Gaming PC Market Report Scope & Overview:

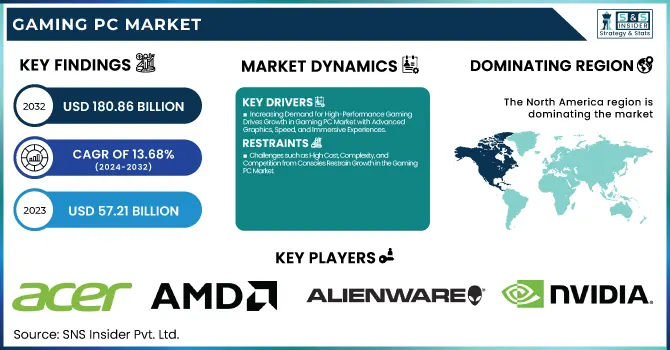

The Gaming PC Market was valued at USD 57.21 billion in 2023 and is expected to reach USD 180.86 billion by 2032, growing at a CAGR of 13.68% from 2024-2032. This report includes insights on key factors shaping the market, such as consumer demographics, sales trends, technological advancements, and the rising impact of esports. It also explores the challenges posed by supply chain disruptions and component shortages, which influence product availability and pricing. The growing demand for high-performance gaming PCs driven by technological innovations and esports integration is expected to continue fueling market growth in the coming years.

To Get more information on Gaming PC Market - Request Free Sample Report

Gaming PC Market Dynamics

Drivers

-

Increasing Demand for High-Performance Gaming Drives Growth in Gaming PC Market with Advanced Graphics, Speed, and Immersive Experiences

As gaming industry advancing at a rapid pace, gamers are expecting more from their systems in order to meet the growing complexity of games. The demand for high-performance gaming PCs has been on the rise, fueled by the need for sophisticated graphics, quicker processing times, and immersive gaming experiences. Contemporary games necessitate powerful GPUs, processors, and improved cooling systems to play smoothly and provide the degree of realism and responsiveness that gamers have come to anticipate. This requirement is particularly prevalent in competitive and multiplayer gaming, where performance can be the difference between winning and losing. With the ongoing innovation in game design, gamers are constantly updating their hardware to remain ahead of the competition, thereby providing a firm growth opportunity for the gaming PC market.

Restraints

-

Challenges such as High Cost, Complexity, and Competition from Consoles Restrain Growth in the Gaming PC Market

The gaming PC market faces number of challenges, with the most important one being that high-performance gaming PCs are expensive. Gaming PCs, especially ones with powerful graphics and processing features, can be very expensive, limiting their potential to appeal to a wide group of consumers. The difficulty in customizing these systems and requiring technical skills to assemble or upgrade them is also a turn-off for less technically inclined consumers. Competition from cheaper and easier-to-use consoles also restricts demand for gaming PCs. The fast rate of technological progress also renders gaming hardware outdated quickly, causing frequent upgrades that could deter investment. In addition, the size of gaming PCs relative to portable options and energy consumption and environmental concerns further restrict market expansion.

Opportunities

-

Emerging Trends like AI, Esports, VR, and Cloud Gaming Present Significant Growth Opportunities for the Gaming PC Market

Improvements in AI and machine learning provide new opportunities in the gaming PC market, enabling features such as smart performance optimization, which can improve the overall gaming experience. The rise of esports offers another major opportunity, with an increasing demand for high-performance systems optimized for competitive gaming. Moreover, the growing appeal of virtual reality and augmented reality necessitates high-performance gaming PCs to support these technologies. Cloud gaming is increasingly becoming popular as well, opening up new dimensions for gaming PCs to be coupled with cloud platforms for hassle-free experiences. In addition, the increasing number of gaming streamers and content creators drives demand for PCs that can support both gaming and streaming, driving innovation in the market.

Challenges

-

Complexity of Customization and Lack of Technical Knowledge Limit Accessibility and Growth in the Gaming PC Market

The gaming PC market is limited by the technical complexity of customization since most consumers do not have the technical expertise to build or customize gaming systems. This constraint holds the market at a niche of technologically adept consumers who are familiar with putting together or replacing components. To the general consumer, the task may appear too complex and labor-intensive, discouraging them from purchasing a gaming PC. Furthermore, the lack of technical expertise might result in problems such as compatibility issues or poor performance, which would also deter potential customers. Though the demand for tailored configurations is increasing, the sophistication of customization still acts as a major hindrance to market growth, especially for less skilled players looking for straightforward, plug-and-play solutions.

Gaming PC Market Segment Analysis

By Distribution Channel

The offline segment domianted the Gaming PC market in 2023, with a revenue share of about 67%. This is due to the demand of consumers for in-store experience where they can touch and feel gaming PCs to evaluate and test them before they buy. Offline stores also provide personalized consultations, expert advice, and instant availability, which is a preferred option for consumers who like to have hands-on product experience and confidence.

The online market is projected to expand at the fastest CAGR of approximately 15.15% during 2024-2032, owing to the rising trend of e-commerce and convenience it provides. Online websites offer more varieties of gaming PCs at affordable prices and easy comparison across models. The expansion is also supported by improved online reviews, offers, and delivery services, attracting technology-conscious customers.

By Product Category

The desktop category led the Gaming PC market in 2023, accounting for approximately 49% of the revenue share. This is mainly because desktops provide better performance, customization, and upgradability than laptops. Gamers looking for high-performance gaming tend to prefer desktops because they can support powerful components, bigger screens, and effective cooling systems, which are perfect for long gaming sessions and immersive gaming.

The laptop segment is expected to grow at the fastest CAGR of around 14.89% during the period 2024-2032, fueled by the need for convenience and portability. Technology innovations in lightweight gaming laptops with high performance, longer battery life, and enhanced display technology are compelling gamers to play on the move. The trend towards remote working and versatile gaming environments is also driving demand for portable gaming solutions.

By Price Range

The mid-range (USD 600 to USD 1000) segment led the Gaming PC market in 2023, with a revenue share of approximately 45%. The reason for this leadership is the tradeoff between price and performance offered by mid-range gaming PCs. They deliver stable gaming performance with good processing as well as graphics capabilities, which suit most gamers willing to pay without the hefty price tag of high-end systems.

The mid-range (USD 600 to USD 1000) segment is expected to grow at the fastest CAGR of approximately 14.98% from 2024-2032, led by rising demand from casual gamers and entry-level enthusiasts. With decreasing costs of gaming technology, consumers look for systems that provide value for money. The growth in this segment is driven by aggressive pricing and ongoing improvement in hardware performance at this price level.

By End-user

The professional gamers category led the Gaming PC market in 2023, accounting for approximately 65% of the revenue share. This is because of the high demand for high-end, high-performance gaming PCs that provide outstanding processing power, speed, and accuracy. Professional gamers use these systems for competitive gaming, where every frame, millisecond, and graphical detail counts, which makes them prefer high-end, high-spec gaming PCs.

The casual gamers segment is expected to grow at the fastest CAGR of approximately 15.62% during the period 2024-2032. The reason behind the highest growth rate in the casual gamers segment is the growing demand for gaming as a mass-level hobby, with more people looking for economical yet highly capable gaming PCs. Casual gamers value ease of use, affordability, and ease of access, which results in increased demand for entry-level to mid-range systems that deliver respectable performance at lesser competitive, recreational gameplay.

Regional Analysis

North America dominated the Gaming PC market in 2023, with around 33% of the revenue share. This dominance is attributed to the large, mature gaming community in the region, coupled with high disposable income, which allows consumers to invest in premium gaming PCs. The presence of major gaming hardware manufacturers, eSports events, and a strong digital infrastructure further strengthens North America's position as the largest market for high-performance gaming systems, driving demand for advanced gaming PCs.

Asia Pacific is expected to grow at the fastest CAGR of about 15.74% from 2024 to 2032, driven by rapid urbanization, growing middle-class populations, and increasing interest in gaming. The region's expanding internet connectivity, burgeoning eSports industry, and a younger demographic that is highly engaged in gaming create significant opportunities for the Gaming PC market. Additionally, improvements in affordability and access to gaming hardware contribute to the region's fast growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Acer (Predator Orion 9000, Predator Helios 300)

-

Advanced Micro Devices, Inc. (Ryzen 9 7900X, Radeon RX 6900 XT)

-

Alienware (Dell Inc.) (Alienware Aurora R13, Alienware m15 R6)

-

CORSAIR (Vengeance i7200, ONE PRO i200)

-

NVIDIA (GeForce RTX 4090, GeForce RTX 3080)

-

CyberPowerPC (Gamer Xtreme VR, Infinity X Series)

-

Lenovo Group Ltd. (Legion Tower 5i, Legion 5 Pro)

-

Razer Inc. (Razer Blade 15, Razer Core X Chroma)

-

Digital Storm (Lynx, Velox)

-

Micro-Star International (MSI) (Trident X, Aegis RS)

-

ASUS (ROG Strix GA35, TUF Gaming GT501)

-

HP Development Company, L.P. (Omen 45L, Omen 25L)

-

Samsung Electronics Co., Ltd. (Odyssey G9 Monitor, Odyssey Neo G8)

-

Apple Inc. (Mac Studio, iMac Pro)

-

Hewlett Packard Enterprise Company (HPE ProLiant DL380 Gen10, HPE Apollo 2000 Gen10)

-

Origin PC (Millennium, Neuron)

-

XPG (XPG Xenia 15, XPG Xenia 14)

-

Zotac (ZBOX Magnus EN173070C, ZBOX MAGNUS EK51060)

-

Maingear (VYBE, F131)

-

iBUYPOWER (Gaming Desktop Slate, iBUYPOWER Element 9260)

Recent Developments:

-

In 2025, ASUS launched the latest ROG Strix SCAR and Strix G laptops, featuring next-gen NVIDIA 50 Series GPUs and Intel and AMD processors, bringing cutting-edge gaming experiences to a broader audience.

-

In 2025, HP introduced the OMEN Max 16 gaming laptop, equipped with next-gen NVIDIA GeForce RTX graphics and Intel Core Ultra 9 processors, offering enhanced thermal management and powerful performance for gamers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 57.21 Billion |

| Market Size by 2032 | USD 180.86 Billion |

| CAGR | CAGR of 13.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Desktop, Laptop, Peripherals) • By Price Range (Low-range, Mid-range, High-end and Extreme High-end-range) • By End-user (Professional Gamers, Casual Gamers, Others) • By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acer, Advanced Micro Devices, Inc., Alienware (Dell Inc.), CORSAIR, NVIDIA, CyberPowerPC, Lenovo Group Ltd., Razer Inc., Digital Storm, Micro-Star International (MSI), ASUS, HP Development Company, L.P., Samsung Electronics Co., Ltd., Apple Inc., Hewlett Packard Enterprise Company, Origin PC, XPG, Zotac, Maingear, iBUYPOWER |