Smart TV Market Size & Growth Trends:

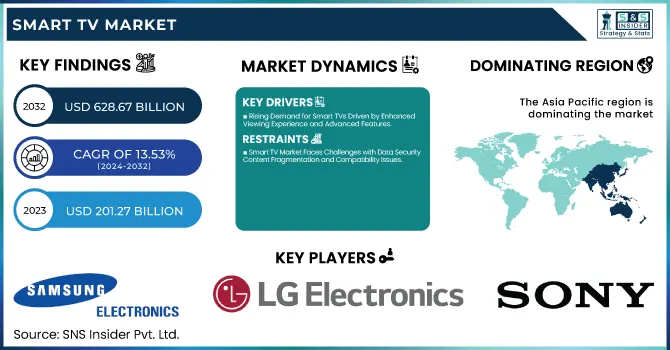

The Smart TV Market Size was valued at USD 201.27 Billion in 2023 and is expected to reach USD 628.67 Billion by 2032 and grow at a CAGR of 13.53% over the forecast period 2024-2032. The Smart TV market is rapidly evolving across all segments. Product performance things like 4K/8K resolution, higher refresh rates, and better HDR technologies that improve the visual experience. Innovative & Technology progression like AI-based content recommendations, Voice control integration, and gaming integration.

To Get more information on Smart TV Market - Request Free Sample Report

As the demand for smart ecosystems gains traction, smart home & connectivity functionalities are broadening with the introduction of connectivity functionalities for seamless integration with IoT devices, smart speakers, and home automation systems. Finally, usage analytics & technical enhancements are aimed at better UI designs, upgraded hardware, energy efficiency, and data security to boost the user experience and overall system betterment stability.

Smart TV Market Dynamics

Key Drivers:

-

Rising Demand for Smart TVs Driven by Enhanced Viewing Experience and Advanced Features

Due to rising consumer acceptance of improving TV viewing experience and high-end functionality offered by smart TV, the smart TV market is observing steady growth. That demand for high-performance Smart TVs is being boosted by the increasing consumption of 4K and 8K content, as well as better internet penetration. Moreover, AI voice assistants like Google Assistant and Amazon Alexa can also help in providing a better user experience and this is expected to drive growth for the AI music generator market during the forecast period. The increasing popularity of OTT platforms such as Netflix, Amazon Prime, and Disney+ adds to the need for Smart TVs with operating systems such as Android TV, Roku, or Tizen. In addition, decreasing prices for large TVs and improved technology in the panel are bringing more premium models within reach of consumers.

Restrain:

-

Smart TV Market Faces Challenges with Data Security Content Fragmentation and Compatibility Issues

There are significant challenges in the Smart TV market that are associated with data security and privacy issues. The connected nature of these devices and their smart capabilities opens them up to a wider range of cyber threats with the potential to endanger user data. Right now, consumers are more hesitant than ever to share personal information, which could make adoption more difficult. Another important issue is content fragmentation, as different platforms can acquire rights to different content, which can create inconvenience to the users, as they have to subscribe to multiple platforms to watch it. They may also face problems with compatibility between operating systems and applications, creating friction in communication and lowering the level of satisfaction amongst users.

Opportunity:

-

Smart TV Market Growth Fueled by Connected Homes Rising Incomes and Gaming Display Demand

With more and more connected home ecosystems in markets, the connected home opens a real growth opportunity for all Smart TV manufacturers. The increasing smart homes trend is boosting the integration of TV with IoT devices, improving user experience. Rising disposable incomes and the emergence of effective digital infrastructure allow for attractive game development scenarios in developing countries in Asia-Pacific and Latin America. Moreover, the increased gaming content and expanding demand for high-refresh displays open new opportunities for manufacturers to network with gamers. The demand for 8K Technology is expected to gain traction in premium segments as the technology matures which is expected to accelerate the demand in the Day & Night Machine Vision Cameras market generating higher revenues shortly.

Challenges:

-

Smart TV Market Faces Challenges with Technology Complexity Compatibility Issues and Sustainability Demands

The complexity of technology is an ever-growing landlord challenge in the Smart TV market. Less tech-savvy consumers may become frustrated with frequent software updates, a continually evolving user interface, and new features, sacrificing adoption. Additionally, seamless integration with hardware is also often not present and that can lead to a slew of compatibility woes problems between devices like sound systems, gaming consoles, or even other smart home gadgets. Balancing enhanced performance with efficiency requirements is another challenge manufacturers face with global sustainability regulations becoming more stringent. For companies that intend to capture greater market share, it is critical to address these concerns while not losing the pace of innovation.

Smart TV Market Segmentation Overview

By Operating System

In 2023, Android TV emerged as the leader in the smart TV market with a significant 39.8% market share. This has gained popularity through a Hands-on free User interface, a massive supportive application environment, and perfect connectivity with Google services (Google Assistant, Chromecast, etc.). Its wide support of a multitude of TV brands at all price points also cemented its status as a leader.

Roku is projected to attain the fastest compound annual growth rate (CAGR) from 2024-2032. The rising interest in Roku is fueled by its user-friendly interface, cost-effective streaming gadgets, and an increasing number of content partnership deals. With its emphasis on providing tailored content recommendations and smooth streaming experiences, the platform can expect to rapidly grow. While Roku is already a major player in North America, its maturing position in the streaming landscape, combined with its expanding footprint in the growing international video consumption markets, signals good business for the company shortly.

By Resolution

In 2023, 4K UHD TV dominated the Smart TV market, securing a notable 49.8% market share. The increased adoption rate can be credited to better picture quality, better color accuracy, and more content in 4K in major streaming services. For this very reason, they are great places on the market, also thanks to making them not very expensive, more people can afford 4k TVs, which are compounded expensively seamlessly so that it is a good option for those who want to enjoy the content they like in an immersive experience.

Full HD TV is projected to witness the fastest CAGR from 2024 to 2032. The burgeoning demand in price-sensitive markets, especially in developing regions, is the key factor behind this growth. Full HD TVs remain popular among buyers looking for affordable and proper display equipment as additional options to their main solution for smaller apartments. Full HD models are expected to gradually gain steam, as manufacturers target enhanced energy efficiency and smart features.

By Screen Size

Smart TVs between 46 to 55 inches, which represent the biggest market share of 34.6% of the entire market in 2023. The segment is also a sweet spot between screen size, price, and capability for normal-sized living rooms, and for that reason, it is the leader in this segment. This size range seems to be in demand by consumers for its ability to present a cinematic experience while not necessitating a major overhaul of the room. Also, nowadays 4K and smart features are available in this segment, and we are seeing a decent amount of sales coming in the segment.

Smart TVs above 65 inches are expected to witness the fastest CAGR from 2024-2032. This growth has been primarily attributed to the increasing adoption of home theatre system, decreasing price of large-size models, and increasing demand for premium viewing experience. With consumers demanding more cinematic space at home, this category should experience considerable growth.

By Distribution Channel

Online distribution channels held the largest share of the Smart TV market in 2023, with a 54.9% share. Significant growth in sales was fueled by the ongoing trend towards e-commerce channels with strategic pricing, discounts, and home delivery. At the same time, buyers experience greater choice, product reviews in detail, and seamless comparison between products through the internet. Another aspect that added to the online sales boom was the digital marketing strategies and influencer promotions.

It is anticipated that the Offline channel will be the highest CAGR from 2024 to 2032 Those in search of advice customized to their needs, a chance to test products, and the ability to make a purchase then and there, still favor physical shops. To get offline growth back on track, retailers are also working on better experiences inside the store, including better display, interactive demos, and better support to customers.

By Technology

LED dominance in the Smart TV market, with 58.7% market share in 2023. Because of reasons such as low cost, minimum power consumption, and variety of screen sizes, LED TVs have the largest share of the market. LED technology is also influencing the mass market for the better the ability to produce brighter displays, along with a broader and more accurate color gamut, has made this bright-display technology ubiquitous throughout the budget to premium buyer segments, too. Local dimming and improved HDR support are other recent developments that have helped secure LED TV adoption.

From 2024 to 2032, it is anticipated that OLED will be the fastest-growing segment in terms of revenue CAGR. Because OLED TVs have better picture quality than regular LED TVs, producing deeper blacks, higher contrast ratios, and wider viewing angles, they are the best solution for setting up high-end home entertainment displays. With prices for OLED continuing to drop and consumers increasingly seeking more immersive viewing experiences, this area is likely to grow quickly in the next few years.

Smart TV Market Regional Analysis

Asia Pacific led the Smart TV Market Share with a massive 34.3% share of the overall marketing in 2023. The expansion is fueled by increasing disposable income, rapid urbanization, and the growing development of digital frameworks in countries including China, India, and Japan. Chinese companies TCL and Hisense are examples of this, successfully growing as some of the largest Smart TV manufacturers around by providing themselves with loaded but affordable products. Brands like Xiaomi, OnePlus, and Samsung have built a huge momentum around affordable Smart TVs with built-in streaming in India. Market growth has soared due to the numerous local manufacturers in the region, and the high demand for home entertainment.

Europe is expected to register the fastest CAGR from 2024 to 2032. This is driven by increasing demand for premium TV models as consumers have developed a growing taste for advanced display technologies like OLED and QLED. A well-known example is brands such as LG, Sony, and Philips dominate the European market with high-end Smart TVs (including Dolby Vision, voice control, etc). Additionally, the concentration of energy efficiency and sustainable electronics among Europeans is driving consumers to replace old traditional televisions with new Smart TVs, which, in turn, propels market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart TV Market are:

-

Samsung Electronics (Samsung Neo QLED)

-

LG Electronics (LG OLED C3)

-

Sony Corporation (Sony Bravia XR)

-

TCL Corporation (TCL Q Class)

-

Hisense (Hisense U8H)

-

Vizio Inc. (Vizio M-Series)

-

Panasonic Corporation (Panasonic JX940)

-

Philips (TP Vision) (Philips OLED+937)

-

Sharp Corporation (Sharp AQUOS)

-

Xiaomi Corporation (Xiaomi TV Q2)

-

Skyworth (Skyworth Q71)

-

Haier Group (Haier LE Series)

-

Toshiba Corporation (Toshiba C350 Series)

-

Insignia (Best Buy) (Insignia F30)

-

OnePlus (OnePlus Q2 Pro)

Recent Trends

-

In January 2024, Samsung launched its 2024 lineup featuring Neo QLED, MICRO LED, OLED, and Lifestyle Displays, integrating advanced AI features to enhance viewing experiences and smart connectivity.

-

In January 2024, LG introduced its newest OLED evo TV lineup at CES 2024, featuring enhanced brightness, improved picture quality, and advanced AI capabilities for an immersive viewing experience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 201.27 Billion |

| Market Size by 2032 | USD 628.67 Billion |

| CAGR | CAGR of 13.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operating System (Android TV, Tizen, WebOS, Roku, Other) • By Resolution (4K UHD TV, HDTV, Full HD TV, 8K TV) • By Screen Size (Below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, Above 65 inches) • By Distribution Channel (Online, Offline) • By Technology (OLED, QLED, LED, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Electronics, Sony Corporation, TCL Corporation, Hisense, Vizio Inc., Panasonic Corporation, Philips (TP Vision), Sharp Corporation, Xiaomi Corporation, Skyworth, Haier Group, Toshiba Corporation, Insignia (Best Buy), OnePlus. |