Urology Devices Market Size & Report Overview:

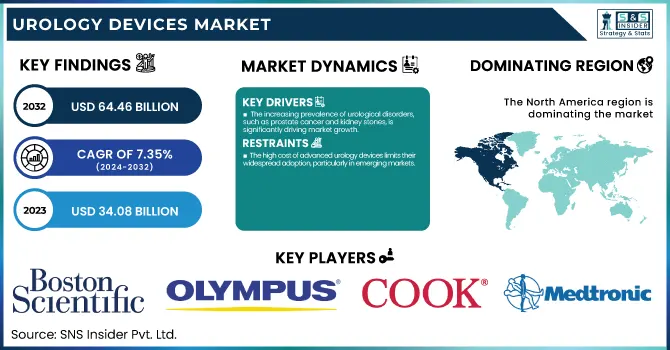

The Urology Devices Market size was valued at USD 34.08 Billion in 2023 and is expected to reach USD 64.46 billion by 2032, growing at a CAGR of 7.35% over the forecast period 2024-2032.

To Get more information on Urology Devices Market - Request Free Sample Report

The Urology Devices Market Report provides key statistical insights and emerging trends shaping the industry. It covers the incidence and prevalence of major urological disorders, analyzing regional variations. The report details market demand and device volume trends, highlighting adoption rates for catheters, lithotripsy devices, ureteroscopes, and dialysis equipment. Prescription trends and treatment adoption rates are examined, comparing minimally invasive and traditional surgical procedures. Additionally, it explores healthcare spending on urology treatments, with a breakdown of government, insurer, and patient out-of-pocket expenses. The report also assesses technological advancements, including AI-driven diagnostics and robotic-assisted surgeries, alongside a review of regulatory and compliance frameworks influencing market growth across regions. The urology devices market is experiencing significant growth driven by the increasing prevalence of urological disorders and the aging population. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), approximately 2 in 1,000 Americans are living with end-stage kidney disease (ESKD) requiring kidney transplant or dialysis.

Urology Devices Market Dynamics

Drivers:

-

The increasing prevalence of urological disorders, such as prostate cancer and kidney stones, is significantly driving market growth.

The rising prevalence of urological disorders, especially prostate cancer and kidney stones, is a major factor propelling the urology devices market. Recently, prostate cancer has become the most diagnosed cancer in men in many areas. In England, the number of diagnoses increased by 25% over the last five years, with 55,033 cases in 2023. This increase is due in part to increased awareness and more men being in the high-risk age groups. Likewise, in India, prostate cancer has risen in rank from 11th place in 1990 to 3rd in terms of incidence rates among males by 2022, with an estimated incidence rate of 6.8 per 100,000. This growth reflects the increasing demand for diagnostic and therapeutic urology devices.

Kidney stones are also a common urological problem. There were around 106 million incident cases worldwide in 2021, with men making up 67% of them. In the U.S., the rate of people developing kidney stones has increased to as much as 9.25% of the population, which is much higher than previously thought. This phenomenon is associated with dietary patterns, obesity, and sedentary lifestyles. A review of ingredients is vital to better understand how these factors may be contributing to the increasing occurrence of kidney stones, pointing to the need for the development and adoption of effective urological devices for the treatment and management of kidney stones. The growing incidence of these urological disorders has further accelerated the demand for advanced urology devices, such as innovative diagnostic tools and less invasive surgical equipment. There is an increasing demand for minimally invasive surgeries and advanced urological treatments to enhance patient outcomes and cater to the rising prevalence of urological disorders.

Restraint:

-

The high cost of advanced urology devices limits their widespread adoption, particularly in emerging markets.

The relatively high cost of advanced urology devices is a major obstacle to their widespread adoption, especially in developing regions. For example, surgical robotic systems that provide greater precision and minimally invasive techniques for complex urological surgeries can cost around $2 million. MRI scanners, which are critical for diagnosing diseases like prostate cancer, can cost up to $1.2 million. This significant cost is often unaffordable for hospitals and clinics in low- and middle-income countries, meaning that they cannot afford to buy this level of equipment. As a result, patients in these areas are likely to have less access to sophisticated diagnostic and therapeutic options, which could lead to inequities in health care outcomes. Furthermore, these inflated procurement costs result in protracted treatment costs for patients, making access to essential urological services even more challenging. To overcome these challenges, strategic initiatives need to be developed, including cost-effective technologies, favorable reimbursement policies, and public-private partnerships to subsidize equipment costs, which are focused on making advanced urology devices more accessible and affordable worldwide.

Opportunity:

-

The growing demand for minimally invasive treatments presents significant growth opportunities in the market.

The growing demand for minimally invasive treatments is driving the growth of the Urology devices market. These next-level procedures provide patients with faster recovery, fewer surgical risks, and better overall results. Recent advancements in this realm illustrate the revolutionary potential and efficacy of such innovations. For example, robotic-assisted surgery has become widely adopted in pediatric urology. An eight-year-old boy in Queensland had a kidney repair surgery in December 2024 that was conducted using the $3.3 million da Vinci XI surgical system. This technology allowed surgeons to work with 3D visualizations in small incisions, leading to a quicker recovery. Remarkably, the patient was discharged within 24 hours post-surgery, highlighting the system's efficacy in reducing hospital stays and promoting swift recuperation.

The FDA gave AngioDynamics approval for their NanoKnife device in January 2025. This novel technology uses irreversible electroporation to accurately kill cancer cells and spare nearby nerves and tissues. The accuracy reduces typical side effects such as incontinence and loss of sexual function, providing patients with a less invasive option than traditional treatments. In October 2024, Ambu also received FDA clearance for its HD (high-definition) cystoscopy solution. This endoscopy platform that consists of the Ambu aScope 5 Cysto HD and two full-HD endoscopy platforms improves visualization in diagnostic and therapeutic ureteroscopy procedures. Enhanced imaging capabilities allow for better evaluations and interventions across procedures and ultimately lead to better patient outcomes.

Challenge:

-

Regulatory hurdles and high development costs pose challenges to market growth.

Strict regulatory requirements and rising development costs are major factors that affect the growth of the urology devices market. The complex approval processes that must be navigated to meet health authority requirements like those established by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) frequently lengthen product development timelines. For example, depending on their classification, medical devices can take three to seven years before receiving market clearance from the FDA. This lengthy process not only slows the launch of advanced urology devices but also adds to the economic burden on the industry. Moreover, advanced urology devices are expensive to manufacture. As an instance, in many areas, robotic-assisted surgical systems can represent 20-25% of overall healthcare costs. The high costs of setting up for compliance may prevent smaller companies from entering the market, which in turn would limit competition and slow down any possibility of innovation. Moreover, non-uniform reimbursement policies ending up in declining reimbursement for urology procedures may create challenges to Thriven's downstream, as they may influence the healthcare provider's willingness to invest in advanced urology devices. Lower reimbursement might also restrict the profitability of some procedures and devices. The high cost of urology devices, along with specific cooperation regulations and embedded processes for particular technologies, including those related to FDA approval, are limiting market growth.

Urology Devices Market Segmentation Analysis

By Application

The kidney diseases segment accounted for the largest share of the urology devices market in 2023. This dominance is primarily due to the widespread incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) worldwide. According to the Centers for Disease Control and Prevention (CDC), an estimated more than 1 in 7 U.S. adults (37 million people) have CKD. The growing prevalence of kidney stones and renal cancer is also expected to augment the demand for urology devices in this segment. The increase in the utilization of minimally invasive methods for treating kidney diseases, including lithotripsy and nephrostomy, has contributed to the market growth. Moreover, factors such as an increasing number of kidney transplants and post-transplant care further contribute to the growth of this segment. The introduction of more advanced dialysis machines along with continuous renal replacement therapy (CRRT) systems are some of the attributes enhancing the management of ESRD, thereby propelling the market growth even further.

Moreover, government initiatives to enhance kidney care and raise awareness about timely disease detection have been instrumental in bolstering the kidney diseases segment For example, the U.S. Department of Health and Human Services’ Advancing American Kidney Health initiative aims to decrease the number of Americans who develop ESKD by 25% by 2030, which could boost demand for preventive and diagnostic devices used in urology.

By Product

In 2023, the hospitals, ambulatory surgical centers (ASCs), and clinics segment held the largest share of the urology devices market. This usually relies on a huge quantity of urology treatments conducted in these contexts, with advanced apparatus and expertly trained medical care workers. The number of urological surgeries in hospitals has continuously increased, according to the Institute of Kidney Diseases and Research Center (IKDRC). In 2024, there were performed 339 major urological surgeries, 2,955 minor urological procedures, and many endo-urological procedures. This depicts that hospitals play a vital role in the urology devices market.

Other factors that have fueled the growth of this segment are the increasing trend toward outpatient procedures, along with the growing strength and presence of ASCs. With the right approach, ASCs can provide cost-effective and timely delivery of care for the majority of urological procedures, making them an attractive solution for patients and providers alike. The segment is also benefiting from government initiatives focused on enhancing healthcare infrastructure and making access to specialized treatment easier. For example, centers such as the U.S. Centers for Medicare & Medicaid Services (CMS) are broadening coverage for types of urological procedures that can be performed in ASCs, promoting the use of advanced urology devices in these settings.

By End-user

The hospitals, ambulatory surgical centers (ASCs), and clinics segment accounted for the largest share, 45% of the urology devices market in 2023. This dominance is primarily due to the high volume of urological procedures performed in these settings and the availability of advanced equipment and skilled healthcare professionals. According to the Institute of Kidney Diseases and Research Center (IKDRC), there has been a consistent increase in the number of urological surgeries performed in hospitals. In 2024, 339 major urological surgeries, 2,955 minor urological procedures, and numerous endo-urological interventions were conducted8. This data underscores the significant role of hospitals in driving the urology devices market.

The growing trend towards outpatient procedures and the rise of ASCs have also contributed to this segment's growth. ASCs offer cost-effective and efficient care for many urological procedures, making them an attractive option for both patients and healthcare providers. Government initiatives to improve healthcare infrastructure and increase access to specialized care have further boosted this segment. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) has expanded coverage for certain urological procedures in ASCs, encouraging the adoption of advanced urology devices in these settings.

Urology Devices Market Regional Insights

North America dominated the urology devices market in 2023, accounting for a market share. This dominance can be attributed to the region's advanced healthcare infrastructure, high healthcare expenditure, and early adoption of innovative medical technologies. The presence of major market players and a large patient pool suffering from urological disorders further contribute to North America's market leadership. Europe held the second-largest market share in 2023, supported by a well-established healthcare system, high prevalence of urological disorders, and increasing adoption of minimally invasive procedures. The European Commission's efforts to harmonize medical device regulations across the EU have also contributed to market growth by facilitating easier market access for new urology devices.

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period. This rapid growth is driven by factors such as improving healthcare infrastructure, increasing awareness about urological disorders, and rising healthcare expenditure in countries like China and India. Government initiatives to enhance healthcare access and the growing medical tourism industry in countries such as Thailand and Singapore are also fueling market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Urology Devices Market

Key Service Providers/Manufacturers

-

Boston Scientific Corporation (US) – (Photoselective Vaporization (PVP) System, UroLift System)

-

Olympus Corporation (Japan) – (Duodenoscopy System, Surgical Endoscopes)

-

Cook Medical Incorporated (US) – (Stone Management Devices, Urological Stents)

-

Medtronic plc (Ireland) – (Holmium Laser System, Thulium Laser System)

-

KARL STORZ SE & Co. KG (Germany) – (HyDome Duodenoscopy System, Surgical Instruments)

-

Dornier MedTech GmbH (Germany) – (Lithotripters, Urology Lasers)

-

Richard Wolf GmbH (Germany) – (Endoscopic Systems, Surgical Instruments)

-

Fresenius Medical Care AG & Co. KGaA (Germany) – (Dialysis Machines, Hemodialysis Products)

-

Coloplast A/S (Denmark) – (Urinary Catheters, Continence Care Products)

-

Stryker Corporation (US) – (Surgical Equipment, Medical Devices)

-

Teleflex Incorporated (US) – (UroLift System, Catheters)

-

Baxter International Inc. (US) – (Renal Care Products, Dialysis Solutions)

-

Ethicon, Inc. (US) – (Surgical Sutures, Endomechanical Devices)

-

Hollister Incorporated (US) – (Urinary Incontinence Devices, Ostomy Care Products)

-

Becton, Dickinson and Company (BD) (US) – (Catheters, Diagnostic Equipment)

-

Endo International plc (Ireland) – (Medical Devices, Pharmaceuticals)

-

Siemens Healthineers AG (Germany) – (Imaging Systems, Diagnostic Equipment)

-

Terumo Corporation (Japan) – (Guidewires, Catheters)

-

Abbott Laboratories (US) – (Diagnostic Devices, Medical Equipment)

-

Intuitive Surgical, Inc. (US) – (Robotic Surgical Systems, Endoscopic Instruments)

Recent Developments

-

In September 2024, Medtronic plc launched an advanced lithotripsy system with improved stone fragmentation capabilities, aimed at reducing procedure time and improving outcomes for patients with kidney stones.

-

In March 2024, Olympus Corporation introduced a next-generation flexible ureteroscope with enhanced imaging capabilities, designed to improve visualization during complex urological procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 34.08 Billion |

| Market Size by 2032 | USD 64.46 Billion |

| CAGR | CAGR of 7.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Consumables & Accessories) • By Application (Kidney Diseases, Benign Prostatic Hyperplasia, Urinary Stones, Urinary Incontinence, Urological Cancer, Erectile Dysfunction, Pelvic Organ Prolapse, Other Applications) • By End User (Hospitals, Ascs, And Clinics, Dialysis Centers, Home Care Settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boston Scientific Corporation, Olympus Corporation, Cook Medical Incorporated, Medtronic plc, KARL STORZ SE & Co. KG, Dornier MedTech GmbH, Richard Wolf GmbH, Fresenius Medical Care AG & Co. KGaA, Coloplast A/S, Stryker Corporation, Teleflex Incorporated, Baxter International Inc., Ethicon, Inc., Hollister Incorporated, Becton, Dickinson and Company (BD), Endo International plc, Siemens Healthineers AG, Terumo Corporation, Abbott Laboratories, Intuitive Surgical, Inc. |