GaAs High Frequency Device Market Report Scope & Overview:

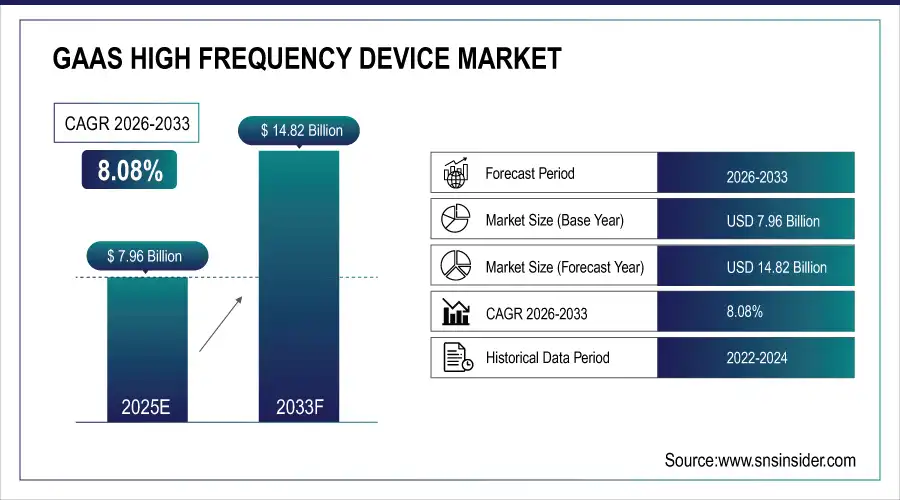

The GaAs High Frequency Device Market size was valued at USD 7.96 Billion in 2025E and is projected to reach USD 14.82 Billion by 2033, growing at a CAGR of 8.08% during 2026–2033.

The GaAs High-Frequency Device Market is witnessing significant growth, driven by the rising demand for wireless communication, satellite systems, defense, and aerospace applications. Key technologies such as HBT, pHEMT, and BiHEMT processes enable high-performance RF and MMIC devices with superior frequency response and efficiency. Increasing adoption of 4G/5G networks, high-speed data transmission, and advanced radar systems is fueling the need for GaAs-based solutions. The market is characterized by strong competition among leading semiconductor manufacturers, expanding production capacities, and ongoing innovation in compound semiconductor fabrication, positioning it for sustained growth in high-frequency applications.

In May 2025 – WIN Semiconductors partnered with Partstat to provide long-term secure storage solutions for GaAs and GaN wafers, die, and mask sets. The collaboration strengthens supply chain reliability for wireless, infrastructure, and networking customers while safeguarding critical semiconductor technologies.

GaAs High Frequency Device Market Size and Forecast:

-

Market Size in 2025: USD 7.96 Billion

-

Market Size by 2033: USD 14.82 Billion

-

CAGR: 8.08% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On GaAs High Frequency Device Market - Request Free Sample Report

GaAs High Frequency Device Market Highlights:

-

Growing smartphone and Android ecosystem is driving demand for GaAs high-frequency devices, especially power amplifiers for 4G/5G networks and next-generation mobile technologies

-

Strategic partnerships, such as IQE’s multi-year agreement with AWSC and Lansus, enhance GaAs wafer supply for Tier-One Android OEMs, strengthening production capabilities and market position

-

High production costs, complex designs, specialized foundries, and geopolitical uncertainties pose challenges to market growth

-

Competition from silicon-based and GaN devices presents cost-effective or higher-efficiency alternatives, affecting GaAs adoption in certain applications

-

Expanding 5G and upcoming 6G networks, along with applications in mobile, satellite, connected vehicles, defense, aerospace, and automotive, create significant growth opportunities

-

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer expansion potential due to rising infrastructure, telecom, and semiconductor investments

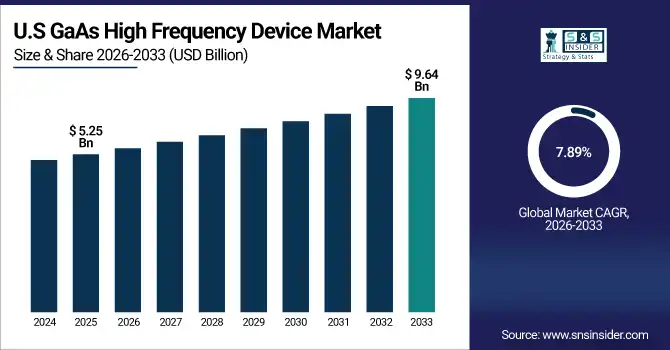

The U.S. GaAs High Frequency Device Market size was valued at USD 5.25 Billion in 2025E and is projected to reach USD 9.64 Billion by 2033, growing at a CAGR of 7.89% during 2026–2033. Market growth is driven by increasing adoption of 4G/5G networks, high-speed data transmission, defense systems, and aerospace applications, with innovation in HBT, pHEMT, and BiHEMT technologies supporting advanced RF and MMIC performance.

GaAs High Frequency Device Market Drivers:

-

Growing Smartphone and Android Ecosystem Fuels GaAs High-Frequency Device Demand

Rising adoption of advanced smartphones and mobile devices is driving significant demand for GaAs high-frequency devices, particularly power amplifiers used in wireless communication. Tier-One OEMs increasingly require high-performance, reliable RF and MMIC components to support 4G/5G networks and next-generation mobile technologies. Long-term supply stability and scalable manufacturing processes are key to meeting market requirements. This trend fuels innovation in GaAs semiconductor fabrication, enhancing device efficiency, thermal performance, and frequency response, while reinforcing the critical role of GaAs-based solutions in enabling high-speed, low-latency communication across mobile, wireless, and connected infrastructure applications.

In April 2024 – IQE expanded its partnership with AWSC and Lansus to supply GaAs wafers for smartphone power amplifiers, supporting Tier-One Android OEMs. The multi-year agreement strengthens IQE’s position in the wireless market and enhances production capabilities for high-performance GaAs-based RF devices.

GaAs High Frequency Device Market Restraints:

-

High Production Costs and Supply Chain Challenges Limit GaAs High-Frequency Device Growth

The GaAs High-Frequency Device Market faces several restraints that could slow growth. High manufacturing and material costs associated with GaAs wafers and advanced MMIC fabrication increase overall production expenses. Complex design and integration requirements for RF and high-frequency systems raise development timelines and technical challenges. Market adoption is also impacted by competition from alternative semiconductor technologies, such as silicon-based and GaN devices, which can offer lower costs or higher power efficiency in certain applications. Additionally, supply chain disruptions, geopolitical uncertainties, and dependency on specialized foundries may constrain production capacity, limiting the ability of manufacturers to meet growing global demand efficiently.

GaAs High Frequency Device Market Opportunities:

-

Expanding 5G, 6G, and Emerging Applications Drive Opportunities in GaAs High-Frequency Device Market

The GaAs High-Frequency Device Market presents significant opportunities driven by the rapid expansion of 5G and upcoming 6G networks, which require high-performance RF and MMIC components. Growing demand for mobile devices, connected vehicles, and satellite communication systems opens new avenues for GaAs-based solutions. The rising adoption of GaAs in defense, aerospace, and automotive applications provides additional growth potential. Technological advancements, including higher power efficiency, improved thermal performance, and miniaturization of devices, enable new product development. Moreover, emerging markets in Asia-Pacific, Latin America, and the Middle East offer opportunities for market expansion and strategic partnerships with semiconductor manufacturers.

The gallium market is accelerating as demand for GaAs and GaN semiconductors surges, driven by global 5G, electric vehicles, renewables, and defence sectors. Supply constraints are tightening, especially with most refined gallium production concentrated in China

GaAs High Frequency Device Market Segment Highlights:

-

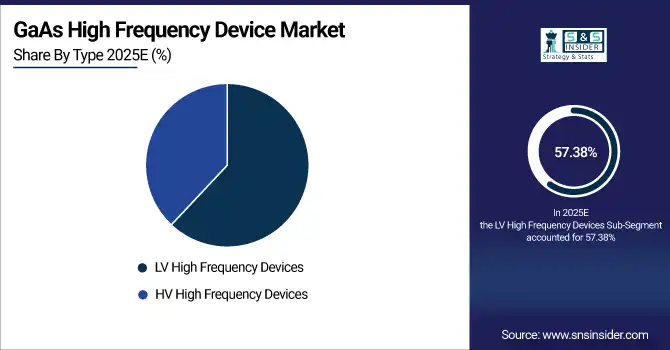

By Type: Dominant – LV High Frequency Devices (57.38% in 2025 → 53.63% in 2033); Fastest-Growing – HV High Frequency Devices (CAGR 9.22%)

-

By Application: Dominant – Mobile Devices (25.38% in 2025 → 27.63% in 2033); Fastest-Growing – Automotive Electronics (CAGR 10.98%)

-

By Material: Dominant – Gallium Arsenide (GaAs) (38.75% in 2025 → 31.25% in 2033); Fastest-Growing – Gallium Nitride (GaN) (CAGR 10.98%)

-

By End User: Dominant – Telecommunication (39.38% in 2025 → 35.63% in 2033); Fastest-Growing – Automotive (CAGR 10.98%)

GaAs High Frequency Device Market Segment Analysis:

By Type, LV High Frequency Devices are dominating and HV High Frequency Devices are fastest-growing.

LV High Frequency Devices lead due to their extensive use in standard RF and wireless applications, offering proven performance and reliability. In contrast, HV High Frequency Devices are the fastest-growing segment, driven by demand for high-power, advanced RF applications in telecom, defense, and aerospace sectors.

By Application, Mobile Devices are dominating and Automotive Electronics are fastest-growing.

Mobile devices dominate due to the widespread adoption of smartphones and wireless communication systems, while automotive electronics are growing rapidly with the rise of connected vehicles, ADAS, and electric mobility solutions.

By Material, Gallium Arsenide (GaAs) is dominating and Gallium Nitride (GaN) is fastest-growing.

GaAs remains dominant because of its high-frequency performance and maturity in RF applications. GaN is fastest-growing due to its higher power efficiency, thermal performance, and increasing use in defense, telecom, and 5G infrastructure.

By End User, Telecommunication is dominating and Automotive is fastest-growing.

Telecommunication leads the market due to the need for reliable RF components in networks and mobile infrastructure, whereas automotive drives growth with increasing demand for high-frequency devices in connected, autonomous, and electric vehicles.

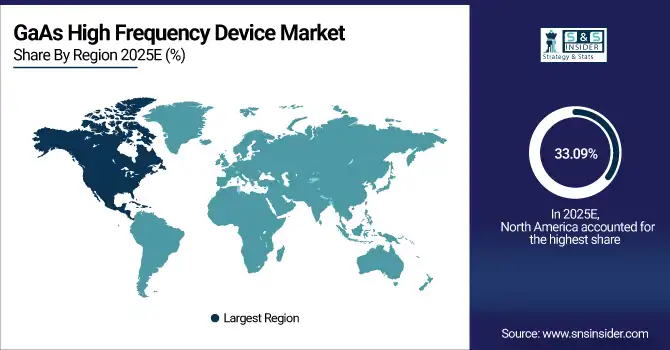

GaAs High Frequency Device Market Regional Highlights:

-

North America (Significant – 33.09% in 2025 → 31.76% in 2033, CAGR 7.53%)

-

Asia-Pacific (Fastest-Growing – 32.07% in 2025 → 35.08% in 2033, CAGR 9.29%)

-

Europe (21.71% → 21.24%, CAGR 7.78%)

-

Latin America (7.68% → 7.23%, CAGR 7.26%)

-

Middle East & Africa (5.45% → 4.70%, CAGR 6.06%)

GaAs High Frequency Device Market Regional Analysis:

North America GaAs High Frequency Device Market Insights:

North America leads the GaAs High-Frequency Device Market, driven by advanced telecom infrastructure, widespread 4G/5G adoption, and a strong presence of semiconductor manufacturers. Robust demand for high-performance RF and MMIC components in wireless communication, defense, and aerospace applications supports market growth, while innovation and technology advancements sustain the region’s leadership position.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. GaAs High Frequency Device Market Insights:

The U.S. leads the GaAs High-Frequency Device Market, driven by advanced wireless infrastructure, strong semiconductor manufacturing, and growing demand for high-performance RF and MMIC components in telecom, defense, and aerospace sectors.

Asia-Pacific GaAs High Frequency Device Market Insights:

Asia-Pacific is the fastest-growing region in the GaAs High-Frequency Device Market, driven by rapid 5G deployment, increasing smartphone and mobile device adoption, and expanding telecom and automotive electronics sectors. Growing investments in high-frequency semiconductor manufacturing and emerging applications in defense and aerospace further accelerate regional market growth.

China GaAs High Frequency Device Market Insights:

China is the dominant country in the GaAs High-Frequency Device Market, driven by its large telecom infrastructure, high smartphone adoption, and significant investments in semiconductor manufacturing and high-frequency electronic applications.

Europe GaAs High Frequency Device Market Insights:

The Europe GaAs High-Frequency Device Market is witnessing emerging trends driven by the adoption of 5G networks, increasing demand for automotive and industrial electronics, and growing investments in defense and aerospace applications. Technological advancements in RF and MMIC components are further supporting market growth across the region.

Germany GaAs High Frequency Device Market Insights:

Germany is the dominant country in the Europe GaAs High-Frequency Device Market, supported by its advanced automotive, industrial, and defense sectors, strong semiconductor ecosystem, and investments in high-frequency RF and MMIC technologies.

Latin America GaAs High Frequency Device Market Insights:

The Latin America GaAs High-Frequency Device Market is steadily expanding, driven by increasing telecom infrastructure development, rising adoption of mobile devices, and growing demand for automotive and industrial electronics. Investments in high-frequency semiconductor components and gradual technological adoption are supporting consistent market growth across the region.

Brazil GaAs High Frequency Device Market Insights:

Brazil is the dominant country in the Latin America GaAs High-Frequency Device Market, driven by its expanding telecom infrastructure, increasing mobile device adoption, and growing demand for automotive and industrial high-frequency applications.

Middle East & Africa GaAs High Frequency Device Market Insights:

The Middle East and Africa GaAs High-Frequency Device Market is witnessing moderate growth, supported by expanding telecom networks, rising demand for defense and aerospace applications, and gradual adoption of high-frequency semiconductor technologies. Investments in infrastructure and technological advancements are driving steady market development across the region.

Saudi Arabia GaAs High Frequency Device Market Insights:

Saudi Arabia is generally considered the dominant country. This is due to its significant investments in telecom infrastructure, defense systems, and aerospace applications, which drive the demand for high-frequency GaAs devices.

GaAs High Frequency Device Market Competitive Landscape:

Qorvo, established in 2015 through the merger of RF Micro Devices and TriQuint Semiconductor, is a leading provider of high-performance RF solutions and GaAs-based devices. The company specializes in amplifiers, filters, and MMICs for aerospace, defense, mobile, and satellite communications, focusing on efficiency, reliability, and advanced high-frequency performance.

-

June 17, 2024 – Qorvo launched three high-power MMIC amplifiers for Ku-Band SATCOM terminals, offering 8 W, 15 W, and 55 W output with wide 12.75–15.35 GHz frequency coverage. The devices feature high efficiency, compact packaging, and enhanced thermal performance for defense, aerospace, and high-speed satellite communication applications.

Skyworks Solutions, Inc., founded in 2002, is a leading provider of high-performance analog and mixed-signal semiconductors, specializing in RF front-end solutions and GaAs-based devices. The company serves mobile, automotive, aerospace, and defense markets, focusing on power amplifiers, filters, and modules to enable efficient, reliable, and high-frequency wireless communication.

-

In October 2025 – Skyworks Solutions announced it will merge with Qorvo in a USD 22 billion deal, creating a major RF front-end and GaAs high-frequency device company. The merger is expected to boost Taiwan GaAs foundry demand and consolidate the global RF semiconductor market.

GaAs High Frequency Device Market Key Players:

-

Mitsubishi Electric Corporation

-

Skyworks Solutions, Inc.

-

Qorvo, Inc.

-

WIN Semiconductors Corp.

-

SUMITOMO ELECTRIC Industries, Ltd.

-

Analog Devices, Inc.

-

MACOM Technology Solutions Holdings, Inc.

-

Advanced Wireless Semiconductor Company

-

Wolfspeed, Inc.

-

NXP Semiconductors N.V.

-

Broadcom Inc.

-

Murata Manufacturing Co., Ltd.

-

RFHIC Corporation

-

STMicroelectronics N.V.

-

Toshiba Corporation

-

Infineon Technologies AG

-

United Monolithic Semiconductors (UMS)

-

Freiberger Compound Materials GmbH

-

AXT Inc.

-

DOWA Electronics Materials Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 7.96 Billion |

| Market Size by 2033 | USD 14.82 Billion |

| CAGR | CAGR of 8.08% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(LV High Frequency Devices and HV High Frequency Devices) • By Application(Wireless Communication, Mobile Devices, Automotive Electronics, Military and Others) • By Material(Gallium Arsenide (GaAs), Silicon Germanium (SiGe), Indium Phosphide (InP) and Gallium Nitride (GaN)) • By End User(Telecommunication, Consumer Electronics, Automotive, Defense & Aerospace and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ELECTRIC Industries, Ltd., Analog Devices, Inc., MACOM Technology Solutions Holdings, Inc., Advanced Wireless Semiconductor Company, Wolfspeed, Inc., NXP Semiconductors N.V., Broadcom Inc., Murata Manufacturing Co., Ltd., RFHIC Corporation, STMicroelectronics N.V., Toshiba Corporation, Infineon Technologies AG, United Monolithic Semiconductors (UMS), Freiberger Compound Materials GmbH, AXT Inc., DOWA Electronics Materials Co., Ltd. |