Friction Stir Welding Equipment Market Report Scope:

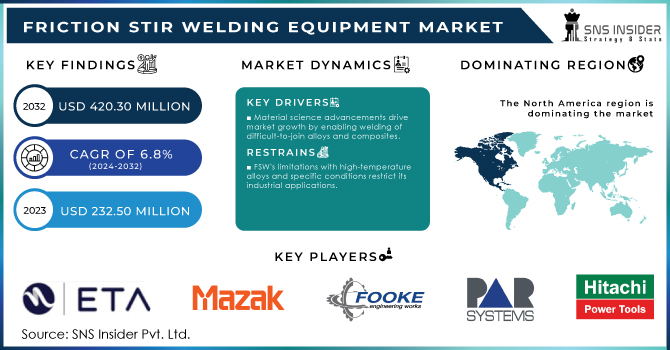

The Friction Stir Welding Equipment Market Size was valued at USD 232.50 Million in 2023 and is now anticipated to grow USD 420.30 Million by 2032, displaying a compound annual growth rate (CAGR) of 6.8% during the forecast Period 2024-2032.

Get more information on Friction Stir Welding Equipment Market - Request Free Sample Report

Technological advancements in FSW equipment, such as robotic and mobile systems development, are further propelling market growth. These innovations enhance the versatility and efficiency of FSW processes, making them suitable for a wide range of applications. Aluminum and its alloys experience notable volume fluctuations up to 4% while going through the melting and solidifying stages. This may lead to severe distortion of the welded parts and result in cracking during solidification due to stress. Friction stirs welding, being a mechanical process that is solid-state, does not face these issues as much and is capable of creating strong welds with minimal distortion in all types of aluminum alloys, whether they are wrought or cast.

The United States plays a crucial role in the market for friction stir welding equipment, due to its dominant position in the aerospace and automotive sectors. The use of FSW technology is being driven by the need for strong, lightweight materials in these industries. The focus of the U.S. government on promoting manufacturing and sustainable industrial practices is also contributing to market growth. Investments made in research and development, along with collaborations between industry and academia, are driving progress in FSW technology. Robotic automation systems are perfect for material handling processes because they remove human error. These systems ensure the safety of your employees by handling the responsibility of moving heavy or hazardous items within a warehouse. Employing precise precision is necessary and hazardous when bonding metal pieces using heat and pressure. Automated welding systems are increasingly chosen due to their ability to eliminate errors and improve the safety of welders. Robotic systems work together with humans for hazardous welding tasks or jobs with high levels of dangerous materials.

Friction Stir Welding Equipment Market Dynaamics

DRIVER

The aerospace and automotive industries are increasingly adopting Friction Stir Welding (FSW) for its ability to join dissimilar metals with high-strength, defect-free welds, driven by the need for lightweight, fuel-efficient vehicles and aircraft.

The aerospace and automotive industries are adopting Friction Stir Welding (FSW) more and more as time goes on. This is because FSW is capable of welding dissimilar metals, and the final weld produces is a high-strength weld without any defects. This is mainly because the demand of lightweight, fuel-efficient automotive and aircraft parts is increasing. Of course, not only the mentioning industries, but also the respective demands of both industries force the latter to use FSW: in aerospace the welding of aluminum and magnesium is critical to lightening up aircraft and increasing fuel efficiency, and for the automotive sector the mixed metal combinations allow better weight and performance. Both industries require welding techniques able to produce minimum distortion and no need for any filler materials. The absence of the need for fillers in the welded parts allows the parts to decrease the weight and as a significant factor of the efforts for making a greener transport, as pursuing more efficient vehicles and aircrafs.

Advancements in material science, which lead to new alloys and composites needing advanced techniques like FSW, are driving market growth by enabling the welding of materials difficult to join with conventional methods.

Advancements in welding technique offer an example of the impacts of materials science advancements on the sector. New alloys and composite materials have been developed and introduced to various industries and applications, some of which require advanced welding techniques to join. Consequently, these materials have specific properties that make them hard to weld using the conventional techniques; they are often too strong, too light, or either resistant to corrosion or temperature, or both. Friction stir welding is an example of the techniques developed for joining such materials. These industries that make use of such advanced welding techniques include those focusing on high performance such as the automotive, aerospace, and defense industries. New, high-performance materials being developed by these industries play a significant role in expanding the materials that require such advanced welding processes, increasing the demand, and the market size for the products. The materials science advancements, through the techniques developed beyond the conventional means, shape the future of the welding industry by supporting market expansions through innovation to meet the new properties offered by modern materials.

RESTRAIN

Although FSW is effective for a wide range of materials, its limitations with certain high-temperature alloys and specific welding conditions restrict its application in some industries.

There are several types of welding procedures that have demonstrated their efficiency when welding materials of most types. As a result, it is possible to argue that friction stir welding is one of the least versatile welding procedures due to the fact that it is not as effective when used for welding some alloys and at specific welding conditions. There are two distinctive groups of alloys which may require the use of the alternative welding technique. The first set includes the high-temperature alloys, such as titanium and nickel-based superalloys, which are primarily characterised by their high melting temperatures and their strength. Their strength, however, leads to increased tool wear and deformation, and reduces weld quality. The second set of factors anti-beneficial to friction stir welding process includes the factors, which require precise control of the welding processes and welding machinery. Usually, these geometrical features refer to models that are characterised by their complexity and gauge thickness. Therefore, although the use of such welding processes as FSU is beneficial in terms of the strength of the welds and their quality when welding most types of alloys, there is still a group of alloys and welding conditions, the materials and welding effects of which are subject to alternative welding procedures.

Friction Stir Welding Equipment Market Segmentation Analysis

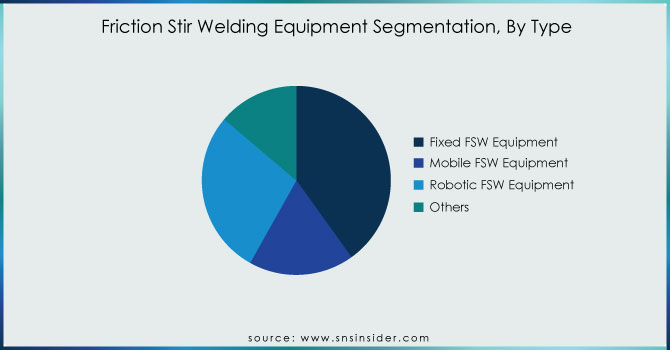

By Type

The fixed FSW equipment segment dominated the market, with a revenue share of 40.1% in 2023. This segment is primarily driven by the application of these systems in manufacturing plants. The equipment is used in the plants for the manufacturing of large and consistent welds. Majority of the plants using this equipment are high production volume oriented. The demand for this equipment is expected to grow further due to the advantages it offers in terms of producing high-quality welds.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End Use

The aerospace end-use segment is projected to retain the highest share of the market. In 2023, it generated 29.9% of the overall revenue of the market. On account of its capacity to create high-strength, defect-free welds, the equipment for FSW is widely implemented in the production of different parts of airplanes, namely, fuselages, wings, and fuel tanks. Overall, the rising manufacture of commercial and military planes will be stimulating the demand for these tools in this area.

The automotive industry is another major end user of FSW equipment, utilizing the technology for welding lightweight materials such as aluminum and magnesium alloys. The growing demand for fuel-efficient and lightweight vehicles is driving the adoption of FSW in automotive manufacturing. The trend towards electric vehicles and the need for strong, lightweight battery enclosures are also expected to boost market growth

Friction Stir Welding Equipment Market Regional Analysis

North America dominated market share over 38.02% in 2023, experiencing strong demand from the aerospace and automotive sectors. The area's cutting-edge manufacturing resources and focus on top-notch, long-lasting products play a crucial role in the acceptance of FSW technology. The U.S. and Canada are making significant investments in upgrading their manufacturing capabilities, with an emphasis on decreasing energy usage and enhancing environmental sustainability. Leading aerospace firms and demand for lightweight, fuel-efficient vehicles are projected to support the growth of the FSW equipment market in North America.

Key Players in the Friction Stir Welding Equipment Market are:

The major key players are ETA Technology, YAMAZAKI MAZAK CORPORATION, FOOKE GmbH, PAR Systems, Hitachi Power Solutions Co., Ltd., NITTO SEIKI CO., LTD., Grenzebach Group, Bond Technologies, PTG, Groupe TRA-C industrie and others.

Recent Devlopment

In August 2023: Bond Technologies, Inc. launched PM2 Friction Stir Welding machine. The PM Series is designed for high-volume production of items such as vehicle inverters, electronic enclosures, and small parts, with manufacturing capacities ranging from thousands to millions per year. This innovative machine combines advanced process controls and data management features with a robust, user-friendly mechanical design, providing customers with a fast and reliable solution for demanding production applications.

In August 2023: Hitachi revealed their next generation of friction stir welding machines, which are more productive and precise for use in the automotive and aerospace industries. To guarantee consistent weld quality and shorten cycle times, the new equipment has sophisticated monitoring and control systems. Hitachi's commitment to offering dependable and effective solutions to the worldwide friction stir welding industry is demonstrated by its investment in technological innovation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 232.50 Million |

| Market Size by 2032 | US$ 420.30 Million |

| CAGR | CAGR of 6.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Fixed FSW Equipment, Mobile FSW Equipment, Robotic FSW Equipment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ETA Technology, YAMAZAKI MAZAK CORPORATION, FOOKE GmbH, PAR Systems, Hitachi Power Solutions Co., Ltd., NITTO SEIKI CO., LTD., Grenzebach Group, Bond Technologies, PTG, Groupe TRA-C industrie |

| Key Drivers | • The aerospace and automotive industries are increasingly adopting Friction Stir Welding (FSW) for its ability to join dissimilar metals with high-strength, defect-free welds, driven by the need for lightweight, fuel-efficient vehicles and aircraft.

• Advancements in material science, which lead to new alloys and composites needing advanced techniques like FSW, are driving market growth by enabling the welding of materials difficult to join with conventional methods. |

| RESTRAINTS | • Although FSW is effective for a wide range of materials, its limitations with certain high-temperature alloys and specific welding conditions restrict its application in some industries. |