Fucoidan Market Report Scope & Overview:

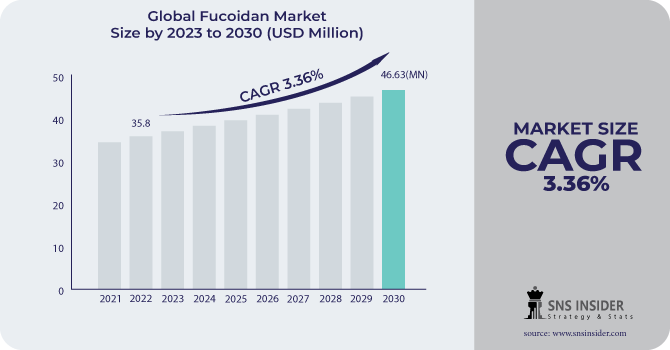

The Fucoidan Market size was USD 35.8 million in 2022 and is expected to Reach USD 46.63 million by 2030 and grow at a CAGR of 3.36 % over the forecast period of 2023-2030.

Fucoidan is a substance found in a variety of brown seaweed species. It is also available in capsules, extracts, and powder form. Fucoidan is a type of complex carbohydrate found in brown seaweeds including kombu, wakame, and mozuku. It has been studied for its possible health advantages, which include anti-inflammatory, antioxidant, and immune-boosting qualities.

The fucoidan market has expanded in recent years as demand for natural health supplements and components has increased. Fucoidan is commonly sold as a dietary supplement, frequently in the form of capsules and powders, and is also found in a variety of functional foods and beverages.

MARKET DYNAMICS

KEY DRIVERS

-

Potential benefits of fucoidan

Cancer and other chronic diseases are major public health concerns, and their global incidence is expected to increase in the coming years. Fucoidan is anti-cancer, anti-inflammatory, and immune-boosting. As a result, fucoidan appears to be a promising natural treatment for a variety of ailments. Fucoidan has been designated as a "Generally Recognized as Safe" food by the Food and Drug Administration (FDA). It does not, however, sell prescription or over-the-counter medications. It is only sold as a supplement outside of meals.

-

The increasing prevalence of cancer and other chronic diseases.

RESTRAIN

-

Lack of awareness of the health benefits of fucoidan

Consumers and healthcare professionals alike are still unaware of the health benefits of fucoidan. This may reduce the demand for fucoidan-based products. Many nations, including China, use fucoidan as a traditional medicine, but there is still a large unexplored market for application. Manufacturers' awareness can promote demand for fucoidan in a variety of industries.

OPPORTUNITY

• Increased investment in research and development

Recent anticancer medication research and development initiatives, as well as the synergistic action of fucoidan with chemotherapeutic medicines to kill tumor cells, are expected to drive the worldwide fucoidan market. Furthermore, with increasing applications in cosmetics, fucoidan is still utilized as a complementary therapy in many countries of Asia, including Japan and Korea, where it is frequently suggested to cancer patients. Fucoidan is gaining popularity and use in the Western world as scientific study advances and global regulatory permissions expand. Fucoidan is increasingly being used as a new ingredient in nutritional supplements, cosmetic products, and functional meals and beverages.

-

Rising applications in various other applications

CHALLENGES

-

High cost of fucoidan

Fucoidan is a substance found in a variety of brown seaweed species. There are several methods for extracting fucoidan from brown seaweed. The most common are Acid extraction, Alkali extraction, Enzyme extraction, and other methods. The extraction process makes it a relatively expensive ingredient. This could limit its adoption in some applications.

-

Limited availability of fucoidan

MARKET SEGMENTATION

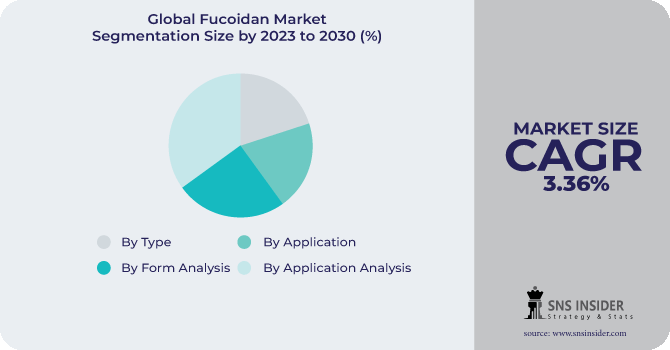

By Type

-

Powder Type

-

Capsule Type

-

Others

By Application

-

Health Care Products

-

Pharmaceutical

-

Cosmetics

By Form Analysis

Based on Form, the market is categorized into Powder Type, Capsule Type, and Others. During the forecast period, the capsule segment is expected to hold a significant proportion of the market. The capsule form has a larger market share since it can be used to make pharmaceuticals and dietary supplements. The capsule is more bioavailable than the other portions. Furthermore, because dietary supplements in capsule form are easier to swallow, various companies are developing them.

Fucoidan powder is used to make a variety of dietary supplements. Liquid forms are utilized to improve product efficacy, particularly in pharmaceuticals and cosmetics, where it guarantees that the product is administered evenly on the skin.

By Application Analysis

Based on application, in 2022, the pharmaceutical sector held a significant proportion of the worldwide fucoidan market. Pharmaceutical businesses are investing in research and development to create medications that are far more effective than previous product versions while also being highly purified and of the finest quality. Fucoidan is used to treat a variety of ailments, including cancer and rheumatoid arthritis.

Fucoidan is used in cosmetics as a thickener, moisturizer, and sunscreen. It is also being studied for its ability to decrease wrinkles and increase skin suppleness.

REGIONAL ANALYSIS

Asia Pacific has been holding a lion’s share of the fucoidan market in the last few years. Countries like Japan, South Korea, and China were key consumers of fucoidan in the Asia Pacific in 2022. The increasing awareness of the health benefits of fucoidan drives the growth. Traditional Chinese medicine has employed the substance's health advantages for millennia. Rising investment in research and development in the pharmaceutical, and cosmetics industries drive the use of the fucoidan market.

North America is also anticipated to hold a vital share of the global fucoidan market during the forecast period. The U.S. constituted a major share of the market in this region. The growth of the market in North America is being driven by the increasing demand for natural health products, the rising prevalence of chronic diseases, and the growing popularity of seaweed extracts.

Europe's fucoidan market size was USD 121.20 million in 2022 and exhibited a CAGR of 7.5% during the forecast period. This growth is attributed to growing consumer inclination towards Natural products. However, limited seaweed cultivation in the European region may hamper the growth.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Fucoidan Market are Kamerycah, Yaizu Suisankagaku, Takara, FMC, Seaherb, Fucoidan Force, Marinova, FucoHiq, Haerim Fucoidan, Jeezao, Kanehide, Sigma-Aldrich Corporation, A.M. Todd Botanical Therapeuticals, and Qingdao, and other key players.

Kamerycah-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 A U.K.-based firm called OCEANIUM created 'OCEAN ACTIVES Fucoidan,' which cosmetic companies can employ to create various skincare formulations, as high-purity bioactive components.

In 2023 Hepatica made significant investments to create its production system to the requirements set by the European Commission. The organization's production, supply, and storage systems were HACCP-certified.

| Report Attributes | Details |

| Market Size in 2022 | US$ 35.8 Million |

| Market Size by 2030 | US$ 46.63 Million |

| CAGR | CAGR of 3.36 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Powder Type, Capsule Type, Others) • By Application (Health Care Products, Pharmaceuticals, Cosmetics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Kamerycah, Yaizu Suisankagaku, Takara, FMC, Seaherb, Fucoidan Force, Marinova, FucoHiq, Haerim Fucoidan, Jeezao, Kanehide, Sigma-Aldrich Corporation, A.M. Todd Botanical Therapeuticals, and Qingdao |

| Key Drivers | • Potential benefits of fucoidan • The increasing prevalence of cancer and other chronic diseases. |

| Market Restrain | • Lack of awareness of the health benefits of fucoidan |