Real-Time Clock (RTC) ICs Market Size & Growth:

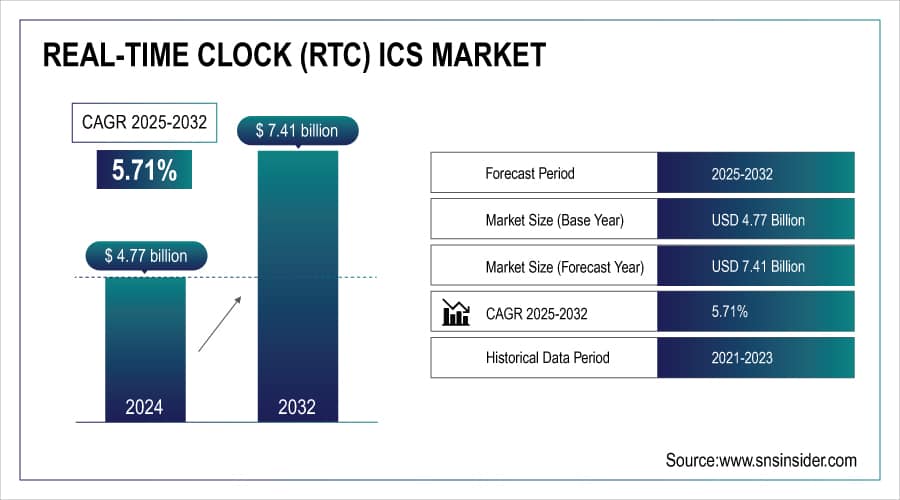

The Real-Time Clock ICs Market Size was valued at USD 4.77 billion in 2024 and is expected to reach USD 7.41 billion by 2032 and grow at a CAGR of 5.71% over the forecast period 2025-2032.

To Get More Information On Real-Time Clock (RTC) ICs Market - Request Free Sample Report

The global market for Real-Time Clock ICs is experiencing impressive growth, fueled by the increasing demand for precise timekeeping and ultra-low power consumption. With electronic devices growing smaller and power-efficient, RTC ICs play a vital role in preserving system performance in low-power modes. The expanding demand for always-on capabilities across various applications is accelerating their integration worldwide.

According to research, over 70% of RTC-enabled devices rely on battery backup modes for persistent timekeeping.

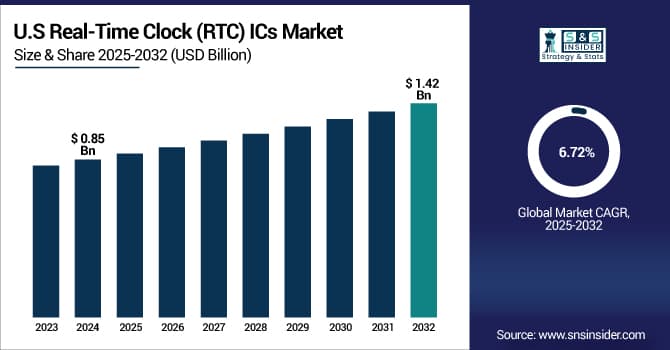

The U.S. Real-Time Clock ICs Market size was USD 0.85 billion in 2024 and is expected to reach USD 1.42 billion by 2032, growing at a CAGR of 6.72% over the forecast period of 2025–2032.

The US real-time clock ics market growth is primarily driven by the rapid expansion of advanced electronics in smart homes, wearables, automotive systems, and industrial automation. Adoption is further driven by growing penetration of IoT-based devices and increased demand for power-saving timing components. Market expansion in the United States is still driven in great part by robust R&D investments and semiconductor innovation.

According to research, around 45% of RTC ICs used in U.S. devices now support ultra-low power modes, reflecting the growing need for energy-efficient, always-on functionality across connected consumer electronics.

RTC ICs Market Dynamics

Key Drivers:

-

Increasing use of battery-powered portable devices necessitates low-power RTC ICs for timekeeping during power-down modes

Ultra-low-power operation is increasingly important to extend battery life as battery-operated devices including wearables, IoT devices, smart meters, and healthcare monitors proliferate. Real-Time Clock ICs assist in precise timekeeping yet with very minimal power consumption in sleep or off modes, making them critical for unintermittent operations. As demand for always-on capability increases, manufacturers are adding RTCs to keep system time intact even in shutdown mode. Such a critical feature has found broad acceptance in small electronics, where power efficiency and dependability are not negotiable. The relentless process of shrinking electronics continues to fuel the demand for ultra-low-power RTC ICs worldwide.

According to research, RTC ICs are embedded in over 80% of smartphones, smartwatches, and portable health monitors.

Restrain:

-

Rising integration of RTC functionality into main microcontrollers reduces standalone RTC IC demand

Modern system-on-chip (SoC) solutions and microcontrollers are increasingly integrating RTC functionalities as part of their embedded architecture. This reduces the need for discrete RTC ICs, especially in cost-sensitive or space-constrained designs. As more features get packed into a single chip, the demand for standalone timing components might drop in certain applications. This trend is impacting unit shipments and shrinking the market for traditional RTC manufacturers, particularly in areas where optimizing size and cost is crucial. The increasing capacity of embedded solutions could impede the segment of standalone RTC IC development over time.

| Factor | Integrated RTC (MCUs/SoCs) | Standalone RTC ICs |

|---|---|---|

|

Cost |

Lower |

Higher |

|

Size |

Compact |

Requires extra space |

|

Power Use |

Low |

Ultra-low (100–300 nA) |

|

Accuracy |

Basic |

High with temp. compensation |

|

Use Cases |

IoT, wearables |

Automotive, industrial, medical |

|

Trend |

Rising |

Stable to declining |

Opportunities:

-

Rising adoption of IoT and smart city infrastructure opens new markets for RTC integration in connected devices

Smart homes, smart grids, and smart transportation are driving demand for RTC ICs in IoT devices needing real-time event monitoring and data logging. RTCs play a crucial role in synchronization, scheduling, and energy-efficient wake-up operations across various devices. Whether it's smart thermostats or connected streetlights, having accurate timing is essential for optimizing energy consumption and ensuring dependable performance. With worldwide urbanization driving investments in smart city infrastructure, RTS IC manufacturers can tap into the need for small, accurate, and ultra-low-power timing solutions integrated into smart devices.

According to research, over 45% of new RTC designs support ultra-low-power or power-switching features for IoT and smart city use cases.

Challenges:

-

Maintaining reliable operation across diverse environmental conditions and long product life cycles is technically demanding

Clock with Real Time Many times, ICs are used in settings requiring consistent performance over humidity, temperature extremes, and electrical noise. RTC ICs are required in applications such as industrial automation, automobile systems, and space electronics to maintain accuracy and functionality over extended periods of operation—toward ten plus years. Selecting the proper materials, handling heat, and laying out circuits can be a formidable challenge in such harsh environments, but it's critical to reliability. Even a small time deviation due to environmental influences can jeopardize system safety and reliability, necessitating—but proving challenging to provide—consistent performance under all conditions of use.

| Challenge | Simple Solution |

|---|---|

|

Extreme temperatures |

Use RTCs that work reliably in hot and cold climates |

|

Humidity/moisture |

Use sealed or coated chips to block moisture |

|

Electrical noise (EMI) |

Add shielding or filters to prevent interference |

|

Long lifespan |

Use high-quality crystals that stay accurate for years |

|

Time drift |

Include auto-adjustment to keep time accurate |

|

Regulations |

Choose RTCs that meet automotive and aerospace standards |

Real-Time Clock ICs Market Segment Analysis:

By Interface

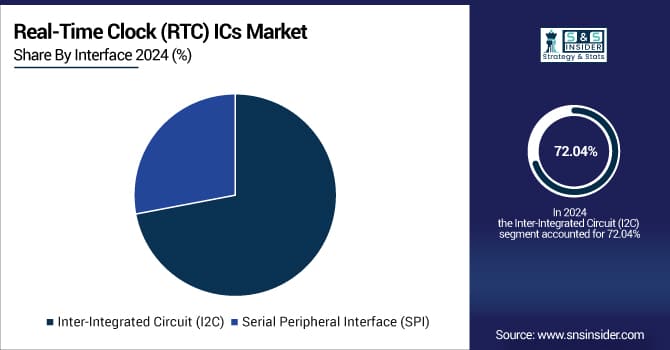

The Inter-Integrated Circuit (I2C) segment dominated the highest Real-Time Clock ICs Market share of about 72.04% in 2024. The reason for its widespread use can be attributed to its low power consumption, minimal pin configuration, and ease of integration into compact designs. NXP Semiconductors stands out as a key player in advancing I2C RTC ICs, particularly for wearables, portable medical devices, and smart home gadgets.

The Serial Peripheral Interface (SPI) segment is expected to grow at the fastest CAGR of about 6.76% from 2025–2032. The rapid communication speed, enhanced data integrity, and suitability for real-time applications are all key factors driving this advancement. Microchip Technology provides high-performance SPI RTC ICs that are utilized in cutting-edge automotive electronics and industrial control systems. The use of SPI is steadily growing as the demand for fast, synchronous data exchange in high-reliability settings continues to rise.

By Mounting Type

The Surface Mount segment dominated the Real-Time Clock ICs Market with the highest revenue share of approximately 76.02% in 2024, because it is supported automated PCB assembly and a small form factor. When it comes to industrial and mobile applications, surface-mount RTCs have primarily been developed by Texas Instruments. These types of mounting are a game changer for mass produced consumer and IoT devices, as they allow for greater circuit density and improved manufacturing efficiency.

The Through Hole segment is estimated to expand at the highest CAGR of around 6.68% during 2025–2032, due to its improved mechanical stability and durability in harsh environments. Designed for harsh environments such as industrial automation and heavy equipment, STMicroelectronics offers a range of through-hole RTC ICs. As the need for reliable, high-stress parts in challenging settings grows, so does the market for these robust solutions.

By Operating Voltage

The 2.1V – 3.5V segment accounted for the highest revenue share of about 57.93% in 2024, supported by its suitability for low-power, battery-operated devices. ABLIC Inc. is a prominent developer of RTC ICs that are specifically optimized for this voltage range and extensively utilized in smartwatches, wireless sensors, and healthcare monitors. The balance between energy efficiency and stable performance drives this segment's dominance.

The 3.6V – 6V segment is forecast to grow at the fastest CAGR of about 6.75% from 2025–2032. This is because it is applicable in higher voltage and industrial applications. Renesas Electronics designs RTC solutions that function without fail in this voltage range for automotive and infrastructure networks. These ICs find growing acceptance in applications where better voltage handling is essential for system stability.

By End-use

The Consumer Electronics segment held the highest revenue share of about 33.08% in 2024, driven by the increasing use of RTC ICs in smartphones, tablets, smart TVs, and other connected devices. Real-Time Clock ics Companies Analog Devices, Inc. provides RTC solutions tailored for low-power, always-on consumer applications. Accurate timekeeping even during system sleep or shutdown boosts efficiency and user experience, ensuring strong adoption in this sector.

The Automotive segment is expected to grow at the fastest CAGR of about 7.01% from 2025–2032, as cars incorporate more sophisticated electronics. Active development of automotive-grade RTC ICs by Infineon Technologies supports telematics, event logging, and ADAS capabilities. RTC acceptance in this market is fast expanding as demand for safe, real-time systems in EVs and autonomous cars grows.

Real-Time Clock ICs Market Regional Analysis:

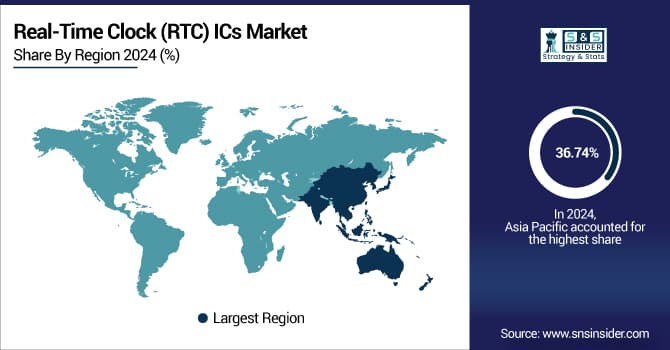

Asia Pacific dominated the Real-Time Clock ICs Market with the highest revenue share of about 36.74% in 2024. The region leads due to its robust semiconductor fabrication infrastructure, extensive consumer electronics production, and cheap supply chain networks. Countries such as China, Japan, South Korea, and Taiwan are key players in fulfilling RTC IC demand around the globe. On top of that, increasing adoption of IoT and wearable technology in the region continues to support its market leadership.

According to research, over 300+ active smart city initiatives across China, India, South Korea, Japan, and Singapore rely on RTC-driven devices for synchronization and energy management.

-

China dominates the Asia Pacific RTC ICs Market owing to its large-scale electronics manufacturing capacity, cost-effective production, and strong domestic demand. Government support for semiconductor self-sufficiency and rapid expansion in IoT and consumer electronics continue to drive its leading position.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America is projected to grow at the fastest CAGR of about 7.27% from 2025–2032, driven by technological advancements and an increase in high-performance electronics demand across automotive, aerospace, healthcare, and industrial automation industry Strong R&D spending, government policies, and a developed consumer electronics market form a strong base. The push toward electrification, automation, and connected infrastructure is expected to significantly boost RTC IC adoption across the region.

-

The United States leads the North American RTC ICs Market due to its advanced semiconductor ecosystem, great presence of consumer electronics and automotive OEMs, and large R&D investments, the United States leads the North American RTC IC market. Widespread acceptance of connected devices and industrial automation helps to define its market place even more.

Europe's RTC ICs Market is driven by Demand in the automotive, industrial automation, and healthcare industries drives Europe's RTC ICs Market. Key contributors benefiting from great automotive innovation and smart manufacturing adoption are nations like Germany and France. To support consistent RTC integration, the area also stresses compliant with rigorous regulatory standards and energy-efficient electronics. Growing attention on digital transformation and Industry 4.0 projects improves Europe's position in the world market even more.

-

Germany leads because of its robust automotive sector, sophisticated industrial automation system, and large smart manufacturing and embedded systems investments. Its emphasis on precision engineering and the extensive use of RTC ICs in motor vehicle ECUs, industrial controllers, and IoT devices establishes it firmly as the region's leader.

The Middle East & Africa Real-Time Clock ICs Market is dominated by the UAE, thanks to accelerated digitization and smart infrastructure plans, while Latin America is dominated by Brazil thanks to robust consumer electronics and automotive industries. Both are witnessing increased adoption in industrial and connected device applications.

Real-Time Clock ICs Companies are:

Major Key Players in Real-Time Clock ICs Market are STMicroelectronics, Seiko Epson Corporation, Texas Instruments, Maxim Integrated, Microchip Technology, NXP Semiconductors, Renesas Electronics, Analog Devices, Abracon, AMS AG and others.

Recent Development:

-

April 2024, Seiko Epson unveiled the RX‑8035SA and RA‑8565SA ultra-low-power RTC modules delivering ±5 ppm accuracy, built-in 32.768 kHz crystal, dual alarms, auto power‑switching—ideal for wearables and compact IoT.

-

January 2025, NXP Semiconductors introduced automotive-grade RTC chips PCF2129AT and PCF8563, AEC‑Q100 qualified, ±3 ppm accuracy, low-power I²C/SPI interfaces—designed for reliable timekeeping in ADAS and vehicle systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.77 Billion |

| Market Size by 2032 | USD 7.41 Billion |

| CAGR | CAGR of 5.71% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Interface (Inter-Integrated Circuit (I2C), Serial Peripheral Interface (SPI)) • By Mounting Type (Surface Mount, Through Hole) • By Operating Voltage (1V – 2V, 2.1V – 3.5V, 3.6V – 6V) • By End-use (Energy & Utility, Consumer Electronics, Automotive, Industrial, IT & Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | STMicroelectronics, Seiko Epson Corporation, Texas Instruments, Maxim Integrated, Microchip Technology, NXP Semiconductors, Renesas Electronics, Analog Devices, Abracon, AMS AG. |