Furniture Market Report Scope & Overview:

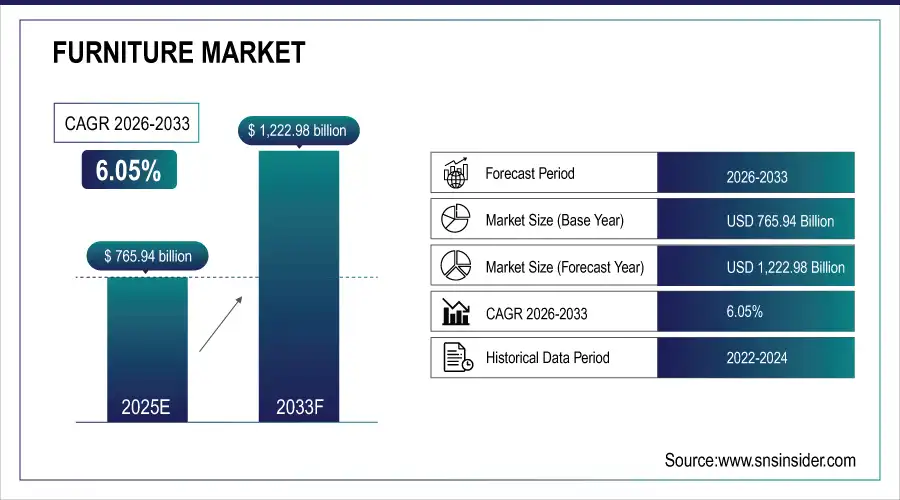

The Furniture Market Size was valued at USD 765.94 Billion in 2025E and is projected to reach USD 1,222.98 Billion by 2033, growing at a CAGR of 6.05% during the forecast period 2026–2033.

The Furniture Market analysis provides a comprehensive overview of trends, developments, and growth across the sector. The market is divided by product type as sofas & seating, tables, beds & mattresses, storage & cabinets, office furniture and outdoor & garden furniture), materials (wood, metal, plastic, glass and upholstery) style (modern style traditional/rustic/minimalist etc.), end use, distribution channel. The Fact.MR report also states that buoyancy in the wood furniture market is being underpinned by urbanization, rise in disposable income, and expanding interest of customers toward smart and stylish furniture.

Sofas & seating lead the Furniture Market, wood is the preferred material, modern styles dominate, residential users account for the largest share, and online retail captures over 20% of sales in 2025.

Market Size and Forecast:

-

Market Size in 2025: USD 765.94 Billion

-

Market Size by 2033: USD 1222.98 Billion

-

CAGR: 6.05% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Furniture Market- Request Free Sample Report

Furniture Market Trends:

-

The trends for modular, multifunctional and space-saving furniture is due to the increasing urbanization and decrease in living spaces.

-

Growing consumer demand for ecological and sustainably sourced materials is prompting wood alternatives, recycled metals and bio-based upholstery innovation.

-

Smart and connected furniture This trend, featuring IoT connectivity, lighting elements, and ergonomic features in furniture continues to gain favor with technology enthusiasts.

-

Quality, bespoke furniture ranges are appealing to affluent purchasers who want a unique, designer-driven home.

-

E-commerce platforms and online marketplaces have transformed furniture distribution, for faster delivery, broader selection and virtual try-before-you-buy experiences.

-

The hospitality, co-working and education sectors are witnessing growing investments in high-quality, durable and stylish furniture that is designed to improve user experience and reflect the brand personality.

U.S. Furniture Market Insights:

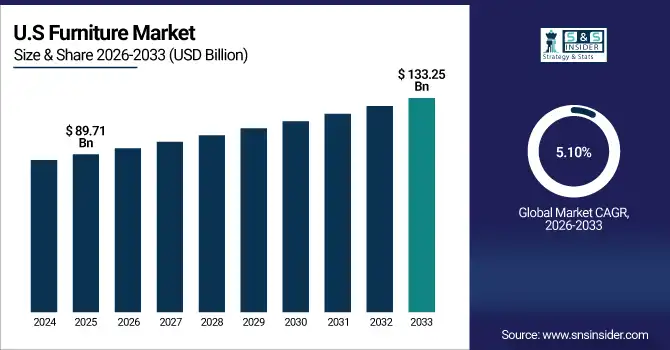

The US Furniture Market was valued at USD 89.71 Billion in 2025, dominated by Sofas & Seating and Wood-based furniture. Residential users accounted for the majority of sales, with commercial and hospitality sectors contributing the remainder. The market is projected to reach USD 133.25 Billion by 2033, growing at a CAGR of 5.10%, driven by urbanization, smart furniture adoption, and e-commerce expansion.

Furniture Market Growth Drivers:

-

Rising urbanization and demand for multifunctional, eco-friendly furniture are creating highly lucrative market opportunities.

Furniture Market Growth is driven by increasing urbanization and multi-functional, eco-friendly furniture demand across residential and commercial segments. The sales of modular furniture came to at least 12 million units in 2025 and were forecast to reach more than 28 million units by 2033. Project profit opportunities are also being created due to rising smart furniture, online retail platforms, and private investments in sustainable designs; sustaining widespread market penetration in all developed and developing economies around the globe.

Rising demand for multifunctional and eco-friendly furniture accounted for 32% of furniture sales in 2025, driven by urbanization, online retail, and smart furniture adoption.

Furniture Market Restraints:

-

Rising raw material costs and supply chain disruptions are limiting furniture production and slowing market expansion.

High prices for raw materials and logistics delays are hindering growth in the Furniture Market. 28% of production projects in 2025 were delayed due to timber, metal, and upholstery shortages Shipping and logistics bottlenecks extended delivery times by 4–6 weeks globally. Small and mid-size furniture manufacturers are not able to pass on these higher costs and cannot compete. Also, the import duties, governmental environmental policies and a scarcity of workforce is adding another limitation toward market growth even when consumer demand exists for multipurpose and sustainable furniture.

Furniture Market Opportunities:

-

Rising consumer interest in smart, modular, and sustainable furniture presents significant growth opportunities across residential and commercial sectors.

The Furniture Market is experiencing new opportunities due toas the smart, modular, sustainable furniture being preferred. More than 12 million smart or multifunctional units worldwide were in use by 2025, a number expected to increase to more than 30 million by 2033. Rising private-sector interest, the explosion of online retail and partnerships with designers are making fashion more affordable and accessible. Robust demand for houses, commercial space and hospitality units will continue to support the market through 2033.

Smart, modular, and sustainable furniture accounted for 27% of new furniture projects in 2025, driven by residential, commercial, and hospitality adoption.

Furniture Market Segmentation Analysis:

-

By Product Type, Sofas & Seating held the largest market share of 35.42% in 2025, while Outdoor & Garden Furniture is expected to grow at the fastest CAGR of 8.14%.

-

By Material, Wood dominated with a 44.73% share in 2025, while Upholstery is projected to expand at the fastest CAGR of 7.96%.

-

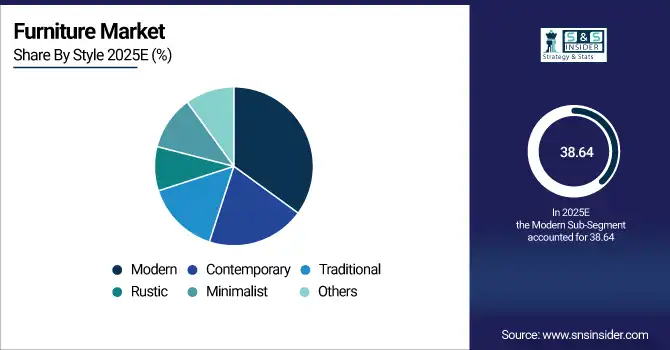

By Style, Modern led with a 38.64% share in 2025, while Minimalist is expected to record the fastest CAGR of 8.27%.

-

By End User, Residential accounted for the highest market share of 52.11% in 2025, while Hospitality is projected to grow at the fastest CAGR of 7.88%.

-

By Distribution Channel, Offline Stores held the largest share of 60.03% in 2025, while Online Retail is expected to grow at the fastest CAGR of 9.12%.

By Product Type Segment, Sofas & Seating Dominated While Outdoor & Garden Furniture Expands Rapidly:

Sofas & Seating segment dominated the Product Type sector in 2025 with over 85 million units sold, driven by residential demand, commercial offices, and hotels seeking comfort and customization. Ergonomic design and broad distribution across price ranges also contributes to its popularity. Outdoor & Garden Furniture is the fastest-growing segment, as an increasing number of people prefer eco-friendly patios, outdoor living areas, and enhanced commercial spaces such as resorts and hospitality. Outdoor & Garden Furniture comprises of 22 million units. And both are informing trends in furniture globally.

By Material Segment, Wood Dominated While Upholstery Expands Rapidly:

Wood segment dominated the Material sector in 2025 with over 340 million units’ production on account of its strength, flexibility and consumer preference for natural finish. Its reach extends across residential, commercial and luxury segments. Upholstery segment is the fastest-growing material sector worth 120 million pieces, driven by demand for comfortable, stylish and personalized sofas, chairs and beds. growth Sustainable materials Combined with new designs; Upholstery is leading the fastest-growing material category while Wood continues to reign supreme.

By Style Segment, Modern Dominated While Minimalist Expands Rapidly:

Modern segment dominated the Style sector in 2025, with 260 million units sold, favored for functional, aesthetic designs across urban homes and commercial spaces. This dominance is supported by open plan designs, mid-market price points and wide spread consumer appeal. Minimalist segment is the fastest growing sector which serves younger people who value small, compact, clutter-free living. The popularity of Minimalist design is also rising, which contrasts the present rule of Modern furniture.

By End User Segment, Residential Dominated While Hospitality Expands Rapidly:

Residential segment dominated the End User sector in 2025, occupying more than 450 thousand furniture units, supported by rising urbanization and increasing demand for home renovations and lifestyle upgrades. Its strength is driven by strong demand for apartments, houses and middle-class homes in developed and emerging markets. The Hospitality segment is the fastest growing sector with 60 million furniture pieces, since hotels and resorts are asking for ergonomic appealing furniture. Residential is way ahead in both regions globally due to the rapid ascent of Hospitality.

By Distribution Channel Segment, Offline Stores Dominated While Online Retail Expands Rapidly:

The Offline Stores segment dominated the Distribution Channel sector in 2025, having sold about 510 million units owing to consumer preference to see and feel the product before making a purchase. Solidified networks and established brands also shore up dominance. Online Retail segment is the fastest growing sector with 170 million units and is fuelled by e-commerce platforms, AR features such as try-before-you-buy and faster delivery. Online Retail’s high growth has been changing purchasing patterns while Offline Stores still remain dominant reflecting a mixed model for furniture retail.

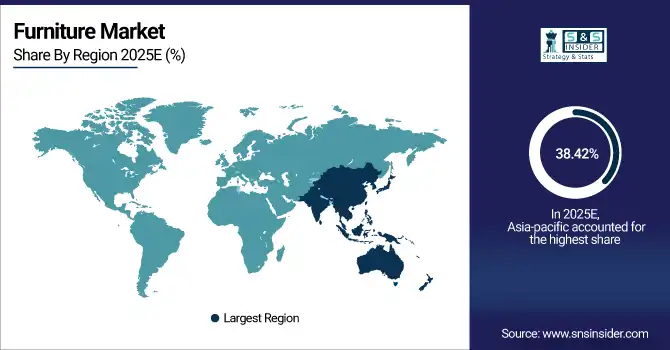

Furniture Market Regional Analysis:

Asia-Pacific Furniture Market Insights:

The Asia-Pacific Furniture Market dominated the market with a 38.42% share in 2025 and has sold over 180 million units across homes, offices, and hospitality industry. The world leader is China, with’s 75 million units, followed by India’s 45 million units. Sofas & Seating and Wood-based furniture are the leading categories and smart, modular sustainable furniture is gaining attention. The region also is seeing robust growth propelled by increases in urbanization, disposable income and e-commerce adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Furniture Market Insights:

China sold more than 75 million furniture items in 2025, driven by Sofas & Seating and Wood-based furniture. Around 45 million were sold for home use while the rest went to commercial/residential clients in the hospitality industry. Strong market growth is being driven by increasing urbanization, rising disposable incomes, smart and modular product designs, and expansion in e-commerce across all country's regions.

North America Furniture Market Insights:

The North America Furniture Market is led by the US and Canada, with over 90 million units sold in 2025. Sofas & Seating are major categories that’s also the same as Wood-based furniture, with smart and ergonomic taking off. 55 million units are in residential and the rest in commercial/hospitality. Growth is primarily due to urbanisation, increasing disposable income, adoption of e-commerce and growing demand for modular and sustainable furniture in both homes and offices.

-

U.S. Furniture Market Insights:

In 2025, about 55 million units of furniture market was sold and Sofas & Seating and Wood accounted for majority of revenues. The residential category accounted for 35 million units, while the rest was in commercial and hospitality. Growth is widespread across the country due to increasing urbanization, disposable incomes, smart furniture adoption and expansion of e-commerce.

Europe Furniture Market Insights:

The Europe furniture market sold more than 80 million pieces in 2025 with Germany amounting to 25 million units, UK at 20 million, and France at 18 million. 50 million units, followed by mixed uses, commercial and hospitality sectors with the rest. Sofas & Seating and wood-based furniture ruled; Smart, and modular are growing quickly. Urbanizations, increasing disposable income, online retailing and sustainable furniture consumption in the region is driving the growth.

-

Germany Furniture Market Insights:

In 2025, more than 25 million of furniture pieces were sold in Germany, 15 million for residential and 10 million for commercial/hospitality. Seating & Sofas and Wood furniture dominated, modular and smart designs are emerging fast. Growth is attributed to increasing urbanization, disposable incomes, technological advancements in furniture design and rising adoption of sustainable and ergonomically-designed products across the country.

Middle East and Africa Furniture Market Insights:

The Middle East & Africa Furniture market is estimated to CAGR of 8.02%, in value terms, reach around 18 million units by 2025. The UAE topped the list with 7 million units, and South Africa followed closely behind with 5 million units. Sofas & Seating and Wooden furniture led, with Modular and Smart furniture growing fastest. Regional growth is also on the rise due to increasing urbanization, disposable income and e-commerce.

Latin America Furniture Market Insights:

Latin America Furniture market total sales are more than 12 million in 2025, led by Brazil (5 million), Argentina (3 million) and Chile (2 million). Most of the sales were residential and the balance included commercial and hospitality. This growth is fueled by growing urbanization, higher disposable incomes, adoption of e-commerce and demand for smart, modular and sustainable furniture in the region.

Furniture Market Competitive Landscape:

In 2025, IKEA dominated furniture market with more than 450 stores in over 60 countries. It is estimated to have sold over 120 million pieces of furniture worldwide, thanks to flat-pack and low-cost designs and efficient logistics. Urban growth goes on, with more than 15 new city-center stores slated worldwide. Its emphasis on sustainable materials, modular offerings and in-store experiences is driving rapid expansion while helping it to retain its position as the market leader.

-

In March 2025, IKEA launched its modular “City Living” furniture line in urban centers worldwide, emphasizing space-saving designs and sustainable materials. The launch included over 150 new products targeting small apartments and co-living spaces, boosting accessibility and modern home customization.

Ashley Furniture Industries, the latter operates more than 900 retail locations worldwide and manufactures over 25 million units of furniture every year through various brands in 2025. The company’s online platform processed over 5 million orders last year. With solid product design, operational excellence and a focus on both the residential and commercial markets, Ashley Furniture is growing toward being one of the world’s leading furniture manufacturers with growth in domestic manufacturing that will lead the way for US-based manufacturers.

-

In February 2025, Ashley Furniture introduced its “SmartHome Seating” collection, integrating ergonomic design with modular, tech-enabled features. Over 50 new furniture units were rolled out across 900+ stores, enhancing residential and commercial comfort solutions.

Steelcase Inc. leads the office furniture industry, shipping more than 12 million units worldwide in 2025 to more than 150 countries. Its ergonimic chairs, smart office solutions and collaborative furniture lines have helped it become a rapidly growing force in corporate sit-areas. With over 1,200 commercial installations in just 2025 under their belt, Steelcase is using tech trends and workspace habits to maintain a place on the top and an ever-widening footprint.

-

In April 2025, Steelcase launched its “FlexWork Office Solutions”, a line of smart, collaborative office furniture with adjustable and tech-enabled features. The rollout included 1,200+ installations across corporate offices globally, supporting hybrid work and ergonomic productivity.

Furniture Market Key Players:

Some of the Furniture Market Companies are:

-

IKEA

-

Ashley Furniture Industries

-

Steelcase Inc.

-

HNI Corporation

-

Williams-Sonoma Inc.

-

Nitori Co., Ltd.

-

Haworth Inc.

-

Kinnarps AB

-

Vitra International AG

-

Knoll, Inc.

-

Design Holding Group

-

Hooker Furnishings

-

Natuzzi S.p.A.

-

Ethan Allen Global, Inc.

-

La-Z-Boy Incorporated

-

Restoration Hardware (RH)

-

Bernhardt Furniture Company

-

Flexsteel Industries

-

Bassett Furniture Industries

-

American Leather

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 765.94 Billion |

| Market Size by 2033 | USD 1222.98 Billion |

| CAGR | CAGR of 6.05% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Sofas & Seating, Tables, Beds & Mattresses, Storage & Cabinets, Office Furniture, Outdoor & Garden Furniture, Others) • By Material (Wood, Metal, Plastic, Glass, Upholstery, Others) • By Style (Modern, Contemporary, Traditional, Rustic, Minimalist, Others) • By End User / Industry (Residential, Commercial, Hospitality, Educational, Healthcare, Others) • By Distribution Channel (Online Retail, Offline Stores, Direct Sales, B2B Contracts, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IKEA, Ashley Furniture Industries, Steelcase Inc., HNI Corporation, Williams-Sonoma Inc., Nitori Co., Ltd., Haworth Inc., Kinnarps AB, Vitra International AG, Knoll, Inc., Design Holding Group, Hooker Furnishings, Natuzzi S.p.A., Ethan Allen Global, Inc., La-Z-Boy Incorporated, Restoration Hardware (RH), Bernhardt Furniture Company, Flexsteel Industries, Bassett Furniture Industries, American Leather |