Annuloplasty System Market Report Scope & Overview:

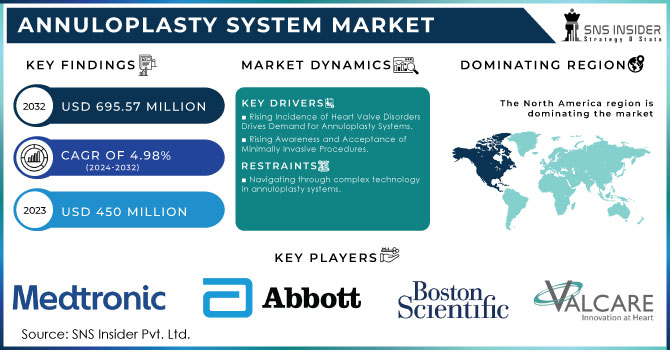

The Annuloplasty System Market size was valued at USD 450 Million in 2023 and is expected to reach USD 695.57 Million by 2032 and grow at a CAGR of 4.98% over the forecast period 2024-2032.

Get More Information on Annuloplasty System Market - Request Sample Report

The annuloplasty system market is a continuously changing part of the cardiovascular medical device sector, specifically targeting treatments for heart valve issues, especially in instances of mitral and tricuspid valve leakage. Mitral valve regurgitation (MVR) impacts around 2% to 3% of the overall population. The likelihood of it occurring rises as people get older, with rates over 10% in individuals aged over 75. Tricuspid valve regurgitation (TVR) is not as prevalent but remains a significant issue, impacting approximately 1% to 2% of the overall population. It is more common in individuals with various cardiac issues, especially those with left-sided heart failure or pulmonary hypertension. These implantable rings or bands are crucial for improving the performance and durability of heart valves by fixing the valve annulus, the circular structure that supports the valve.

The rising occurrence of heart valve diseases, especially in the elderly, highlights the need for better repair options. Aortic stenosis, a prevalent type, impacts around 2-4% of people aged 65 and older. Approximately 2-3% of the population is affected by mitral valve prolapse, with around 1.7% of adults experiencing mitral regurgitation. Tricuspid valve disease impacts around 0.5% of the populace. In 2023, approximately 50,000 new instances of aortic stenosis were identified, with over 100,000 valve surgeries, such as replacements and repairs, carried out in the United States. The likelihood of these conditions rises with age, putting elderly individuals at higher risk. Progress in minimally invasive surgical procedures is also driving the market forward, due to their lower risk and quicker recovery times in comparison to conventional open-heart surgery. These advancements are leading to a rise in the use of annuloplasty systems in various healthcare settings.

Market Dynamics

Drivers

-

Rising Incidence of Heart Valve Disorders Drives Demand for Annuloplasty Systems.

The frequency of heart valve issues like mitral and tricuspid valve regurgitation is increasing because of a growing elderly population and more cases of heart diseases. Recent research indicates that the population affected by these conditions is projected to increase significantly in the future as a result of lifestyle modifications, chronic illnesses, and advancements in diagnostic technology. As the prevalence of heart valve disorders rises, the need for successful treatment options also grows. Annuloplasty systems help fix injured heart valves by providing support or reconstructing the annulus, giving a less invasive alternative that can greatly enhance patient results. The rising number of patients is increasing the demand for annuloplasty systems as healthcare providers aim to meet the growing need for effective treatments.

-

Rising Awareness and Acceptance of Minimally Invasive Procedures

Minimally invasive annuloplasty procedures have multiple benefits compared to traditional open-heart surgery, such as decreased surgical trauma, shorter hospital stays, and quicker recovery times. These advantages are leading to growing favoritism for minimally invasive methods in addressing heart valve conditions. As patients learn more about the advantages of minimally invasive procedures, they are increasingly inclined to explore treatment options with reduced risks and faster recovery times. Healthcare professionals are also more frequently using minimally invasive procedures because of their beneficial effect on patient results and overall healthcare expenses. The increasing popularity of minimally invasive techniques is driving the need for annuloplasty systems that are compatible with these procedures.

Restraints

-

Navigating through complex technology in annuloplasty systems

The high order of technological complexity of annuloplasty systems can easily daunt healthcare providers who are unfamiliar with the state of the art. Most annuloplasty systems will require specialized training and expertise to handle them an attribute that can result in a learning curve for medical professionals. This variability in procedural outcomes owing to the complexity of these systems can be further influenced by the healthcare provider's skill and experience in annuloplasty procedures, thus affecting the overall adoption of annuloplasty systems and probably leading to variable patient outcomes. It means that adequate training and capacity building on the use of annuloplasty systems should be provided to health professionals. Further education and the creation of continuous professional development will reduce or eliminate such obstacles of technological complexity, enhancing the overall effectiveness of annuloplasty procedures.

Market Segmentation

By Application

Mitral Valve Repair has a large market share of 64% in 2023, because of the high frequency of mitral valve conditions such as mitral regurgitation and stenosis. Mitral valve conditions are more prevalent than other heart valve issues, fueling the need for annuloplasty systems tailored for repairing the mitral valve. Approximately 300,000 new cases are identified in the United States annually. Risk factors for the condition include age, mitral valve prolapse, rheumatic fever, and ischemic heart disease. Furthermore, the segment's dominance has been strengthened by progress in minimally invasive surgeries and the creation of customized annuloplasty rings for the mitral valve's specific structure.

The tricuspid valve repair is to see a quicker growth during 2024-2032. The tricuspid valve is now being recognized for its vital role in the functionality of the heart. The frequency of tricuspid regurgitation in people with heart failure can vary from 25% to 75%, indicating its connection to more intricate heart problems. The growth in this segment has been driven by an increase in research and development for specialized annuloplasty devices for tricuspid valve repair, along with greater awareness among clinicians about tricuspid valve diseases. Technological advancements and safer repair systems are also contributing to the growth of this trend.

By End User

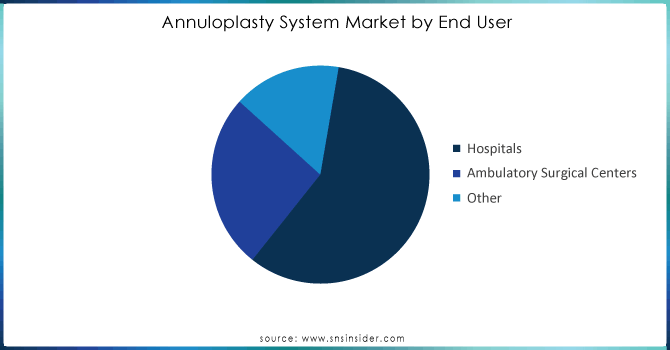

Hospitals led the market in 2023 with a market share of more than 60%, because of their extensive infrastructure, access to advanced technologies, and specialized cardiac care units. These facilities are well-prepared to perform intricate heart valve repair procedures, such as annuloplasty. Moreover, hospitals draw in a larger number of patients in need of heart surgery, further solidifying their leading role. The existence of experienced heart surgeons and interdisciplinary teams enhances hospitals' position in this market.

Ambulatory surgical centers are the most rapidly expanding segment during 2024-2032 in the annuloplasty system market. ASCs are driving growth with their focus on outpatient procedures, cost-effectiveness, and shorter recovery times. These facilities provide a more comfortable and less scary setting in comparison to typical hospitals, drawing in patients seeking minimally invasive procedures. Due to advancements in surgical techniques and technology, ASCs are gaining more ability to conduct intricate procedures such as annuloplasty.

Need any customization research on Annuloplasty System Market - Enquiry Now

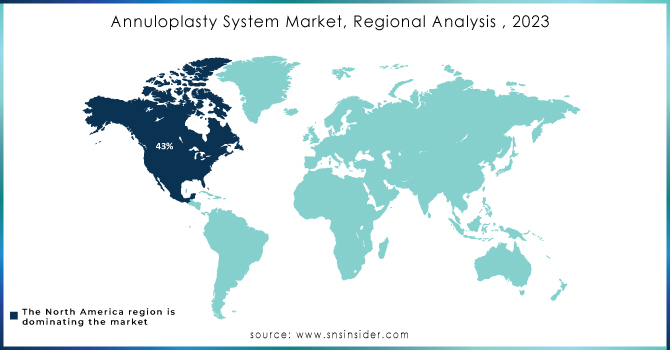

Regional Analysis

North America dominated the market with a market share of 43% in 2023 because of its advanced healthcare system, high rates of heart diseases, and wide use of cutting-edge surgical methods. North America's market dominance has been driven by the presence of top medical device manufacturers, high healthcare spending, and favorable reimbursement policies. Moreover, the area gains advantages from robust research and development efforts and rapid implementation of cutting-edge products.

Asia Pacific region is accounted to grow at a faster rate during the forecast period 2024-2032. The increase is fueled by a growing elderly population, higher knowledge about heart diseases, and better healthcare facilities. Nations such as China and India are experiencing a rise in the need for advanced cardiac treatments, driven by the expansion of medical tourism and higher healthcare investments. The increasing demand for annuloplasty systems is also a result of the fast economic growth and growing middle class in this area.

Key Players

The major key players in the market are Medtronic, Abbott, Edwards Corp, Labcor, Valcare Medical, Braile Biomedica, Affluent Medical, Corcym, Micro Interventional Devices, Sorin Group, Boston Scientific Corporation, B. Braun Melsungen AG, & others players

Recent Development

-

In April 2024, Edwards Lifesciences introduced the FORWARD Annuloplasty Ring, designed to offer improved durability and flexibility. This ring aims to enhance patient outcomes by providing better structural support for the heart's mitral valve.

-

In June 2024, Medtronic's Harmony Annuloplasty System is designed to optimize valve repair with a focus on ease of implantation and enhanced patient comfort. The system features advanced materials and design innovations to improve long-term performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 450 Million |

| Market Size by 2032 | USD 695.57 Million |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application Type (Mitral Valve Repair, Tricuspid Valve Repair, Aortic Valve Repair) • By End User (Hospitals, Ambulatory Surgical Centers, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott, Edwards Corp, Labcor, Valcare Medical, Braile Biomedica, Affluent Medical, Corcym, Micro Interventional Devices, Sorin Group, Boston Scientific Corporation, B. Braun Melsungen AG |

| Key Drivers | • Rising Incidence of Heart Valve Disorders Drives Demand for Annuloplasty Systems. • Rising Awareness and Acceptance of Minimally Invasive Procedures. |

| RESTRAINTS | • Navigating through complex technology in annuloplasty systems. |