Customer Intelligence Platform Market Size & Overview:

To Get More Information on Customer Intelligence Platform Market - Request Sample Report

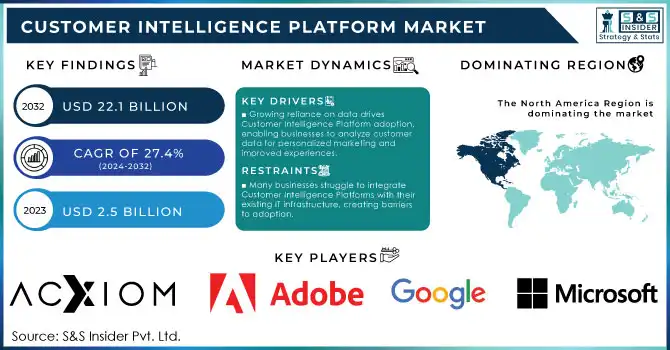

Customer Intelligence Platform Market Size was valued at USD 2.5 Billion in 2023 and is expected to reach USD 22.1 Billion by 2032, growing at a CAGR of 27.4% over the forecast period 2024-2032.

Customer Intelligence Platform (CIP) market is experiencing substantial growth, fueled by increasing consumer expectations, the exponential growth of artificial intelligence, and the paradigm shift towards data-driven decision-making on the part of the business department (DBDM). Recent government statistics have shown us the adoption of the Customer Intelligence Platform is increasing around the world because customer engagement & satisfaction is a key factor that keeps industries moving. The U.S. government has been constantly furthering the idea of digital transformation in organizations through the National Institute of Standards and Technology (NIST) for better data privacy, analytics, and customer experience. This correlates with the growing source of investments in digital systems and platforms where organizations are looking to utilize customer data to make smart decisions.

In the 2023 report of the U.S. Department of Commerce, increased investment in the digital economy continues to be a priority of governments around the world where investments in technology alone increased by 10% despite the global economic downturn, which includes platforms that focus on digital solutions towards better customer experience. The U.K.'s Digital Strategy also highlights data-driven solutions as a foundation for building customer-centric business models. Leveraging the power of AI and big data analytics, Customer Intelligence Platforms (CIPs) are necessary to ensure businesses have access to in-depth information about customer preferences, behavior, and trends for their personalized marketing efforts.

Furthermore, the e-commerce and digital services boom has created an even greater need for platforms that can process and analyze vast customer data. There are also various regulatory measures being introduced by Governments around the world to secure privacy and consumer data leading to a significant increase in confidence around the adoption of CIP technologies. The adoption of these platforms has primarily soared over the years due to their ability to allow businesses to manage customer relationships efficiently, providing a strong market growth outline. Growing data generation and the requirement to manage customers efficiently will continue to drive growth for the CIP market.

Customer Intelligence Platform Market Dynamics

Drivers

-

The growing reliance on data for business decisions is fueling the adoption of Customer Intelligence Platforms. These platforms help businesses collect and analyze vast amounts of customer data, enabling personalized marketing and enhanced customer experiences.

-

As consumers expect more personalized experiences, businesses are turning to Customer Intelligence Platforms to provide real-time, tailored services across various channels, boosting customer satisfaction and loyalty.

-

The need for seamless customer interactions across multiple channels is driving the growth of Customer Intelligence Platforms. These platforms help integrate data from diverse touchpoints like social media, email, and in-store experiences.

The growing demand for personalization in customer experience is one of the key factors driving the Customer Intelligence Platform market growth which is only going to boost even further in the coming years. Consumers today expect businesses to deliver highly tailored interactions, from personalized recommendations to relevant content and offers. The increasing accessibility of data and tools to analyze it is pushing marketers towards more personalized marketing.

In 2023, recent survey found that 71% of consumers now expect companies to deliver individualized interactions, while 76% are frustrated when this doesn’t happen. This is a powerful motivation for companies to implement solutions such as CIPs, which hear the voices of customers you combine data at customer touchpoints to build a customer monitor for customer and prospect preferences and behavior. For example, Amazon’s recommendation engine, driven by its data analytics capabilities, generates approximately 35% of the company's revenue by providing highly relevant product suggestions based on previous browsing and purchasing behavior. CIPs can help organizations collect customer information from diverse touchpoints such as social media, website visits, and offline stores and develop personalized marketing campaigns accordingly. CIPs are like if Starbucks came and bought out the entire competition, opening the opportunity for stores to offer tailored rewards and promotions to those who allow them on the app, leading to better customer engagement and retention. This personalized trend is changing customer expectations and is one of the critical drivers behind the multi-industry adoption of CIPs.

Restraints:

-

The increasing focus on data privacy regulations (e.g., GDPR) presents challenges for businesses using Customer Intelligence Platforms, as managing customer data securely is becoming more complex.

-

The cost of implementing and maintaining advanced Customer Intelligence Platforms can be prohibitive, especially for small and medium-sized enterprises.

-

Many businesses struggle to integrate Customer Intelligence Platforms with their existing IT infrastructure, creating barriers to adoption.

The data privacy concern is a major restraint for the customer intelligence platform market However, with companies becoming more reliant on customer data to produce insights and personalization, strong data privacy regulations like GDPR in Europe create real headaches for businesses. This has resulted in regulations that force companies to make sure customer data is transparent and secure in its collection, storage, and processing. Legal ramifications, as well as fines, may arise as a result of this. Moreover, enterprises need to spend a fortune to install data security tools and implement processes to protect privacy. This complexity is even more of a challenge for smaller organizations that may not have the bandwidth to cope with solid data governance frameworks. At the same time, the criticality of balancing data-driven decision-making with ethical considerations and privacy regulations can delay the implementation of CIP solutions. These obstacles have increased the demand for improved causes that protect individual privacy and data without losing the benefits of customer intelligence platforms.

Customer Intelligence Platform Market Segment Analysis

By Component

In 2023, the platform segment held the largest market share of over 66% of the total revenue. This dominance is driven mainly by increasing awareness of platforms as all-in-one solutions for customer data management and customer data analytics. Governments around the globe are increasingly promoting digital platforms in multiple sectors, further expediting their use. For instance, the U.S. government's "Digital Economy Agenda" launched in early 2023 highlighted the importance of integrated digital platforms in powering businesses to take advantage of big data and gaining deeper insights into customer engagement. This ties in with the move toward integrated platforms to combine data and provide insights across many sources.

Furthermore, the U.S. Census Bureau governmental statistics state that more than 70% of the customer Intelligence platforms that are used by the U.S. in retailing and service-oriented industries have used such related mechanisms, which would boost this demand for such platforms. These platforms provide insights into consumer behaviour, help in predicting buying patterns, and from there, allow for personalization which are imperative in the competitive landscape. As companies strive to maintain a competitive edge in increasingly crowded markets, the demand for Customer Intelligence Platforms, which centralize customer data and streamline interactions, is growing exponentially.

By Data Channel

The web segment held the largest market share of over 24% in 2023. The reason behind this dominance is the growing consumer shift from shopping to digital interactions with brands via web channels, making the web the primary source of customer data. E-commerce in the U.S. alone generated more than $1 trillion in total sales in 2023, according to U.S. Bureau of Economic Analysis statistics, and a notable amount of these sales were made through web platforms. As online shopping and web interactions continue to grow, businesses are increasingly investing in Customer Intelligence Platforms to capture and analyze web data for insights that drive customer engagement.

The web portion has also been formed to a more prominent stage due to the support of governments. As an example, efforts like the European Union's 2023 Digital Single Market, which have enabled the free flow of data across country lines and encouraged companies to leverage web-enabled solutions for better customer intelligence have empowered companies further. Web data provides valuable insights into customer preferences, behaviors, and purchasing patterns, which are critical for businesses looking to improve their marketing strategies and customer experience. Government efforts are also encouraging the use of secure yet efficient web analytics tools to safeguard consumer information, thus catalyzing the adoption of web-based customer intelligence solutions.

By Application

The customer experience management (CXM) segment dominated the market with the largest market share in 2023 at over 21%. This growth is attributed to the increasing focus on customer-centric strategies across the industries. This is a testament to how governments have realized the need to improve customer experiences and embedding with national digital strategies. The U.S. government initiative "National Strategy for Trusted Identities in Cyberspace" (2023), for example, is concerned with giving businesses the means for personally identifiable information to be guaranteed secure, personalized customer experiences which is crucial for gaining customer trust in digital platforms.

Additionally, customer experience management is one of the essential applications of Customer Intelligence Platforms, as businesses strive to understand customer needs and deliver tailored experiences across multiple touchpoints. Supportive government initiatives such as the U.K.'s "Tech Nation" have also furthered the customer experience management solution's incorporation as components in the digital business environment. A seamless integration and analysis helps businesses to develop and enhance customer loyalty and retention rates by providing information on customer feedback, sentiment, and interactions across multiple channels.

By Deployment:

In 2023, the cloud deployment segment held over 50% market share. That dominance can be attributed to the scalability, flexibility, and cost-effectiveness of cloud solutions. With the cloud deployment model, businesses can store and process unlimited amounts of customer data; thus, enabling companies to generate actionable insights in real time. Government statistics, such as those from the U.S. Federal Cloud Computing Strategy, show that cloud adoption among businesses has increased by over 35% in the last three years, driving the demand for cloud-based customer intelligence solutions.

This cloud approach can provide businesses with access to powerful analytics solutions and infrastructure without large capital expenditures for on-premises hardware and is especially appealing to small and medium-sized enterprises (SMEs). And they have met compliance into the cloud and have seen some recent strides toward greater cloud adoption such as the U.S. Cloud Smart Strategy to create a security net for businesses moving to the cloud.

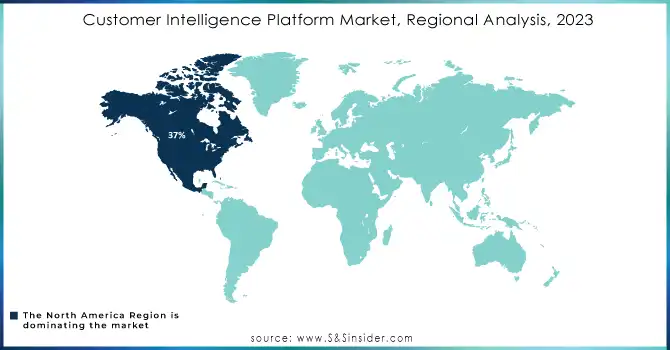

Regional Analysis

In 2023, North America dominated the Customer Intelligence Platform Market and held more than 37% share in 2023, with major contributions from the U.S. North America is one of the top regions in terms of digital transformation owing to having the highest level of technological infrastructure, high investments in customer experience technologies and strong government initiatives for driving data-driven business strategies. With continuous initiatives from the US government in supporting digital technologies through the "Digital Government Strategy," Customer Intelligence Platforms have been widely adopted by different segments like retail, healthcare, and finance. The significant presence across key market players including options such as Salesforce, Adobe, and Oracle further solidified North America’s dominance in the CIP market.

In contrast, the Asia-Pacific (APAC) region growing with the highest compound annual growth rate (CAGR) over the forecast period. The APAC region is driven by the rapid adoption of digital technologies across emerging economies like India, China, and Japan. The adoption of customer intelligence platforms is further fueled by government initiatives such as India’s “Digital India” program and the “Internet Plus” strategy in China, as both nations continue to adopt everything digital to improve customer experiences and operations in their businesses.

Do You Need any Customization Research on Customer Intelligence Platform Market - Enquire Now

Recent Developments

-

In Sep 2024 Salesforce launched a new suite of AI-powered customer intelligence tools to help organizations provide hyper-personalized customer experiences. Using machine learning and natural language processing, the tools process huge quantities of customer data and allow businesses to become proactive in meeting customer needs and improving engagement strategies.

-

iManage and vLex announced a strategic partnership in May 2024 to further integrate their platforms by enabling easy access to the most relevant legal insights, as well as improving legal research and workflow. Firms and legal professional has reached another vital milestone in customer intelligence, whilst at the same time offering the literal tools needed for efficient knowledge management and standards based decision making.

Key Players

Service Providers / Manufacturers:

-

Acxiom LLC (Acxiom Audience Insight, Acxiom Personalization)

-

Adobe (Adobe Experience Platform, Adobe Analytics)

-

Google LLC (Google Analytics 360, Google Cloud AI)

-

IBM Corporation (IBM Watson Marketing, IBM Customer Experience Analytics)

-

iManage (iManage Work, iManage RAVN AI)

-

Informatica (Informatica Intelligent Cloud Services, Informatica Data Governance)

-

Microsoft Corporation (Microsoft Dynamics 365 Customer Insights, Power BI)

-

Oracle Corporation (Oracle CX Cloud Suite, Oracle Data Cloud)

-

Proxima (Proxima Analytics Platform, Proxima Intelligence)

-

Salesforce.com, Inc. (Salesforce Marketing Cloud, Salesforce Customer 360)

Users of Services/Products

-

SAP SE

-

Nestlé

-

Unilever

-

Coca-Cola

-

Ford Motor Company

-

PepsiCo

-

L'Oréal

-

Walmart

-

Nike

-

H&M

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.50 Bn |

| Market Size by 2032 | US$ 22.1 Bn |

| CAGR | CAGR of 27.4% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Services) • By Data Channel (Web, Social Media, Smartphone, Email, Store, Call Centre, Others) • By Deployment (On-premise, Cloud) • By Application (Customer Data Collection and Management, Customer Segmentation and Targeting, Customer Experience Management, Customer Behaviour Analytics, Omnichannel Marketing, Personalized Recommendation, Others) • By Enterprise Size (SMEs, Large Enterprises) • By End Use (Banking, Financial Services, and Insurance, Retail and e-commerce, Telecommunications and IT, Manufacturing, Transportation and Logistics, Government and Defense, Healthcare and Life Sciences, Media and Entertainment, Travel and Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acxiom LLC, Adobe, Google LLC, IBM Corporation, iManage, Informatica, Microsoft Corporation, Oracle Corporation, Proxima, Salesforce.com, Inc. |

| Key Drivers | • The growing reliance on data for business decisions is fueling the adoption of Customer Intelligence Platforms. These platforms help businesses collect and analyze vast amounts of customer data, enabling personalized marketing and enhanced customer experiences. • As consumers expect more personalized experiences, businesses are turning to Customer Intelligence Platforms to provide real-time, tailored services across various channels, boosting customer satisfaction and loyalty. • The need for seamless customer interactions across multiple channels is driving the growth of Customer Intelligence Platforms. These platforms help integrate data from diverse touchpoints like social media, email, and in-store experiences. |

| Market Restraints | • The increasing focus on data privacy regulations (e.g., GDPR) presents challenges for businesses using Customer Intelligence Platforms, as managing customer data securely is becoming more complex. • The cost of implementing and maintaining advanced Customer Intelligence Platforms can be prohibitive, especially for small and medium-sized enterprises. • Many businesses struggle to integrate Customer Intelligence Platforms with their existing IT infrastructure, creating barriers to adoption. |