Functional Beverages Market Report Scope & Overview:

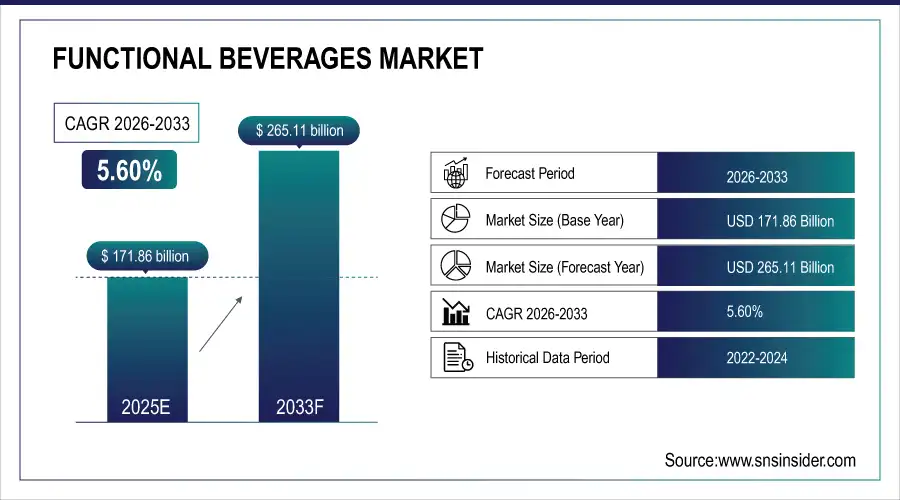

The Functional Beverages Market Size was valued at USD 171.86 Billion in 2025E and is projected to reach USD 265.11 Billion by 2033, growing at a CAGR of 5.60% during the forecast period 2026–2033.

The Functional Beverages Market analysis is based on demand from health-conscious consumers, athletes, and wellness segments. Market growth is fuelled by growing health consciousness, dietary preference for nutrient-fortified beverages and product innovation, expanding retail and online distribution channels across regions.

Functional beverage consumption reached 12.5 billion litters in 2025, driven by health-conscious consumers and growing sports, probiotic, and vitamin drink demand.

Market Size and Forecast:

-

Market Size in 2025: USD 171.86 Billion

-

Market Size by 2033: USD 265.11 Billion

-

CAGR: 5.60% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Functional Beverages Market - Request Free Sample Report

Functional Beverages Market Trends:

-

Growing health consciousness and wellness centric lifestyle has created a demand of nutrient fortified vitamins, probiotic beverages around the world.

-

Formulation innovations such as plant-based ingredients, adaptogens and functional botanicals are broadening products sets and user base.

-

Increased trends of fitness and sports nutrition are propelling the intake of energy drinks and electrolyte drinks among all age groups.

-

The emergence of modern trade and e-commerce being extended has been helping functional beverages reach its presence.

-

Intensifying rivalry is pushing brands toward more premium, personalized and clean-label beverages to win-over health-conscious consumers.

U.S. Functional Beverages Market Insights:

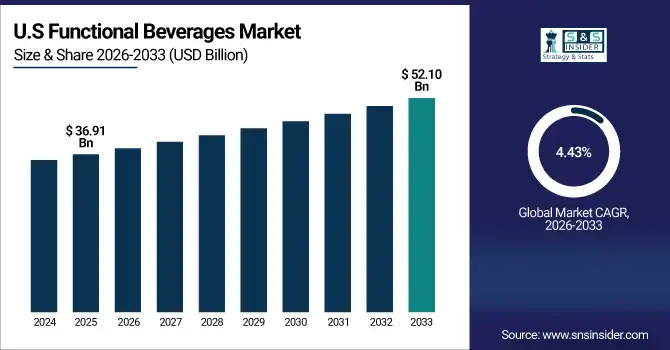

The U.S. Functional Beverages Market is projected to grow from USD 36.91 Billion in 2025E to USD 52.10 Billion by 2033, at a CAGR of 4.43%. Growing health awareness, high demand for energy, probiotic and vitamin-enriched products and availability through retail and e commerce is expected to drive the market.

Functional Beverages Market Growth Drivers:

-

Rising health consciousness and demand for nutrient-enriched drinks are accelerating Functional Beverages market growth globally.

Rising health consciousness and increasing demand for nutrient-enriched drinks are the primary drivers of Functional Beverages market growth. There's consumer demand for beverages with added vitamins, minerals, proteins and probiotics that are positioned to offer health or an active lifestyle. There is innovation with formulations and flavors that broadens adoption through all age groups, while expansion at retail and ecommerce advance accessibility. Moreover, clean-label and personalized options are driving consumption and unlocking long-term growth potential.

Consumption of nutrient-enriched functional beverages grew 6% in 2025, driven by rising health-conscious and active lifestyle consumers globally.

Functional Beverages Market Restraints:

-

High production costs and regulatory compliance complexities are limiting large-scale adoption of innovative functional beverage products.

High production costs and stringent regulatory compliance are key factors restraining Functional Beverages market growth. The use of elite ingredients, probiotics and plant-based products also means manufacturers are at the mercy of raw material price fluctuations and a disrupted supply chain. Fulfillment of food safety and labeling requirements poses difficulties and burdens. Smaller and start-up brands in the beverage space frequently find it challenging to scale, innovate in formulation or be compliant effectively within a fast-growing, wellness-oriented beverage market.

Functional Beverages Market Opportunities:

-

Growing demand for plant-based, probiotic, and personalized beverages presents opportunities for product innovation and market expansion.

Increasing demand for plant-based, probiotic, and personalized functional beverages presents significant opportunities for market expansion. The study of formulations, incorporation of new ingredients and clean label issues are examples of advances that facilitate the development by companies to provide unique products for healthy attentive consumers. Increasing penetration among fitness and wellness enthusiasts, aging population, increasing retail and e-commerce penetration are fueling product innovations and expanding brand portfolio creating a positive impact on the industry attractiveness factors in the Functional Beverages market.

Plant-based and probiotic functional beverages accounted for 18% of beverage innovations in 2025, driven by health-conscious and active lifestyle consumers.

Functional Beverages Market Segmentation Analysis:

-

By Type, Energy Drinks held the largest market share of 35.42% in 2025, while Probiotic Drinks are expected to grow at the fastest CAGR of 8.15%.

-

By Ingredient, Vitamins dominated with a 40.21% share in 2025, while Botanicals are projected to expand at the fastest CAGR of 9.04%.

-

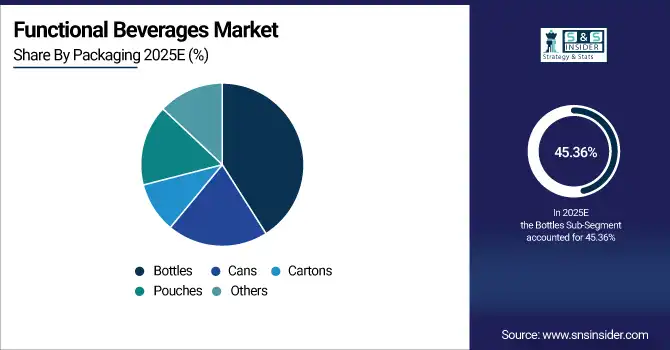

By Packaging, Bottles accounted for the highest market share of 45.36% in 2025, and Pouches are expected to record the fastest CAGR of 8.76%.

-

By Distribution Channel, Supermarkets / Hypermarkets held the largest share of 50.12% in 2025, while Online Retail is projected to grow at the fastest CAGR of 10.22%.

By Type, Energy Drinks Dominate While Probiotic Drinks Expand Rapidly:

Energy Drinks segments dominated the market since these are the most popular among fitness-enthusiasts and working professionals who want immediate energy and hydration. They benefit from strong brand exposure, widespread in-store availability and a stream of new flavors. Probiotic Drinks are the fastest growing segment as consumers become increasingly aware of gut health, immunity benefits and general wellness. Rapid development is being driven by growth in product portfolio ranges and acceptance within health-focused retail channels.

By Ingredient, Vitamins Dominate While Botanicals Expand Rapidly:

Vitamins segment dominated the market as they offer wide range of health benefits with high consumer acceptance in many beverages such as energy, sports, and wellness. Their part in immunity, energy and wellness means continued demand. Botanicals are the fastest growing segment as consumers demand natural, plant-based ingredients for functional health benefits. New formulations, clean label trends and increased use in functional and herbal beverages are among the growth drivers of this segment’s rapid market growth.

By Packaging, Bottles Dominate While Pouches Expand Rapidly:

Bottles segment dominated the market as they are easy to use, eco-friendly, and can be used in several functional beverages. They are popular across mall, fitness and convenience sectors. Pouches are the fastest growing segment, leveraging convenience, sustainability and packaging material evolution. Increasing trend of on-the-go consumption and need for sustainable packaging solutions are compelling manufacturers to adopt pouch formats, driving visibility, adoption and growth in emerging markets across the world.

By Distribution Channel, Supermarkets / Hypermarkets Dominate While Online Retail Expands Rapidly:

The Supermarkets and Hypermarkets segment dominated the market as they can reach the customers widely, have variety of products and are trusted by consumers when it comes to purchase of functional beverage. Online Retail are the fastest growing segment, where e-commerce, the direct-to-consumer model and by subscription services and convenience-driven consumers are driving growth. Growing digital penetration, targeted marketing and availability of niche focused, personalised and premium products online are driving growth and opening new opportunities for companies.

Functional Beverages Market Regional Analysis:

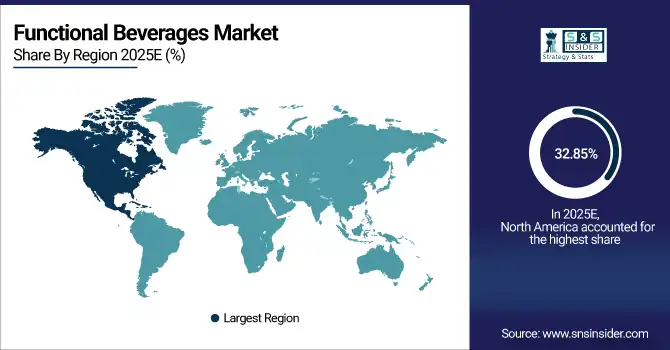

North America Functional Beverages Market Insights:

North America dominated the Functional Beverages market with a 32.85% share in 2025, due to high health consciousness, growing fitness trends and its established retail network. A large network of energy, sports and vitamin-enhanced beverages provides excellent market penetration. Increasing demand for clean label, fortified and probiotic beverages is also contributing well toward market penetration. Fast fashion is being fueled by new product development, strong consumer branding and a greater focus on wellness and healthy living.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Functional Beverages Market Insights:

The U.S. Functional Beverages Market may be driven by rising demand for nutrient rich, probiotics & plant-based beverages in fitness going and aging population. Growing health awareness, surge in retail and e-commerce outlets, novel formulations, clean-label trends and brand-led marketing campaigns are contributing to strong market expansion and consumer traction.

Asia-Pacific Functional Beverages Market Insights:

The Asia-Pacific Functional Beverages Market is the fastest growing region with a CAGR of 7.01%, owing to rising health consciousness, urbanization, and improved income levels. Quick acceptance of energy, probiotic and plant-based drinks in China, India, Japan and South Korea coupled with increasing modern retailing and e-commerce distribution is driving regional expansion. Formulation innovation, clean label trends and wellness-centric marketing are all driving increased consumption and market expansion in the region.

China Functional Beverages Market Insights:

The China’s Functional Beverages market is to experience robust growth mainly due to increasing health consciousness, urbanization and higher disposable incomes. Rising demand for energy, probiotic and plant-based beverages along with modern store expansion and uptake of e-commerce underline consumption. The market is growing due to the increasing launch of clean label, fortified, and wellness beverages.

Europe Functional Beverages Market Insights:

The Europe Functional Beverages Market is witnessing a rapid growth due to the rising demand for nutrient-fortified and plant based & probiotic beverages among health-conscious and physical fitness active consumers. Main markets are Germany, France and the UK. Growth is being driven by innovation in clean label formulas, growing modern retail and e-commerce channels, wellness trends and strong branding. Rising consumer emphasis on immunity, fitness and sustainability packaging is expanding regional market growth and product variety.

Germany Functional Beverages Market Insights:

Germany is a key market for Functional Beverages, with strong demand for vitamin-enriched, probiotic, and plant-based drinks. Demand is reinforced by strong health consciousness, new product introductions and broadening modern shopping and ecommerce channels. Strong market demand is driven by wellness trends, a preference for clean-label and a growing emphasis on nutrition and lifestyle.

Latin America Functional Beverages Market Insights:

The Latin America Functional Beverages industry is poised as a lucrative shelter with growing popularity for energy, probiotics and plant-based drinks. Increasing health awareness, urbanization and the growing retail and e-commerce are driving consumption. Clean label formulations, products and wellness-positioning are driving opportunity in leading markets such as Brazil, Mexico and Argentina.

Middle East and Africa Functional Beverages Market Insights:

The Middle East & Africa Functional Beverages Market And the market is expected to grow due to increasing health awareness, urbanization and rising disposable incomes. Sales are boosted by an increasing number of retail and e-commerce channels, the growing demand for energy, probiotic and plant-based drinks and regional emphasis on wellness trends and novel fortified drinks.

Functional Beverages Market Competitive Landscape:

PepsiCo Inc., headquartered in Purchase, New York, is a leader in the food and beverage industry. The Company is also taking a vigilant approach at new cutting-edge functional beverages and identifies special markets both domestically and abroad. PepsiCo is expanding its footprint in the functional beverage segment with acquisitions such as Poppi, a prebiotic soda brand, and Pepsi Prebiotic Cola. With its wide distribution network, robust brand power and ongoing innovation, it has thus far dominated the market.

-

In July 2025, PepsiCo launched Pepsi® Prebiotic Cola, a 30-calorie cola containing 3 grams of prebiotic fiber and 5 grams of cane sugar. It caters to health-conscious consumers seeking digestive benefits without artificial sweeteners, expanding PepsiCo's functional beverage portfolio.

The Coca-Cola Company, based in Atlanta, Georgia, has maintained a leading position in the beverage industry for decades. Taking note of the trend for health-oriented consumption, Coca-Cola expanded to functional beverages such as vitamin-fortified, probiotic, and plant-based drinks. With its strong R&D ability, supply chain and broad retail channel, it instantly responds to market changes and offers perfectly tailor-made products. All these enablers and successful marketing techniques made Coca-Cola the leader in functional beverages market.

-

In February 2025, Coca-Cola introduced Simply Pop, its first prebiotic soda made with real fruit juice, no added sugar, and enriched with 6 grams of prebiotic fiber, Vitamin C, and Zinc. It targets consumers interested in gut health and immune support, marking Coca-Cola's step into functional beverages.

Nestlé S.A., headquartered in Vevey, Switzerland, is a multinational food and beverage giant with a significant presence in functional beverages. With its wealth of R&D experience, Nestlé has launched products relating to current trends such as immunity, energy and wellness. Its commitment to quality, sustainability, and innovation serves large and varied markets throughout the world. Its strong distribution, brand string and focus on health and wellness have made Nestlé a major player in the functional beverages market.

-

In July 2025, Nestlé launched Milo Pro, a protein-enhanced version of Milo, offering three times more protein than traditional Milo. Initially introduced in Indonesia, it will roll out across Southeast Asia, catering to growing demand for protein-rich beverages among young adults.

Functional Beverages Market Key Players:

Some of the Functional Beverages Market Companies are:

-

PepsiCo Inc.

-

The Coca-Cola Company

-

Nestlé S.A.

-

Red Bull GmbH

-

Monster Beverage Corporation

-

Danone S.A.

-

Keurig Dr Pepper Inc.

-

Suntory Holdings Limited

-

Otsuka Pharmaceutical Co., Ltd.

-

The Campbell Soup Company

-

General Mills, Inc.

-

Hain Celestial Group

-

Amway Corporation

-

Abbott Laboratories

-

Clif Bar & Company

-

GNC Holdings LLC

-

Vita Coco Company, Inc.

-

OLIPOP

-

Recess

-

Suja Life LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 171.86 Billion |

| Market Size by 2033 | USD 265.11 Billion |

| CAGR | CAGR of 5.60% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Energy Drinks, Sports Drinks, Probiotic Drinks, Vitamin & Mineral Drinks, Herbal & Botanical Drinks, Others) • By Ingredient (Vitamins, Minerals, Proteins, Amino Acids, Botanicals, Electrolytes, Others) • By Packaging (Bottles, Cans, Cartons, Pouches, Others) • By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | PepsiCo Inc., The Coca-Cola Company, Nestlé S.A., Red Bull GmbH, Monster Beverage Corporation, Danone S.A., Keurig Dr Pepper Inc., Suntory Holdings Limited, Otsuka Pharmaceutical Co., Ltd., The Campbell Soup Company, General Mills, Inc., Hain Celestial Group, Amway Corporation, Abbott Laboratories, Clif Bar & Company, GNC Holdings LLC, Vita Coco Company, Inc., OLIPOP, Recess, Suja Life LLC |