Automotive Artificial Intelligence Market Report Scope & Overview:

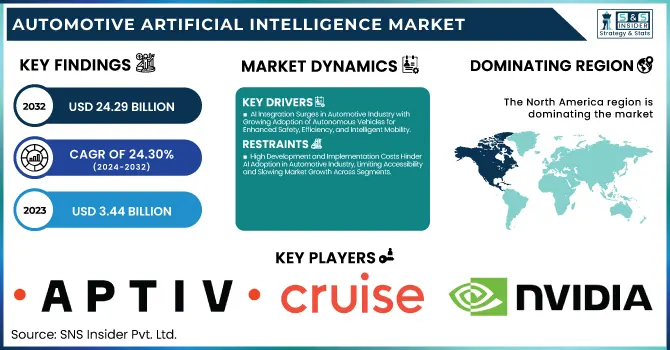

The Automotive Artificial Intelligence Market was valued at USD 3.44 billion in 2023 and is expected to reach USD 24.29 billion by 2032, growing at a CAGR of 24.30% from 2024-2032.

To Get more information on Automotive Artificial Intelligence Market - Request Free Sample Report

This report includes a comprehensive analysis of key factors such as technology adoption rates, investment trends, consumer adoption rates, regulatory landscape, and cost-saving and efficiency gains within the industry. The rapid advancements in AI technologies, along with increasing demand for autonomous vehicles and smarter automotive systems, are driving market growth. Additionally, the regulatory environment and significant investments are fostering innovation, while AI’s potential to reduce costs and improve operational efficiency is becoming a major catalyst for market expansion.

Automotive Artificial Intelligence Market Dynamics

Drivers

-

AI Integration Surges in Automotive Industry with Growing Adoption of Autonomous Vehicles for Enhanced Safety, Efficiency, and Intelligent Mobility.

The growing shift toward autonomous and semi-autonomous vehicles is driving the need for sophisticated AI technologies. Automakers increasingly integrate AI-powered systems for real-time perception, decision-making, and vehicle control to improve safety, efficiency, and driving experience. Machine learning and deep learning algorithms analyze vast amounts of LiDAR, radar, and camera sensor data to facilitate accurate navigation and object detection. Predictive analytics using AI also maximize route planning and traffic management, minimizing congestion and travel time. Regulatory support and investments in autonomous mobility further accelerate AI advancements, making it a crucial enabler of next-generation automotive solutions. As autonomous vehicles progress toward higher levels of automation, AI’s role in ensuring seamless and intelligent mobility continues to expand.

Restraints

-

High Development and Implementation Costs Hinder AI Adoption in Automotive Industry, Limiting Accessibility and Slowing Market Growth Across Segments.

Implementation of AI in the automotive sector is expensive, thus restricting its application to all segments of the market. The process of creating AI-based systems entails sophisticated computing, high-performance processing, and the latest sensor technology like LiDAR, radar, and high-definition cameras, all of which increase production expenses. Ongoing software updates, machine learning model training, and validation testing are also additional expenses. Automakers and suppliers toil against great financial hurdles in attaining the large-scale roll-out, hindering smaller manufacturers from being competitive. Cost pressures thereby hinder the mass use of AI, especially in budget and mid-range vehicles, holding back the aggregate growth trend of the market.

Opportunities

-

AI-Powered ADAS Adoption Surges as Automakers Enhance Vehicle Safety, Driving Convenience, and Compliance with Evolving Regulatory Standards.

The increasing integration of AI-powered Advanced Driver Assistance Systems (ADAS) is revolutionizing the auto industry by enhancing road safety and driving convenience. Automakers are using AI for adaptive cruise control, automatic emergency braking, lane-keeping assistance, and traffic sign recognition, minimizing human errors and the risk of accidents. As consumers increasingly demand better safety, governments around the globe are implementing regulations requiring ADAS integration in newer cars. The processing of real-time data from cameras, radar, and LiDAR by AI provides accurate decision-making, reducing driving time and making it safer. With developing technology, AI-based ADAS solutions are a key differentiator, fueling innovation and spurring opportunities within the automotive market.

Challenges

-

Cybersecurity and Data Privacy Risks in AI-Powered Vehicles Raise Safety Concerns, Demanding Strong Protection Against Hacking and Data Breaches.

Self-driving cars depend on immense pools of real-time information to navigate, make decisions, and connect, putting them squarely in the crosshairs of cyberattacks. Intruders may be able to take advantage of vulnerabilities in AI systems to hijack control of a vehicle, sensitive user data, or cloud-based infrastructure. Breaches in data are not only invading drivers' privacy but also potentially cause critical safety risks, subjecting manufacturers to regulation and litigation nightmares. Automakers need to establish strong cybersecurity architectures, encryption techniques, and AI-based threat detection mechanisms to protect vehicle ecosystems. With the growing adoption of AI in cars, secure data management and cyberattack protection remain top priorities, which have a direct bearing on consumer confidence and the overall development of AI-based mobility solutions.

Automotive Artificial Intelligence Market Segment Analysis

By Component

The hardware division captured the Automotive Artificial Intelligence Market leadership in 2023, occupying about 69% of revenue share. It is motivated by the heavy usage of AI-empowered chips, sensors, LiDAR, radar, and computing units that require elevated processing capacities, which are demanded for autonomous mobility and ADAS purposes. AI-capable hardware is highly funded by car makers to bolster processing capabilities in real-time for improved decision-making efficiency and increased on-road safety. Furthermore, the increasing use of AI-based processors in electric and connected vehicles further enhances the leadership of the hardware segment.

The software segment is expected to expand at the fastest CAGR of approximately 25.88% during the period from 2024 to 2032, driven by developments in AI-based algorithms, machine learning models, and cloud-based automotive solutions. Rising demand for AI-driven vehicle control, predictive maintenance, and over-the-air software updates is driving growth. Automakers and technology companies are concentrating on AI software development to improve autonomous driving features and user experiences. The transition towards software-defined cars and AI-based analytics also adds to the fast growth of this segment.

By Vehicle Type

The passenger vehicles segment led the Automotive Artificial Intelligence Market in 2023, accounting for around 78% of the revenue share. This leadership is fueled by the growing uptake of AI-based Advanced Driver Assistance Systems (ADAS), autonomous technologies, and in-vehicle infotainment systems. Customers require improved safety, convenience, and customized driving experiences, leading manufacturers to incorporate AI-based functionalities. Moreover, rising regulatory requirements for AI-based safety features and expanding production of AI-based electric vehicles further solidify the passenger vehicles segment's leadership in the market.

The commercial vehicles segment is expected to advance at the fastest CAGR of approximately 26.85% during the forecast period of 2024 to 2032, driven by growing adoption of AI for autonomous trucking solutions, predictive maintenance, and fleet management. Logistics and transportation organizations are using AI for optimizing routes, fuel efficiency, and lowering operational costs. Furthermore, growth in AI-driven driver monitoring systems and regulatory backing for autonomous commercial vehicles is driving market expansion. The demand for intelligent mobility solutions in business transport also fuels the fast growth of this segment.

By Technology

The machine learning segment led the Automotive Artificial Intelligence Market from 2023 with a revenue share of around 39%. This is due to its pivotal position in the development of autonomous driving, predictive maintenance, and driver behavior analysis. Automakers utilize machine learning algorithms to handle huge volumes of real-time sensor data, which facilitates better decision-making and optimizing vehicle performance. Its use in AI-based diagnostics, fuel optimization, and adaptive cruise control also supports its broad adoption across the automotive industry.

The computer vision segment is expected to expand at the fastest CAGR of approximately 26.17% during 2024-2032, led by its rising application in autonomous driving and Advanced Driver Assistance Systems (ADAS). Computer vision powered by AI facilitates real-time object detection, lane detection, and pedestrian tracking, improving vehicle safety and navigation. The increasing adoption of high-resolution cameras, LiDAR, and radar in intelligent vehicles also drives growth. As the need for AI-powered vision-based applications increases, this segment shall witness a swift growth.

By Level of Autonomy

The Level 2 segment led the Automotive Artificial Intelligence Market in 2023, holding around 41% of the revenue share. The reason behind this is the extensive use of partially automated driving technology, such as adaptive cruise control, lane-keeping assist, and automated braking. Automakers incorporate Level 2 automation in mid-range and premium cars based on growing consumer interest in added safety and convenience. ADAS regulatory mandates and the decreasing cost of AI-based driver assistance technology further support the segment's robust market stand.

The Level 3 segment is anticipated to expand at the fastest CAGR of around 26.92% during 2024-2032, driven by improving AI-based autonomous driving and rising regulatory approvals. Level 3 automation enables the vehicle to be in full control under particular conditions, minimizing driver intervention. Automakers are heavily investing in AI-based sensors, LiDAR, and real-time decision-making software to improve self-driving functionality. As the acceptance of hands-free driving increases among consumers, and autonomous mobility infrastructure improves, this segment is ready for extremely fast growth.

Regional Analysis

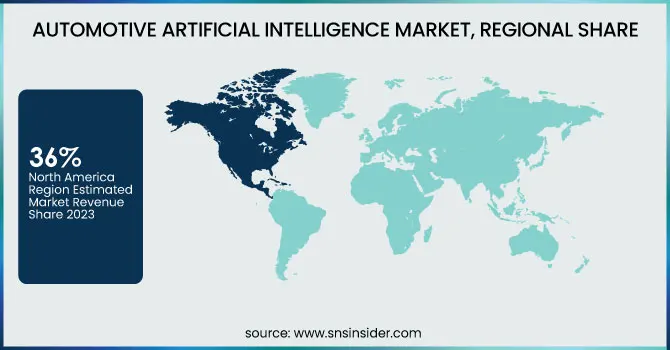

North America led the Automotive Artificial Intelligence Market in 2023 with a share of around 36% in terms of revenue. This dominance is fueled by the robust presence of top AI technology vendors, automakers, and autonomous vehicle startups. The region enjoys significant investments in AI-based automotive technologies, large R&D efforts, and pro-self-driving regulatory policies. Moreover, the increasing deployment of AI-enabled Advanced Driver Assistance Systems (ADAS) and connected cars, along with the demand for advanced mobility solutions by consumers, also enhances North America's dominance in this market.

Asia Pacific is expected to expand at the fastest CAGR of approximately 26.13% during 2024-2032, led by speedy developments in AI-based automotive technologies and growing vehicle production. The growing electric vehicle (EV) market in the region, growing investments in smart mobility solutions, and government support for AI adoption drive growth. Moreover, the presence of leading automotive players and technology companies in China, Japan, and South Korea encourages innovation. Increased need for autonomous and connected cars powered by AI drives further growth in the market within Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aptiv (Advanced Driver Assistance Systems, Automated Driving Solutions)

-

Cruise LLC (Autonomous Vehicles, Cruise Origin)

-

Mobileye (EyeQ Chipsets, Roadbook)

-

NVIDIA Corporation (Drive PX, Drive AGX)

-

Qualcomm Technologies, Inc. (Snapdragon Automotive Platform, C-V2X Solutions)

-

Robert Bosch GmbH (ADAS Sensors, Automated Driving Solutions)

-

Tesla (Autopilot, Full Self-Driving Software)

-

The Ford Motor Company (Ford Co-Pilot360, FordPass)

-

TOYOTA RESEARCH INSTITUTE (Guardian System, Platform for Autonomous Vehicles)

-

Waymo LLC (Waymo Driver, Waymo One)

-

Alphabet Inc. (Waymo, AI-Driven Transportation)

-

Intel Corporation (Mobileye, AI for Autonomous Vehicles)

-

Microsoft Corporation (Azure Cloud for Automotive, AI for Connected Vehicles)

-

IBM Corporation (Watson AI for Autonomous Driving, IBM Cloud for Automotive)

-

BMW AG (BMW iX, BMW ConnectedDrive)

-

Micron Technology (Automotive Memory Solutions, DRAM for AI Applications)

-

Xilinx Inc. (Adaptive Computing for Autonomous Vehicles, FPGAs for Automotive)

-

Harman International Industries Inc. (Harman ExP, Harman Connected Services)

-

Volvo Car Corporation (Volvo Pilot Assist, Volvo On Call)

-

Audi AG (Audi AI, Audi Virtual Cockpit)

-

General Motors Company (Super Cruise, OnStar)

-

Honda Motor Co. Ltd. (Honda Sensing, Honda Connect)

-

Hyundai Motor Corporation (Hyundai SmartSense, Hyundai Blue Link)

-

Daimler AG (Mercedes-Benz MBUX, Autonomous Driving Solutions)

-

Uber Technologies Inc. (Uber Advanced Technologies Group, Uber Freight)

-

Didi Chuxing (Didi Autonomous Vehicles, AI for Ride-Hailing)

-

Mitsubishi Electric (Autonomous Driving Systems, In-Vehicle Networking)

Recent Developments:

-

In January 2025, Aptiv announced it would showcase its next-generation Advanced Driver-Assistance Systems (ADAS), in-cabin experiences, and advanced power distribution technologies at CES 2025, focusing on software-defined vehicles.

-

In 2024, Intel introduced the Intel® Automotive SoC platform, featuring powerful compute, AI capabilities, and built-in graphics to support dynamic in-cabin user experiences and flexible, scalable automotive solutions.

-

In January 2025, BMW introduced the Panoramic iDrive system at CES, which transforms the windshield into a 3D heads-up display. The system uses augmented reality to overlay navigation and driving assistance information, enhancing the overall driving experience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.44 Billion |

| Market Size by 2032 | USD 24.29 Billion |

| CAGR | CAGR of 24.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Level of Autonomy (Level 1, Level 2, Level 3, Level 4) • By Technology (Machine Learning, Natural Language Processing, Computer Vision, Context-aware Computing, Others) • By Vehicle Type (Passenger Vehicles, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aptiv, Cruise LLC, Mobileye, NVIDIA Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, Tesla, The Ford Motor Company, TOYOTA RESEARCH INSTITUTE, Waymo LLC, Alphabet Inc., Intel Corporation, Microsoft Corporation, IBM Corporation, BMW AG, Micron Technology, Xilinx Inc., Harman International Industries Inc., Volvo Car Corporation, Audi AG, General Motors Company, Honda Motor Co. Ltd., Hyundai Motor Corporation, Daimler AG, Uber Technologies Inc., Didi Chuxing, Mitsubishi Electric |