Gelato Market Report Scope & Overview:

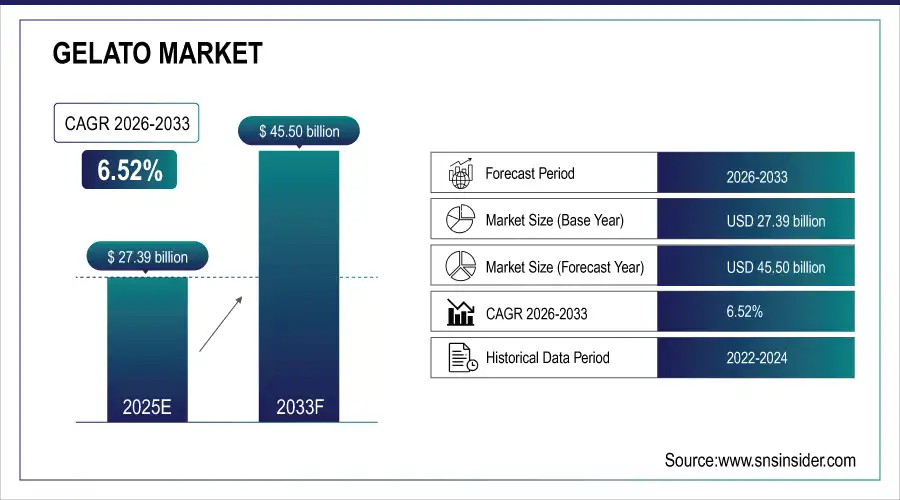

The Gelato Market Size was valued at USD 27.39 billion in 2025E and is expected to reach USD 45.50 billion by 2033, growing at a CAGR of 6.52% over the forecast period of 2026-2033.

Growing consumer preference towards upscale and luxurious and frozen desserts majorly drive the upsurge in global gelato market. In retail and foodservice channels, changing lifestyles and rising disposable incomes have supported increased consumption, and there is a larger trend towards eating out as well. There is also a substantial move towards wholesome and functional alternatives like dairy-free, plant-based, low-sugar gelato that is helping the underlying consumer base to grow to lactose-intolerant, vegan, and health-conscious individuals. Varieties that are gourmet or limited-edition flavoured variety are appealing to younger demographics and encouraging repeat purchases.

To Get more information on Gelato Market - Request Free Sample Report

Market Size and Forecast:

-

Gelato Market Size in 2025E: USD 27.39 Billion

-

Gelato Market Size by 2033: USD 45.40 Billion

-

CAGR: 6.52% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

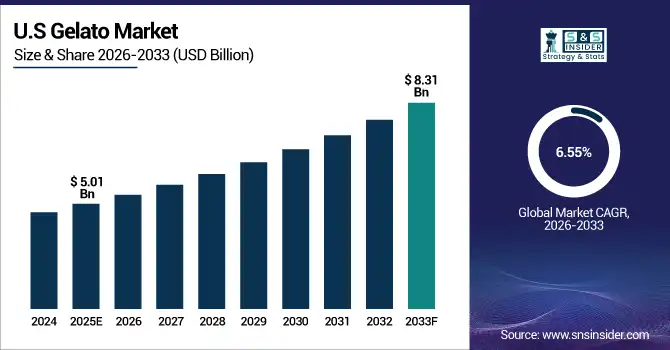

U.S. Gelato Market Insights

The U.S. Gelato Market was valued at USD 5.01 billion in 2025E and is projected to grow USD 8.31 billion by 20233, with growing CAGR of 6.55%.Driven by consumer preference for premium, artisanal, and non-dairy gelato. Investments in R&D, particularly in plant-based alternatives and functional ingredients, support growth. Retail expansion through supermarkets, specialty stores, and online platforms further strengthens market adoption. Government incentives supporting small-scale artisanal food production also help drive market penetration.

Key Gelato Market Trends

-

Rising demand for premium & artisanal gelato with handcrafted, high-quality, and small-batch production

-

Growth of plant-based & dairy-free gelato options using almond, oat, coconut, and soy milk

-

Introduction of innovative flavors & limited editions, including seasonal, exotic, and fusion varieties

-

Popularity of health & functional ingredients, including low-sugar, protein-enriched, and probiotic gelatos

-

Expansion of retail & e-commerce distribution channels, including supermarkets, specialty stores, and online delivery

-

Adoption of sustainable & eco-friendly packaging with biodegradable and recyclable materials

Gelato Market Growth Driver

-

Rising Demand for Premium & Artisanal Gelato

Consumers are increasingly seeking authentic, high-quality gelato made with natural ingredients and traditional Italian techniques. This has led to global expansion for artisanal brands like Grom and Amorino, which are opening new stores across Europe, North America, and Asia-Pacific. Government initiatives in Europe and Italy, including small business grants for local food production, have further incentivized artisanal growth. Social media promotion has increased consumer awareness and repeat purchases, while investments in small-batch production facilities and flavor innovation continue to accelerate to meet rising demand.

Gelato Market Restraint

-

High Production Costs and Seasonal Demand Fluctuations

Premium gelato production involves expensive ingredients, specialized equipment, and skilled labor, resulting in high operational costs. Seasonal demand, which peaks in summer months, adds additional strain on profitability. For example, artisanal gelato production costs can be 3–5 times higher than conventional ice cream, affecting pricing strategies. Unless brands invest in production optimization, cold chain infrastructure, and inventory planning, maintaining year-round profitability remains a challenge.

Gelato Market Opportunity

-

Large-Scale Investments and International Expansion

Gelato brands are investing in global expansion to capture growth in emerging markets with rising disposable incomes and urbanization. Unilever, for instance, has expanded its Talenti gelato production and distribution into Asia-Pacific and North America. Governments in emerging economies, such as India and Southeast Asia, offer incentives for foreign direct investment in food processing. Strategic partnerships with retailers and e-commerce platforms further enhance market reach, making international expansion a significant growth opportunity for gelato producers.

Gelato Market Segment Highlights:

-

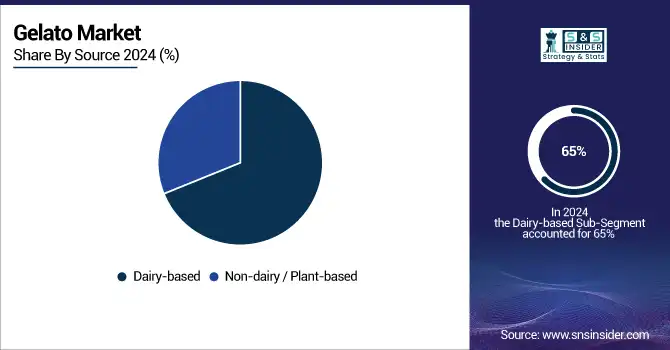

By Source: Dairy-based – 65% share (largest); Non-dairy/Plant-based fastest-growing at 18.5% CAGR.

-

By Flavor: Classic Flavors – 40% share (largest); Gourmet & Limited Edition fastest-growing at 22.4% CAGR.

-

By Production Method: Industrial Gelato – 58% share (largest); Artisanal Gelato fastest-growing at 21.7% CAGR.

-

By Packaging: Take-home – 62% share (largest); Impulse fastest-growing at 19.3% CAGR.

-

By Distribution Channel: Supermarkets & Hypermarkets – 50% share (largest); Online Retail/E-commerce fastest-growing at 24.1% CAGR.

Gelato Market Segment Analysis:

By Source

Dairy-based gelato continues to dominate the market with a 65% share in 2025, driven by consumer preference for traditional, creamy textures and well-established supply chains in Europe and North America. Non-dairy or plant-based gelato is the fastest-growing segment, expected to register a CAGR of 18.5%, fueled by rising veganism, lactose intolerance, and increasing demand for sustainable alternatives. Plant-based options are also supported by product innovation using almond, oat, and coconut milk to match the taste and creaminess of traditional dairy gelato.

By Flavor

Classic flavors, such as vanilla, chocolate, and strawberry, hold a 42.60% market share, maintaining dominance due to their consistent consumer acceptance and strong presence in retail and foodservice channels. Gourmet and limited-edition flavors are the fastest-growing sub-segment, with a CAGR of 22.4%, as brands introduce seasonal, exotic, and fusion flavors to attract younger, experimental consumers. Social media marketing and influencer endorsements also help drive consumer trial and repeat purchases of unique flavor offerings.

By Production Method

Industrial gelato leads the market with a 58% share in 2025, supported by large-scale production efficiency, widespread distribution, and cost-effectiveness for supermarkets and retail chains. Artisanal gelato is the fastest-growing segment, projected at a CAGR of 21.7%, as consumers increasingly seek authentic, handcrafted products made with natural ingredients. The artisanal segment benefits from premium pricing, experiential consumption, and expansion in tourist-heavy and urban areas.

By Packaging

Take-home gelato dominates the market with a 62% share, primarily due to its convenience for at-home consumption and widespread availability in supermarkets and hypermarkets. Impulse packaging, however, is the fastest-growing sub-segment with a CAGR of 19.3%, driven by the rising demand for single-serve portions and grab-and-go options at convenience stores, specialty outlets, and online delivery platforms. Growth is also supported by packaging innovations such as eco-friendly cups and portable containers.

By Distribution Channel

Supermarkets and hypermarkets continue to be the leading distribution channel with a 50% market share, owing to their extensive retail network, promotional campaigns, and ability to stock a wide variety of gelato flavors and brands. Online retail/e-commerce is the fastest-growing channel, expected at a CAGR of 24.1%, due to increasing consumer adoption of digital shopping platforms, home delivery services, and subscription-based gelato offerings. Investments in cold chain logistics and partnerships with food delivery apps are further boosting online sales.

Gelato Market Regional Analysis

Europe Gelato Market Analysis

Europe holds the largest Gelato market share of around 39.34% in 2025, driven by high consumer preference for artisanal, premium, and plant-based gelato. Germany, Italy, and France are key contributors, with strong investments in industrial and artisanal production facilities, cold chain logistics, and flavor innovation. High demand is supported by well-established retail and specialty gelato stores, as well as government policies promoting local food production and sustainable dairy alternatives. The European market also benefits from robust tourism, which increases demand for artisanal gelato in urban and leisure destinations.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Gelato Market Insights

North America is one of the fastest-growing regions in the Gelato market, holding a market share of around 24.67% in 2025. This growth is supported by mature dairy and plant-based supply chains, high consumer awareness of premium and artisanal gelato, and strong retail and e-commerce penetration. The U.S. leads the region due to high disposable income, health-conscious consumer trends, and technological advancements in gelato production and cold chain logistics. In 2025, major players such as Talenti and Unilever expanded production facilities and online delivery networks in response to increasing domestic and export demand. The growing demand for plant-based and functional gelato also boosts innovation and product diversification across the region.

Asia Pacific Gelato Market Insights

Asia Pacific is emerging as a rapidly growing Gelato market, fueled by increasing urbanization, rising disposable incomes, and greater exposure to global dessert trends. The region benefits from lower manufacturing costs, expanding retail networks, and favorable government policies for food processing and plant-based production. China and Japan are leading markets, with local players investing in premium and artisanal gelato facilities, as well as plant-based innovation. The adoption of e-commerce and cold chain infrastructure is increasing accessibility in semi-urban and urban centers, supporting strong CAGR growth in this region.

Latin America (LATAM) and Middle East & Africa (MEA) Gelato Market Insights

LATAM and MEA represent developing but strategically important markets for gelato. Brazil leads LATAM due to its strong dairy industry and growing consumer interest in premium and plant-based gelato. Chile and Argentina are investing in cold chain infrastructure to expand artisanal and retail gelato offerings. In MEA, countries like the UAE and Saudi Arabia are seeing increased adoption of premium and imported gelato products, supported by rising disposable income and hospitality sector growth. Government initiatives promoting food industry investment, tourism, and sustainable production practices are further supporting market growth in both regions.

Competitive Landscape for Gelato Market:

Unilever PLC

Unilever is a leading global gelato manufacturer, offering a wide range of dairy and plant-based gelato brands, including Talenti and Magnum.

-

In February 2025, Unilever launched a new artisanal gelato production facility in Italy to expand its premium and plant-based gelato portfolio for European and North American markets.

Nestlé S.A.

Nestlé produces and distributes gelato across multiple segments, focusing on premium, functional, and non-dairy offerings.

-

In March 2025, Nestlé introduced a new line of protein-enriched and low-sugar gelato in North America to cater to health-conscious consumers.

Froneri International Ltd.

Froneri is a joint venture specializing in frozen desserts, with a strong presence in both retail and foodservice channels.

-

In January 2025, Froneri opened a new industrial gelato plant in Germany to scale production of artisanal and classic flavors for European markets.

Gelato Messina

Gelato Messina is renowned for its artisanal and innovative gelato flavors, emphasizing limited editions and premium ingredients.

-

In April 2025, the company expanded its international footprint by launching stores in Singapore and Hong Kong to target high-demand urban markets.

Gelato Market Key Players

Some of the Gelato Companies

-

Unilever PLC

-

Nestlé S.A.

-

Froneri International Ltd.

-

General Mills, Inc.

-

Ferrero Group

-

Gelato Italia Ltd.

-

Grom

-

Talenti Gelato & Sorbetto

-

Venchi S.p.A.

-

Amorino Gelato

-

Gelato Messina

-

Breyers Gelato Indulgences

-

Bassetts Ice Cream Company

-

Carpigiani Group

-

PreGel S.p.A.

-

La Gelateria della Musica

-

Morano Gelato

-

Gelato Fiasco

-

Ciao Bella Gelato Company

-

Il Laboratorio del Gelato

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD27.39 Billion |

| Market Size by 2033 | USD 45.50 Billion |

| CAGR | CAGR of6.52% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Dairy-based, Non-dairy / Plant-based) • By Flavor (Classic Flavors, Fruit-based Flavors, Nut-based Flavors, Gourmet & Limited Edition, Others) • By Production Method (Industrial Gelato, Artisanal Gelato) • By Packaging (Impulse, Take-home) • By Distribution Channel (Retail, Food Service) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Unilever PLC, Nestlé S.A., Froneri International Ltd., General Mills, Inc., Ferrero Group, Gelato Italia Ltd., Grom, Talenti Gelato & Sorbetto, Venchi S.p.A., Amorino Gelato, Gelato Messina, Breyers Gelato Indulgences, Bassetts Ice Cream Company, Carpigiani Group, PreGel S.p.A., La Gelateria della Musica, Morano Gelato, Gelato Fiasco, Ciao Bella Gelato Company, Laboratorio del Gelato |