Sepsis Therapeutics Market Report Scope & Overview:

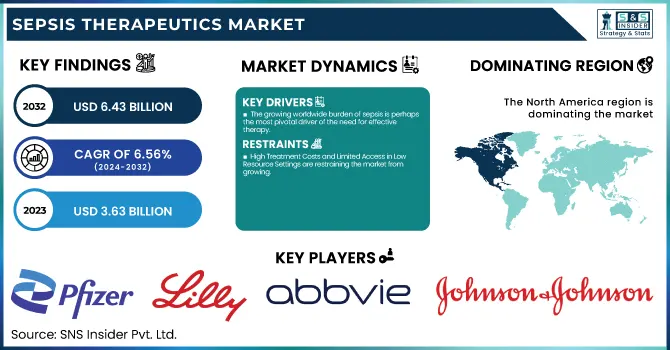

The Sepsis Therapeutics Market was valued at USD 3.63 billion in 2023 and is expected to reach USD 6.43 billion by 2032, growing at a CAGR of 6.56% from 2024-2032.

To Get more information on Sepsis Therapeutics Market - Request Free Sample Report

This report provides original, data-driven intelligence on the Sepsis Therapeutics Market by emphasizing key epidemiological and utilization metrics. It provides extensive data on the incidence and prevalence of sepsis worldwide, as well as regional trends in prescribing, showcasing therapeutic trends. The report also analyzes healthcare expenditure by payer type—government, commercial, private, and out-of-pocket—providing granular insight into economic impact. It also differentiates itself by including the clinical trials environment, reviewing both active and finished studies, and monitoring the market adoption rates of advanced sepsis drugs, with a focus on real-world integration.

The U.S. Sepsis Therapeutics Market was valued at USD 0.96 billion in 2023 and is expected to reach USD 1.69 billion by 2032, growing at a CAGR of 6.51% from 2024-2032. The United States is in a leading position in the North American Sepsis Therapeutics Market owing to its highly developed healthcare infrastructure, increased rate of diagnosis, and early adoption of new therapeutics. The nation is also a leader in clinical studies as well as regulatory approvals, further solidifying its leadership in the region.

Market Dynamics

Drivers

-

The growing worldwide burden of sepsis is perhaps the most pivotal driver of the need for effective therapy.

The World Health Organization (WHO) has estimated that there are 49 million cases of sepsis worldwide annually and 11 million deaths, of which many could be prevented if treated in time. The illness frequently results from ordinary infections and progresses to lethal organ dysfunction. In addition, the fast expansion of antimicrobial resistance (AMR) is hindering routine antibiotic treatments, making sepsis increasingly harder to manage. With resistant infections increasingly becoming dominant in ICUs, there is a greater need for specific, broad-spectrum, or future-generation antibiotics. The trend has encouraged healthcare systems to invest in new therapeutics and has stirred up interest within the pharmaceutical sector to grow sepsis-driven pipelines with enhanced biologics, immunotherapy, and targeted medicine strategies.

-

Advancements in Diagnostic Technologies and Biomarker Research are driving the market growth.

Advancement and assimilation of cutting-edge diagnostics like rapid molecular diagnostics and biomarker-based assays are substantially impacting the timeliness and effectiveness of sepsis management. Both early and precise diagnosis are instrumental in lowering mortality because delayed treatment by each hour raises mortality by almost 8%. These technologies, including procalcitonin (PCT) and lactate-level testing, are being increasingly implemented in emergency and intensive care units to inform early intervention tactics. An example of the development is the FDA clearance of new sepsis detection devices, such as BioMérieux's VIDAS B.R.A.H.M.S PCT and BacT/ALERT systems that enable clinicians to rapidly detect bloodstream infections. These diagnostics are being combined with targeted therapies to enhance patient outcomes, decrease hospital stays, and limit the inappropriate use of antibiotics, thus aiding the development of the sepsis therapeutics market through precision treatment approaches.

Restraint

-

High Treatment Costs and Limited Access in Low-Resource Settings are restraining the market from growing.

Among the significant Sepsis Therapeutics Market restraints is the exorbitant price of advanced treatment modalities and poor availability in low- and middle-income nations (LMICs). Treatment for sepsis is commonly a combination of expensive antibiotics, biologics, ICU care, and prolonged hospitalization, making it costly for both patients and healthcare systems. Whereas developed countries have reimbursement and insurance coverage, resource-constrained areas struggle to pay for usual care, not to mention new therapies. As reported in The Lancet, sepsis mortality in LMICs is much higher, primarily because diagnosis is delayed and there is limited access to successful treatments. Moreover, most healthcare centers in these countries do not have the infrastructure for real-time diagnostics, adding to the problem and slowing down the equitable expansion of the global sepsis therapeutics market.

Opportunities

-

The increased emphasis on new drug development, especially biologics and immunotherapies, offers a tremendous opportunity in the Sepsis Therapeutics Market.

Conventional antibiotics are frequently hampered by resistance and non-specific targeting, which is leading to the adoption of therapies that either modulate the immune response or neutralize bacterial toxins. Pipeline contenders like recombinant human proteins, monoclonal antibodies, and host-directed therapies are actively under investigation in clinical trials. Firms such as Inotrem and RevImmune are creating novel biologic-based sepsis therapies that will enhance survival rates and minimize organ damage. Growing regulatory support, such as fast-track and orphan drug designations, is also driving investment and speeding up time-to-market. As these next-generation therapies demonstrate efficacy in trials, they will generate high-impact market opportunities, especially in developed healthcare markets that can accommodate their integration and reimbursement.

Challenges

-

One of the most persistent challenges in the Sepsis Therapeutics Market is the complexity of early diagnosis.

Sepsis presentations usually mirror those of other frequent ailments, like flu or pneumonia, making identification both prompt and accurate less than straightforward. The disease changes quickly, and clinical presentations depend on age, baseline health, and cause of infection. Recognition delays result in delayed treatment, greatly elevating the risk of mortality. Despite progress in diagnostic equipment, inconsistency in their availability, sensitivity, and clinician training within healthcare systems constrains their utility. A majority of sepsis cases are only diagnosed after the patient has reached a critical condition, as per research. This diagnostic deficit acts as an impediment to the timely provision of therapy, impacting patient outcomes and being a significant challenge in the successful realization of even the best treatment regimens.

Segmentation Analysis

By Drug class

The Cephalosporin segment dominated the sepsis therapeutics market with 62.08% market share in 2023 because of its wide-spectrum antibacterial activity, established clinical effectiveness, and extensive availability in all healthcare environments. Cephalosporins are frequently employed as initial therapy for sepsis, particularly in empirical therapy, since they have broad coverage against Gram-positive and Gram-negative pathogens. Their tissue penetration and ability to reach effective levels in the blood make them perfect for treating systemic infections such as sepsis. Also, the segment has high rates of prescriptions, complemented by global sepsis treatment guidelines that endorse cephalosporins as part of a combination regimen for initial therapy. Third-generation cephalosporins such as ceftriaxone and ceftazidime were specifically popular because they have efficacy against resistant pathogens. Their relative affordability in comparison to newer or biologic drugs also made them dominate, particularly in both developed and low-resource healthcare markets.

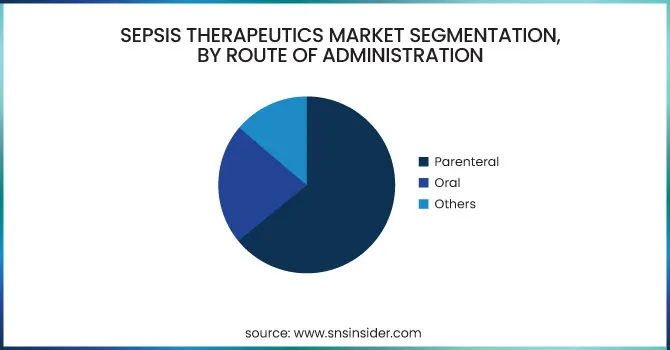

By Route of Administration

In 2023, the Parenteral segment proved to be the most prominent route of administration in the Sepsis Therapeutics Market and accounted for 64.12% market share because of the need for swift therapeutic action in critically ill patients. Sepsis is a potentially life-threatening condition that demands immediate action, and intravenous (IV) administration guarantees speedy drug delivery, maximum bioavailability, and more rapid onset of action—all significant determinants in minimizing mortality. Parenteral administration is the norm in intensive care units (ICUs) and emergency rooms, where sepsis is treated in the majority of cases. Additionally, most of the most frequently administered antibiotics and biologics for sepsis, such as cephalosporins, glycopeptides, and monoclonal antibodies, exist mainly in injectable presentations. This is consistent with clinical practice guidelines promoting IV administration during the early treatment phase to obtain therapeutic levels quickly, further solidifying the preeminence of the parenteral route.

The Oral segment is expected to be the fastest-growing route of administration over the forecast period with 7.24% CAGR, led by the growing emphasis on early discharge and outpatient treatment of stable or recovering sepsis patients. As healthcare systems strive to minimize hospital stays and costs, the step-down therapy of moving patients from IV to oral antibiotics has gained widespread usage. Further, the approval of high-bioavailability oral products and better patient compliance levels are also favoring the trend. As telemedicine and remote monitoring technologies advance, treating less severe cases of sepsis or post-discharge treatment with oral therapy has become easier and efficient. The increasing pipeline of oral products and the focus on patient-centered care are likely to further drive the segment's growth in the future.

By Distribution Channel

The Hospital Pharmacies segment dominated the sepsis therapeutics market with 40.16% market share in 2023, mainly because sepsis is an acute and emergency condition that needs to be treated immediately and intensively, and is generally done in hospital setups. Patients suffering from sepsis may need intravenous drugs, especially antibiotics and biologics, which are mostly distributed and administered by hospital pharmacies under intensive medical control. Hospitals also have diagnostic equipment and intensive care units (ICUs) that are crucial for the treatment of sepsis, hence, they remain the key point of care where treatment may start. In addition, hospital pharmacies have a comprehensive stock of broad-spectrum antibiotics, critical care medication, and biologics to address the pressing needs of sepsis patients. Hospital pharmacies are well-integrated with clinical departments, which facilitates quick dispensing and administration of drugs in high-risk, time-dependent situations. Their function as formulary managers, infection managers, and sepsis treatment protocol enforcers further cements their market dominance.

Regional Analysis

North America dominated the sepsis therapeutics market with a 37.60% market share in 2023 because of its developed healthcare infrastructure, high level of awareness among medical professionals, and better access to early diagnosis and treatment. Major pharmaceutical firms, high clinical trial activity, and good regulatory support from organizations such as the FDA are major contributors to the leadership of the region. Moreover, North America also experiences a greater incidence of hospital-borne infection and sepsis-associated ICU admissions among the elderly, contributing further to the demand for new therapeutics and combination therapies. Elevated healthcare expenditure, coupled with reimbursement availability for treatments associated with sepsis, also supports greater therapeutic uptake. Lastly, the region is strengthened by the convergence of digital health solutions for early detection and enhanced patient monitoring.

Asia Pacific is expected to show the fastest growth with 7.27% CAGR throughout the forecast period, The rapid growth is through enhancing healthcare infrastructure, enhanced sepsis awareness, and mounting government expenditure in infection management. The number of cases of sepsis in nations such as China and India is growing on account of population increase, urbanization, and escalating rates of antimicrobial resistance. In addition, increasing healthcare coverage and greater emphasis on public health programs are driving up diagnosis and treatment rates. Increased medical tourism and strategic alliances with international pharmaceutical companies are also fueling market growth. As the region further develops its healthcare systems and physician training, adoption of sophisticated sepsis therapeutics is anticipated to increase significantly.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Pfizer Inc. (Zyvox, Tygacil)

-

F. Hoffmann-La Roche Ltd. (Rocephin, Actemra)

-

Eli Lilly and Company (Xigris, Ertapenem)

-

AbbVie Inc. (Cefazolin, Aztreonam)

-

Merck & Co., Inc. (Invanz, Primaxin)

-

Johnson & Johnson (Levaquin, Doribax)

-

GlaxoSmithKline plc (Zinnat, Augmentin)

-

Sanofi S.A. (Amoxicillin, Tavanic)

-

AstraZeneca plc (Merrem, Zinforo)

-

Novartis AG (Tobramycin, Amikacin)

-

Bayer AG (Avelox, Ciprobay)

-

Bristol Myers Squibb (Claforan, Tequin)

-

Takeda Pharmaceutical Company Limited (Baxdela, Cefepime)

-

Theravance Biopharma (Vibativ, Ampicillin)

-

Astellas Pharma Inc. (Micamine, Cefotaxime)

-

Paratek Pharmaceuticals, Inc. (Nuzyra, Seysara)

-

Melinta Therapeutics, Inc. (Minocin, Orbactiv)

-

Shionogi & Co., Ltd. (Fetroja, Cefiderocol)

-

BioMérieux SA (VIDAS B.R.A.H.M.S PCT, BacT/ALERT)

-

Asahi Kasei Corporation (Sepax, Hemoclear)

Suppliers (These suppliers commonly provide active pharmaceutical ingredients (APIs) and biopharmaceutical manufacturing services, including fermentation, cell culture systems, and sterile fill-finish solutions essential for the production of sepsis-related therapeutics.) in Sepsis Therapeutics Market

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

Lonza Group AG

-

Sartorius AG

-

WuXi AppTec

-

Boehringer Ingelheim BioXcellence

-

Samsung Biologics

-

Catalent, Inc.

-

Evonik Industries AG

-

FUJIFILM Diosynth Biotechnologies

Recent Developments

-

April 2024 – Pfizer Inc. reported that the U.S. Food and Drug Administration (FDA) has approved BEQVEZ (fidanacogene elaparvovec-dzkt), a gene therapy for adults with severe or moderate hemophilia B. The treatment is reserved for those patients receiving factor IX (FIX) prophylaxis therapy, having a history of current or past life-threatening bleeding, or experiencing recurrent serious spontaneous bleeding events.

-

January 2025 – Alchemab Therapeutics, a biotechnology firm specializing in discovering naturally occurring therapeutic antibodies in resistant individuals, released news of its partnership with Lilly to create novel treatment candidates against amyotrophic lateral sclerosis (ALS). Using its proprietary technology platform, Alchemab utilizes patient samples from subjects with abnormally slow disease development to identify resilience-associated antibodies, potentially unveiling new therapeutic solutions not present in patients with common disease development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.63 Billion |

| Market Size by 2032 | US$ 6.43 Billion |

| CAGR | CAGR of 6.56 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Cephalosporin, Aminoglycosides, Glycopeptide, Other Drug Class) • By Route of Administration (Parenteral, Oral, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., F. Hoffmann-La Roche Ltd., Eli Lilly and Company, AbbVie Inc., Merck & Co., Inc., Johnson & Johnson, GlaxoSmithKline plc, Sanofi S.A., AstraZeneca plc, Novartis AG, Bayer AG, Bristol Myers Squibb, Takeda Pharmaceutical Company Limited, Theravance Biopharma, Astellas Pharma Inc., Paratek Pharmaceuticals, Inc., Melinta Therapeutics, Inc., Shionogi & Co., Ltd., BioMérieux SA, Asahi Kasei Corporation, and other players. |