Cosmetics, Healthcare, Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stora Enso, International Paper, 3M, Temptime Corporation, AVERY DENNISON CORPORATION, Emerson Electric Co, BASF SE, R.R. Donnelley & Sons Company, Thin Film Electronics ASA, American Thermal Instruments |

| Key Drivers | • Consumers are increasingly looking for interactive and captivating interactions with brands. • The global movement towards sustainable packaging solutions has impacted the uptake of interactive packaging. |

| Challenges | • The adoption of interactive packaging may be influenced by the regulatory landscape, especially in regard to privacy and data protection concerns. • With consumers becoming more adept at technology and interconnected digitally, their expectations for interactive and personalized experiences are expected to escalate further. |