Vitamin Ingredients Market Report Scope & Overview:

Get More Information on Vitamin Ingredients Market - Request Sample Report

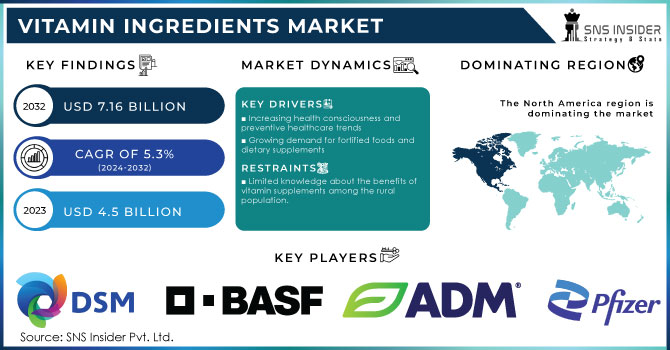

The Vitamin Ingredients Market size was USD 4.5 billion in 2023 and is expected to Reach USD 7.16 billion by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

The vitamin ingredients market is experiencing robust growth, driven by increasing health consciousness among consumers and a rising prevalence of vitamin deficiencies globally. This growing demand is further propelled by an aging population more susceptible to deficiencies, as well as the expansion of the nutraceutical and pharmaceutical industries, which utilize vitamins to enhance their products. Recent examples of companies active in the vitamin ingredients market include BASF SE, DSM, and Lonza Group AG.

According to the World Health Organization for International Public Health, chronic diseases kill nearly 41 million people globally each year. People who are vitamin deficient have a weaker immune system and are more prone to chronic disease. The rise in chronic diseases has increased people's need for vitamins, fueling the growth of vitamin ingredients.

Market Dynamics

Drivers

-

Increasing health consciousness and preventive healthcare trends

-

Growing demand for fortified foods and dietary supplements

-

Expanding aging population and associated health concerns

-

Rising disposable incomes and urbanization

-

Rising prevalence of lifestyle diseases and vitamin deficiencies

The rising prevalence of lifestyle diseases and vitamin deficiencies is a key driver of the vitamin ingredients market. Sedentary lifestyles, consumption of processed foods, and chronic stress contribute to poor nutritional intake, while micronutrient malnutrition and specific dietary restrictions further exacerbate the problem. With over 2 billion people worldwide suffering from deficiencies, consumers are turning to vitamin supplements to bridge the gap and prevent chronic diseases. product launches like Nestlé's "Garden of Life mykind Organics B-Complex" cater to the rising demand for targeted and plant-based vitamin solutions.

Restraints

-

Limited knowledge about the benefits of vitamin supplements among the rural population.

-

High cost of premium vitamin ingredients

-

Complex and time-consuming approval processes for new vitamin ingredients.

-

Presence of substandard and adulterated products in the market.

The presence of substandard and adulterated products in the vitamin ingredients market poses a significant restraint on its growth. Counterfeit vitamins, often containing little or no active ingredients, fillers, or even harmful substances, erode consumer trust and undermine the perceived effectiveness of legitimate products. A notable example is the case of counterfeit vitamin D supplements found in the US market in 2019. The Food and Drug Administration (FDA) issued a warning about these products, which contained dangerously high levels of vitamin D, potentially leading to serious health complications. This incident highlights the risks associated with counterfeit vitamins-

-

Counterfeit vitamins can cause harm due to incorrect dosage, contamination, or the presence of harmful substances.

-

Widespread counterfeiting undermines consumer trust in the entire vitamin market, making individuals hesitant to purchase any supplements.

-

Legitimate manufacturers suffer financial losses as counterfeit products divert sales and damage brand reputation.

A study published in the Journal of the American Medical Association found that 20% of herbal supplements tested contained unlisted ingredients, including pharmaceutical drugs.

Opportunities

-

Innovation in delivery formats and product differentiation

-

Growing demand for personalized nutrition and customized vitamin solutions

-

Expansion into emerging markets with increasing health awareness

-

The rising popularity of clean-label and organic vitamin products

-

Integration of vitamins into functional foods and beverages

Challenges

-

Ensuring the quality and safety of vitamin ingredients

-

Educating consumers about proper dosage and usage

-

Developing innovative and affordable vitamin formulations

-

Addressing environmental concerns related to vitamin production

IMPACT OF RUSSIA UKRAINE WAR

Russia's invasion of Ukraine has negatively affected the vitamin ingredients market. Russia and Ukraine are consumers, importers, and exporters of vitamin supplements. Geopolitical instability and sanctions led on Russia by countries had hampered the transport of vitamin materials. GlaxoSmithKline has suspended deliveries of supplements and vitamins into Russia as part of its efforts to cut ties with Moscow following its invasion of Ukraine. They no longer favor global sanctions. This has resulted in a decrease in vitamin supplies in Russia and many other countries. Vitamin supplement prices have risen as a result of this.

Impact of Economic Downturn:

During economic downturns, consumers tend to prioritize essential goods and cut back on discretionary spending, which can include vitamin supplements. Price-sensitive consumers may opt for lower-priced generic or private-label brands over more expensive, branded vitamin supplements. This can intensify competition and pressure profit margins for manufacturers.

Vitamin supplements’ major demand was during Covid-19 followed by Russia Ukraine war. However, the war and sanctions had led to disruption in supply chains. The demand for vitamins in pharmaceuticals is constantly increasing but the prices may fluctuate on the basis of availability of raw materials. The prices of vitamin ingredients could increase by 10-15% during a recession. If there are alternative sources of vitamin ingredients available, the impact on the market is likely to be less severe.

Market segmentation

By Type

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

By Type, vitamin C held the highest revenue share of more than 32% in 2023. Vitamin C's dominance in the vitamin ingredients market is due to its widespread recognition and diverse applications. Vitamin C is renowned for its immune-boosting properties, antioxidant benefits, and role in collagen synthesis, making it a popular choice for consumers seeking overall health and wellness support.

In Nov 2023, a product launch that exemplifies the continued popularity of vitamin C is the introduction of Lakmé's 9to5 Vitamin C+ range. This range includes a variety of skincare products such as serum, day cream, and night cream, all formulated with vitamin C to address various skin concerns like dullness, uneven skin tone, and signs of aging. This launch aligns with the growing consumer demand for high-quality, effective vitamin C products that offer comprehensive skincare benefits.

By Form

-

Tablets and Capsules

-

Powder

-

Others

By Form, Tablets and Capsules are anticipated to dominate the Vitamin Ingredients Market with the highest revenue share of more than 46.5% in 2023 due to their convenience, stability, variety, and familiarity with consumers. Their portable, pre-measured format requires no preparation, making them ideal for busy lifestyles. This dominance is evident in the recent (Jan 2022) launch of Nature Made's Stress Relief Gummies with Ashwagandha & Vitamin D3, highlighting the ongoing innovation in this format to cater to evolving consumer preferences for convenient and targeted vitamin supplementation.

By Source

-

Natural

-

Synthetic

By Application

-

Food and Beverages

-

Pharmaceuticals

-

Animal Feed

-

Personal Care Products

-

Others

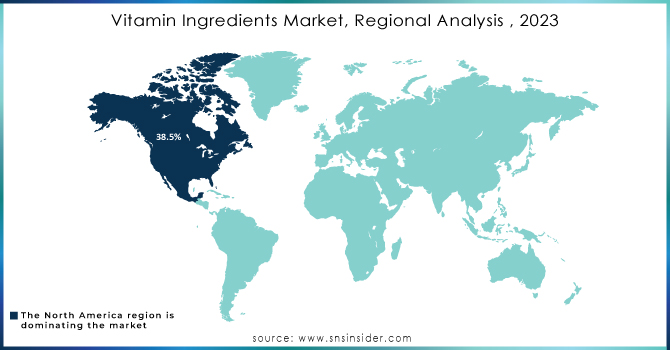

Regional Analysis

North America led the Vitamin Ingredients Market with the highest revenue share of more than 38.5% in 2023. The region boasts a highly health-conscious population that prioritizes preventive healthcare and wellness, driving a strong demand for vitamin supplements. Additionally, the high prevalence of lifestyle-related diseases like obesity, diabetes, and heart disease in North America further fuels the need for vitamins to address deficiencies and support overall health. A well-established regulatory framework for dietary supplements ensures product safety and quality, fostering consumer trust and confidence in the market. The region's reputation as a hub for research and development in the nutraceutical industry leads to the continuous launch of innovative vitamin products, catering to evolving consumer preferences. The growing aging population also seeks vitamins for healthy aging, bone health, and cognitive function, further contributing to market growth.

March 2022- A recent example of this innovation is Nature Made's launch of their "Wellblends Immune Support with Vitamin C, D3, and Zinc," aligning with consumer interest in preventive health measures.

Asia Pacific is estimated to grow at the highest CAGR during the forecast period from 2024-2031 driven by a rapidly expanding population with increasing disposable income and a growing awareness of preventive healthcare. Changing dietary habits and urbanization have led to imbalanced diets, creating a significant demand for vitamin supplements. Government initiatives promoting nutritional awareness and the rising prevalence of lifestyle diseases further contribute to this demand.

A recent example is Amway India's launch of "Nutrilite Vitamin C Cherry Plus," catering to the growing demand for convenient and palatable vitamin formats. China and India are leading the market due to their large populations and increasing health consciousness.

Need any customization research on Vitamin Ingredients Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Koninklijke DSM N.V., BASF SE, Archer Daniels Midland Company, Pfizer Inc., Nestlé S.A., Evonik Industries AG, Ingredion Incorporated, DuPont de Nemours and Company, Bactolac Pharmaceutical Inc., Lonza Group, AIE Pharmaceuticals Inc., Atlantic Essential Products Inc., Glanbia PLC, Bluestar Adisseo Co., Dow Chemical Company, Probi AB, The Wright Group, CHR Hansen Holding A/S, Nutritional Yeast Company, Algatechnologies Ltd., Amway Corporation, and Kensing Solutions LLC.

Recent Development:

-

In May 2024, Evonik will be showcasing its latest nutraceutical ingredient innovations at Vitafoods Europe 2024 in Geneva, Switzerland. Among the highlights will be the introduction of AvailOm® & Boswellia for joint health, the presentation of new study results on IN VIVO BIOTICS™, and the expansion of the Healthberry® portfolio into the U.S. market.

-

In August 2022, Kensing, LLC, a prominent manufacturer of natural vitamin E, plant sterols, specialty esters, and high-purity anionic surfactants, and a portfolio company of One Rock Capital Partners, LLC, announced the acquisition of the amphoteric surfactants and specialty esters manufacturing operations in Hopewell, Virginia from Evonik Corporation.

-

In July 2022, BASF revealed plans to enhance its presence in the vitamin A market by increasing its formulation capacities at its Verbund site in Ludwigshafen. The cutting-edge facility, fully integrated into vitamin production at the site, will bolster the production of top-quality vitamin A powder products for the animal nutrition industry, reinforcing BASF's commitment to delivering excellence in its offerings.

-

In 2021, Bain Capital and Cinven completed the acquisition of Lonza Specialty Ingredients (LSI) for CHF 4.2 billion. This acquisition included Lonza's vitamin B3 operations, further expanding LSI's portfolio and market presence.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.5 Billion |

| Market Size by 2032 | USD 7.16 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, and Vitamin K) • By Form (Tablets and Capsules, Powder, and Others) • By Source (Natural and Synthetic) • By Application (Food and Beverages, Pharmaceuticals, Animal Feed, Personal Care Products, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Koninklijke DSM N.V., BASF SE, Archer Daniels Midland Company, Pfizer Inc., Nestlé S.A., Evonik Industries AG, Ingredion Incorporated, DuPont de Nemours and Company, Bactolac Pharmaceutical Inc., Lonza Group, AIE Pharmaceuticals Inc., Atlantic Essential Products Inc., Glanbia PLC, Bluestar Adisseo Co., Dow Chemical Company, Probi AB, The Wright Group, CHR Hansen Holding A/S, Nutritional Yeast Company, Algatechnologies Ltd., Amway Corporation, and Kensing Solutions LLC. |

| Key Drivers | • Increasing health consciousness and preventive healthcare trends • Growing demand for fortified foods and dietary supplements • Expanding aging population and associated health concerns • Rising disposable incomes and urbanization • Rising prevalence of lifestyle diseases and vitamin deficiencies |

| Market Restrain | • Limited knowledge about the benefits of vitamin supplements among the rural population. • High cost of premium vitamin ingredients • Complex and time-consuming approval processes for new vitamin ingredients. • Presence of substandard and adulterated products in the market. |