Geriatric Care Devices Market Report Scope & Overview:

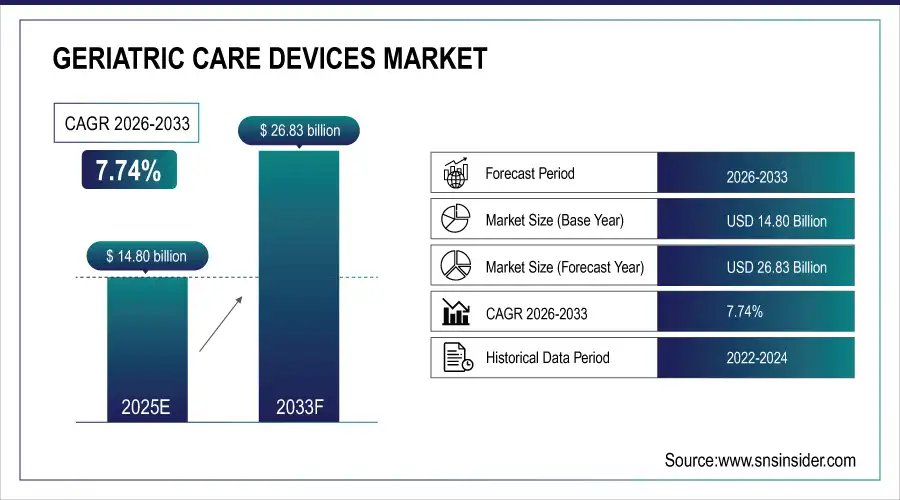

The Geriatric Care Devices Market was valued at USD 14.80 billion in 2025E and is projected to reach USD 26.83 billion by 2033, growing at a CAGR of 7.74% during the forecast period 2026–2033.

The market for geriatric care devices covers mobility aids, monitoring and assistive devices, and homecare furniture product types across applications. Mobility aids were projected to have the most market share in 2025, followed by monitoring devices. Hospitals & clinics, and home care settings continue to be the prominent end users. Market growth will remain steady through 2033, buoyed by increasing elderly numbers, a higher incidence of long-term conditions and demand for elderly monitoring solutions.

Mobility Aids contributed 32% in 2025, driven by rising demand for walkers, wheelchairs, and scooters supporting elderly mobility and fall prevention.

Market Size and Forecast:

-

Market Size in 2025: USD 14.80 Billion

-

Market Size by 2033: USD 26.83 Billion

-

CAGR: 7.74% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Geriatric Care Devices Market - Request Free Sample Report

Geriatric Care Devices Market Trends:

-

Over 6.8 million mobility aids (walkers, canes and wheelchairs) were sold worldwide in 2025, with demand for senior citizens’ mobility assistance continue to rise.

-

More than 4.1 million monitoring devices were in use by 2025 which signifies increasing attention to remote elderly health management.

-

28% of device deployment was for home care indicating a growing demand for aging in place solutions.

-

3.5 million installs are attributable to assisted living facilities, highlighting need for fall prevention and chronic disease management devices.

-

Online sales accounted for 18% to the total distribution thereby depicting trend of people now preferring online purchase of geriatric care solutions.

U.S. Geriatric Care Devices Market Insights:

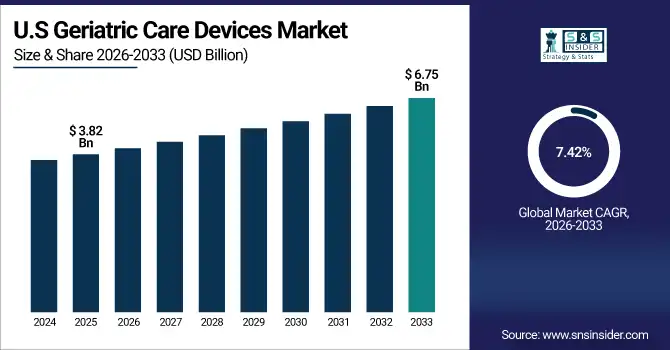

The U.S. geriatric care devices market was valued at USD 3.82 billion in 2025E, projected to reach USD 6.75 billion by 2033 at a CAGR of 7.42%. Market growth is determined by an increasing need for monitoring devices, mobility aids, and smart IoT-connected investments in hospitals, clinics and the home.

Geriatric Care Devices Market Growth Drivers:

-

Expanding Home Healthcare and Assisted Living Markets Boost Demand for Geriatric Care Devices.

The market growth is driven by expanding home healthcare and assisted living services. In 2025 there were more than 6.8 million used mobility aids worldwide, and also home care and assisted living deployed to over 4.1 million monitoring devices. Devices with fall prevention solutions represented 28% of total device utilization and chronic conditions management devices were 18%. Digital distribution and robust market expansion amounted to 15% from online platforms.

Mobility aids accounted for 32% of device usage in 2025, driven by growing demand for elderly fall prevention and assisted mobility.

Geriatric Care Devices Market Restraints:

-

High Device Costs and Limited Insurance Coverage Restrict Widespread Adoption of Geriatric Care Solutions.

High device costs and limited insurance coverage continue to restrain market growth. In 2025, some 27% of seniors were unable to use mobility aids because of cost, and18 percent of home care facilities faced delayed adoption of monitoring devices due to lack of appropriate insurance payment. Smaller assisted living facilities had a difficult time funding advanced chronic disease management program. These economic barriers prevent widespread use of geriatric care devices, despite the increasing size of the aging population.

Geriatric Care Devices Market Opportunities:

-

Integration of Smart and IoT-Enabled Devices Creates New Opportunities in Elderly Care and Remote Monitoring.

The integration of smart and IoT-enabled devices is creating new opportunities in elderly care and remote monitoring. In 2025 there were more than 4.1 million smart sensor enabled monitoring devices and 2.7 million personalised safety tracking mobility aids, utilizing connected technology across the two service pathways respectively. Approximately, 12% of the ALFs implemented IoT-based real-time health monitoring systems. Market growth and the quality of care will be improved by these technology-based advances through 2033.

Smart and IoT-enabled monitoring devices accounted for 22% of total device adoption in 2025, reflecting rising demand for connected elderly care.

Geriatric Care Devices Market Segmentation Analysis:

-

By Product Type, Mobility Aids held the largest market share of 32.45% in 2025, while Monitoring Devices are expected to grow at the fastest CAGR of 9.12%.

-

By Application, Fall Prevention & Mobility contributed the highest market share of 34.20% in 2025, while Elderly Monitoring is forecasted to expand at the fastest CAGR of 9.05%.

-

By End User, Hospitals & Clinics held the largest share of 37.50% in 2025, while Home Care Settings are anticipated to grow at the fastest CAGR of 8.90%.

-

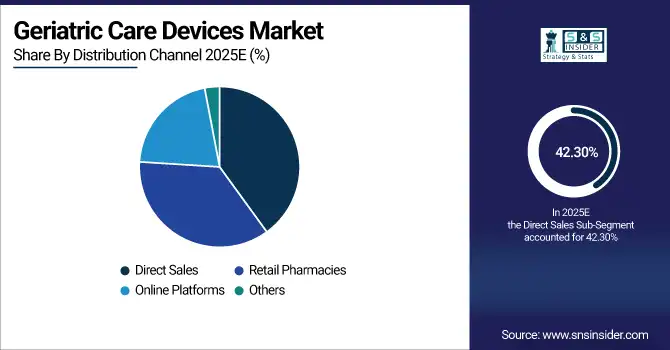

By Distribution Channel, Direct Sales accounted for the dominant share of 42.30% in 2025, while Online Platforms are projected to grow at the fastest CAGR of 9.25%.

By Product Type, Mobility Aids Lead While Monitoring Devices Expand Rapidly:

There were more than 6.8 million walkers, canes and wheelchairs purchased worldwide in 2025, so there is an obvious need of elderly mobility and fall prevention. There were an estimated 4.1 million monitoring devices in the same year and it is predicted to rise to over 8.2 million by 2033. Advent of connected and sensor-based monitoring is gaining momentum providing remote health monitoring and management for the elderly population.

By Application, Fall Prevention & Mobility Leads While Elderly Monitoring Expands Rapidly:

Fall prevention and mobility applications were mostly employed using the technology in 2025, as demand was spurred by safety concerns related to elderly people. Applications for elderly monitoring reached 3.9 million devices and are expected to expand rapidly, with over 7.5 million users by 2033. intelligent monitoring solutions, wearable sensors, and remote health maintenance technologies are currently encouraging the use of both at home and by assisted housing.

By End User, Hospitals & Clinics Lead While Home Care Settings Expand Rapidly:

Hospitals and clinics accounted for more than 8.5 million devices in adoption in 2025, demonstrating high institutional use of mobility aids and monitoring devices. Home care settings represented some 5.2 million devices and are expected to grow rapidly, surpassing 5.8 million by 2033. Rapid adoption in the home over traditional care settings Accelerated adoption is being seen in residential settings (e.g., aging-in-place, home-based chronic care management, telehealth) due to growing preference for stay-at-home care.

By Distribution Channel, Direct Sales Lead While Online Platforms Expand Rapidly:

By 2025, a total of more than 9.2 million devices were sold directly, indicating established direct (manufacturer-to-end-user) sales through hospitals and clinics. The online platforms deliver around 3.5 million units and are anticipated to grow substantially, reaching in excess of 5.2 million devices by 2033. Increasing e-commerce penetration rates, home delivery service, as well as the marketing of geriatric care solutions online are rapidly increasing consumer accessibility and convenience.

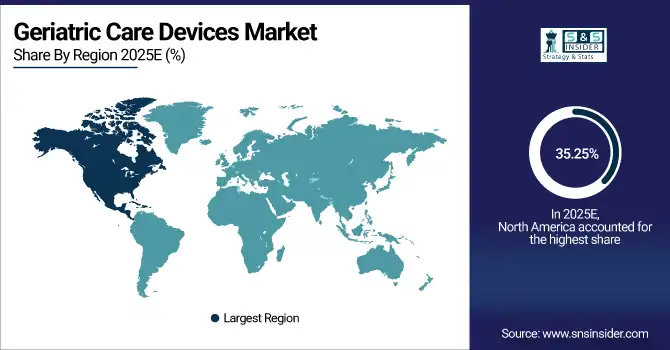

Geriatric Care Devices Market Regional Analysis:

North America Geriatric Care Devices Market Insights:

North America contributed to more than 35.25% of the global geriatric care devices market revenue in 2025 with installation of over 5.2 million mobility aids and over 3.1 million monitoring devices in hospital, clinics and home settings. Assisted living facilities deployed 2.4 million devices, while direct sales and online products distributed over 4.5 million units. High availability of healthcare services and increasing acceptance of smart monitoring systems will drive good growth, in turn positioning the market as a leader through 2033.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Geriatric Care Devices Market Insights:

In 2025, more than 2.1 million mobility aids and 1.4 million monitoring devices were deployed in hospitals, clinics and home care. Assisted living facilities placed 850,000 units and direct sales and Internet channels shipped 1.9 million and 620,000 units fragmented the market for another large gain in volume growth.

Asia-Pacific Geriatric Care Devices Market Insights:

The Asia Pacific geriatric care devices market is estimated to register a CAGR of 8.84% with an average sales volume exceeding 3.2 million mobility aids and 2.5 million monitoring devices in use across China, Japan, India, and Australia by 2025. Assisted living facilities implemented 1.1 million devices, and home care installed 2.0 million numbers. Strong market growth is propelled through 2033 by increasing integration of smart and IoT enabled solutions, as well as a rising elderly population.

Japan Geriatric Care Devices Market Insights:

Japan dominates the APAC geriatric care devices industry share in 2025, with more than 1.5 million mobility aids and over 1.2 million monitoring devices installed at hospitals, clinics as well as homecare facilities. Growing use of smart and Internet of Things devices, and aging population are contributing to a desire for robust market success through 2033.

Europe Geriatric Care Devices Market Insights:

Europe financed more than 2.7 million mobility aids and over 1.9 million monitoring devices in 2025, with Germany, the UK and France contributing the most. There were 1.2 million devices installed in assisted living facilities and 1.5 million in home care settings. Increasing uptake of smart and IoT-based devices, growing elderly population and increasing healthcare spending are supporting the continuous growth of aging care market in Europe over 2033.

Germany Geriatric Care Devices Market Insights:

During 2025, the most mobility aids and monitoring devices will be used in Germany, over 1.1 million arm butlers and over 750,000 monitors in hospitals, other healthcare facilities and nursing homes. Robust uptake of smart/IoT based solutions, coupled with well-established healthcare infrastructure and aging demographics, will account for sustained market expansion through 2033.

Latin America Geriatric Care Devices Market Insights:

The market for geriatric care devices in Latin America released 950,000 mobility aids and 620,000 monitoring devices in 2025 across Brazil, Mexico, and Argentina as the leading revenue contributors. Assisted living facilities added 410,000 devices and home care settings acquired 520,000 units. Increasing acceptance of smart monitoring systems, along with a growing elderly population and rising healthcare expenditure are leading to strong regular market hikes until 2033.

Middle East and Geriatric Care Devices Market Insights:

Middle East & Africa geriatric care devices industry distributed more than 620,000 mobility aids and around 410,000 monitoring devices in the year 2025 with robust deployment in UAE, Saudi Arabia and South Africa. Steady market growth throughout the region through 2033 is enabled by increasing use of smart monitoring solutions, expanding pool of geriatric population, and government-supported healthcare programmes.

Geriatric Care Devices Market Competitive Landscape:

Cardinal Health is a dominant force in the geriatric care devices market, executing over 1.2 million home healthcare equipment deliveries in 2025. There are more than 350,000 elderly patients being treated by the company in normally distributes close to a plethora all over the U.S. on which they have both wide distribution networks and healthcare partner affiliations. With Cardinal Health’s extensive international network and broad product offering, we are well positioned to supply critical care solutions for growing elderly populations.

-

In June 2025, Cardinal Health launched the Kendall DL™ Multi System for continuous patient monitoring. The device simplifies tracking of vital signs from admission to discharge.

Invacare Corporation is a dominant force in the geriatric care equipment industry where they generate more than 500,000 mobility aides yearly. The company produces such diverse items as wheelchairs, scooters and patient lifts, which are available in over 80 countries. Invacare is dedicated to providing products that promote the recovery of range of motion, as our full line of lift chairs are quality and reliable options seniors can rely on for senior independence.

-

In August 2025, Invacare expanded mobility aids with ergonomic designs and smart technology. These new products enhance independence and comfort for elderly users.

Medline Industries, Inc., a major player in the geriatric care equipment market too distributes more than 2 million units of senior care products each year. The company operates in 100-plus countries and is planning a U.S. initial public offering (IPO) in 2025 with the potential to value it at about USD 50 billion. Medline's portfolio and global footprint make them a strong competitor in the industry.

-

In September 2025, Medline launched its Smart Monitoring Bed for elderly care, integrating real-time vital sign tracking. The device enhances patient safety, fall prevention, and remote monitoring in hospitals, assisted living, and home care.

Geriatric Care Devices Market Key Players:

Some of the Geriatric Care Devices Market Companies are:

-

Cardinal Health

-

Invacare Corporation

-

Medline Industries, Inc.

-

Kimberly-Clark Corporation

-

Unicharm Corporation

-

Svenska Cellulosa Aktiebolaget (SCA)

-

Sunrise Medical LLC

-

Mobility Aids Sales & Services

-

Nippon Paper Industries Co., Ltd.

-

Medical Depot, Inc. (Drive DeVilbiss Healthcare)

-

Sonova Holding AG

-

Starkey Hearing Technologies

-

Pride Mobility Products® Corporation

-

Aloe Care Health

-

SafelyYou

-

Intuition Robotics

-

Nobi

-

Integrity Tracking

-

Oisín Biotechnologies

-

Rejuvenate Bio

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 14.80 Billion |

| Market Size by 2033 | USD 26.83 Billion |

| CAGR | CAGR of 7.74% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Mobility Aids, Monitoring Devices, Assistive Devices, Home Care Furniture, Others) • By Application (Fall Prevention & Mobility, Chronic Disease Management, Elderly Monitoring, Personal Care, Others) • By End User (Hospitals & Clinics, Long-Term Care Centers, Home Care Settings, Assisted Living Facilities, Others) • By Distribution Channel (Direct Sales, Retail Pharmacies, Online Platforms, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cardinal Health, Invacare Corporation, Medline Industries, Inc., Kimberly-Clark Corporation, Unicharm Corporation, Svenska Cellulosa Aktiebolaget (SCA), Sunrise Medical LLC, Mobility Aids Sales & Services, Nippon Paper Industries Co., Ltd., Medical Depot, Inc. (Drive DeVilbiss Healthcare), Sonova Holding AG, Starkey Hearing Technologies, Pride Mobility Products® Corporation, Aloe Care Health, SafelyYou, Intuition Robotics, Nobi, Integrity Tracking, Oisín Biotechnologies, Rejuvenate Bio |